TripAdvisor's Q4 2013 Corporate Earnings Review

Companies / Corporate Earnings Feb 14, 2014 - 09:32 PM GMTBy: Submissions

Vikram Nagarkar writes: TripAdvisor (NASDAQ: TRIP), the online travel research company reported its Q4 2013 numbers post market hours at 5 P.M EST on the 11th of Feb 2014. Within minutes of the announcement, the stock price had plunged by close to 10%, eventually recovering and settling at $82.75, about 2% lower than the day’s closing price. We look at the key take-aways and TripAdvisor’s valuations post its Q4 2013 earnings release in which the company delivered many surprises, though not all of them were necessarily pleasant in nature.

Vikram Nagarkar writes: TripAdvisor (NASDAQ: TRIP), the online travel research company reported its Q4 2013 numbers post market hours at 5 P.M EST on the 11th of Feb 2014. Within minutes of the announcement, the stock price had plunged by close to 10%, eventually recovering and settling at $82.75, about 2% lower than the day’s closing price. We look at the key take-aways and TripAdvisor’s valuations post its Q4 2013 earnings release in which the company delivered many surprises, though not all of them were necessarily pleasant in nature.

Key Financials & Metrics

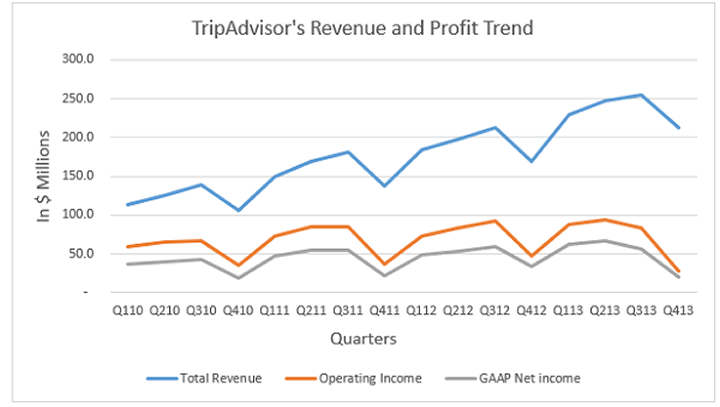

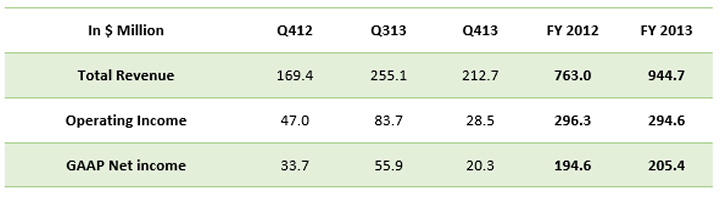

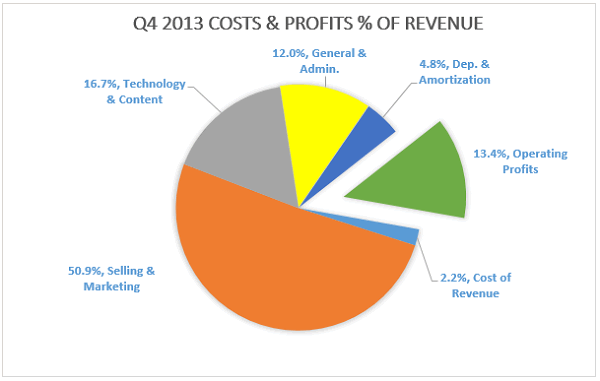

In addition to beating the market’s revenue expectations, the company met adjusted EPS estimates. However, in the same earnings release, the company also reported its lowest profit margins ever. Operating margins were down by 14.4% and net margins were down 10.4% at 13.4% and 9.5% respectively. The company reported an adjusted EPS of $ 0.21 per share.

The surprise on the revenue front saw revenue at $212.7 million vs estimates of $205-206 million, implying a 25.6% growth over the same quarter a year ago (YoY) with the growth rate also showing improvement when compared to the YoY growth in Q4 2012. The revenue for FY 2013 totaled to $944 million, up 24% YoY.

TripAdvisor Revenue and Profit Margins

Though the company managed to clock a higher revenue, the effect of the same was not seen on the EPS which, according to estimates, had already factored the decline in profit margins. Prior to the earnings release, speculation was rife that the company’s revenues would suffer owing to the Meta search feature introduced on their website.

As we had discussed in our Q4 2013 earnings preview, the largest jump in costs came in the form of advertising expenses, accounted for under the line item ‘Sales & Marketing’. Going by the language in the con-call, one should expect to see these expenses on a recurring basis and probably more towards the back end of the financial year.

TripAdvisor Q4 2013 costs and profits percentage of revenue

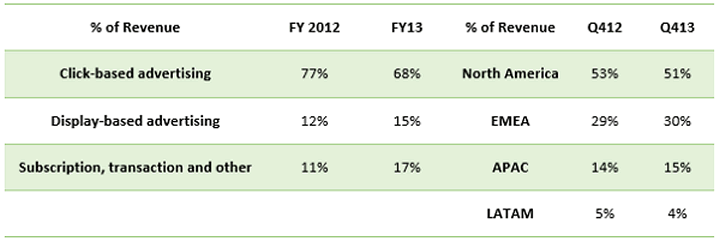

TripAdvisor Q4 2013 revenue break up

APAC continued to be the fastest growing revenue stream by region and accounted for 15% of the company’s revenue in FY 2013 as opposed to 12% in FY 2012. TripAdvisors clocked 2 billion unique visitors in FY 2013 with mobile traffic climbing to 40%. The apprehensions at large, surrounding the Meta search feature and its impact on revenues have been laid to rest for the time being.

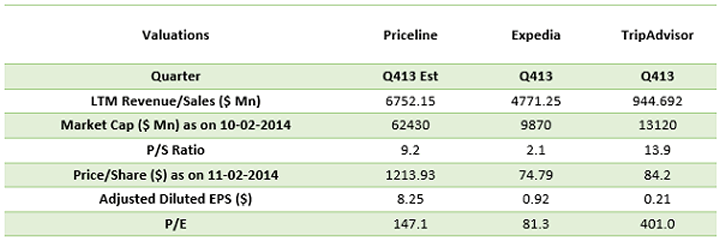

Valuations

There have been more positives than negatives that have come out from this quarter’s results for TripAdvisor.

The company’s revenue growth in the recent past, though always decent, has not been stellar by any stretch of imagination. In this quarter, however, they did manage to pip Expedia (NASDAQ: EXPE) in terms of YoY growth for Q4 2013. Given that TRIP has the smallest revenue base, the fact that its revenue growth rates haven’t matched those of say, a much larger Priceline (NASDAQ: PCLN) , is not very flattering.

The one thing that has consistently looked good in the case of TripAdvisor is its ability to deliver healthy operating and net margins. However, with profit margins having gone for a casual walk in the park, suddenly it all looks a little lacklustre. Things as they stand make it exceedingly difficult to justify the company’s valuations.

TripAdvisor Q4 2013 stock valuation

Undoubtedly, Priceline is the most consistent among these companies with the best revenue growth rates and profitability. If one were to be lenient and value TripAdvisor using the P/S and P/E multiples that Priceline enjoys, the procedure would throw out two numbers: a price per share of $ 56 based on Priceline’s P/S ratio, and $ 31 based on its P/E ratio.

Any other attempts such as weighted average P/S, average P/E, etc. give us numbers within this range of $31-56 gravitating towards $42-44.

There’s no doubt that TripAdvisor is a brilliant company, and having silenced some of the fears that were surrounding this Q4 result, we won’t be surprised if the stock price finds a lofty accommodation. However, we can’t ignore the compelling case for price correction that a P/E of 400 makes. Whichever way you see it, at anything above $44 per share or so, it’s not a very safe trip to embark on.

Vikram Nagarkar is a Financial Analyst at Amigobulls. An MBA in Finance, Vikram has a penchant for macro economics, fiscal and monetary policy, apart from the innovative new-age businesses that we cover at Amigobulls. He loves biking, photography, traveling and exploring different cuisines. Connect with him at vikram.nagarkar AT amigobulls.com

To read other articles by Vikram Nagarkar click here.

About amigobulls.com:

Amigobulls specializes in analysing internet and technology stocks. We believe in providing high-quality, independent analysis for every investor wanting to invest in technology stocks. Register with us to see our top stock picks. We keep updating the stock picks regularly based on our evaluation criteria. Our stock picks have consistently outperformed the broad indices. We evaluate each stock based on a detailed list of 56 check points followed by a review by our finance and technology experts. You can find interesting articles, valuable advice and spam-free discussion boards on our website.

© 2014 Copyright Amigobulls - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.