Silver Price Outperforming Gold

Commodities / Gold and Silver 2014 Feb 07, 2014 - 02:55 PM GMTBy: Alasdair_Macleod

Since Monday financial markets have consolidated following the emerging market currency shocks of the previous week. Safe-haven bonds were strong initially, before tailing off yesterday. Equities started the week badly but steadied yesterday, and gold spiked at $1274 on Wednesday before being knocked back $20 subsequently. The result is gold was more or less unchanged on the week by last night, though early indications London time are for better prices today.

The event traders are waiting for is the unemployment numbers at 08:30 New York time (13:30 GMT). These may be bolstered by the temporary improvement in the weather for the period concerned; and because 1.3 million lost their benefits on 1st January, the statistical treatment of these unfortunates could be a major factor.

What the Fed will make of these figures is perhaps more important to markets than the numbers themselves. If the Fed appears to take them as more evidence of economic recovery, we can expect more tapering, which will risk undermining confidence in minor currencies. If not they may get a temporary respite.

This will be crucial for all markets in the coming weeks. Relationships between precious metals and other markets seem to be changing, with established market trends being broken. Unusually, both gold and the dollar have been strong at the same time, which must have hurt some of the hedge funds. Strongest of all has been the yen, as carry trades have been unwound in all the uncertainty. Borrowing low-cost yen to buy high-yielding securities has been common practice and these trades have come unstuck, hence the short-covering of yen.

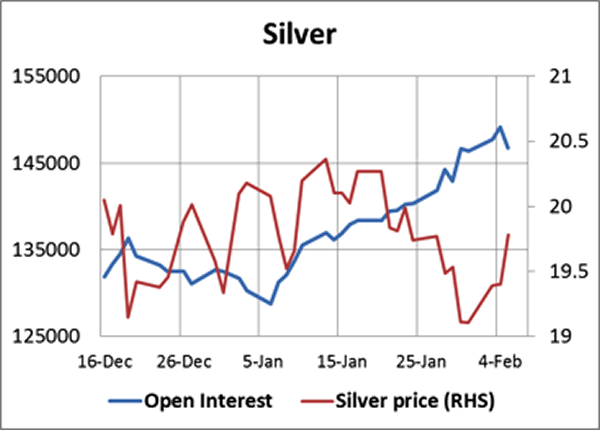

Silver outperformed gold this week, having risen about 5% from $19.05 to last night's close at about $20. Intra-day movements have been the result of market-makers trying to work the price lower, because they are net short, and being squeezed by lack of genuine selling. This is illustrated in the chart below of silver's price and open interest on Comex.

When the price was falling from mid-January, open interest was rising. Looking at the underlying Commitment of Traders statistics we learn that Producers and Merchants (i.e. miners, processors and industrial buyers) were net buyers of about 1,700 contracts, while Managed Money (mostly hedge funds) cut their longs and increased their shorts. Much of the increase in open interest has been through swap positions, which being only one end of a trade cannot be read with any certainty.

Overall, this confounds the argument that mines and processors should use the market to hedge forward, particularly when the bullion banks tell them prices are at risk of falling, which is broadly their message today. This would have allowed market-makers to close their shorts, reducing open interest.

Instead, much of future production is already committed forward through off-market long-term contracts with just a few of the major bullion banks. Put another way, forward production has already been absorbed, which is why the Producers and Merchants category are not sellers.

The Managed Money category (hedge funds) is just about the only liquidity in the market, and it still has an unusually large short position. This is not news to other categories of trader, which is why the smart money is adding to long positions and open interest has been rising.

Next week's statistics

Monday. Japan: Consumer Confidence, Economy Watchers Survey. Eurozone: Sentix Indicator

Tuesday. US: Wholesale Inventories. Japan: Key Machinery Orders, M2 Money Supply.

Wednesday. Eurozone: Industrial Production. US: Budget Deficit.

Thursday. US: Initial Claims, Retail Sales, Business Inventories.

Friday. Eurozone: GDP, Trade Balance. US: Import Price Index, Capacity utilisation, industrial Production.

Alasdair Macleod

Head of research, GoldMoney

Alasdair.Macleod@GoldMoney.com

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2014 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.