Who Most Benefits From MyRAs: Savers Or The US Treasury?

Personal_Finance / Pensions & Retirement Jan 31, 2014 - 06:39 PM GMTBy: Dan_Amerman

By executive order of the President of the United States, as announced in the State of the Union address, there is now a new type of tax-advantaged retirement account.

By executive order of the President of the United States, as announced in the State of the Union address, there is now a new type of tax-advantaged retirement account.

These are the MyRAs, the user-friendly "my retirement accounts" for small investors, that are presented as being one part of the campaign to help close the income and wealth disparity gap in the US. And one of the issues that is identified as being part of that gap is that the poor and middle class have relatively little money in retirement accounts when compared to the wealthy and the upper middle class.

So the United States Treasury is offering a no-fee and very convenient means for low income and middle class investors to build retirement wealth. And this article will explore, based upon what is now known about these new accounts, the advantages and disadvantages for investors.

We will also take a look at the potentially extraordinary advantages for the United States government when savers choose MyRA accounts. Which may raise the question about whether our seemingly benevolent government is truly attempting to help "close the income and wealth gap", or whether it is instead targeting what is generally the least financially-educated portion of society, for the direct financial benefit of the United States government.

MyRAs From A Saver's Perspective

MyRAs appear to be a new variant on Roth IRAs, which means that unlike a 401 or 403 plan or an IRA, there is no ability to deduct the retirement account contribution. Instead, taxes are paid to the government in full as they otherwise would be on income. The tax advantage comes on the back end, in retirement, with interest earnings and principal withdrawals being tax-free.

Now MyRAs are not invested in traditional mutual funds, but rather represent a direct investment with the United States Treasury for the purpose of purchasing what are effectively US Treasury bonds. It appears that yields would likely be similar to what federal employees currently get in their Thrift Savings Plan Government Securities Investment Fund program, which was 1.5% in 2012.

A MyRA is very convenient to open up, with an initial contribution of $25, subsequent minimum contributions of as little as $5, and an annual limit of $5500. Moreover, no financial advisor is needed; this is supposed to be a very simple and easy program for bringing a new kind of investor into retirement accounts.

Now let's take a closer look from a saver's perspective.

1) No Initial Tax Benefit.

There is no upfront deduction for opening the account. So the saver, unlike if they opened up an IRA, takes a hit on the front end by paying taxes in full.

2) Very Low Interest Rate.

There is an extraordinarily low interest rate paid with these accounts. As part of what is at this time a long-term program of keeping interest rates near zero in the short term, and also quite low over the medium and long term, US treasury bond yields are some of the lowest in history.

A 1.5% rate of return is negligible. Even when invested over the long term, it fails to compound anything like a traditional retirement account investment might do.

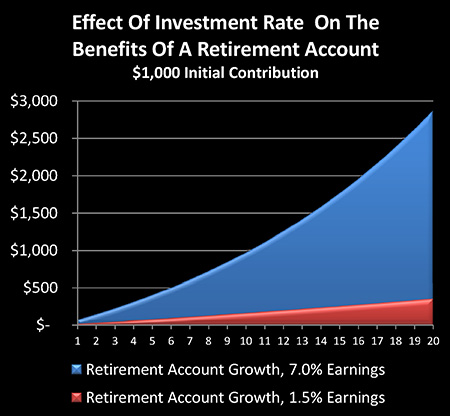

The graph below shows the difference in earnings from a retirement account invested at 1.5% over a 20 year period, versus a retirement account invested at 7%.

The "magic" that is supposed to build wealth in a retirement account over time just isn't there, given our current government-induced world of very low interest rates.

3) Steady Loss Of Purchasing Power.

The yield on short term government securities is less than even the official rate of inflation, let alone the costs we've all been seeing for actual spending when it comes to food, education, medical insurance costs, and the like.

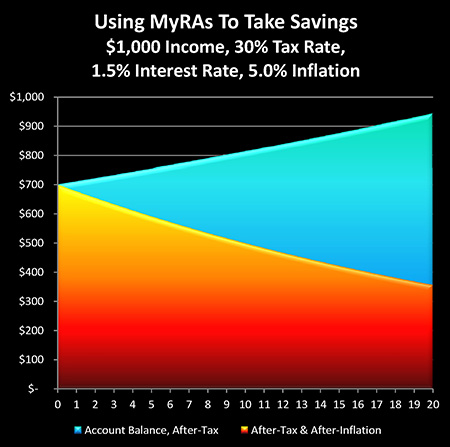

The above graph combines our first three MyRA components to see how they work in combination.

Looking at $1,000 in income, and assuming a 30% marginal combined federal and state tax rate - because there is no tax deduction, the saver can only deposit $700, rather than the $1,000 they would be able to with an IRA or 401 plan.

The blue area shows how the balance in the account would climb over 20 years if invested at 1.5% - it wouldn't even make it back to the initial $1,000.

With our current monetary system, the purchasing power of the dollar will be dropping each year. There's nothing controversial about that - it's the stated goal of the Federal Reserve as well as other central banks around the world, each of whom have minimum inflation targets.

The graph uses a conservative example of a 5% rate of inflation, and even with that - the value of a $700 after-tax account contribution steadily declines to a value of $355 in after-inflation terms over 20 years.

So instead of building wealth it has the opposite effect - the wealth slowly bleeds away over time. And even if you use the official inflation figures from the last 10-15 years (about 2.4% over the last 15 years), the rate of inflation is still higher than the interest rates that appear likely to be paid in a MyRA. So the savings still decline in real purchasing power terms each year, even if the rate of decline is not as great as that shown in the graph.

4) Ending Tax Treatment Uncertain.

So what is being offered to the investor is a very low-yield account, with no upfront tax benefits, that is likely to steadily lose value over the years if government-manipulated interest rates stay where they are.

Given how deeply in debt the United States government is, and the extraordinary burdens of paying for state and government pension plans as well as Social Security as well as Medicare, the one thing we do know is that the United States is likely to be in even greater financial distress five, ten, fifteen years now than it is right now. And I think we should count on a pretty good chance of a comprehensive change in the tax code regarding retirement accounts.

MyRAs From A Governmental Perspective

The 2nd half of this article explores:

1) The five powerful benefits for the US government when savers invest in MyRAs;

2) The bigger picture about how MyRAs are a perfect fit with a heavily indebted government seeking to subtly tap into the wealth of retirement accounts in a manner that much of the general public will not understand; and

3) The major flaw with the MyRA program and why it may not work nearly as well as the government is hoping.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2014 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.