Bitcoin Trading Alert: Bitcoin Exchanges Under Attack

Currencies / Bitcoin Feb 12, 2014 - 05:02 PM GMTBy: Mike_McAra

If you don’t have time: we still don’t support having any short-term positions.

If you don’t have time: we still don’t support having any short-term positions.

The news of the day is probably the denial of service attack carried out on major Bitcoin exchanges. Bitstamp, a Slovenian exchange, and BTC-e, a Bulgarian one, have both announced they would experience the same kind of problems that earlier hit Mt. Gox.

A denial of service attack (DDoS) is basically an attempt to disrupt the functioning of a website by requesting enormous amounts of information from it. In layman’s terms, the attackers cause the website to “overheat” under the amount of data is has to process. This, in turn, results in the site being unavailable to its usual visitors or customers.

What’s important, no funds are supposedly endangered by the attacks. The full statement from Bitstamp:

Bitstamp’s exchange software is extremely cautious concerning Bitcoin transactions. Currently it has suspended processing Bitcoin withdrawals due to inconsistent results reported by our bitcoind wallet, caused by a denial-of-service attack using transaction malleability to temporarily disrupt balance checking. As such, Bitcoin withdrawal and deposit processing will be suspended temporarily until a software fix is issued.

No funds have been lost and no funds are at risk.

This is a denial-of-service attack made possible by some misunderstandings in Bitcoin wallet implementations. These misunderstandings have simple solutions that are being implemented as we speak, and we're confident everything will be back to normal shortly.

Withdrawals which failed on the 10th and 11th of February will be canceled and the amounts added back to the customer account balances.

We will communicate any further developments regarding this issue.

BTC-e announced withdrawal delays via their Twitter account:

Due DDOS on Bitcoin network there is a delay possible with crediting of transactions madden between 10-11 February. Be patient please

Not much in the way of reassuring Bitcoin users. Adding to the problems of Mt. Gox, this creates a situation in which the three biggest exchanges don’t function properly. It might be wise to wait for the situation to clarify, before allocating any capital to Bitcoin exchanges.

Now back to Mt. Gox.

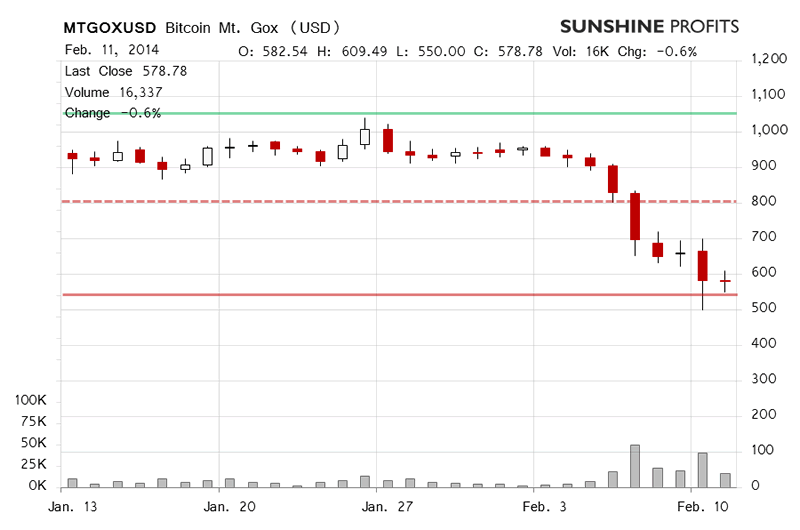

Bitcoin was relatively stable yesterday on Mt. Gox, losing 0.6% at the end of the day. 16,337.05 bitcoins were traded, less than half of what we had seen the day before. Overall, the picture yesterday was of a move declining in strength and we even said it was tempting to bet on a reversal. We did not do that, since we perceived the situation as particularly risky, given Mt. Gox’s current problems.

The action today seems to deny any possible reversal (this is written just before 8:30 a.m. EST) since the volume is already almost as high as it was yesterday. The move itself has been down, 9.1% down compared with yesterday’s close. This paints a picture of possible further declines, perhaps below $500.

Because of the problems the Bitcoin exchanges have recently experienced, we are currently considering including more than one exchange in our analysis. Changes should be introduced in the nearest future. We also think that the current situation on Mt. Gox is still worth looking at, since any severe deterioration here might translate into decisive moves on other exchanges.

Bitcoin is currently dancing around the $540 level (close to the Dec. 18 close, solid red line on the chart). There are no strong indications that the price is coming back above $600 just now. The outlook is all the more bearish as the actual price level is below $540. A move away from this level to the downside could possibly bring Bitcoin as low as to $450 (no sure bet, though).

Any serious moves on Mt. Gox would be likely accompanied by similar, although weaker, moves on other exchanges. This makes the short-term outlook bearish throughout major exchanges.

Summing up, in our opinion no short-term positions should be kept at this moment.

Trading position (short-term, our opinion): no position. We’re waiting for the situation on Bitcoin exchanges to normalize.

Regards,

Mike McAra

Bitcoin Trading Strategist

Bitcoin Trading Alerts at SunshineProfits.com

Disclaimer

All essays, research and information found above represent analyses and opinions of Mike McAra and Sunshine Profits' associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Mike McAra and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. McAra is not a Registered Securities Advisor. By reading Mike McAra’s reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Mike McAra, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.