Apple, Ebay and Visa - Stocks to Watch as Activist Investors Unlock Value

Companies / Investing 2014 Feb 05, 2014 - 10:28 AM GMTBy: DailyGainsLetter

Sasha Cekerevac writes: One of the most hotly debated topics these days is the role of activist investors. Some people have the impression that an activist investor is not a positive factor when it comes to long-term investing. I disagree, as many times, the investment strategy recommended by these activist investors ends up benefiting all shareholders.

Sasha Cekerevac writes: One of the most hotly debated topics these days is the role of activist investors. Some people have the impression that an activist investor is not a positive factor when it comes to long-term investing. I disagree, as many times, the investment strategy recommended by these activist investors ends up benefiting all shareholders.

Probably the most well-known, and certainly the wealthiest, activist investor is Carl Icahn. One of the things I like most about Icahn’s investment strategy is that he is willing to buy when others are selling and be vocal about his intentions.

A perfect example of his long-term investing ideology was when he stepped in to buy shares of Netflix, Inc. (NASDAQ/NFLX). If you remember a few years ago, Netflix shares were trading around $60.00 and many analysts were recommending an investment strategy to stay away from Netflix. Icahn saw an opportunity to accumulate a solid company for long-term investing purposes and has held on, making a return well in excess of 500%.

I would never recommend someone simply follow a successful activist investor like Icahn; rather, I would investigate any investment strategy he advocates to see if it matches my own risk profile. For long-term investing purposes, if I was a shareholder and he became active, I would certainly be happy.

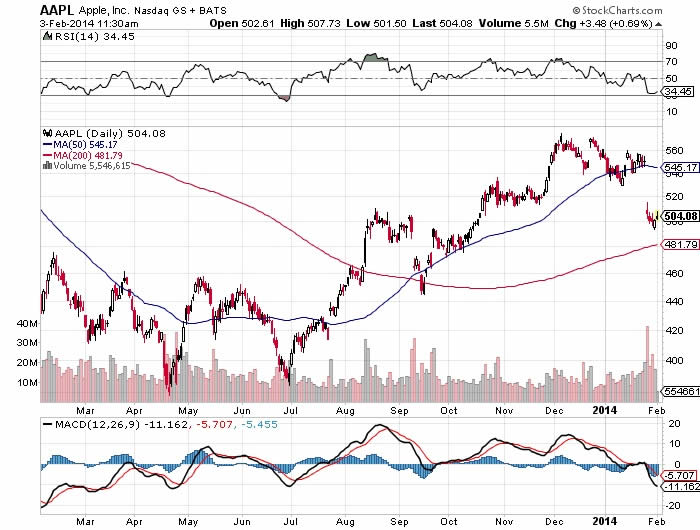

Chart courtesy of www.StockCharts.com

His recent investment strategy in Apple Inc. (NASDAQ/AAPL) makes perfect sense. The recent sell-off, I believe, is an excellent opportunity for investors to take a look at Apple as a possible long-term investing option, since the current valuation is only 10.9X its forward price-to-earnings (P/E). That is an extremely attractive valuation for a company that has a massive cash pile, is actively buying back shares, and is paying a dividend, and I believe the company will be able to introduce new, successful products to continue driving growth.

With Icahn being a vocal investor in Apple, in addition to strong fundamentals, this strengthens the possibility that long-term investing in this stock has a high probability of being successful. Obviously, no one can predict the future and be 100% accurate, but if you can align as many positive factors with an attractive valuation, this increases your chance of success when creating an investment strategy.

One factor that Icahn seems to consider for his long-term investing strategy is companies that are undervalued, from which he can try to unlock value for shareholders. One such recent acquisition is eBay Inc. (NASDAQ/EBAY).

Chart courtesy of www.StockCharts.com

As you can see in the chart above, eBay has remained essentially flat over the past year. The investment strategy that Carl Icahn is recommending is that eBay splits off its PayPal division as an independent company. This is not a new investment strategy, but hopefully, with Icahn’s vocal input and the possible nomination of two of his employees to eBay’s board of directors, it will be more seriously entertained.

The long-term investing theory for splitting PayPal away from eBay is that it will gain greater acceptance by other retailing venues. As it stands, most people associate PayPal strictly with eBay. However, as we’ve seen, the recent performance of payment processing companies such as Visa Inc. (NYSE/V) has been exceptional. The investment strategy for PayPal should be to expand and compete against these payment processors for all retailers.

Chart courtesy of www.StockCharts.com

The chart of Visa above is a clear sign that you can certainly make money in this market—as long as you have a sound investment strategy. I think the long-term investing thesis that is fairly certain is that over the next several decades, the use of cash will continue to decline and online or virtual payment processors will gain in market share.

As it stands, eBay’s management is fighting back against this investment strategy, but if Icahn’s nominees can get voted onto the board of directors, we could see real changes occurring. For long-term investing purposes, management might not like it if Icahn is active, but shareholders should certainly be happy.

This article Three Stocks to Watch as Activist Investors Unlock Value was originally published at Daily Gains Letter

© 2014 Copyright Daily Gains Letter - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.