Gold and Silver Stocks Sector New Uptrend - Juniors to Lead the Charge

Commodities / Gold and Silver 2014 Feb 03, 2014 - 10:37 AM GMTBy: Clive_Maund

We sold our Precious Metals sector holdings on Monday 27th January, which we had bought just a few weeks earlier, in order to sidestep a possible reaction. The reason for this was that both gold and silver had arrived at important trendline resistance and some of our juniors had become critically overbought after strong gains. Were we correct to sell at that point, in view of the building major uptrend across the sector?

We sold our Precious Metals sector holdings on Monday 27th January, which we had bought just a few weeks earlier, in order to sidestep a possible reaction. The reason for this was that both gold and silver had arrived at important trendline resistance and some of our juniors had become critically overbought after strong gains. Were we correct to sell at that point, in view of the building major uptrend across the sector?

The answer to that question depends on what you are looking at. With respect to gold and silver and leveraged ETFs in them, the answer is yes, as they have reacted back, although, thus far at least, the reaction back in gold is not large. With respect to stocks the picture is mixed as while most have reacted back, others have stood still and some have even started higher over the past several days. These latter may be "jumping the gun" however, as gold and silver have yet to break out of their downtrends.

The purpose of this article is to paint as complete and accurate a picture as possible of where we stand right now with respect to the outlook for gold and silver, Precious Metals stocks, and the broad stockmarket, before then going on to list, for subscribers, the strongest junior mining stocks then can be expected to race ahead once gold and silver do break out to the upside.

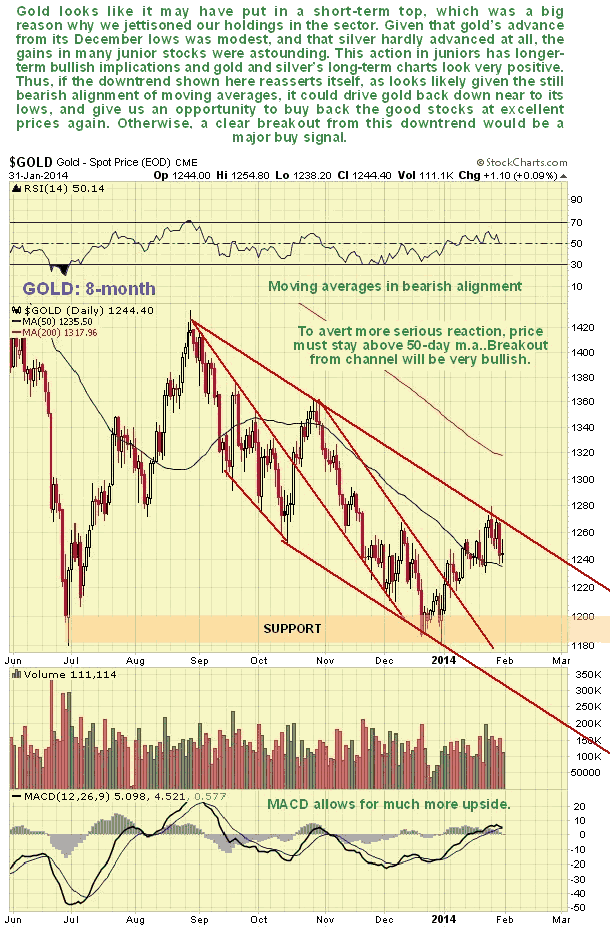

Let's start with gold. Our 8-month chart makes plain why we sold a week ago - it had then arrived at a classic target at the upper boundary of its intermediate downtrend in force from last August. It has since started to turn down again, and, with its moving averages still in bearish alignment, the probability is considered high that it will now react further towards the key support shown near its late June lows - but it shouldn't drop below these lows. One possibility that we should be aware of is that a small Head-and-Shoulders bottom has been forming in gold from mid-November. If true then gold could turn up soon and break out from the downtrend, perhaps without dropping back any further.

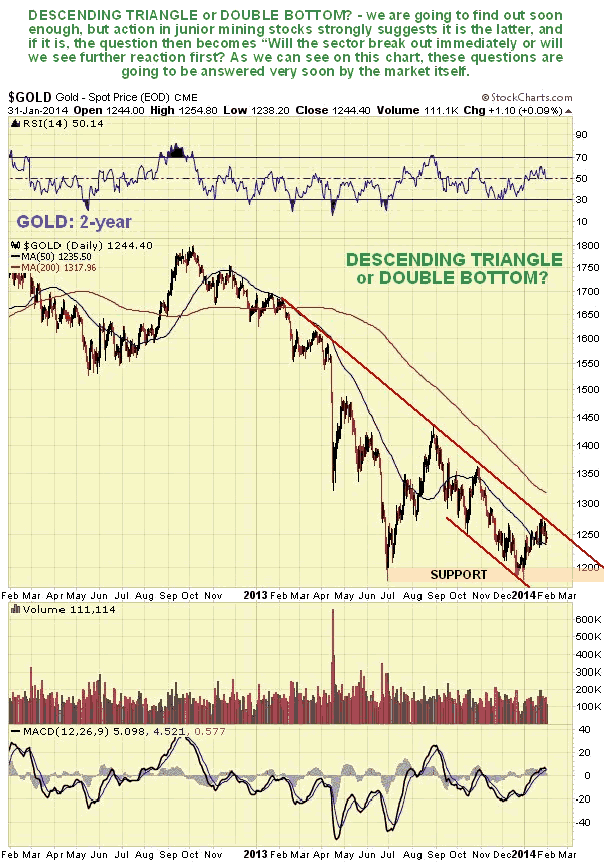

The 2-year for gold is interesting as it shows that the situation is becomes technically "tight" with the price being squeezed into a corner between its falling downtrend line and the horizontal support originating at the June - July lows. Since these lines are rapidly converging it follows that we must have resolution of the current standoff soon, within 2 months absolute maximum, which will end with either a breakdown to lower levels, or a breakout marking the start of the major uptrend that we are expecting for reasons that will become clear as we continue. The 2-year chart also shows to advantage the potential Double Bottom that is completing with the June - July lows.

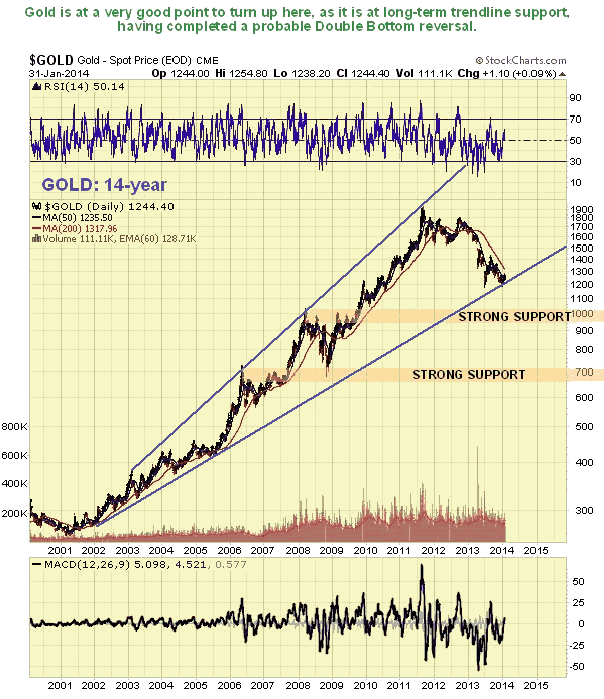

The long-term 14-year chart for gold makes it very clear why it is at an excellent point to turn up, after its gruelling reaction of the past several years - it appears to be basing just above its long-term uptrend line. You can argue until the cows come home about the reasons for this long and deep reaction, but one thing is clear - while it was going on an awful lot of gold has made the long journey from western countries, whose banks are anxious to see a low gold price, to eastern powers like China who are going to sit on it, and probably use it to back their currencies when western currencies fail.

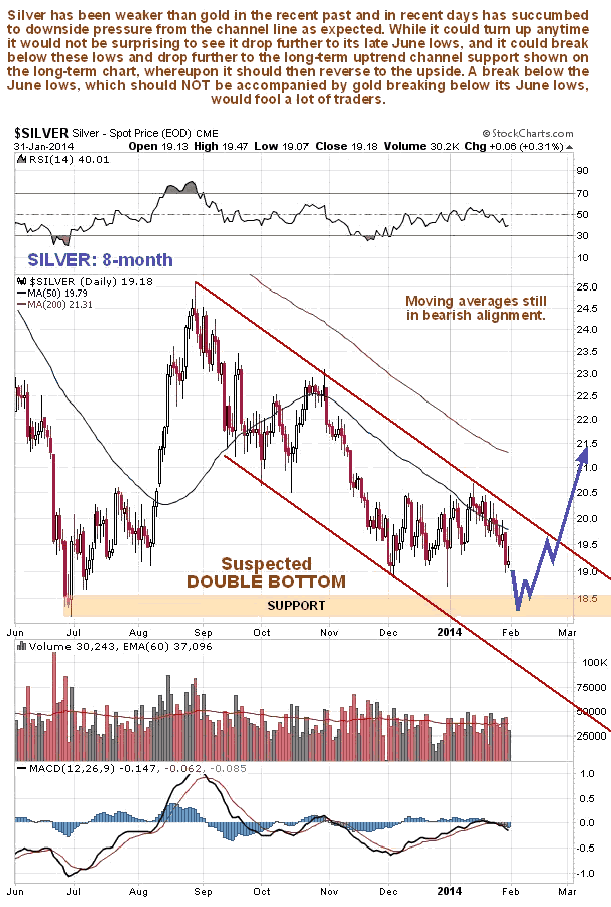

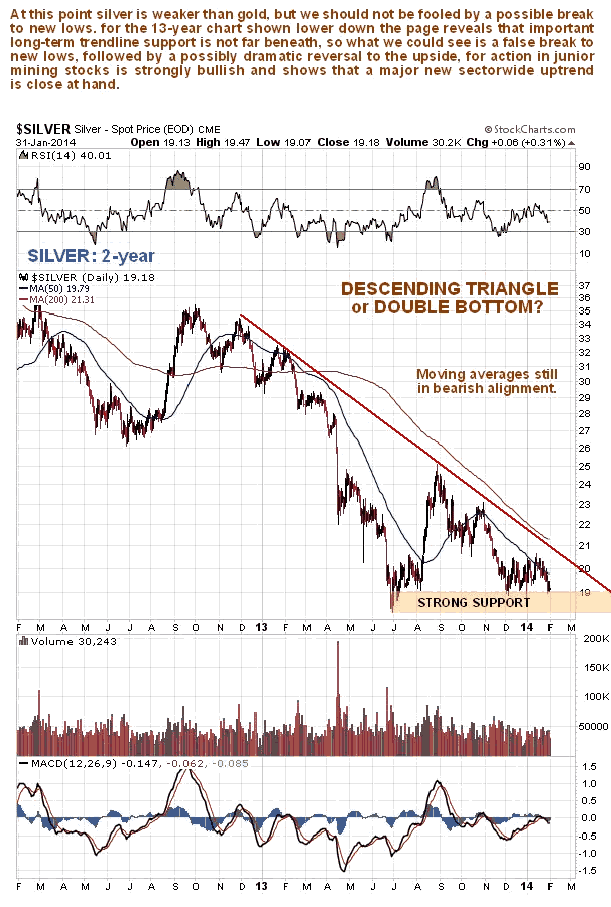

Turning now to silver we can see on its 8-month chart that it has been considerably weaker than gold in the recent past, as after nudging sideways towards its downtrend line and finally touching it, it has dropped away and looks like it is headed for the support shown near the June - July lows, which is not far beneath and possibly lower to the trendline support shown on the 14-year chart farther down the page.

As with gold, the 2-year chart shows the silver price being forced into a corner by the descending trendline converging with the horizontal support level, which will force either a breakdown or a breakout, within a little over 2 months, maximum.

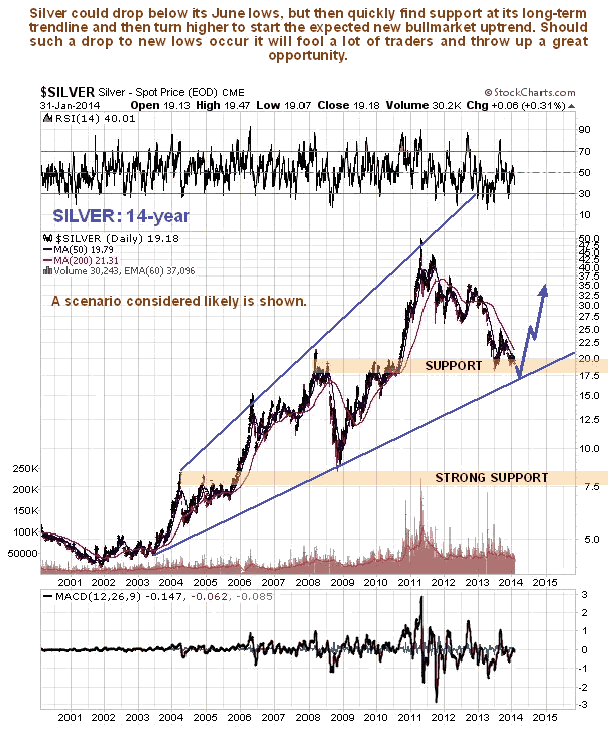

Unlike gold, silver has not yet arrived at its long-term uptrend support line shown on its 14-year chart, although it is already dug into strong support. What this means is that there is some chance that it will break below its June - July lows short-term before it turns up again, perhaps bottoming at about $16.50 - $17. Thus we should not be fooled in the event that it does break below its June- July lows, as any such move is likely to be "false" and followed by a rapid reversal to the upside.

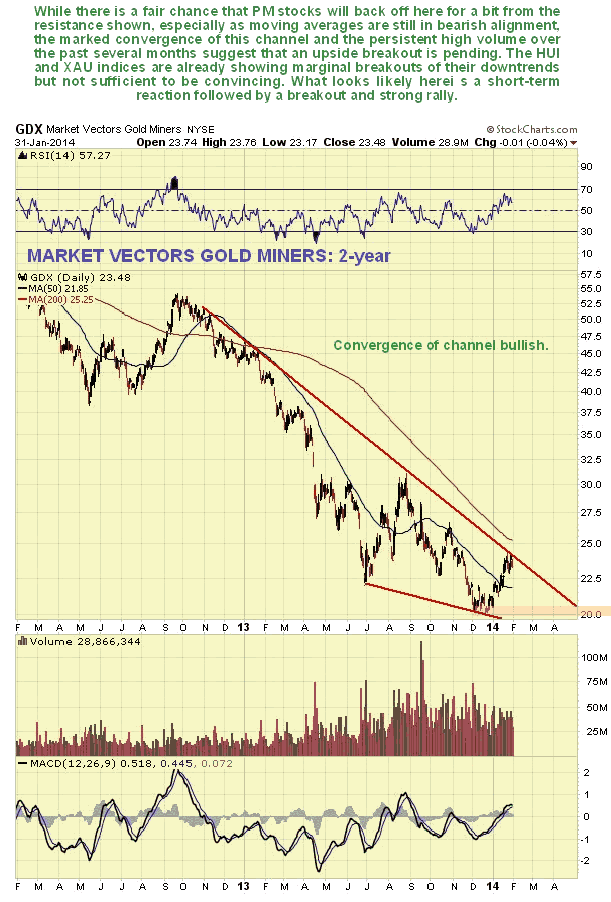

Turning now to mining stocks we see on the 2-year chart for the GDX ETF, which is a useful proxy, that it stalled after hitting its downtrend line a week ago, and may now react back some, especially as its moving averages are still in bearish alignment. However, this is not a weak chart. The marked convergence of the downtrend is strongly bullish, and the persistent high volume of recent months is a sign that it has been bottoming. It could now break out at any time, although our assessment is that a (probably minor) reaction is likely first. Other stocks indices like the HUI and XAU are already verging on breakouts, although so far by an unconvincing margin, so they could drop back.

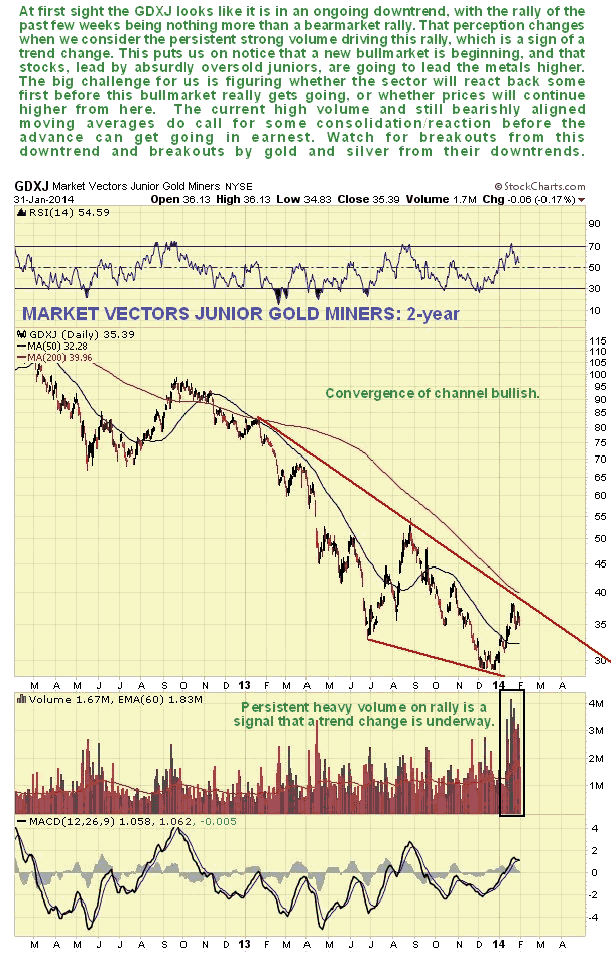

Now this is where things start to get really interesting, for as we can see on the 2-year chart for the GDXJ, which is the ETF for the juniors, it has risen quite strongly this year, but unlike the larger stocks, it has risen on big record volume, which is a sure sign of a trend change. We had observed in mid-late December that the better junior mining stocks were absurdly oversold, and went ahead and bought a raft of them, which worked out very well. Juniors outperformed other larger mining stocks in the rally of recent weeks and dramatically outperformed gold. What we can infer from this is that juniors are going to lead stocks which are going to lead gold (and silver) in the early stages of the upcoming major sector uptrend, so if you are out to make as much money as possible this is where you should be. The fundamental reason for this simple - after being trampled into the dust, juniors mining stocks are amongst the most undervalued stocks it is possible to buy. Therefore when the sector recovers, the best of them are going to make stellar recovery moves. These are the ones which we are going to focus on in the early stages of the sector uptrend.

The following 8-month chart of the GDXJ over gold shows the dramatic outperformance of juniors relative to gold on the recent runup, and makes it abundantly plain why they are the place to be during the early stages of the expected major PM sector uptrend.

If you have read all of the above you will know exactly where we stand in relation to the upcoming sector uptrend, and why juniors look set to - and already are - leading the charge. Don't be put off the best ones by them looking expensive compared to a month or so ago, although we may see better prices soon as detailed above - the sharp advance is a sign of strength, and if you think they look expensive on short-term charts, trying looking at their long-term charts and you should see that they have much further to go. Also, don't make the mistake of buying the ones that haven't moved on the grounds that they are cheaper - if they didn't move, it's probably for a reason - that they are duds, saddled with huge unpayable debts or whatever.

Alright, that's enough of the theory, time to get practical. Here's the list of the strongest junior Precious Metals stocks....

More follows for subscribers...

By Clive Maund

CliveMaund.com

For billing & subscription questions: subscriptions@clivemaund.com

© 2013 Clive Maund - The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maunds opinions are his own, and are not a recommendation or an offer to buy or sell securities. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications.

Clive Maund Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.