Most Dangerous Economic Era, The Great Divergence: Productivity and Wages

Economics / Earnings Feb 09, 2014 - 03:45 PM GMTBy: John_Mauldin

"In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

"In the economic sphere an act, a habit, an institution, a law produces not only one effect, but a series of effects. Of these effects, the first alone is immediate; it appears simultaneously with its cause; it is seen. The other effects emerge only subsequently; they are not seen; we are fortunate if we foresee them.

"There is only one difference between a bad economist and a good one: the bad economist confines himself to the visible effect; the good economist takes into account both the effect that can be seen and those effects that must be foreseen.

"Yet this difference is tremendous; for it almost always happens that when the immediate consequence is favorable, the later consequences are disastrous, and vice versa. Whence it follows that the bad economist pursues a small present good that will be followed by a great evil to come, while the good economist pursues a great good to come, at the risk of a small present evil."

– From an essay by Frédéric Bastiat in 1850, "That Which Is Seen and That Which Is Unseen"

The devil is in the details, we are told, and the details are often buried in an appendix or footnote. This week we were confronted with a rather troubling appendix in the Congressional Budget Office (CBO) analysis of the Affordable Care Act, which suggests that the act will have a rather profound impact on employment patterns. You could tell a person's political leaning by how they responded. Republicans jumped all over this. The conservative Washington Times, for instance, featured this headline: "Obamacare will push 2 million workers out of labor market: CBO." Which is not what the analysis says at all. Liberals immediately downplayed the import by suggesting that all it really said was that people will have more choice about how they work, giving them more free time to play with their kids and pets and pursue other activities. Who could be against spending more time with your children?

Paul Krugman noted that the data means that potential GDP will be reduced by as much as 0.5% per year, which he dismissed as a small number. And he states that people voluntarily reducing their work hours does not have the same economic effect as people being laid off or fired. Which is true, but not the point nor the import of that pesky little appendix.

Where Will the Jobs Come From?

To me the economic and employment effects of Obamacare are another piece of the larger puzzle called Where Will the Jobs Come From? This may be the most important economic question of the next 30 years. Because this topic has been the focus of my thinking for the past few years, I could be reading more into the CBO's report than I should, but indulge me as I make a few points and then see if I can tie them together in the end.

First let's look at what the report actually said. The CBO stated that the implementation of the Affordable Care Act will result in a "substantially larger" and "considerably higher" reduction in the labor force than the "mere" 800,000 the budget office estimated in 2010. The overall level of labor will fall by 1.5% to 2% over the decade, the CBO figures. The revision was evidently driven by economic work done by a professor at the University of Chicago by the name of Casey Mulligan. (When you do a little research on Professor Mulligan and look past the multitude of honors and awards, you find people calling him the antithesis of Paul Krugman. I must therefore state for the record that I already like him.) For you economics wonks, there is a very interesting interview with Professor Mulligan in the weekend Wall Street Journal. For those who don't go there, I will summarize and quote a few salient points.

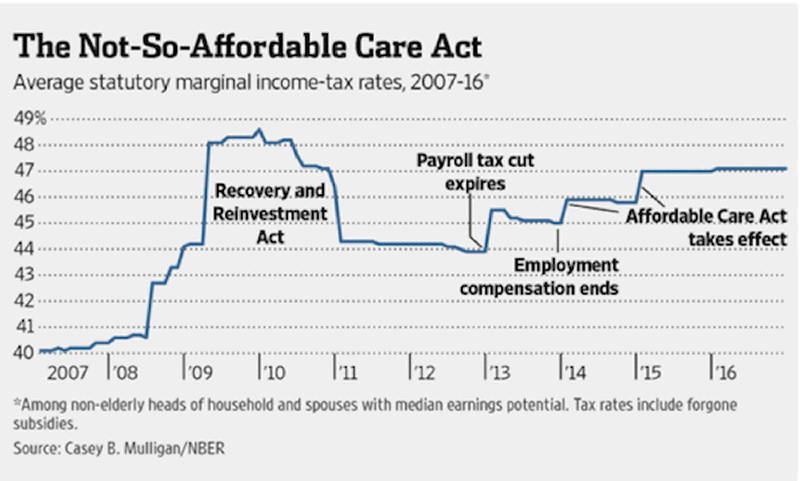

Let's be clear. This report and Mulligan's research do not say Obamacare destroys jobs. What they suggest is that Obamacare raises the marginal tax rates on income, and to such an extent that it reduces the rewards for working more hours for marginally higher pay at certain income levels. The chart below does not pertain to upper-income individuals but rather to those at the median income level.

What Mulligan's work does demonstrate is that the loss of government benefits has the same effect on an individual as a tax increase. If you lose a government subsidy because you work more hours, then for all intents and purposes it is the same as if you were taxed at a higher rate. Quoting now from the WSJ piece:

Instead, liberals have turned to claiming that ObamaCare's missing workers will be a gift to society. Since employers aren't cutting jobs per se through layoffs or hourly take-backs, people are merely choosing rationally to supply less labor. Thanks to ObamaCare, we're told, Americans can finally quit the salt mines and blacking factories and retire early, or spend more time with the children, or become artists.

Mr. Mulligan reserves particular scorn for the economists making this "eliminated from the drudgery of labor market" argument, which he views as a form of trahison des clercs [loosely translated, "the betrayal of academic economists" – JM]. "I don't know what their intentions are," he says, choosing his words carefully, "but it looks like they're trying to leverage the lack of economic education in their audience by making these sorts of points."

A job, Mr. Mulligan explains, "is a transaction between buyers and sellers. When a transaction doesn't happen, it doesn't happen. We know that it doesn't matter on which side of the market you put the disincentives, the results are the same.... In this case you're putting an implicit tax on work for households, and employers aren't willing to compensate the households enough so they'll still work." Jobs can be destroyed by sellers (workers) as much as buyers (businesses).

He adds: "I can understand something like cigarettes and people believe that there's too much smoking, so we put a tax on cigarettes, so people smoke less, and we say that's a good thing. OK. But are we saying we were working too much before? Is that the new argument? I mean make up your mind. We've been complaining for six years now that there's not enough work being done.... Even before the recession there was too little work in the economy. Now all of a sudden we wake up and say we're glad that people are working less? We're pursuing our dreams?" The larger betrayal, Mr. Mulligan argues, is that the same economists now praising the great shrinking workforce used to claim that ObamaCare would expand the labor market.

Paul Krugman interprets the CBO estimates to mean a loss of the number of hours that would be equivalent to the loss of 2 million jobs. The Wall Street Journal sees that same number as equivalent to 2.5 million jobs. Professor Mulligan's research suggests that they are still off by a factor of two and that it could be closer to 5 million job equivalents.

That means a drop in potential GDP growth of somewhere between 0.5% and 1% per year. A small price to pay for universal healthcare, suggests Krugman. I would personally see it as a large price to pay for structuring healthcare reform the wrong way. That we need healthcare reform and that we as a country want it to be universal is clear. But the CBO report makes it evident that there is a hidden economic cost to the country in the way healthcare reform is currently structured. Dismissing potential GDP growth loss of 0.5% per year as "not all that much" is simply not intellectually sufficient.

(And that is taking Krugman's estimate of 0.5% to be the actual negative effect. There are other economists who can produce credible estimates that are much higher, but for the purposes of this letter Krugman's lower estimate will do.)

Doug Henwood over at The Liscio Report produced some fascinating research this week on what it has meant for our economy to be growing at a lower rate since 2007. In another report, the CBO offered its own estimate of future growth, which the normally sanguine Henwood thinks has the potential to make us complacent. Let's jump right to his impact paragraphs (emphasis mine):

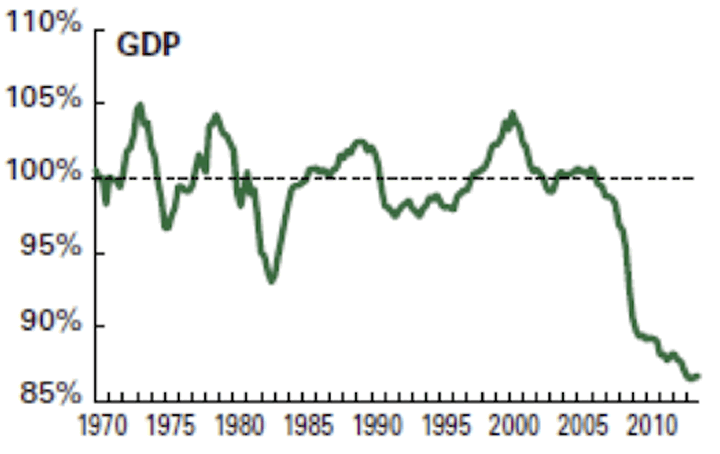

Another way to measure where GDP is relative to where it "should" be is by comparing the actual level to its long-term trend. [That's what's graphed below.] This technique shows the economy in a much deeper hole than the CBO does.

By this method, actual GDP at the end of 2013 was 86.7% of its trend value. That's actually 3 points below where it was when the recession ended. Consumption was 87.4% of its trend value; investment, 75.1%; and government, 84.5%. (Note that government, despite perceptions to the contrary, has been falling, not rising, relative to its trend.)

These are huge gaps. In nominal dollar terms, per capita GDP is $8,278 below its 1970–2007 trend. Using the CBO's less dramatic gap estimate works out to an actual per capita GDP $2,141 below its potential. Either way, that's a lot of money. One way of reconciling the $6,137 disparity between the figures derived from CBO's method and the trend method is by pointing to the long-term economic damage done by the financial crisis and recession.

The hit to investment, productivity, and labor force participation is enormous and long-lived. To put that $6,137 number in perspective, it's very close to the per capita GDP of China. That is not small, and if the CBO is even half right, it's not going away any time soon.

By the way, Casey Mulligan argues in his 2012 book, The Redistribution Recession, that the expansion of the welfare state through the surge in food stamps, unemployment benefits, disability, Medicaid, and other safety-net programs was responsible for about half the drop in work hours since 2007, and possibly more.

The CBO is de facto admitting that the increase in the entitlement spending due to Obamacare is going to reduce GDP. If Mulligan's larger projection is right, we could lose roughly 10% of GDP potential over the next decade. That means the pie in the future will be smaller by 10%. That is a huge difference, not an inconsequential one. It means tax revenues needed to pay for government benefits will be 10% smaller. I am not arguing for or against whether such benefits are a proper expenditure of money; I'm simply saying that we cannot ignore the economic consequences simply because they may be politically inconvenient.

Think about this for a moment. We have lost the equivalent of Chinese per-person GDP in the space of seven years as a result of policy choices made by both Republican and Democratic administrations and due to the financial repression visited upon us by the Federal Reserve – which, by the way, has created multiple bubbles. The way we structure our policy decisions has consequences beyond the obvious.

Rather than immediately jumping to some kind of conclusion on employment that simply offers a number and doesn't offer insight, I want us to look at the larger picture of work and what we get paid for it. We are rightly concerned in the developed world about the concentration of income and wealth in the top fraction of the population. When 85 people own 46% of the world's wealth, as we've repeatedly heard the past few weeks, what does this portend for the future?

Understand that wealth distribution is all relative:

You need an annual income of $34,000 a year to be in the richest 1% of the world, according to World Bank economist Branko Milanovic's 2010 book The Haves and the Have-Nots. To be in the top half of the global population, you need to earn just $1,225 a year. For the top 20%, it's $5,000 per year. You enter the top 10% with $12,000 a year. To be included in the top 0.1% requires an annual income of $70,000." (From a brilliant piece by Morgan Housel titled "50 Reasons We’re Living Through the Greatest Period in World History," in The Motley Fool.)

(Most of the readers of this letter are in the top 1% and many are in the top 0.1%. Feel better about yourself now?)

Now stay with me here. I am going to work toward making a connection between the following section and the Affordable Care Act. In last week's Thoughts from the Frontline we explored the long-term obstacles to growth in emerging markets, as a powerful wave of new technologies shrinks developed-world trade demand for energy and manufactured goods.

I believe this disruption in long-standing trade relationships signals a gradual realignment in the global economy as the developed world moves toward a Third Industrial Revolution and threatens to leave a lot of global workers behind. This week, let's shift our focus to the long-term impact of tech transformation on productivity and wages in developed markets – particularly in the USA, where the majority of the innovation is happening.

The gist is simple and unavoidable: Since the majority of jobs are vulnerable in some way to automation, almost all of us – your humble analyst included – will have to make a real effort to continually learn and hone new skills in order to participate in the new economy. There has never been a better time for talented workers who possess the right mix of skills and creativity to capitalize on new technology, and there has never been a worse time for workers who lack the skills or creativity to tap into the abundance that awaits. (I invite readers to cogently disagree with that last sentence. I hope I am wrong. Seriously, I think about this a lot and am open to learning.)

The Great Divergence: Productivity & Wages

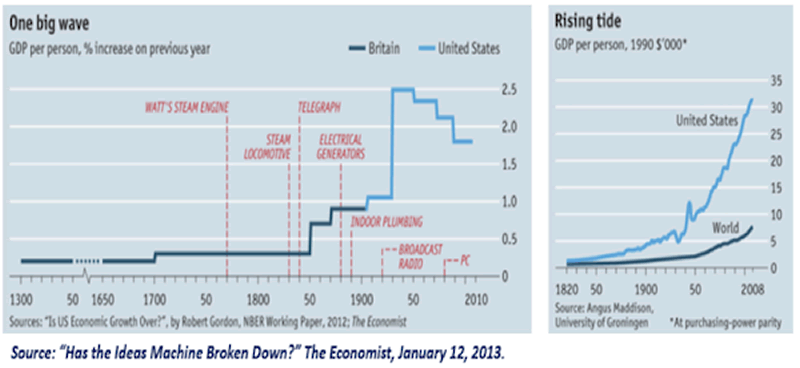

Over the very long term, the real drivers of lasting economic growth around the world have been the great spurts of innovation enabled by the First and Second Industrial Revolutions – two transformative periods between 1750 and the mid-1970s during which the invention of world-changing "general-purpose technologies" like the steam engine, electricity, and indoor plumbing enabled generations of follow-on innovation and drove massive gains in productivity and real GDP per capita.

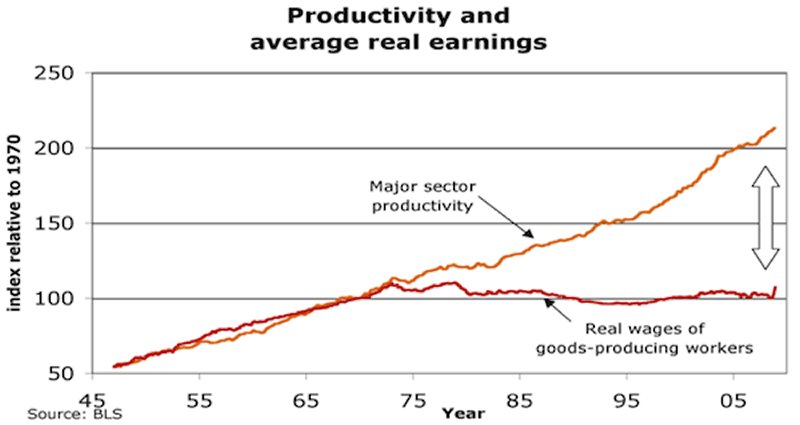

The miracle of industrialization was that real wages grew roughly in line with productivity – meaning that the returns to labor and the returns to capital were fairly evenly distributed. As workers produced more output in less time and with less effort, they also received higher pay. This relationship held until the mid-1970s, when real wages suddenly flat-lined in the face of rising productivity.

It seems that the positive effects on wages produced by the First and Second Industrial Revolutions petered out in the late '70s, just as the Information Revolution was producing what could be called the Information Economy.

Thus far, the gains of the Information Economy have been unevenly distributed, and the past 40 years have not been kind to the American worker. US multinationals began to outsource more and more manufacturing jobs to lower-wage emerging markets just as computers started to enable the use of increasingly capable but also increasingly complex technologies. Average workers could not easily join the Information Economy without the skills or educational foundation to adapt from labor-intensive manufacturing work to knowledge-intensive information work; and so they have not participated in the real wage gains available to higher-skilled workers.

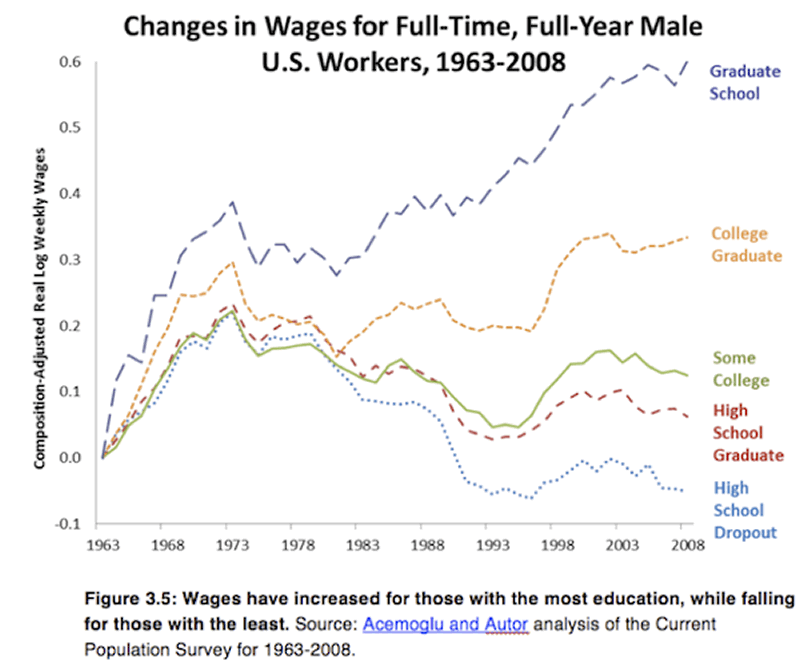

As you can see in the chart below, workers with college and graduate-level educations have enjoyed higher wages while workers with less education have struggled to make ends meet.

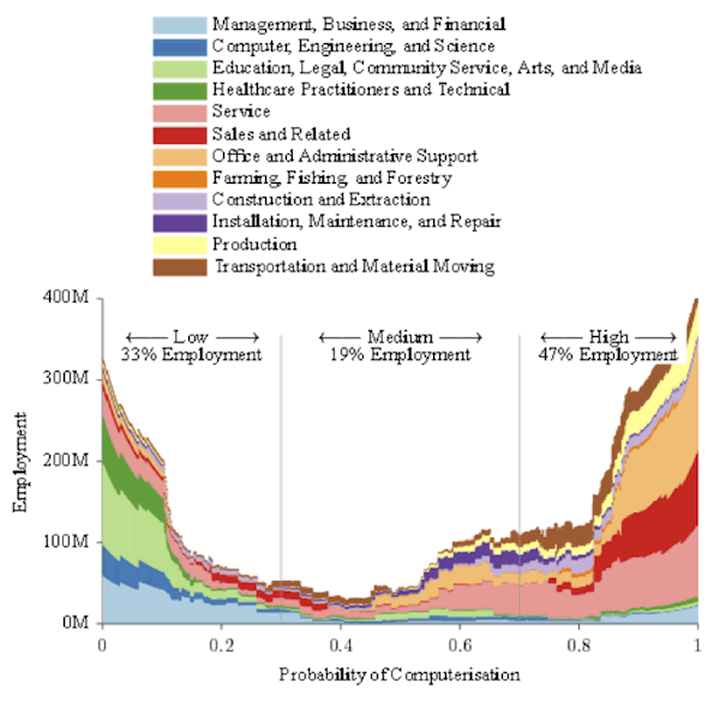

Still, earning a college degree does not guarantee gainful employment, something that many of us told our children would happen as we encouraged them simply to "go to college." Ultimately, scoring a good job comes down to skills. The vast majority of jobs are vulnerable to some kind of disruption or displacement from computer-enabled innovation. Meaning that – at some point in their careers – most workers will have to learn new skills and evolve as technology evolves. As you can see in the following chart from a study by Oxford University professors Carl Benedikt Frey and Michael Osbourne, nearly 50% of all jobs in the United States run a very high risk of displacement or disruption by computerized automation in the coming years. (Warning: reading the study requires the information skills and especially math that they suggest may be lacking.)

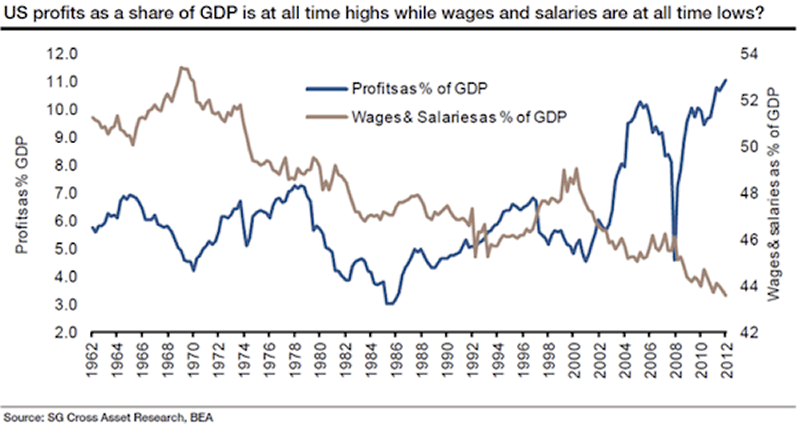

All this suggests that the current trend, wherein the average wage earner has not seen his wages increase along with GDP and corporate earnings growth, is likely to continue, not due to some malignant greed on the part of heartless corporate entities but because of the very nature of the Information Economy and the emerging Third Industrial Revolution. Those with skills and adaptability are going to continue to outperform, at least with regard to income, those who have not been able to develop the necessary skills for the coming economic transformation.

The next chart illustrates just how long this trend has continued and how significantly different the directions are between corporate profits and wages as a percentage of GDP. Given the uneven nature of the future employment market, it may be quite some time before we see these lines cross again. The last time it took the deepest recession in our lifetimes, but the bounce down was only temporary.

Now, what does the shifting of jobs in a knowledge-based economy have to do with work incentives in the Affordable Care Act? If we structure a society in which people are incentivized not to work, we are going to create a society that not only produces less but that displays a growing disparity in the distribution of wealth. If we offer people economic reasons not to work, we should not be surprised when they take us up on the offer. We can disguise that offer as all sorts of necessary social reforms, but at the end of the day a smaller labor force will affect the size of the pie that we all want to see grow and to partake of. I refer you back to Bastiat, whom I quoted at the beginning of this letter: it is the unseen things in well-intentioned public policies that will have small, incremental, but finally significant effects upon the whole economic body.

I have struggled with allergies off and on over the years. What I have learned is that allergies are incremental. I can be around many things to which I only have a mild allergic reaction, and I have no symptoms. But when I'm around many of them all at once I have to start looking for my allergy medicine. One can argue, perhaps correctly, that the economic effects of a particular policy like the Affordable Care Act are only a minor problem. But it is the cumulative effect of numerous social policies, regulations, monetary policies, incentive structures, lack of educational reform (and the list goes on and on) that takes a toll on our economic body.

If government is small relative to the economy, then incremental changes in its policies have a lesser effect than when the government is large and its policies pervasive.

The coming Third Industrial Revolution requires a profound realignment and restructuring of the incentive systems built into our society. We are talking about a technological revolution that in its compound effects will accelerate change to such an extent that we will see as much change in the next 10 to 20 years as we saw all of last century. Suggesting that one employment- or growth-reducing policy or another only makes a small difference and is worth the price we'll pay is a flippant dismissal of the dynamics of the situation we face. These things have consequences.

Jeremy Grantham in his recent quarterly letter looks at the incremental effect of a lower growth rate. He tells us that the remarkably steady 3.3% US growth rate from 1880 to 1980 multiplied income 26 times over that century, that the 2.8% average growth from 1980 to 2000 would compound income 16 times over a period of a century, but that the 1.4% rate experienced over the past 13 years would multiply income by just 4 times over a century.

In the same report mentioned at the beginning of this letter, the CBO gave us its economic and budget outlook for 2014 to 2024. They projected GDP growth of 3.1% this year and 3.4% in 2015 and 2016.

But growth, according to the CBO, will fall to 2.7% in 2017 and continue to slow "to a pace that is well below the average seen over the past several decades," largely because of slower growth in the labor force due to the aging population and mild inflation (under 2.0%) for the next several years.

How significant is this slowing? The CBO estimates if the economy grows just one-tenth of a percentage point slower each year for 10 years, the cumulative deficit will be $311 billion greater than the $7.9 trillion it is now projecting. That 0.5% less GDP growth per year that Krugman expects would therefore translate into another $1.5 trillion added to the deficit that would have to be dealt with either through reduced spending or increased taxes. That amount is just slightly less than 10% of our current GDP. I think that is significant. But that's just me, the deficit worrywart.

I agree with the conclusion of Ezra Klein (if not his general thesis), writing in Bloomberg on February 6:

Policies don't exist in vacuums. By untying the link between employment and health care, the Affordable Care Act reduces the incentive to work. But there are ways to increase incentives to work without making people dependent on their jobs for health insurance. We can help people without taking away their health care.

It's all connected: healthcare, financial regulation, technological transformation, energy policy, foreign policy, trade policy, immigration, tax reform (and the list goes on and on and on). Everything contributes to the environment for business and economic activity; and when the environment is good, that translates into jobs. It is becoming ever more vitally important to focus on how our policies across the board connect and to see them as parts of a whole rather than in a simplistic one-off manner. Does a policy not only allow us as a society to behave in a more responsible manner but also allow us to grow our economy and create jobs? If it doesn't do both, then it's back to the drawing board.

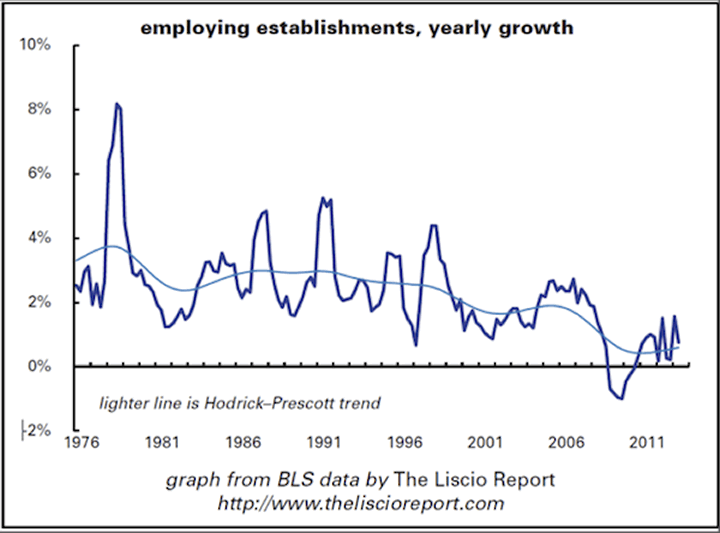

I'll finish with one final chart (courtesy of my friend Philippa Dunne at The Liscio Report). This is a chart of new businesses being created. New businesses are the true engine of economic growth and job creation. Policy makers need to think about this chart with every decision they make. They need to determine why the trend is clearly down and how to reverse it.

Los Angeles, Miami, Argentina, and South Africa

I will be speaking next week at the George W. Bush Presidential Library auditorium with local celebrity investment advisor Erin Botsford, who wrote The Big Retirement Risk: Running Out of Money Before You Run Out of Time. The event is sponsored by my partners at Altegris Investments. (It sold out before I even had a chance to mention it. Sorry.)

And speaking of Altegris, let me suggest for further reading that you look at the work of my old friend Jack Rivkin, who has become (to my great delight) the new Chief Investment Officer there. A respected thought leader, Jack has had CIO roles in the investment industry with Neuberger Berman, Citigroup Investments, and Paine Webber and has overseen tens of billions of dollars. His work has also been featured in one of Harvard Business School's most-read case studies. You can find his full biography here if you're interested. If it seems that he's done a lot (and he has!) it's because he's been at it for a while. Jack and I share an avid interest in how the future of technology will shape our society, and I treasure the time I get to spend with him talking about that.

Since joining Altegris in December, Jack has begun offering commentary about global economic and political events, trends, investing, and alternative investments. People in the know in the investment community pay attention to what Jack says. I highly encourage you to visit his "CIO Perspectives" at Altegris.com to read his latest articles. Jack consistently makes very good points in his commentaries, and I think you will find he has real insights on the topics we've been discussing of late.

In mid-March I will fly to Cafayate, Argentina, where I get to relax and spend time with friends Bill Bonner and Doug Casey and Mauldin Economics business partners David Galland and Olivier Garret. The plan is to round up a serious four-wheel-drive vehicle and trek to Bonner's hacienda at 9,000 feet in the Andes. We made the trip last year but had to be towed several times as your humble analyst got us stuck in sand and again as we crossed the river. There is literally no road for the last hour, just (hopefully) dry riverbed and cow paths over very rocky terrain. Quite the adventure and fabulous fun with a great deal of fantastic conversation awaiting us at Bill's. Last year I even ventured out horseback riding, although I might ask for a less frisky animal this year. I may be a Texan, but I was not born in the saddle.

Then in one of those "you can't get there from here" trips, I'll fly back to Texas, only to get on another plane later that same evening to fly to South Africa (don't even ask). I hope to spend four days at some fabulous game reserve in South Africa but have yet to choose which one. I am open to suggestions. My only requirement is wifi.

It is time to hit the send button. This weekend should prove a great deal of fun. I intend to see The Monuments Men with that long list of (ahem) older stars, and then the next night Paul Simon and Sting are in concert just a few blocks away. When I tell people I'm going, nearly all of them (especially the ladies) tell me their favorite Sting song, but I have to admit that I'm going for Paul Simon. He has been one of my favorites for almost 50 years. His songs dominate my playlist. His music simply feeds my soul. "Bridge Over Troubled Water," "The Sound of Silence," "Graceland," "Diamonds on the Soles of Her Shoes," and the inimitable "Slip Sliding Away." I met him once at a Yankees World Series game, but that's another story. Have a great week and spend some time with your favorite musician. It will make the future world a little less scary.

Your still crazy after all these years analyst,Like Outside the Box?

Sign up today and get each new issue delivered free to your inbox.

It's your opportunity to get the news John Mauldin thinks matters most to your finances.

© 2013 Mauldin Economics. All Rights Reserved.

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.MauldinEconomics.com.

Please write to subscribers@mauldineconomics.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.MauldinEconomics.com.

To subscribe to John Mauldin's e-letter, please click here: http://www.mauldineconomics.com/subscribe

To change your email address, please click here: http://www.mauldineconomics.com/change-address

Outside the Box and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA, SIPC, through which securities may be offered . MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at http://www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, and none is expected to develop.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.