Stock Market Napalm - Can You Hear the Popping Sounds?

Stock-Markets / Stock Markets 2014 Feb 08, 2014 - 06:43 PM GMTBy: Ty_Andros

Once again the smell of NAPALM is in the air. Reversals in liquidity and Massive markets reaction to PUNY emerging market outflows PROBABLY signals the next waves of insolvencies are STRIKING as I write this. Most main stream economists, banksters, brokers, governments and public servants are calling for continued recovery in developed world economies; to me it APPEARS we just saw the PEAK.

Once again the smell of NAPALM is in the air. Reversals in liquidity and Massive markets reaction to PUNY emerging market outflows PROBABLY signals the next waves of insolvencies are STRIKING as I write this. Most main stream economists, banksters, brokers, governments and public servants are calling for continued recovery in developed world economies; to me it APPEARS we just saw the PEAK.

As Warren Buffet once said “When the tides go out we find out who has been swimming naked” and we are about to see this statement in ACTION!!!

Now the weakest hands (IN AT THE TOP) are set for the firecrackers they call developed world stocks and UBER LEVERAGED financial assets to IMPLODE, blowing massive holes in their portfolios and lives, sparking a momentum driven liquidation as overleveraged players meet their WATERLOO as the leverage which is epidemic in the FINANCIAL Systems and their investment positions FAILS. Most people live in the matrix and cannot SEE as the media and governments in which they have placed their trust BLACK OUT critical issues from their eyes, ears and MINDS. This episode is no different. They are in for a surprise.

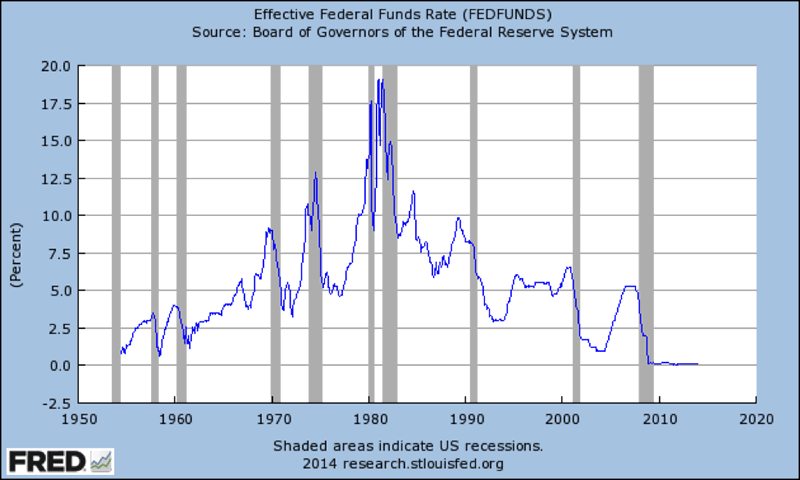

I believe Janet Yellen is being met at the door as she assumes control of the central bank to the world by the next CRISIS for the Global financial systems and economies. Every Fed chief in the last 60 years has been subjected to trial by FIRE; hers may be arriving before she does. LET ME BE CLEAR: the GLOBAL financial system and financialized economies CANNOT withstand ANY TIGHTENING and a lot is being SERVED UP NOW! The reason the rout did not start in December is that the actual taper did not start till now.

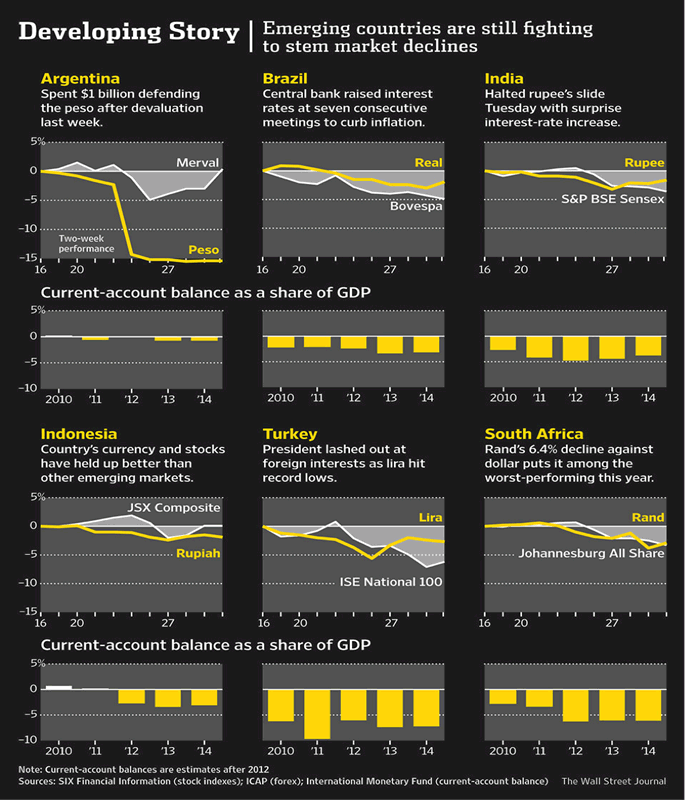

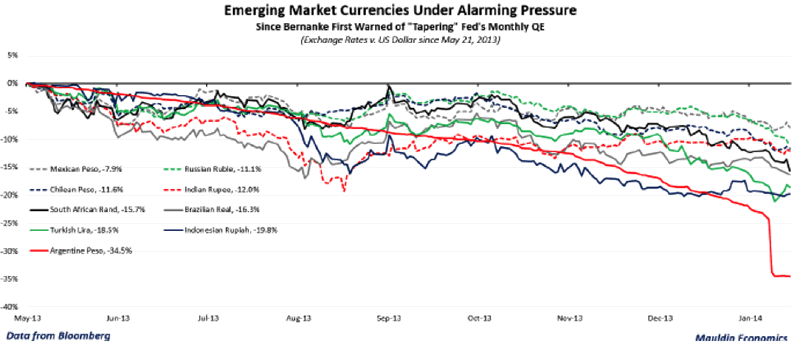

These challenges include Dodd Frank (stealth political directed tightening and politically directed lending to favored constituents: students, US government and the housing industry to name a few), the taper, and the emerging markets convulsions as investment flows reverse. Take a look at the EM rout which has just unfolded since December’s taper announcement.

This rout has just BEGUN, as the outflows have been PUNY compared the total FDI ($4Trillion foreign direct investment) since 2008. Check out this chart from John Mauldin’s latest Missive (do not miss this it is one of his best ever, www.mauldineconomics.com )

This run has barely begun; the first country to set up capital controls will IGNITE the BOMB!

The beginning of the proverbial run on the bank of the emerging world actually began back in May when Bernanke floated his HOT AIR TRIAL balloon of the TAPER. The reaction at that time was a DOUBLING of US interest rates on just the thought of it. The Fed did a quick climb-down then, what will happen now?

Most thought dollar and euro reserves where adequate compared to 1998 crisis. Yes, if the problem was the SAME size as it was at that time. NO, as the external investments in their countries NOW DWARFS what it was then. MANY ARE DEPENDANT on FDI to fund government consumption and hot money propped up asset markets.

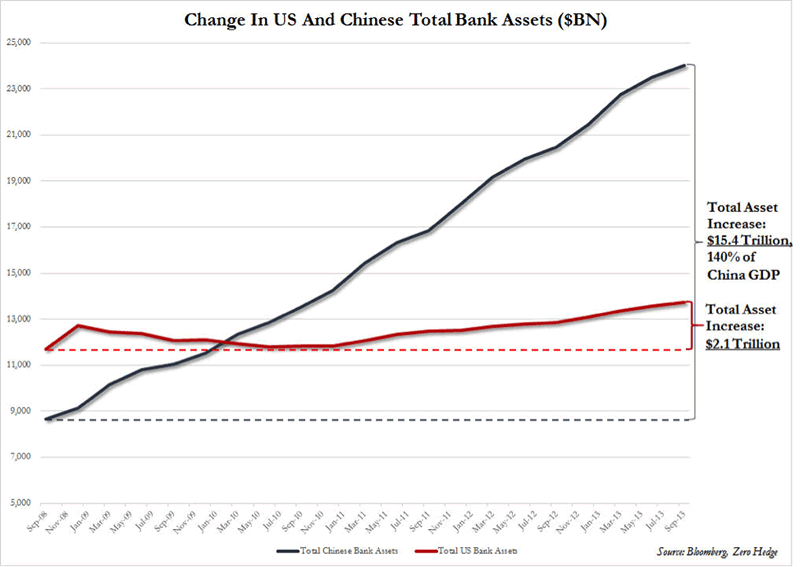

Add to this China’s MANDARINS desperate attempt to pull their financial system back from the MOUNTAINS of DEBT that they have created since 2007. They are truly sitting on a financial system extinction event if this mountain of new lending GOES BAD (hint, it already has it just hasn’t been announced yet).

Author’s Note: In my opinion the greatest manmade disaster and OPPORTUNITY in history is unfolding in every corner of the world. Are you diversified or operating with EYES WIDE SHUT? Are you prepared to turn it into opportunity by properly diversifying your portfolio? Adding absolute return investments which have the potential to thrive (up and down markets) regardless of what unfolds economically? Hedging the printing presses impact on your paper money? This is what I do for investors; help them diversify into investments which are created to potentially thrive in the storm. For a personal consultation with me CLICK HERE!

The Chinese government has BANNED the words: CREDIT CRUNCH, and it is being reported many cash transfers have been HALTED (not confirmed).

Authors Note: The financial and personal destruction and draining of liquidity (huge money now redirected to healthcare that used to be for personal consumption for those earning over $45,000) created by the Affordable care act aka Ob@m@c@re and expanded Chinese analysis will be covered in a commentary’s later in this series, subscribe for free CLICK HERE

Since 2009, CREDIT in China has compounded at almost 30% plus per year and fueled growth of about 8%. Once again, debt MASQUERADING as GROWTH. The Bernanke Fed created the bombs with QE and lit the fuse as he exited with the TAPER in place. Now we will see if they can extinguish the fuse BEFORE the EXPLOSION. It appears to be too late as I will ILLUSTRATE. The dominoes are already in motion.

Yellen is joined in this battle by the Peoples bank of China (central bank of china) which is trying to engineer a soft landing to the explosive credit bubbles which have formed there since 2008. Credit in China has grown from 8 trillion dollars to over 24 TRILLION in just 5 short years (chart courtesy of www.zerohedge.com ):

It is estimated that AT LEAST 15% of this debt is NO GOOD (spent on consumption, and fueled massive capital flight of NEWLY MINTED CHINESE MILLIONAIRES) and that almost 45% of it MUST ROLL OVER in 2014. Can it do so without triggering a Lehman moment? Don’t bet on it! This will be covered in detail in a future edition of TedBits. Subscribe for free CLICK HERE

The world’s two largest economies are NOW highly correlated to one another, and being challenged SIMULTANEOUSLY. The next episode of the Global financial crisis is set to begin. Globally tightening cycles have begun and NOMINAL fragile economic recoveries are being aborted. I say nominal because there is no REAL growth in the developed world, only growth in piles of paper and debt-fueled consumption called growth.

Malinvestments (stocks, bonds, real estate which yield virtually nothing) have now accumulated for YEARS. Investors (banks, institutions, pension funds, etc.) of all stripes are out on a limb in investments which yield little or nothing and they are being SAWED off. Since Quantitative easing began in 2008, correlations in many asset classes have gone to 1! They will crater the same way when the BIG WAVE of insolvency hits again. It is not “if” it is “when”….

These investments involve ungodly amounts of leverage to create YIELD which is no longer available to the common man because of the 5 years of FINANCIAL REPRESSION. Just the absence or reduction in available leverage is the same as a tightening, and paper fueled growth cannot continue to expand.

“Financial repression is any of the measures that governments employ to channel funds to themselves, their financial systems, and politically connected corporations, that, in a deregulated market (unmanipulated by central and commercial banks), would go elsewhere. Financial repression can be particularly effective at liquidating debt” - Wikipedia

And transferring income to themselves that should belong to the private sector savers I would add. Interest rates have now been at ZERO for over 5 years and assets that really yield anything are PRICED for perfection. This chart by www.dshort.com illustrates an economy where money is FREE for the most connected system insiders (not you and me):

That is a picture of a US economy and financial system on life support since 2008. It is dead, like a patient at the hospital kept alive by machines. In this case, computers which can print money OUT OF THIN AIR to buy toxic FINANCIAL assets of all types to prop up insolvent banks and governments.

In the stock markets, the tea leaves are frightening to view, but a connect the dots moment has arrived for readers of this missive. After last year’s melt up, courtesy of the feds, printing presses (one million million was printed or aka $1.02 TRILLION) fueled last year’s historic rise. The stock market run into the end of the year was nothing short of insane with major global macro BEARS, THROWING in the TOWEL signaling a top is at hand.

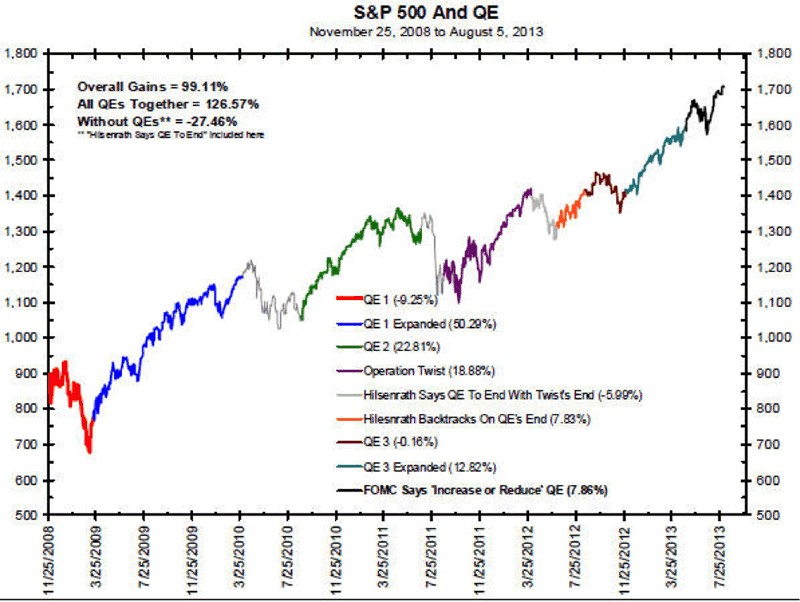

Check this chart by Bianco research showing stock gains or losses with and without QE illustrating the CAUSE and effect of QE on and QE off:

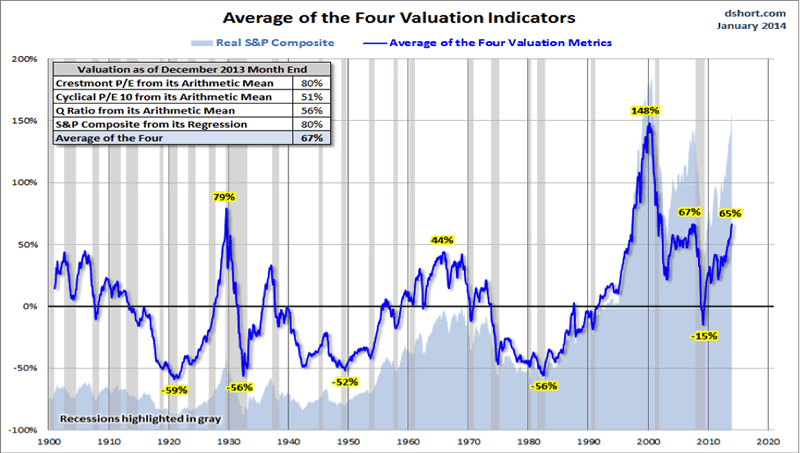

Markets have only risen when the printing presses are ENGAGED. Just as in previously illustrated episodes, it’s now BOMBS AWAY! Only 3 times in the last 113 years have valuations been higher and all were preludes to a CRASH, once again courtesy of www.dshort.com:

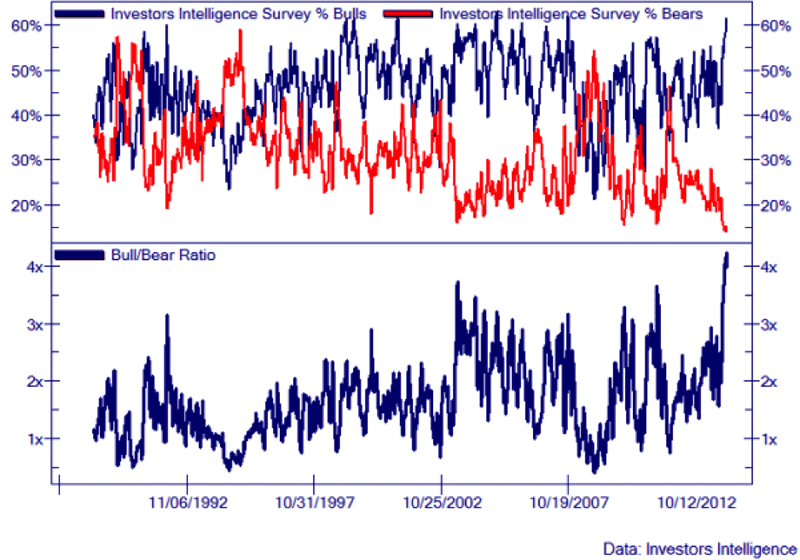

Bullish sentiment is at 3 decade highs and bearish sentiment is at 3 decade lows:

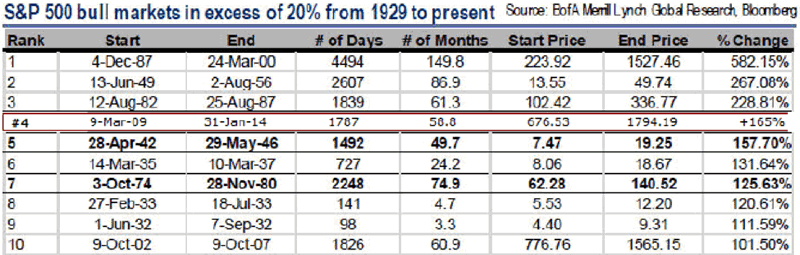

Looking at the 10 greatest BULL markets in the S&P 500 since 1929, we get a good hint of what the comparisons are of previous bull markets (courtesy of Global money trends and Gary Dorsch).

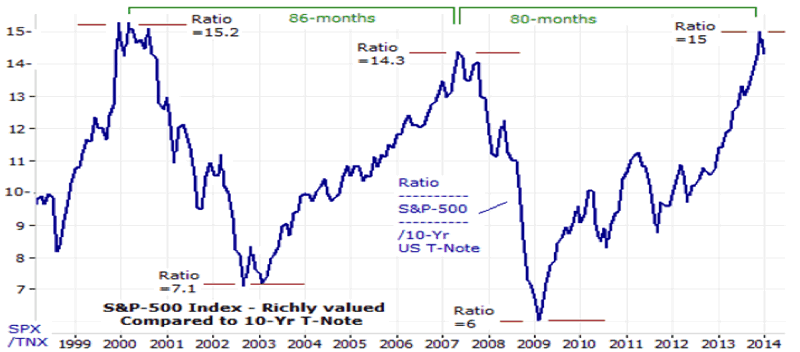

Let’s review: the current bull is the 4th best ALL TIME, the average is 55 month/this one is now 59 months - Just 2½ months shy of the 3rd longest in history. Look at the 3 that are greater, and compare it to the credit growth we have seen leading to this peak. Now let’s look at the S&P 500 versus Bonds on a valuation basis since the secular BEAR market in stock began in 2000 (courtesy of www.sirchartsalot.com I recommend this highly):

OUCH, stock valuations versus the 10 year note at highs that preceded every major CRASH in the last 14 years. Is past prologue?

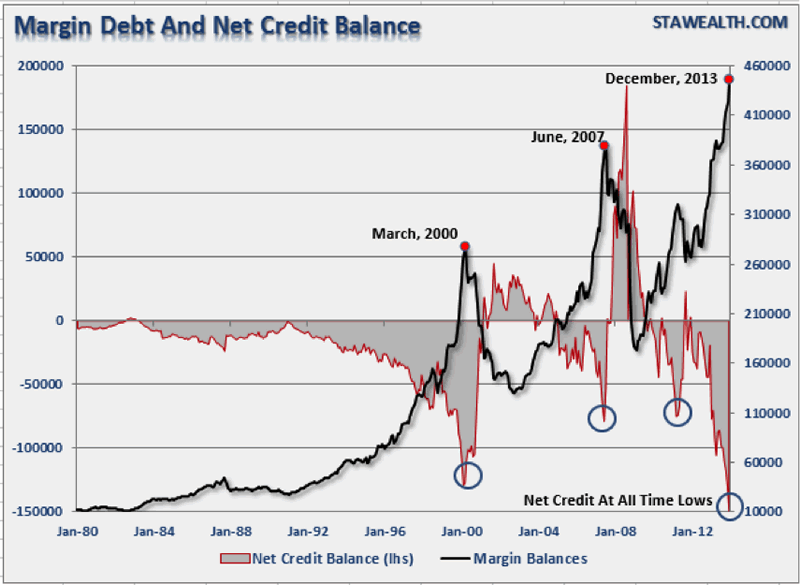

DO YOU REALLY THINK THE MAJORITY OF INVESTORS ARE ALL GOING TO PROFIT FROM HERE? There is something called the 20/80 rule: 20% of the investors get 80% of the gains while the other 80% get to other 20%. In my opinion, this time will be no different. There is a lot of pain between here and there. Margin debt is at the HIGHEST LEVELS IN HISTORY BY FAR (chart courtesy of Lance Roberts www.stawealth.com) while net credit is at ALL TIME LOWS:

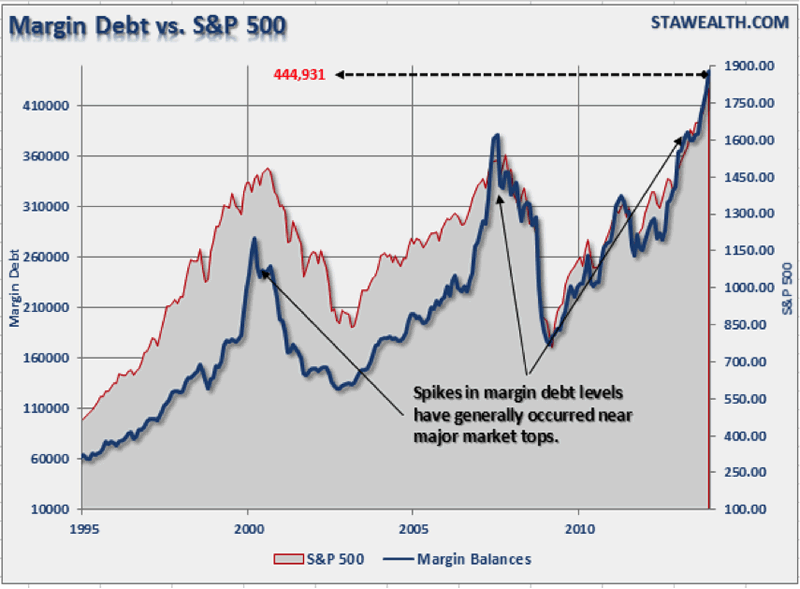

Notice net credit balance at ALL TIME LOWS with Margin at BIG ALL TIME HIGHS, where is the money going to come from to fuel the move upward from here? I believe that surge in margin is the public arriving in DROVES. And now Lance overlays the S&P 500 with the margin picture:

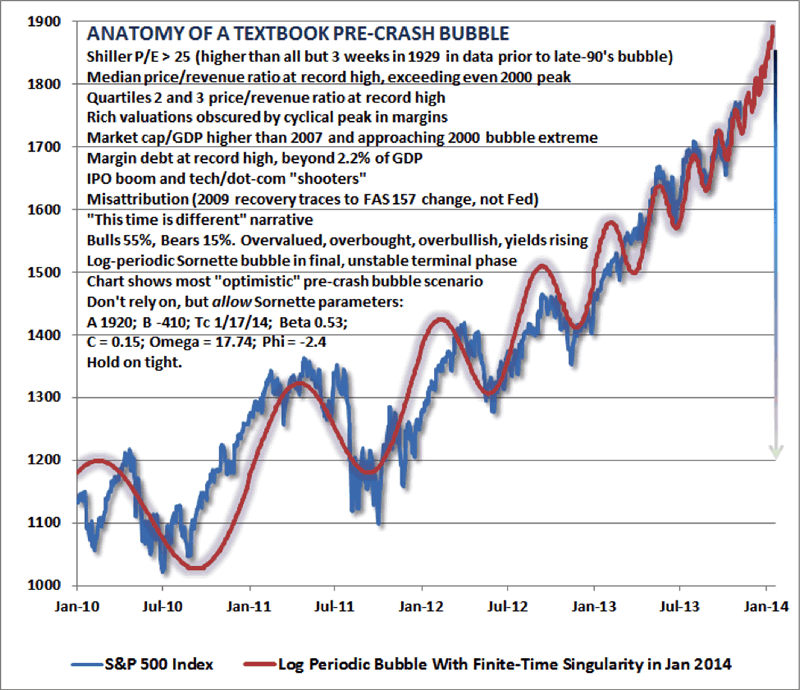

When this margin turns lower, LOOK OUT BELOW (CASCADING MARGIN CALL LOOM). The STOCK market bull is as ripe as a 7 day old banana. Look CAREFULLY at this chart of the S&P 500 by Dr. John Hussman overlaid with his notes/analysis:

This is an illustration of the MADNESS of CROWDS and INSANITY. His referral to fasby 157 was the catalyst for the launch off the 2009 lows when “mark to myth” of financial assets was restored and “mark to market” valuations BURIED, allowing financial system insolvency to be OFFICIALLY COVERED UP. OVERT Regulatory approved INSOLVENCY of the financial systems as it is up to today.

In terms of Fibonacci time frames, between crashes it was 13 years between 1987 and 2000. The time between 2000 and 2008 was 8 years, a Fibonacci time period of about 62%. If we use that SAME Fibonacci timeframe from 2008, the next crash is set for about the 5 year anniversary this fall.

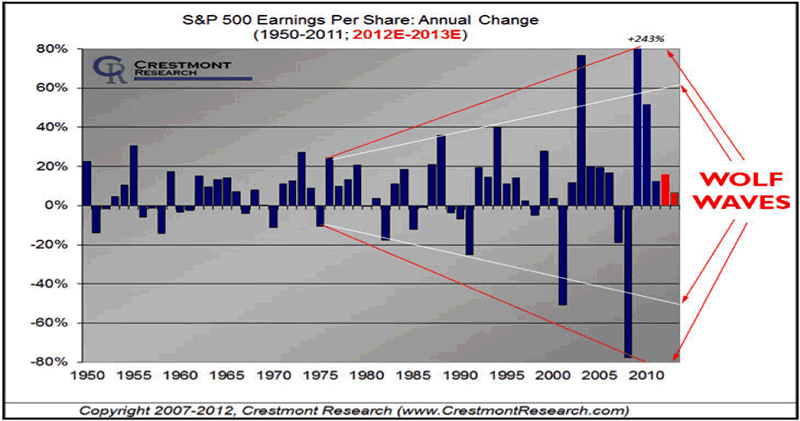

And a wolf wave (see the mega phone formation in the earnings chart?) in EARNINGS is due to BOTTOM in late 2013 or early 2014. Notice how this wolf wave began at about the time of Bretton Woods II in 1971? This wolf wave is a product of Bretton Wood II as the financialization of the economy BEGAN at that time. Now GROWTH only comes from FIAT MONEY illusions, the REAL economy in flyover country has been KILLED and HOLLOWED OUT by corrupt public servants, crony capitalist companies and the beast called the FEDERAL RESERVE and banking systems!

WOLVES EAT THINGS and this one will too. This is a wave of instability with money and credit growth increasing and decreasing as money and credit creation is either too hot or too cold. Will we decline to the inner wolf wave or the outer one? Will the predictive ability of this chart signal the near future or FAIL?

I used this chart in commentary in March 2007 to predict a crash into the 2008 elections. I am doing so again today with a crash into the 2014 elections accompanied with a crash in the economy. With a top already in place or before MAY. MAKE a NOTE of it!

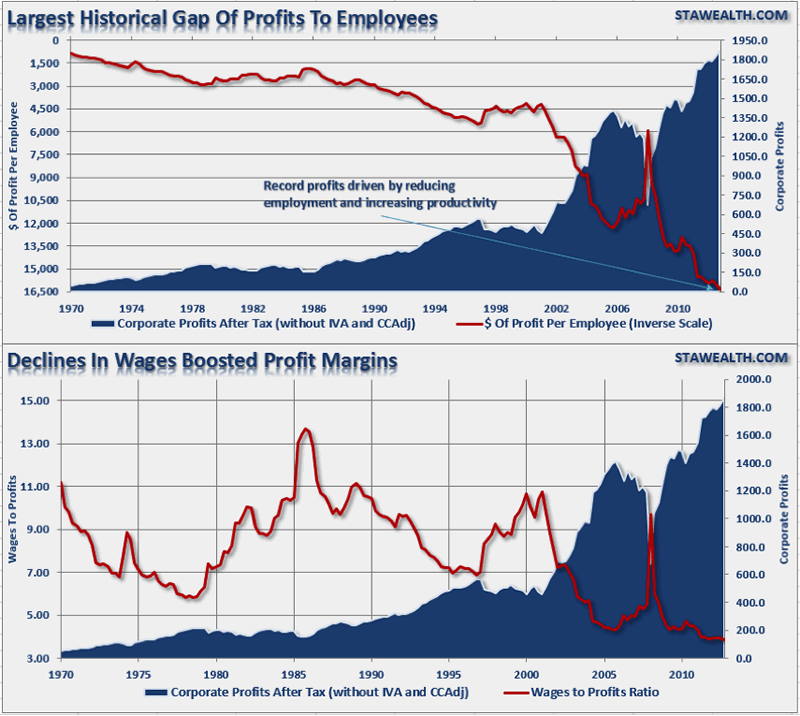

There has been virtually no CORPORATE revenue growth for over a year. Earnings growth has been courtesy cost cutting, MASSIVE buybacks, refinancing debt at low interest rates and a virtual abandonment of CAPEX investment for the five years since 2008. Spawning the widest gap in corporate earnings over pay in HISTORY (courtesy of Lance Roberts of www.STAWEALTH.com):

Part of this divergence is because the LABOR participation rate has plummeted about 10% since the CHOSEN ONE ascended to power and implemented the CHICAGO way of doing things at the federal level. He is not the champion of the poor he claims to be, he is their worst NIGHTMARE as his policies have DESTROYED THEM.

This is why he can lead the something for nothing society HE has CREATED to eat the last vestiges of the private sector. It is the democrat’s 2014 campaign theme. Cannibalism of the worse sort as NO RECOVERY will be fathered from INSIDE WASHINGTON D.C. (district of corruption). It will not come by bringing those that still have success down, by dividing the nation between have and have nots. These are not solutions, they are RECIPES for disaster.

“Any man who thinks he can be happy and prosperous by letting the government take care of him had better take a closer look at the American Indian.” ~ Henry Ford

In my opinion, the greatest manmade disaster and OPPORTUNITY in history is unfolding in every corner of the world. Are you diversified or operating with EYES WIDE SHUT? Are you prepared to turn it into opportunity by properly diversifying your portfolio? Adding absolute return investments which have the potential to thrive (up and down markets) regardless of what unfolds economically? Hedging the printing presses impact on your paper money? This is what I do for investors; help them diversify into investments which are created to potentially thrive in the storm. For a personal consultation with me CLICK HERE!

It will come only from the private sector and they have gone into hiding from his policies and minions. The idea that Washington D.C. can guarantee your success is FALSE, only you can determine that. Only something-for-nothings believe government can provide people with prosperity they must earn and toil for.

Just as they have destroyed the great state of ILLINOIS and city of CHICAGO, it is the government as mafia, preying on the very people they claim to protect. The USEFUL IDIOTS who support him are VICTIMS of the policies he has IMPLEMENTED. Lambs for him to SLAUGHTER as he has buried them and their children’s futures in DEBT!

Just as Ronald Reagan once said: “the twelve most frightening words in the world are “I am here from the government and I am here to help”, no truer words have ever been spoken… Government gone wild is the ROOT of the ECONOMIC problems not the solution to them.

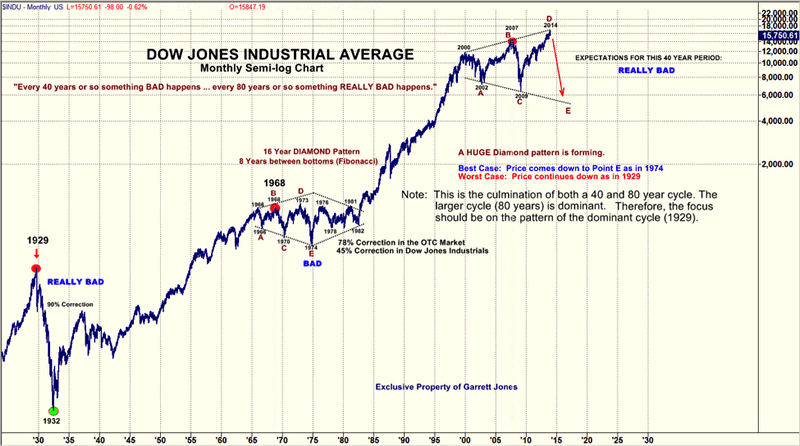

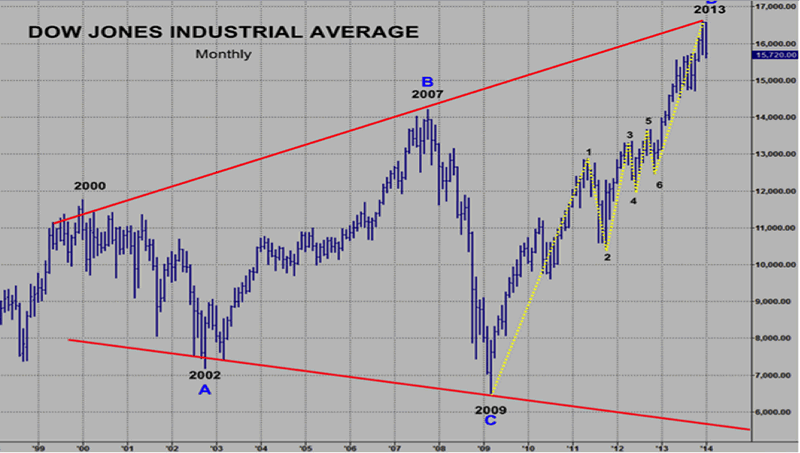

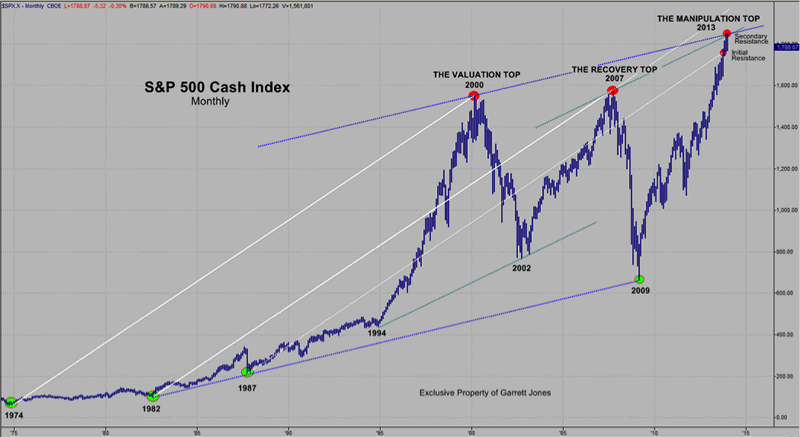

An analogue to the 1970’s and another wolf wave as well can be seen in these charts by my good friend Garrett Jones:

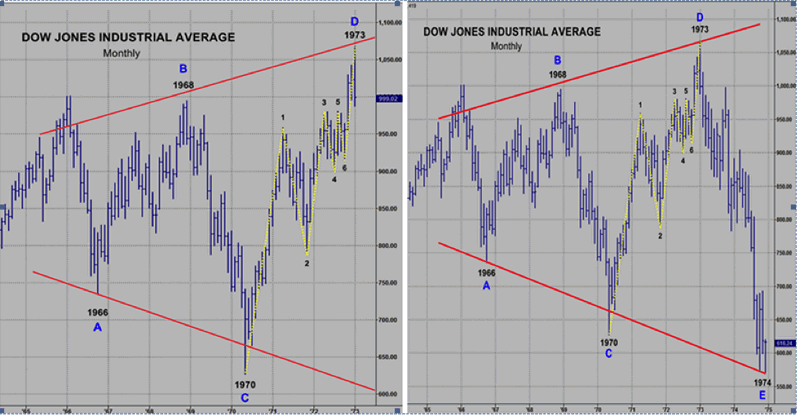

For this DIAMOND to complete, we have a journey to touch the lower trend line of the Wolfe wave around 5500 today but by the time we arrive will be well below 4000. Let’s look more closely at the 1973 diamond and how it resolved itself into the 1974 low and then today’s MEGA DIAMOND courtesy of Garrett Jones:

The picture on the left is the rally into the final high before the crash into the 1974 low. Pay particular notice to the outside down bar that failed to test the top of the megaphone trend line. Now to today’s analogue:

This is virtually identical to that previous period, only on a much LARGER SCALE, with the descent to the final low due to START NOW! Note Garret’s work showing the internal wave pattern by the yellow lines in both charts. If correct, we should be headed to the bottom of the megaphone over the next year or two.

NOTICE the outside down bar is here as well (other outside down reversals on monthly’s: German Dax, Uk FTSE 100, Nasdaq, Dow transports, Russell 2000, Shanghai comp., Aussie Asx 200, Nikkei 225, and many more). It is a deadly chorus of technical reversals.

In closing, the cyclical bull markets off the 2009 lows are long in tooth, over loved, and printing press and plunge protection team DEPENDENT.

“The Fed is an agent of distortion. They have their fingers, their thumbs, on the scales of finance. To change the metaphor, we all live to a degree in a valuation hall of mirrors. Who knows what value is when the Fed fixes the determining interest rate to zero,”... “It strikes me that the Fed in substance, if not in name, is engaged in a massive experiment in price control,” - James Grant, Grants interest rate observer

The next leg down in global stock markets looms as the TAPER, Dodd Frank (huge reductions in credit availability enshrined in LAW) and CHINA try to inch back from the precipice of previous credit EXCESSES. And this WAVE of INSOLVENCY is going to be a doozy in my opinion.

I have tried to be exhaustive in my review of the stock , history and a wide variety of indicators which are singing from the same hymnals and I hope you heed the MESSAGES of the markets they contain. The idea that an economic recovery can take place when markets are rushing lower is a challenging idea. The most dangerous words in history, “It’s different this time” are about to BITE again as those with short memories get a HISTORY LESSON.

In my opinion the greatest manmade disaster and OPPORTUNITY in history is unfolding in every corner of the world. Are you diversified or operating with EYES WIDE SHUT? Are you prepared to turn it into opportunity by properly diversifying your portfolio? Adding absolute return investments which have the potential to thrive (up and down markets) regardless of what unfolds economically? Hedging the printing presses impact on your paper money? This is what I do for investors; help them diversify into investments which are created to potentially thrive in the storm. For a personal consultation with me CLICK HERE!

The last secular bear market lasted from 1965 until 1982 or 17 years (diamond pattern), this one is now 14 years old and the midpoint low is not yet in place. Look for it soon (1 to 2 years).

Globally, the powers that be are attempting to pull the punchbowl without triggering an economic and market crash. Will they be successful? Highly doubtful in my opinion. I am an Austrian economist and highly respectful of HISTORY and Human behavior. Quoting Von Mises:

"There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved." - Ludwig von Mises

This is and remains the bottom line. To me, everything is BAKED in the CAKE. An explosion in suppressed volatility is at hand.

Tedbits is global Macro analysis PURELY through the AUSTRIAN lens and when this series concludes I will have extracted you from the MATRIX of UNREALITY and cut through the ILLUSIONS of the Keynesian world most people live in. YOU will KNOW the truth and SEE the unfolding collapse of the developed world unmasked from political and monetary illusions. Don’t miss this series as subscriptions are free CLICK HERE.

In coming issues, I will be covering, stocks, bombs er bonds, something for nothing societies, energy and natural resources, commodities, precious metals and currencies, policies of insolvency, G-8 economies, China, suppressed volatility, politically correct and practically incorrect economic stats, unmargined derivatives, financial repression, QE, demographics, debt, deflation, inflation, etc. All black swans: which one will land first TRIGGERING the next CRISIS? In my opinion this is the greatest opportunity in history but you need a clear vision of it, don’t miss the next TedBits! - CLICK HERE.

Tedbits subscribers also get video roundtables with Gordon T. Long, Charles Hugh Smith, John Rubino of www.Dollarcollapse.com, Catherine Austin Fitts, Bert Dohmen and many more, keeping you right in front of breaking news and global macroeconomic analysis.

You do not want to miss the next edition of TedBits. Why not subscribe? Subscriptions are free!

By Ty Andros

TraderView

Copyright © 2013 Ty Andros

Hi, my name is Ty Andros and I would like the chance to show you how to capture the opportunities discussed in this commentary. Click here and I will prepare a complimentary, no-obligation, custom-tailored set of portfolio recommendations designed to specifically meet your investment needs . Thank you. Ty can be reached at: tyandros@TraderView.com or at +1.312.338.7800

Tedbits is authored by Theodore "Ty" Andros , and is registered with TraderView, a registered CTA (Commodity Trading Advisor) and Global Asset Advisors (Introducing Broker). TraderView is a managed futures and alternative investment boutique. Mr. Andros began his commodity career in the early 1980's and became a managed futures specialist beginning in 1985. Mr. Andros duties include marketing, sales, and portfolio selection and monitoring, customer relations and all aspects required in building a successful managed futures and alternative investment brokerage service. Mr. Andros attended the University of San Di ego , and the University of Miami , majoring in Marketing, Economics and Business Administration. He began his career as a broker in 1983, and has worked his way to the creation of TraderView. Mr. Andros is active in Economic analysis and brings this information and analysis to his clients on a regular basis, creating investment portfolios designed to capture these unfolding opportunities as the emerge. Ty prides himself on his personal preparation for the markets as they unfold and his ability to take this information and build professionally managed portfolios. Developing a loyal clientele.

Disclaimer - This report may include information obtained from sources believed to be reliable and accurate as of the date of this publication, but no independent verification has been made to ensure its accuracy or completeness. Opinions expressed are subject to change without notice. This report is not a request to engage in any transaction involving the purchase or sale of futures contracts or options on futures. There is a substantial risk of loss associated with trading futures, foreign exchange, and options on futures. This letter is not intended as investment advice, and its use in any respect is entirely the responsibility of the user. Past performance is never a guarantee of future results.

Ty Andros Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.