As Sochi Starts, 1929 Stock Market Crash Warnings Accelerate

Stock-Markets / Financial Crash Feb 08, 2014 - 06:24 PM GMTBy: Doug_Wakefield

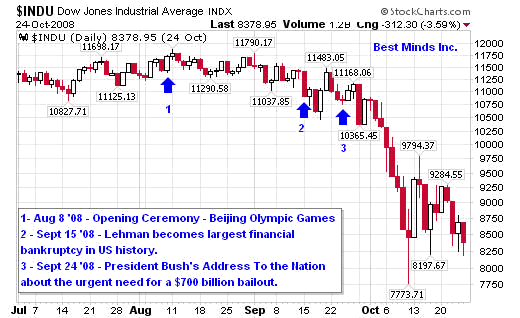

"Good evening. This is an extraordinary period for America's economy. Over the past few weeks, many Americans have felt anxiety about their finances and their future. I understand their worry and their frustration. We've seen triple-digit swings in the stock market. Major financial institutions have teetered on the edge of collapse, and some have failed. As uncertainty has grown, many banks have restricted lending. Credit markets have frozen. And families and businesses have found it harder to borrow money.

"Good evening. This is an extraordinary period for America's economy. Over the past few weeks, many Americans have felt anxiety about their finances and their future. I understand their worry and their frustration. We've seen triple-digit swings in the stock market. Major financial institutions have teetered on the edge of collapse, and some have failed. As uncertainty has grown, many banks have restricted lending. Credit markets have frozen. And families and businesses have found it harder to borrow money.

We're in the midst of a serious financial crisis, and the federal government is responding with decisive action....

In close consultation with Treasury Secretary Hank Paulson, Federal Reserve Chairman Ben Bernanke, and SEC Chairman Chris Cox, I announced a plan on Friday. First, the plan is big enough to solve a serious problem. Under our proposal, the federal government would put up to $700 billion taxpayer dollars on the line to purchase troubled assets that are clogging the financial system. In the short term, this will free up banks to resume the flow of credit to American families and businesses. And this will help our economy grow...." [President George W. Bush, The Economy & The Bailout: Primetime Address to the Nation, Washington, DC, September 24, 2008]

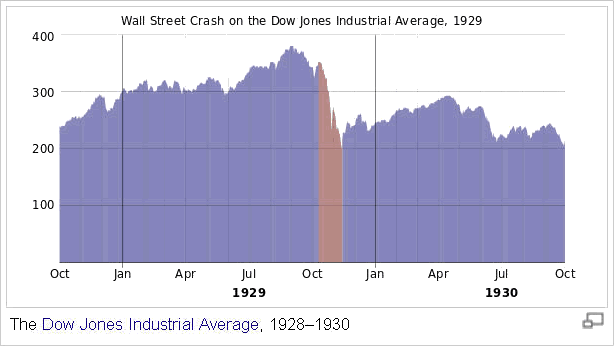

We should all remember the events shown in the chart above. Was this crisis one that many individuals did warn about well in advance? Did China, like recently, produce history-making events in 2007 that warned of massive problems ahead?

Since 2006 and the release of my research paper, Riders on the Storm: Short Selling in Contrarian Winds, we have ALL lived through bubble two, crash two, and bubble three. With the plethora of events that have taken place to bring us to this point in February 2014, I would like to share a few pictures from a theme that has come across my desk four times since early November.

What is the theme you asked? It is how today's movement of the Dow is tracking closely with the crash of 1929.

It is my most passionate desire, that this writing be understood by as many individuals as possible, and for that reason will be short and with a series of pictures. All must be interested in the same agenda, the ultimate exit plan.

Past and Present Collide

The Frightening Thing That Threatens To Crash World Markets, Kings World News, October 31, 2013

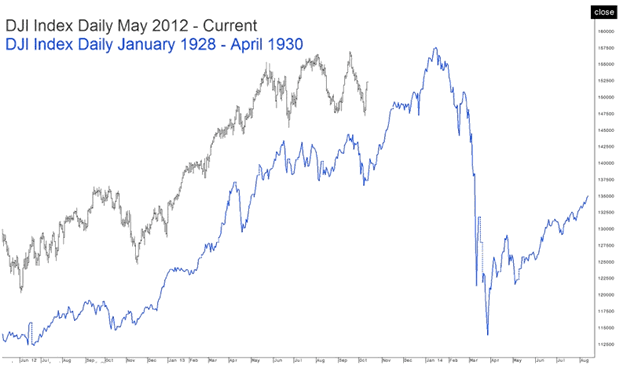

"So, the markets are prone to panic if Yellen or Bernanke says the wrong thing. For the moment they have to say they will keep interest rates low for an extended period of time, or at least until March (laughter ensues). But before March you will see savvy professionals taking 'risk' off the table. The following chart is from Bloomberg and it basically overlays the recent market action on top of the 1929 period (see chart above).

What it shows is a broadening top in the markets back then (1928/1929) and today. The prediction is that you break out through the top of the broadening top, which we are doing right now. You then have one more run-up that might last 2-to-3 months -- and then you crash.

This scenario fits with the cycle call. So, even though QE has dragged this catastrophe out a bit into the future, it will still end in disaster. It is extremely important for KWN readers around the world to understand that no government in all of history has ever been able to alter the long-term secular trends.

Eventually, if you've created a debt mountain, the debt mountain will have its revenge. The bottom line here is this will be incredibly painful and destructive for investors who do not understand, or who are not prepared for the carnage that is to come." [Red text my own - Chart and comments by Robin Griffiths, Investment Strategist for Cazenove Capital. Cazenove Capital is the appointed stockbroker to Her Majesty the Queen of England]

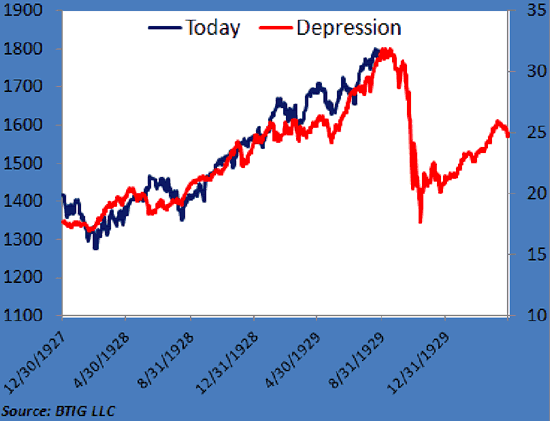

Wall Streeters Are Starting To Pass Around This Chart, Showing the Market On the Cusp of a Big Crash, Business Insider, Nov 22, 2013

"Indeed, we recently devoted an entire conference speech to pushing back on the idea of an equity bubble. How do we know the story remains? The chart above, overlaying the S&P 500 today against equities in the 20s/30s is now starting to make the rounds. Without getting too personal, "chart overlaying" is lazy and this is no less so. But it does remind us that as much as everyone thinks everyone else is "all bulled up," these views still persist and have shown no indication they are going away any time soon." [Dan Greenhaus, Chief Global Strategist for BTIG, an institutional trading firm]

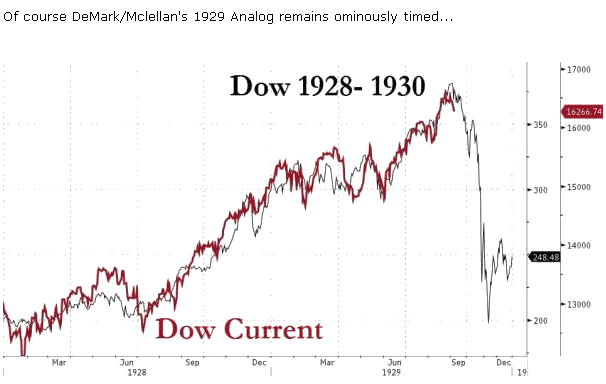

Some More Fun With Market Timing, Zero Hedge, Jan 28, 2014

[The Demark mentioned in the chart above, is Thomas DeMark, founder and CEO of Demark Analytics. Demark is a 40 year industry veteran, whose clients include George Soros and Goldman Sachs.]

Tom Demark: The Next Two or Three Days are 'Extremely Critical' For the Market - it may crash 40%, The Financial Post, Feb 5, 2014

Noted market-timer Tom DeMark did not sound optimistic about the prospects for stocks in an interview with CNBC this morning.

DeMark compared today's market to that preceding the Black Friday crash in 1929.

"When the market made its high on September 3, [1929], there were 23 subsequent trading days where the Dow Jones Industrial Average had a short-term bottom," he said.

"23 days aligns with the low end on Monday. And subsequent to that, we had a four-day rally, and then the market unraveled -- went down 48%. We are currently at that inflection point. Like I said, so far, everything is aligned. We think the next two to three days are extremely critical....

What we're seeing right now, if the market does unravel, I think we'll have a correction of 40% off the high, which would put us at about 1100 [on the S&P 500 index]."

[Source - Wall Street Crash of 1929, Wikipedia. The peak in the Dow Jones Industrial in 1929 was 381, and the bottom after the crash was 198. After a rally in early 1930, it continued its decline to 41 in 1932. Source - StockCharts]

As I write this article in February 2014, I think of all of the history we have lived through since the 1990s. Look at the enormous educational benefits of the Internet and the ability to tap into such wealth of information. Why would anyone reading the comments above, totally ignore warnings of this gravity, solely based on being bailed out by trillions of ADDITIONAL debt by the Federal Reserve after the previous two stock bubbles burst, saddling the entire nation with debt that could never be repaid?

The only explanation that keeps ringing in my head over and over again, is the profound faith we have today in central bankers ability to produce unlimited amounts of "free money" out of thin air AND with no consequences. But is that faith well placed?

Faith Misplaced?

Let me take you back to two ideas pulled from the July and December 2006 issues of The Investment Minds. I have quoted and discussed them often since. They were valuable when the Dow topped in 2007, bottomed in 2009, and even more considering the Dow's most recent high in history on December 31, 2013.

The first idea comes from the July issue of The Investor's Mind: Whose Got the Power:

"'So why do people believe that the Fed has absolute power?' In answering this question, allow me to defer to Dr. Jared Diamond.

'Consider a narrow river valley below a high dam, such that if the dam burst, the resulting flood of water would drown people for a considerable distance downstream. When attitude pollsters ask people downstream of the dam how concerned they are about the dam's bursting, it's not surprising that fear of a dam burst is lowest far downstream, and increases among residents increasingly close to the dam. Surprisingly, though, after you get to just a few miles below the dam, where fear of the dam's breaking is found to be the highest, the concern then falls off to zero as you approach closer to the dam! That is, the people living immediately under the dam, the ones most certain to be drowned in a dam burst, profess unconcern. That's because of psychological denial: the only way of preserving one's sanity while looking up every day at the dam is to deny the possibility that it could burst.

If something that you perceive arouses in you a painful emotion, you may subconsciously suppress or deny your perception in order to avoid the unbearable pain, even though the practical results of ignoring your perception may prove ultimately disastrous. The emotions most often responsible are terror, anxiety, and grief.'

People believe that the Fed is almighty because they want to, and, in some ways, they must. To say that the Fed is not able to overcome any problem is to threaten the very core of our world and how we live in it. And yet, the one thing that is certain from looking at the information presented in this newsletter is that our world is going to change." [Dr Jared Diamond's quote is from his work, Collapse: How Societies Choose to Fail or Succeed (2005), pg 436.]

The second idea is found in the December issue, titled Mindgames. The comments came from an interview with Dr. Janice Dorn. Dr. Dorn holds a PhD in neuroanatomy, and is a board certified MD by the American Board of Psychiatry and Neurology in the areas of general and addiction psychiatry. She is extremely unique in understanding our markets; having coached hundreds of traders as well as personally traded the futures markets for two decades. She is soon to release her new book, co-authored with Dave Harder, Money & Markets: A Guide for Every Investor, Trader, and Business Person.

"Doug - What I find fascinating, in regards to our thinking, is that if we look at a variety of cultures and nations, we find an enormous group of people living out their day-to-day lives under the premise that the one of the primary roles of government is to provide various safety nets. We have even come to believe that the greater the complexity, the safer the safety net must be. In a world where our morning fruit comes from one country, our transportation from another, and our computers from yet another, the elaborateness of our distribution system has given us a sense of stability and ease, when by the nature of its complexity, it becomes more difficult to maintain stability.

So, if I start thinking about change and the complexity of the system upon which I am relying, and I realize that I can't control all of these variables and that based on the level of spending to support this complexity, the status quo is unsustainable, then I become afraid.

Dr. Dorn - I agree, something's got to give. What happens in a situation like this is very interesting. When people are not thinking about how something is provided for their benefit - just expecting it to continue - they come to the conclusion that somebody else is going to take care of them; somebody else is going to think for them and tell them what to do, where to go, and what to take on a plane... So the more the government keeps establishing and/or expanding programs that will "protect us," the more people feel this sense of security. Of course, this sense of security is completely false, and in the process, freedoms are taken away from us.

This issue is critical when it comes to making trading and investing decisions, and I'll tell you why. Let's say we're just moving along; everybody is taking care of us; everything is just fine; the government is paving our streets as well as providing Social Security for income and Medicare to cover certain medical cost; we have this sense of being safe and cozy in this artificial environment that our government has created. The suddenly it is not there.

When an individual has been in the amniotic sac: when we have been "cocooned," and then the cocoon is gone and we are presented with making choices that we were not used to making before, the neocortex becomes overwhelmed. Since, when placed under a great deal of stress, the brain cannot process this much conflicting information (upon which decisions must often be made) it defaults to the limbic system. And by reverting to the limbic system, we make decisions purely on an emotional basis."

What do you think? Incredible isn't it. The logical side of our brain continues picking up signal after signal from the last few years, telling us that something is terrible wrong with trusting in ongoing bank bailouts and wider government intervention into our lives. Yet the emotions of making money at the fastest pace in American history, or trusting the government to always have plenty of free money for its expanding rank of dependents, becomes so addicting, that we turn off the negative, and rationalized our recent "stable" emotional experience.

That is, until we must return to reality through the next crisis that "no one could see coming".

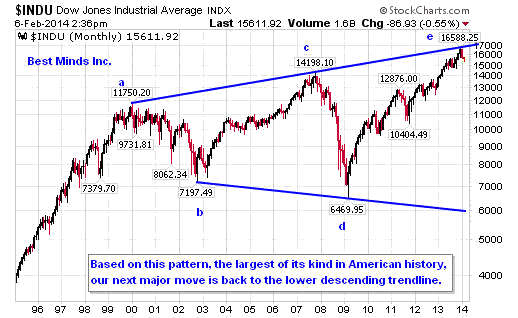

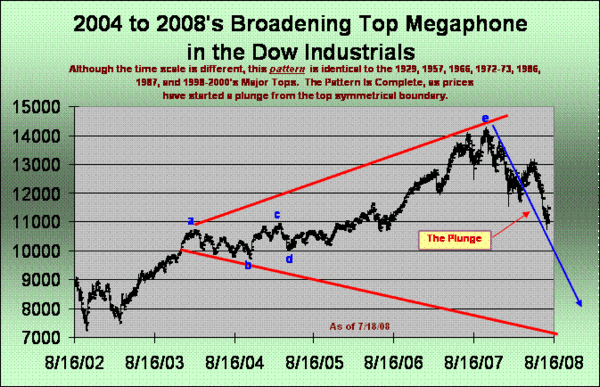

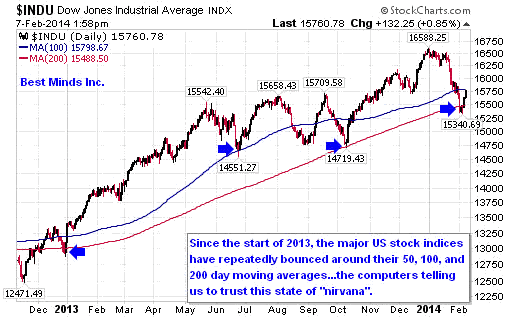

Multiyear Ceiling Meets Daily Nirvana Net

Another picture we should all consider is one that has taken years to develop. If we draw a line connecting the three tops in the Dow between January 2000 and December 2013, we realize it took 14 years for that pattern to develop. It was what Robin Griffiths of Cazenove Capital referred to as the broadening top in his October 31st interview with Kings World News.

Yet we are more focused on our recent quarterly statements, or each day's headlines, as the Dow rises once again this week from its "nirvana trade" level, an idea I released in a public article last July.

[Chart above by Dr. Robert McHugh in his public article, Broadening Top Megaphone Pattern Predicted 2007/2008 Stock Crash, "The Jaws of Death", released on July 25, 2008, less than 2 months before Lehman became the largest bankruptcy in American history.]

It is my humble opinion, that listening to a collection of counsel is wiser than trusting our own emotional desire for a world that will not change, and listening to all the soothing propaganda...until the captain says, "Ladies and Gentlemen, we have hit another 'random' iceberg".

I will enjoy watching the Winter Olympics in Sochi, but with the patterns shown above, I will be watching closely the movements of the Dow. It would appear that the U.S. government's ability to borrow money so it can fund all of the promises it continues to make is an issue once again at our front door.

Russia Stages Glitzy Opening for Sochi Games, Yahoo Sports, Feb 7, 2014

Treasury Secretary Lew Warns that U.S. Default Could Happen Quickly, Reuters, Feb 3 '14

If the Dow and S&P 500 stall below their respective December and January highs in the near future, it will only solidify the patterns shown in this article, providing further warnings to all investors and traders.

"The sheer pace and pressure of our modern lives can easily crowd out time for reflection. To make matters worse, we live in a war zone against independent thinking. Television jingles, advertising hype, political sound-bites, and 'dumb down' discourse of all kinds assault an individual's ability to think for himself or herself." [When No One Sees: The Importance of Character in an Age of Image (2000) Os Guinness, pg 7]

"A wise man will hear and increase in learning, and a man of understanding will acquire wise counsel" Proverbs 1:5

If you are concerned about the lives of those around you, and are seeking specific ideas regarding how individuals and groups can prepare for the other side of the current state feed debt bubble, please contact my office. Presentations are for all, both non- investors and investors, big as well as small. I am available for public speaking, radio interviews, and consulting.

In the meantime, to follow this incredible period of change through the lens of history, science, and a study of human behavior, subscribe to my most comprehensive research and trading commentary with a 6-month subscription to The Investor's Mind: Anticipating Trends through the Lens of History. Using the logical side of our brains, rather than enjoying the emotional comfort of the "unlimited" mania, has never been more crucial.

Doug Wakefield

President

Best Minds Inc., a Registered Investment Advisor

2548 Lillian Miller Parkway

Suite 110

Denton, Texas 76210

www.bestmindsinc.com

doug@bestmindsinc.com

Phone - (940) 591 - 3000

Alt - (800) 488 - 2084

Fax - (940) 591 –3006

Copyright © 2005-2012 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.