When Bubbles Bite - Debt Rattle 2014

Stock-Markets / Liquidity Bubble Jan 27, 2014 - 06:01 PM GMTBy: Raul_I_Meijer

I guess I may be getting myself in a bit of a jam here, since I posted no Debt Rattle yesterday, but did do the Daily Links, and I do have things to say about some of those. For instance, I think it’s a big piece of news to see Stephen Hawking say black holes don’t exist, and I also think that Mish’s line “Bubbles burst when the pool of greater fools runs out” is important to note, certainly in view of recent events. So this will be a lightly longer Debt Rattle, in all likelihood. I’ll just get started, and let’s see where this goes. Please do note that present bubbles in finance have an incestuous releationship with those in energy: when one pops, the other starts biting.

I guess I may be getting myself in a bit of a jam here, since I posted no Debt Rattle yesterday, but did do the Daily Links, and I do have things to say about some of those. For instance, I think it’s a big piece of news to see Stephen Hawking say black holes don’t exist, and I also think that Mish’s line “Bubbles burst when the pool of greater fools runs out” is important to note, certainly in view of recent events. So this will be a lightly longer Debt Rattle, in all likelihood. I’ll just get started, and let’s see where this goes. Please do note that present bubbles in finance have an incestuous releationship with those in energy: when one pops, the other starts biting.

While all the talk is about emerging markets, I’d like to begin with Japan, which has gone from trade surpluses to trade deficits in no time. Abenomics drove down the yen some 20%, and the intention was of course to make Japanese products cheaper on the world markets. But those intentions hammer home with a vengeance. Maybe Shinzo Abe simply isn’t a math wizard, but even then, this looks like a very costly miscalculation. Because of the yen devaluation, Japan’s LNG imports rose 0.2% in volume, but cost the nation 18% more in dollars/yen. In my book, this is nothing but yet another example of how you can’t fight debt with more debt, or a bubble with more bubbles. In that sense, Japan is just a first victim of what many “rich” countries have invited onto their doorsteps.

And that is where emerging markets come in as well, obviously. US and EU stimulus has blown huge bubbles in emerging economies, and countries such as Argentina and Turkey, having relied on the inflow of western stimulus money, are now starting to feel the pain of withdrawal. Or even just the pain of the fear of it. The average time a stock is held in today’s global markets is a mere 22 seconds, down from 4-5 days not that long ago. It’s like holding stocks has gone from a liquid state into a gaseous state, due to a large extent to high frequency trading. As soon as the slightest doubt arises over returns in emerging markets, the free money will evaporate and move to safer places, leaving the domestic economies holding enormous empty bags.

The artificial distortions in currency markets don’t help. Every country wants to raise exports, and to do that they know they need to bring their currencies down. But if everyone wants to do the same, someone’s bound to get hurt, badly. Ironically, a country like Turkey may then seem to benefit – through exports – at first glance from the sinking lira, but it will soon hit the same wall as Japan now does: more expensive imports. It seems obvious that it may take a while for markets to resettle into the next semblance of equilibrium, and even then it will be extremely volatile. What we see happening today is that financial predators have – again – started picking off the weakest animals in the herd, Turkey, Argentina, and just watch Greece and Italy going forward. That will not be a short or easy battle.

A few more economics articles first, and then we’ll delve into energy issues, on which much is being written lately. As is the case of Japan, the two can be painfully intertwined. At The Automatic Earth, we don’t subscribe to the view that energy issues are at the root of the financial crisis (finance blows its own bubbles), but they will surely make the aftermath of the crisis much more difficult to handle. To wit, a quote from one of the articles below states:” … the west needs to abandon the idea of uninterrupted electricity supply“. How, pray tell, are we going to deal with that sort of issue when we can no longer build infrastructure with a credit bubble? Because that’s what we’re moving toward: a world with much less available credit.

• Japan reports record annual trade deficit (BBC)

Japan has reported a record annual trade deficit after the weak yen pushed up the cost of energy imports. Its deficit rose to 11.5 trillion yen ($112 billion) in 2013 – a 65% jump from a year ago.

Japan has seen its energy imports rise in recent years after it shut all of its nuclear reactors in the aftermath of the tsunami and earthquake in 2011. But it is having to pay more for those imports after a series of aggressive policy moves weakened the yen sharply. The Japanese currency fell more than 20% against the US dollar between January and December last year.

The latest trade data showed that while Japan’s imports of Liquefied Natural Gas (LNG) rose 0.2% by volume in 2013 from the previous year – the value of those imports surged nearly 18%. This is the third year in a row that Japan – traditionally known for the strength of its exports – has reported an annual trade deficit.

• Japan’s 2013 LNG imports hit record high on nuclear woes

Japan’s imports of liquefied natural gas (LNG) rose to another record in 2013 as the country’s second complete shutdown of its nuclear stations since the Fukushima disaster in 2011 forced utilities to burn more fossil fuels to generate power.

The soaring cost of fuel imports let Japan to post a record annual trade gap of 11.47 trillion yen ($112.06 billion) in 2013, up from 6.94 trillion yen in the previous year and a third straight year of deficit. LNG imports increased 0.2% to 87.49 million tonnes last year, the Ministry of Finance said in preliminary trade figures on Monday.

Japan’s crude oil imports in 2013 fell 0.6% to 3.65 million barrels per day (211.717 million kilolitres), a two-year low. Thermal coal imports, used mainly for power generation, also rose 1.3% to a record 109.03 million tonnes last year, reflecting a rise in coal-fired power plants’ capacity. Japan, the world’s top importer of liquefied natural gas (LNG), paid a record 7.06 trillion yen ($68.98 billion) last year for LNG, overturning a previous record in 2012.

The Guardian writes about a quite alarming report on future energy shortages. Our world undone by the use of air-conditioning. Who would have foreseen that 100, even 50 years ago? Power systems, electricity grids, are much more vulnerable then we care to believe.

• Past power failures ‘dress rehearsals’ for frequent future blackouts (Guardian)

Soaring electricity demand for air-conditioning, iPads and increasingly cars, combined with a growing population and inadequate investment in creaking power networks, is pushing the world towards frequent blackouts, academics warn. China, Brazil and Italy have all had significant power failures in the past decade but these are just “dress rehearsals for the future” in which the lights will go out with increasing frequency and severity, predicts a new paper, Blackouts: a sociology of electrical power failure.

The authors, Hugh Byrd of Lincoln University in the UK and Steve Matthewman of Auckland University in New Zealand, argue that the west needs to abandon the idea of uninterrupted electricity supply. “Supply will become ever more precarious because of peak oil, political instability, infrastructural neglect, global warming and the shift to renewable energy resources. Demand will become stronger because of population growth, rising levels of affluence and the consumer addictions which accompany this,” they argue.

They note that there have already been frequent warnings about future blackouts in Britain from as early as 2015 from government advisers, network operators and the energy regulator, Ofgem. Byrd and Matthewman argue the picture is broadly similar across the world, with the American Society of Civil Engineers warning that US generation systems could collapse by 2020 without $100bn of new investment in power stations.

The enormous growth in demand across the US is highlighted by figures showing that even as long ago as 2007 commercial and domestic air-conditioning alone consumed 484bn kilowatt hours of electricity – not much more than the country’s total energy consumption in the mid-1950s.

Wolf Richter elaborates on something I said this about the other day:

“Wait a minute! Wasn’t there more gas in the US than it knew what to do with? One series of cold snaps and it’s already not enough anymore? What is going on here is that the – shale induced – glut has provoked so much speculation that the price has plummeted to such an extent that investment in gas exploration infrastructure has plummeted just as fast. And now, baby, it’s cold outside.”

This is a major issue, speculation has distorted US energy markets so much it’s going to hurt something bad. Believing that the picture painted by purely speculative developments would last for years, “Utilities dispatched electricity generation from their coal-fired plants to their gas-fired plants, utilities have built gas-fired power plants and have retired – not mothballed! – their oldest power plants. Global industrial companies have been building plants in the US for energy-intensive processes .

One cold snap and the entire picture, which has led to billions of dollars in industry decisions, stands on its head. Shale oil was always just land speculation. Shale gas now destroys itself.

• From “Glut” To Panic: Natural Gas Soars

On Friday, when stocks were plunging, natural gas soared 9.6% to $5.18 per million British thermal units (MMBtu) at the Henry Hub. Up 20% for the week. The highest close since June 2010.

Back then, the “shale gas revolution” had turned into a crazy no-holds-barred land-grab and fracking boom that veered into overproduction and a “glut” – accompanied by a historic collapse in price. The US could not export its excess production due to export restrictions and the lack of major LNG export terminals. By April 2012, when the Japanese were paying around $17 per MMBtu for LNG on the world markets, natural gas in the US hit a decade low of $1.92 per MMBtu, and predictions that it would go to zero showed up in the mainstream media. That was the bottom.

But nothing can be priced below the cost of production forever. By Friday, natural gas was up 170% from the April 2012 low. Turns out, only a low price can cure a low price.

The low price caused demand to creep up. Gas exports via pipeline to Mexico have been growing, especially since additional pipeline capacity went into service last year. Mexico is switching power generation from using its own oil to cheap US natural gas. This allows it to export its more valuable oil to the US. Ka-ching. But building gas-fired generating capacity is a slow-moving process.

Other exports are also moving forward – in people’s heads. There are pipelines between the US and Canada, but the US is a net importer. Exports of LNG are at this point still a pipedream, so to speak, though deals are being made, contingent on getting government approvals to export LNG. It’s going to take years before LNG can be exported in large quantities.

But the low price had short-term and structural impacts. Utilities dispatched electricity generation from their coal-fired plants to their gas-fired plants. And there have been structural changes: utilities have built gas-fired power plants and have retired – not mothballed! – their oldest, most inefficient, and most polluting coal-fired power plants. Global industrial companies have been building plants in the US for energy-intensive processes and for processes that use natural gas as feed stock. Even natural gas in transportation is picking up.

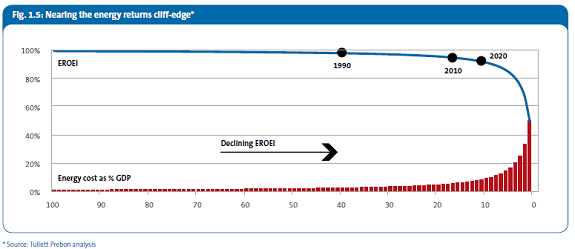

Asia Confidential presents as new something The Automatic Earth has explained for years, and a pivotal part of Nicole’s lectures: EROEI. So be it. Let them think it’s new. A little more recognition of our work would be good though. There is precious little in the field of energy that we haven’t, through the years, dealt with extensively.

• Why Shale Oil Boosters Are Charlatans In Disguise (Asia Confidential)

[..] … the era of surplus energy, which has driven economic growth since 1750, is over. The key isn’t to be found in the theories of “peak oil” proponents and the potential for absolute declines in oil reserves. Instead, it’s to be found in the relationship between the energy extracted versus the energy consumed in the extraction process, also known as the Energy Return on Energy Invested (EROEI) equation.

The equation maths aren’t difficult to understand. If the EROEI is 10:1, it means that 10 units are extracted for every 1 unit invested in the extraction process. From 1750-1950, the EROEI of oil discoveries was very high. For instance, discoveries in the 1930s had 100:1 EROEIs. That ratio declined to 30:1 by the 1970s. Today, that ratio is at about 17:1 with few recent discoveries above 10:1.

Morgan’s research suggests that going from EROEIs of 80:1 to 20:1 isn’t disruptive. But once the ratio gets below 15:1, energy becomes a lot more expensive. He suggests the ratio will decline to 11:1 by 2020 and the cost of energy will increase by 50% as a consequence.

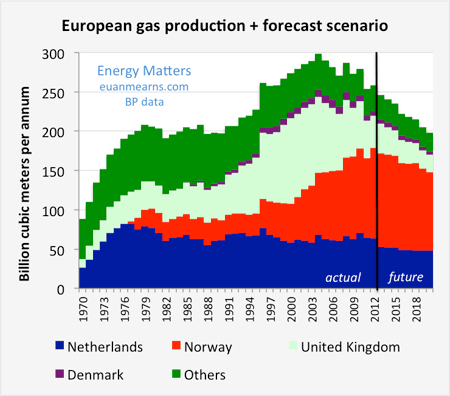

Our good friend Euan, from the Oil Drum days, updates the European gas situation. It only gets worse as we go along. And then one day it will start popping and biting.

• European gas security (Euan Mearns)

News last week that the Dutch Government is to cut production from the Groningen gas field (due to protests over earth tremors) has prompted me to revisit European gas security, a subject I last looked at in 2007.

- European conventional gas production appears to have peaked at 298 billion cubic meters (bcm) per annum in 2004 and has since fallen by 40 bcm/y (Figure 1). In the same time frame, consumption appears to have plateaued and import growth has slowed.

- There are likely 5 reasons for the consumption plateau: 1) the recession and ongoing hardship in the € zone periphery, 2) high natural gas prices linked to LNG heading east, 3) increased use of coal that has become cost competitive, 4) growth of renewable electricity and 5) improving energy efficiency.

- The forecast scenario, that is described in some detail below, sees European conventional gas production falling a further 60 bcm/y by 2020.

Emerging markets. They will be in the headlines for some time to come. It’s an abstract term, but there are real people behind it, who are about to see their dreams of even marginally better lives shattered. Economic upheaval will lead to lots of political unrest. Is it really worth it to wreck poorer nations, just so we may have our illusions of grandeur a while longer? Does a market model work that preys on weaker global citizens just so western investors can raise their profit margins? Is that really what we want to build our children’s futures on?

• After Getting High on Emerging Markets, Now for the Comedown (TIME)

You’d think that the world’s investors would be in good spirits right now. The U.S. economy finally appears to be recovering. Japan may be stirring back to life. Both the IMF and World Bank recently upgraded their projections for global growth. But as we get started on 2014, financial markets are in turmoil. Emerging markets from Argentina to Turkey to South Africa are seeing their currencies get slammed as investors flee. The jitters ricocheted to the U.S. last week, pummeling stocks in New York City. What in the world is going on?

Call it coming down off an emerging-markets high. During the Great Recession, when the U.S. and Europe became crushed under debt, joblessness and recession, the developing world appeared to be the future of the global economy. Growth in countries like China, India, Brazil and Indonesia shrugged off the woes of the West and supported the world economy through this toughest of times. Money flowed generously into many of these markets as a result, especially since anxious central banks in the U.S., Europe and Japan flooded their economies with liberal amounts of cash to prevent an even worse downturn. What’s happening now is that global investors are starting to realize the developing world has its own issues, and that it hasn’t detached itself from the West’s problems either.

More emerging nations from John Rubino. And yes, maybe labeling them Subprime countries makes the picture easier accessible for people.

• What Blows Up First? Part 3: Subprime Countries (John Rubino)

The crucial point here is that this crisis is not a case of one or two little countries screwing up. It’s everywhere, from Latin America to Asia to Eastern Europe. Each country’s problems are unique, but virtually all can be traced back to the destabilizing effects of hot money created by rich countries attempting to export their debt problems to the rest of the world. ZIRP, QE and all the rest succeeded for a while in creating the illusion of recovery in the US, Europe and Japan, but now it’s blow-back time. The mess we’ve made in the subprime countries will, like rising defaults on liar loans and interest-only mortgages in 2007, start moving from periphery to core.

What’s interesting about the following Bloomberg piece is that it addresses the REAL unemployment number in Europe, comparable to U6 in the US. It is 19.9%, once everyone is counted. The EU uses the same lame methodical tricks the US does to keep its official unemployment rates down.

• Euro Jobless Record Seen in Legacy of Italians Giving Up (Bloomberg)

Euro-area data this week will probably show the region ended 2013 with a record jobless rate that reveals only part of the social legacy of the debt crisis. While economists predict unemployment in December stayed at an all-time high of 12.1%, with about 19 million jobless, that tally excludes legions of adults who would also work if they could. Bloomberg calculations for the third quarter show a wider total of 31.2 million people of all ages are either looking for jobs, willing to do so though unavailable, or else have given up. [..]

The euro area’s official unemployment rate includes only those who actively sought work in the previous four weeks and are available to start within the next two weeks. The labor underutilization rate compiled by Bloomberg using Eurostat data for the third quarter includes the official unemployed as well as those willing to work who have given up looking for a job or are not immediately available.

Among euro-zone countries, Italy has the largest group of potential workers who don’t appear on official unemployment statistics. The gap between the country’s labor underutilization rate, encompassing people between the ages of 15 and 74, and its unemployment rate is more than twice that of Spain and more than five times that of Greece. [..]

Over 12% of workers in Italy aren’t able to live on their salaries alone, according to an EU study published this month. That’s the highest percentage after Romania and Greece. Italy is also one of the worst countries in which to lose a job, since the percentage of people able to find other employment within a year is between 14% and 15%, the lowest in Europe.

Iceland’s future isn’t anywhere near as sunny as this piece suggests, but letting banks fail has certainly saved the country from much worse trouble. Unfortunately, in the rest of the west, the banks have usurped political power, and they won’t let themselves fail, not as long as they have access to public funds and credit.

• Let Banks Fail Is Iceland Mantra as 2% Joblessness In Sight (Bloomberg)

Iceland let its banks fail in 2008 because they proved too big to save. Now, the island is finding crisis-management decisions made half a decade ago have put it on a trajectory that’s turned 2% unemployment into a realistic goal. While the euro area grapples with record joblessness, led by more than 25% in Greece and Spain, only about 4% of Iceland’s labor force is without work. Prime Minister Sigmundur D. Gunnlaugsson says even that’s too high.

The island’s sudden economic meltdown in October 2008 made international headlines as a debt-fueled banking boom ended in a matter of weeks when funding markets froze. Policy makers overseeing the $14 billion economy refused to back the banks, which subsequently defaulted on $85 billion. The government’s decision to protect state finances left it with the means to continue social support programs that shielded Icelanders from penury during the worst financial crisis in six decades.

Of creditor claims against the banks, Gunnlaugsson says “this is not public debt and never will be.” He says his main goal while in office is “to rebuild the Icelandic welfare state.” [..]

Successive Icelandic governments have forced banks to write off mortgage debts to help households. In February 2010, 16 months after Kaupthing Bank, Glitnir Bank and Landsbanki failed, unemployment peaked at 9.3% The rate was 4.2% in December, according to Statistics Iceland. In the euro area, unemployment held at a record 12.1% in November, Eurostat estimates.

Mish with a great article on the “character” of bubbles. Note that the Fed, even if they were to recognize them, which they don’t, would have no power over bubbles, other than the ones they blow themselves.

• Bubbles burst when the pool of greater fools runs out (Mish)

Make enough predictions and sooner or later you are going to look mighty foolish. Since someone is bound to point them out, you may as well admit them yourself. That said, my underlying thesis is correct: Once again the Fed has totally and completely ignored asset price inflation, and once again, the Fed cannot see a massive bubble staring them right in the face. This bubble will bust, on time, like all other bubbles, as soon as the pool of greater fools runs out.

Can Bubbles Be Prevented? That is kind of a trick question. The correct answer is “In general, bubbles can be prevented”. The “trick” is I modified the question from the title of this article “Can the Fed Prevent Bubbles?” The answer to the question as originally posed is an emphatic “No!”

The Fed cannot prevent what it cannot see, even after the fact, when bubbles are in plain sight to any clear-thinking person. More importantly, the biggest cause of economic bubbles is the Fed (central banks in general). It is axiomatic that the cure for the disease cannot possibly be the same as the cause of the disease (the Fed).

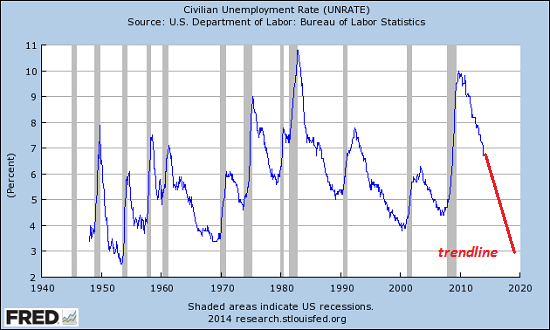

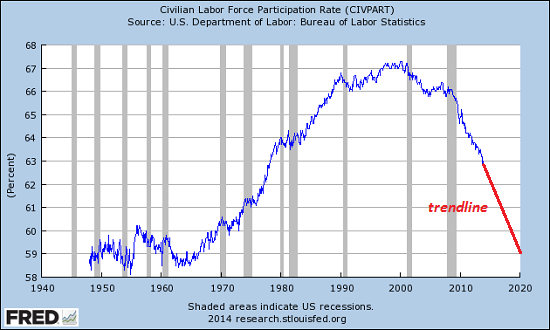

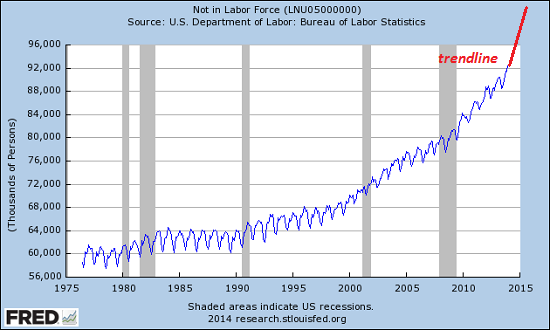

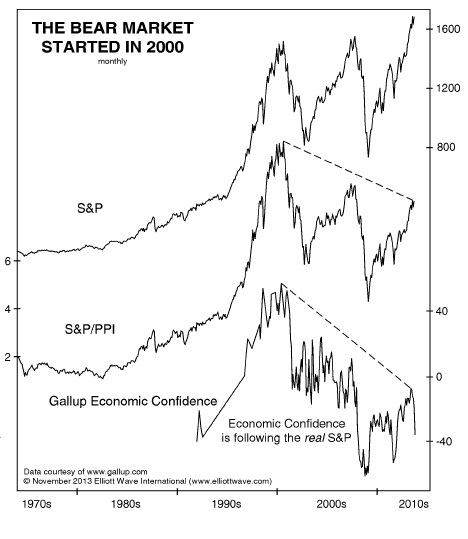

Charles Hugh Smith with some educational graphs. See the artice on EU joblessness above.

• The Recent “New High” in Stocks Is as Bogus as the Unemployment Rate (CHSmith)

Here’s the unemployment rate. If the downtrend continues (and it will, as long as the participation rate keeps going down), the unemployment rate will soon be 3%, regardless of how many people have full-time jobs they can live on.

The participation rate (percentage of the population in the labor force) will soon be at levels last seen when the typical household only had one employed adult:

Those not in the labor force will soon equal the number of people with full-time jobs (around 115 million):

This is what happens when the Status Quo is incapable of reforming itself or recognizing reality: propaganda and bogus statistics are substituted for actual solutions.

China? I’m scared. But I already said that.

• China’s Great Wall of Credit Begins to Crumble (Phoenix Capital)

China’s credit-fueled bubble economy is falling to pieces before our very eyes. Between 2008 and 2013, China’s credit market increased from $9 trillion to an incredible $23 trillion. To give this number some perspective, China’s GDP is a little over $7 trillion. So China today has a credit market well north of 300% of its GDP. There is simply no other way to view this than as a bubble. Indeed, we see all of the clear signs of a bubble in the real estate markets today with countless ghost cities, massive empty malls, and other excess capacity.

What’s truly stunning to witness however, is the fact that in spite of all of this expansion in credit, China’s GDP growth continues to fall. Indeed, GDP is now trending downwards for the first time in a decade. China’s Government has realized that this is a major problem for the country and so has announced that “GDP is no longer a measure of success.” This is an incredible admission from the Chinese Government as everyone on the planet knows China’s GDP measure has been a work of fiction for decades. The fact that GDP growth is slowing in spite of all the manipulation of the metric is a major sign that things are sharply turning for the worse in the People’s Republic.

Indeed, we get additional indications that China’s economic data is dramatically overstated from other less massaged metrics. China recently announced that it would be implementing a crackdown on fraudulent trade invoicing. It is not coincidence that right after this, China posted a truly horrible steel export results for the month of May: a mere 1% increase from the year before (hardly the stuff of which 8% GDP growth is made of). Another metric is electricity usage, which increased by a mere 2.9% in the first quarter of 2013.

So, steel exports are increasing by 1% year over year. Electrical usage increased by just 2.9% in the first quarter of this year, and the Chinese Government has announced that the world should stop looking at its GDP numbers because they are not truly indicative of the economy there.The Government is right in saying this, though not in the way it means. China’s GDP is not indicative of its true GDP growth… it’s sharply overstating it.

More evidence shows up in the China ETF (FXI) which has been in a massive wedge pattern for five yeas now. AS soon as we take out that bottom line, it’s GAME OVER.

And last but not least, Stephen hawking. We’re going to have to erase the entire concept of black holes from our vocabulary. They don’t exist. Hawking has for years said that some radiation (or, rather, information) can escape from what we used to call black holes, and now finds it’s so much that even a term like “event horizon” is no good. “Metastable bound states of the gravitational field” sure sounds a lot less scary. And no, I guess we can’t talk about credit black holes either anymore.

• Stephen Hawking declares: ‘There are no black holes’ (CNet)

It’s charming when a phrase enters the language and we think we all know what it means. In the case of “black hole,” we think of an infinity of black nothingness that swallows everything that slips into it. But now, in a new paper called “Information Preservation and Weather Forecasting for Black Holes,” Stephen Hawking has cast the cat among the black, holey pigeons and caused a scattering of incomprehension.

His precise words were: “The absence of event horizons mean that there are no black holes — in the sense of regimes from which light can’t escape to infinity.” It seems clear. There are no forever and ever holes of blackness. There is always the chance that light might emerge. Hawking continued: “There are however apparent horizons which persist for a period of time. This suggests that black holes should be redefined as metastable bound states of the gravitational field.”

This article addresses just one of the many issues discussed in Nicole Foss’ new video presentation, Facing the Future, co-presented with Laurence Boomert and available from the Automatic Earth Store. Get your copy now, be much better prepared for 2014, and support The Automatic Earth in the process!

By Raul Ilargi Meijer

Website: http://theautomaticearth.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

Raul Ilargi Meijer Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.