U.S. Treasury Bonds Defying Dire Forecasts

Interest-Rates / US Bonds Feb 01, 2014 - 12:36 PM GMTBy: Sy_Harding

There was no doubt about it in 2013. If the Fed were ever to cut back on its five years of massive QE bond-buying, bond prices would collapse.

There was no doubt about it in 2013. If the Fed were ever to cut back on its five years of massive QE bond-buying, bond prices would collapse.

It made sense. Of the $85 billion a month of QE, $40 billion was in mortgage-backed securities, and $45 billion in Treasury bonds.

If the Fed cut back its buying, say by $10 billion a month, who would pick up the slack? With such a sharp reduction in demand by a big buyer, bond prices would have to plunge.

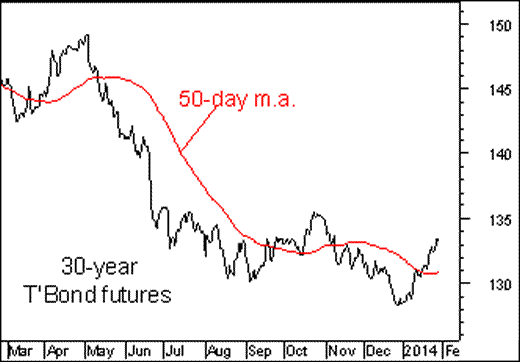

Indeed, even when the Fed only hinted in May of last year that it might be getting close to tapering, bonds plummeted in anticipation of the impact it would have on their value.

The financial media reversed from cheerleading and stressing the virtues of bonds and the safe haven role they play in a diversified portfolio, to the notion that bonds are riskier than stocks. By mid-December, investor sentiment for U.S. Treasury bonds had plunged to its most bearish level in seven years.

However, after reaching a low at the end of the year, bonds rallied for four straight weeks in January. The rally began soon after the Fed announced in December that it would begin tapering in January. The bond rally continued this week even as the Fed confirmed it will also taper by $10 billion in February, and probably at that pace in following months.

So who is picking up the slack, not only closing the gap as the Fed buys fewer bonds, but producing enough extra buying to generate a rally?

Apparently it is investors made nervous by the stock market in January, now believing bonds are a safer haven after all.

The stock market’s unusual day-to-day volatility alone has been enough to make investors nervous. The Dow experienced a triple-digit close in one direction or the other on nine of the 20 trading days to Friday, on average of every other day. Five were to the downside, the largest of which was minus 318 points. Four were to the upside.

For the month the 30-year T’bond gained 3.9%, while the S&P 500 is down 3.3%.

Will the bond rally have legs beyond the short-term?

Bond action through the month indicates that will almost surely depend on the stock market.

It was almost spooky the way bonds moved opposite to stocks virtually on a day-to-day basis in January, rallying only on days when stocks were down, and pulling back on days when stocks were up on the day.

It is an indication that if the short-term pullback in stocks should morph into something worse, the traditional safe haven appeal of bonds will be a greater influence than concerns that the Fed is not buying bonds at its previous pace.

Given the rate investors were pulling money out of bonds last year, and pouring money into the stock market at a near record pace, there would be ample funds to support a sizable bond rally if those money flows were to reverse to any degree.

It is not an issue at this point, with the stock market probably only in a short-term correction.

However, the action of bonds in January will be important to be aware of and keep in mind if I am right in expecting the stock market to experience serious trouble in the second and third quarter.

Sy Harding is president of Asset Management Research Corp., and editor of the free market blog Street Smart Post.

© 2014 Copyright Sy Harding- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Sy Harding Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.