Why I Recently Turned Bullish on Gold Mining Stocks

Commodities / Gold and Silver Stocks 2014 Feb 14, 2014 - 12:54 PM GMTBy: DailyGainsLetter

Sasha Cekerevac writes: A friend of mine asked me the other day about the best way to build a long-term investment strategy. This is a great question, but it’s also one of the most difficult ones to answer.

Sasha Cekerevac writes: A friend of mine asked me the other day about the best way to build a long-term investment strategy. This is a great question, but it’s also one of the most difficult ones to answer.

Obviously, different people have various goals and objectives, especially when it comes to risks. For me, the way I put together an investment strategy is by looking to buy things when they are on sale, including stocks.

Over the past couple of months, if you’ve been following my articles, you’ve likely noticed that I’ve started to become quite bullish on gold mining stocks. This is the classic investment strategy of buying when most people are selling. When you consider the current sentiment, it’s clear that gold mining stocks haven’t experienced this much negativity in years.

Of course, you can’t simply have an investment strategy to buy any random stock or sector when it goes down; that’s doomed to fail. At some point, for the investment strategy to work, there must be some fundamental strength over the long term.

We all know about the pain felt by most gold mining stocks. But don’t forget: the market is a forward-looking mechanism. Your investment strategy should not focus on what’s happening today, but what is likely to occur over the next several quarters and even years.

Why did I recently become bullish on gold mining stocks?

I believe part of the reason for the significant weakness in the precious metal, especially in December, was due to institutions continuing to play the trends. You have to remember that large funds are measured by their performance (yearly and quarterly), and with a strong 2013, very few institutions would initiate an investment strategy of buying gold mining stocks right before year-end, as this could hurt their bonuses.

Over the last few months, we have also seen a large number of gold mining stocks write off bad investments and reduce expansion plans. This has naturally hurt the financial situation over the short term, but I believe most of the bad news has now been priced into the market.

When the stock market bottomed in March of 2009, it was a great time to buy, even though this was a very difficult investment strategy because of all the negativity around the state of the economy at that point. I think gold mining stocks are currently being met with a similar barrage of negativity, which is certainly warranted, considering the state of their businesses.

But as we all know, the business cycle oscillates, and I think gold mining stocks are now at a point where they have written off most of the bad assets and the stocks are pricing in a terrible environment. I’m considering gold mining stocks because very few investors are talking about an investment strategy in this sector, and I think there is the potential for a rise in the price of precious metals in 2014.

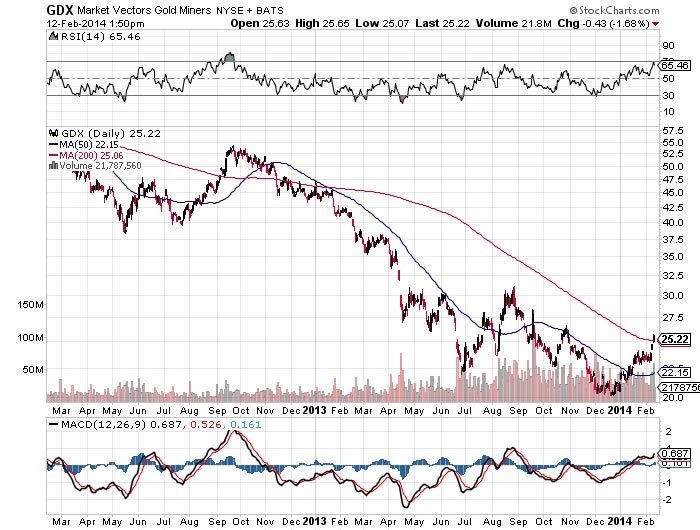

Chart courtesy of www.StockCharts.com

Above is a chart of the gold mining stocks exchange-traded fund the Market Vectors Gold Miners ETF (NYSEArca/GDX). Since gold mining stocks bottomed out in December 2013, the index has quickly moved up to the 200-day moving average. As I noted earlier, the investment strategy to accumulate at the end of 2013 was correct, as large institutions stayed out of the market.

With gold mining stocks moving up quickly to an initial area of resistance, we should see some consolidation before the market continues moving higher. I would keep my eye on the 50-day moving average, as a break below this technical indicator might trigger additional selling pressure and lower prices over the short term.

With gold mining stocks writing off bad assets, and physical demand still remaining quite strong, I think the risk/reward ratio remains in favor of having some allocation to this market sector as part of your investment strategy.

This article Why I Recently Turned Bullish on Gold Mining Stocks was originally published at Daily gains Letter

© 2014 Copyright Daily Gains Letter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.