LIBOR Interbank Market Stays Frozen Despite Bank of England £50 Billion Bailout

Interest-Rates / Credit Crisis 2008 Apr 22, 2008 - 02:50 PM GMTBy: Nadeem_Walayat

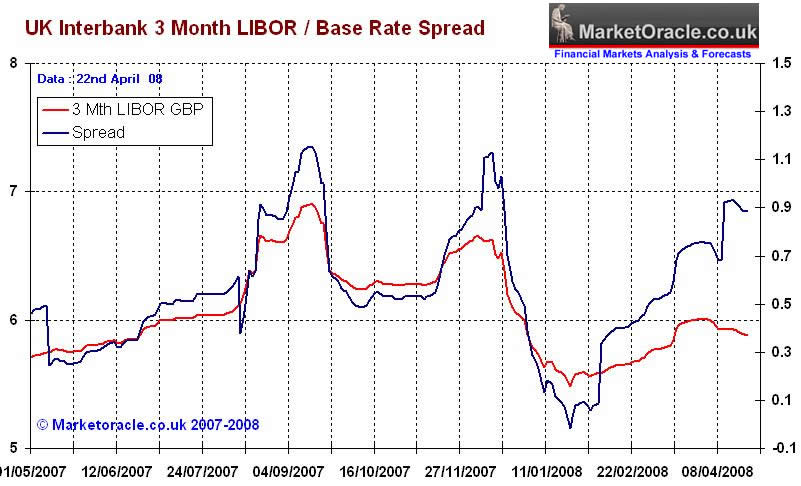

This weeks Bank of England and UK Treasuries unprecedented near 'panic' action to prevent a string of Northern Rock type Bank Busts has so far failed to have any impact on the interbank market. The spread between the official LIBOR rate and the base rate remains at credit crisis extremes.

This weeks Bank of England and UK Treasuries unprecedented near 'panic' action to prevent a string of Northern Rock type Bank Busts has so far failed to have any impact on the interbank market. The spread between the official LIBOR rate and the base rate remains at credit crisis extremes.

The £50 billion of UK Tax Payers money was expected to kick start the interbank money market, however as I pointed out in the article preceding the announcement ( Bank of England Throws £50 billion of Tax Payers Money at the Banks ) it is unlikely to have any significant impact, and sets in motion the precedent of the banks drawing £50 billion every few months from the UK treasury by exchanging unpriceable and effectively worthless mortgage backed bonds with 100% safe gilt edged government stock. We could easily pass the £200 billion mark before the end of this year which would result in an increase of UK government debt of 33%. The banks are quite successfully effectively blackmailing the UK Government that either you pay up £50 billion every few months or we threaten to go bust !

Whatever spin the government puts on the conditions attached to the swaps, the fact is that bad debt that cannot be priced by the market IS being put up as collateral against as good as cash bonds. Therefore the banks can literally walk away from the bad debts, leaving them on the governments balance sheet.

The governments naive reasoning for the huge amounts being handed out to the banking sector is for the banks to start passing on the three interest rate cuts to the consumer / home owners and to make mortgages more readily available. The problem with this is that the world has moved on from the pre-credit crunch easy credit days. Which basically means the banks are now risk averse, they do not want to lend money to UK Mortgage applicants just as the UK Housing market shows signs of falling off the edge of a cliff.

Neither do the Bank of England and the Treasury recognise that the official BBA LIBOR rate is broken , i.e. that the reported rate is not reflective of the true level of crisis as the reporting Banks are reluctant to announce the degree to which the banks are unable to function due to the continuing deleveraging of the huge $500 trillion derivatives market.

Earlier today, Alistair Darling, the Chancellor of the Exchequer had another meeting with the big mortgage banks, basically stating that the ransom has been paid so please release the mortgage interest rate hostages so as UK economy does not tip into recession during 2009 as the New Labour's clock ticks towards an election deadline. A lot of loud and favourable words were heard, but actions speak louder than words and it is highly probable that for prospective home buyers the mortgage market conditions are set to deteriorate further as the UK housing market is heading for negative year on year house price inflation this month, this despite 'seasonal adjustment' attempts by the mortgage banks to try and prevent these headlines from hitting the media.

Earlier today, Alistair Darling, the Chancellor of the Exchequer had another meeting with the big mortgage banks, basically stating that the ransom has been paid so please release the mortgage interest rate hostages so as UK economy does not tip into recession during 2009 as the New Labour's clock ticks towards an election deadline. A lot of loud and favourable words were heard, but actions speak louder than words and it is highly probable that for prospective home buyers the mortgage market conditions are set to deteriorate further as the UK housing market is heading for negative year on year house price inflation this month, this despite 'seasonal adjustment' attempts by the mortgage banks to try and prevent these headlines from hitting the media.

The banks fearing the consequences of negative equity are set to tighten the already tight lending criteria further so as reduce the risk of default on new mortgages towards zero. Whilst attempting to offload current risky mortgages on their books to other banks through high mortgage interest rates thus a cycle of ever tighter lending criteria and high interest rates to prevent mortgage applications, or as we may start to eventually see to the Bank of England and Treasury.

The UK housing market remains on track of following my analysis as of August 2007 by targeting a fall of 15% over 2 years. If anything the coming months may see an acceleration in the rate of house price decline as the below graphs illustrate that house prices are falling at the more extreme end of the forecast trend range.

Important Articles on the UK Housing Market and Credit Crisis:

By Nadeem Walayat

Copyright © 2005-08 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 20 years experience of trading, analysing and forecasting the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication. We present in-depth analysis from over 120 experienced analysts on a range of views of the probable direction of the financial markets. Thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.