Global Stock Markets Recieve Earnings Boost Amidst Bearish Sentiment

Stock-Markets / Financial Markets Apr 20, 2008 - 09:05 AM GMT

It's Earnings, Stupid! Or so it seemed during the past week as the stock market took its cue from a host of better-than-feared earnings reports, propelling the S&P 500 Index 4.3% higher – a bigger gain than for the entire 2007. And what a swift turnaround it was after the market got “GE'd” and was in sackcloth and ashes by the close of the previous week!

It's Earnings, Stupid! Or so it seemed during the past week as the stock market took its cue from a host of better-than-feared earnings reports, propelling the S&P 500 Index 4.3% higher – a bigger gain than for the entire 2007. And what a swift turnaround it was after the market got “GE'd” and was in sackcloth and ashes by the close of the previous week!

Thomson Financial estimated at the start of the week that first-quarter earnings would decline by 14.1%; however, when the financial sector is excluded, the growth rate for the remaining nine sectors would be 6.4%.

Thomson Financial estimated at the start of the week that first-quarter earnings would decline by 14.1%; however, when the financial sector is excluded, the growth rate for the remaining nine sectors would be 6.4%.

Against the backdrop of a US recession, this round of earnings reports is of particular interest for the stock market in order to ascertain specifically how the earnings for the non-financial sector stack up, i.e. whether more earnings announcements surprise on the downside than upside. (Earnings expectations for financials have already been reduced by so much that the potential for shocks is probably fairly limited.)

Mike Lenhoff ( Brewin Dolphin ) highlights the following: “… with nearly 20% of the S&P 500 having reported, the non-financial earners are doing comparatively well by surprising on the upside. For example, if one excludes the results for financials and consumer discretionary, we're talking about almost 5 companies surprising on the upside with their earnings for every one company surprising on the downside. The corresponding ratio for the entire set of companies that has reported so far is closer to 2.”

It is quite apparent that the US currently has a two-stream economy, with multi-nationals such as Coca-Cola (KO), IBM (IBM) and Intel (INTC) being cushioned against the slowdown in the US by the weak US dollar and stronger growth abroad.

Before highlighting some thought-provoking news items and quotes from market commentators, let's briefly review the financial markets' movements on the basis of economic statistics and a performance round-up.

Economy

The Beige Book for the US was released last week and concluded that the economy was characterized as weakening over the past six weeks. “This downbeat report is consistent with our assessment that the economy is in recession,” said Moody's Economy.com .

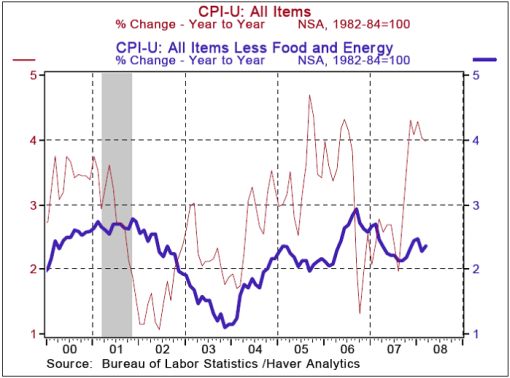

The past week witnessed a number of inflation reports causing concern about rising prices.

The Consumer Price Index (CPI) increased by 0.3% in March after holding steady in February. During the three months ended March, the CPI rose at an annual rate of 3.1% compared with a 4.1% gain in 2007.

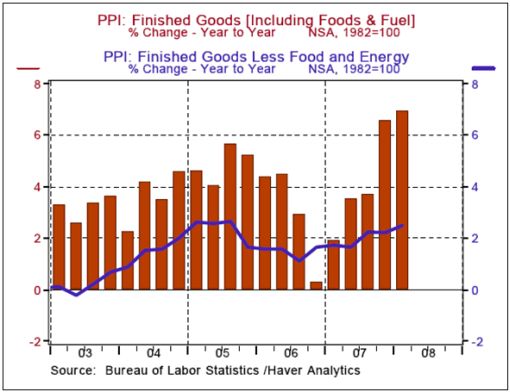

Wholesale prices stoke concerns of hawks, with the Producer Price Index (PPI) for finished goods having risen at an annual rate of 10.2% in the first three months of 2008 versus an 11.5% increase in the fourth quarter of 2007 and a 6.3% gain in 2007.

Elsewhere in the world, higher fuel and food costs also saw price increases in Germany hit an annual rate of 3.2% in March. This helped drive inflation across the 15-country euro region to 3.5% last month – a 16-year high. Japanese inflation is also back, with consumer inflation now more than 1% for the first time this decade.

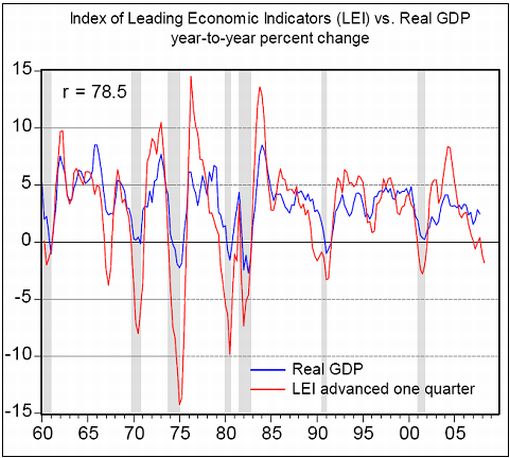

Back to the US, the Conference Board's Index of Leading Economic Indicators (LEI) declined by 1.8% in the first quarter of 2008. This is the largest quarterly drop in the current economic expansion. “Historically, negative year-to-year readings of LEI are associated with recessions,” said Asha Bangalore ( Northern Trust ).

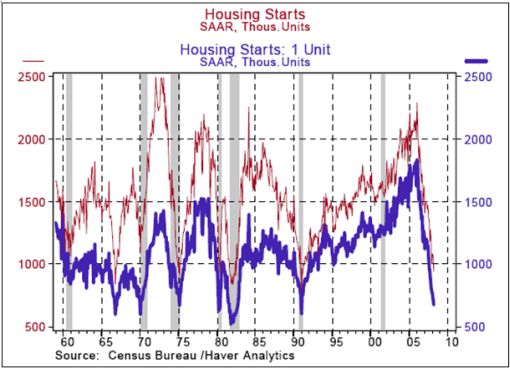

Furthermore, the housing starts and permits data in March suggested that the bottom for construction of new homes was not yet in sight.

Given the weakness in the housing sector, retail sales and employment conditions, the FOMC is most likely to lower the Fed funds rate by 25 basis points to 2.0% at its meeting of April 30. However, the upward pressure from rising import prices due to a weak dollar could result in the Fed deciding to adopt a wait-and-see approach after the April 30 meeting.

WEEK'S ECONOMIC REPORTS

| Date | Time (ET) | Statistic | For | Actual | Briefing Forecast | Market Expects | Prior |

| Apr 14 | 8:30 AM | Retail Sales | Mar |

0.2% |

0.4% |

0.0% |

-0.4% |

| Apr 14 | 8:30 AM | Retail Sales ex-auto | Mar |

0.1% |

0.7% |

0.1% |

-0.1% |

| Apr 14 | 10:00 AM | Business Inventories | Feb |

0.6% |

0.7% |

0.6% |

0.9% |

| Apr 15 | 8:30 AM | PPI | Mar |

1.1% |

0.4% |

0.6% |

0.3% |

| Apr 15 | 8:30 AM | Core PPI | Mar |

0.2% |

0.1% |

0.2% |

0.5% |

| Apr 15 | 8:30 AM | NY Empire State Index | Apr |

0.6 |

-17.0 |

-17.0 |

-22.2 |

| Apr 15 | 9:00 AM | Net Foreign Purchases | Feb |

$72.5B |

NA |

$60.0B |

$57.1B |

| Apr 16 | 8:30 AM | CPI | Mar |

0.3% |

0.3% |

0.3% |

0.0% |

| Apr 16 | 8:30 AM | Core CPI | Mar |

0.2% |

0.2% |

0.2% |

0.0% |

| Apr 16 | 8:30 AM | Housing Starts | Mar |

947K |

1015K |

1010K |

1075K |

| Apr 16 | 8:30 AM | Building Permits | Mar |

927K |

975K |

970K |

984K |

| Apr 16 | 9:15 AM | Industrial Production | Mar |

0.3% |

0.1% |

-0.1% |

-0.7% |

| Apr 16 | 9:15 AM | Capacity Utilization | Mar |

80.3% |

80.4% |

80.4% |

80.3% |

| Apr 16 | 10:30 AM | Crude Inventories | 04/12 |

-2356K |

NA |

NA |

NA |

| Apr 16 | 2:00 PM | Fed's Beige Book | - |

- |

- |

- |

- |

| Apr 17 | 8:30 AM | Initial Claims | 04/12 |

372K |

385K |

375K |

355K |

| Apr 17 | 10:00 AM | Leading Indicators | Mar |

0.1% |

0.2% |

0.1% |

-0.3% |

| Apr 17 | 10:00 AM | Philadelphia Fed | Apr |

-24.9 |

-13.0 |

-15.0 |

-17.4 |

Source: Yahoo Finance , April 18, 2008.

The next week's economic highlights, courtesy of Northern Trust , include the following:

1. Existing Sales (April 23): Sales of existing homes are predicted to have declined in March. Existing home sales have dropped 30.6% from their peak in September 2005. Sales of existing homes have fallen by 19.7% from a year ago in February. Consensus : 4.95 million versus 5.03 in February.

2. New Home Sales (April 24): Sales of new homes are expected to have fallen in March. Purchases of new homes have fallen by 57.5% from their peak in July 2005. Sales of new homes have declined by 30.6% from a year ago in February. Consensus : 580,000 versus 590,000 in January.

3. Durable Goods Orders (April 24): Durable goods orders (+0.5%) are predicted to reverse a part of the 1.1% decline seen in February. Consensus : 0.6% versus -1.1% in February.

4. Other reports : Consumer Sentiment Index (April 25).

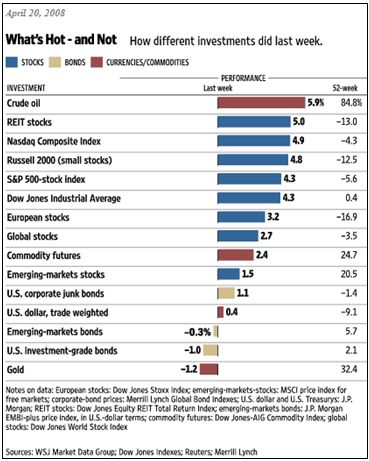

Markets

The performance chart obtained from the Wall Street Journal Online shows how different global markets fared during the past week.

Source: Wall Street Journal Online , April 20, 2008.

Equities

Global stock markets experienced a strong week as the US earnings reporting season turned up better-than-feared results. The MSCI World Index gained 2.7% during the week, with both the US and European markets rising strongly.

The Asian markets experienced a mixed performance: The Japanese Nikkei 225 Average eked out a gain of 1.2%, but the Hong Kong Hang Seng Index and the Shanghai Stock Exchange Composite Index recorded losses of 1.9% and 11.4% respectively. The latter has now dropped by almost 50% since its peak in October 2007.

As far as the US stock markets were concerned, the strongest index was the Nasdaq Composite Index with a surge of 4.9% (its best week since August 2006), followed by the Russell 2000 Index (+4.8%), the S&P 500 Index (+4.3%) and the Dow Jones Industrial Index (+4.3%).

The energy sector (+7.7%), the technology sector (+6.3%) and the financial sector (+5.2%) were the star performers for the week.

Fixed-interest instruments

Monetary conditions for financial institutions tightened markedly as reflected by the three-month dollar Libor rate jumping from 2.71% to 2.91% during the week.

The rise in global stock markets and mounting inflation worries resulted in investors switching from government bonds to equities, pushing government bond yields sharply higher in most parts of the world. For example, the yield on the two-year US Treasury Note jumped by 43 basis points to 2.18%, whereas the 10-year US Treasury Note yield rose by 28 basis points to 3.75%. UK and other European bond yields showed similar increases. (Also see my recent article “ Soaring inflation creates headwind for long bonds ”.)

US mortgage rates also increased, with the 15-year fixed rate rising by 22 basis points to 5.54% and the 5-year ARM rate increasing by 35 basis points to 5.73%.

Currencies

The past week was characterized by a fair amount of volatility in the currency markets.

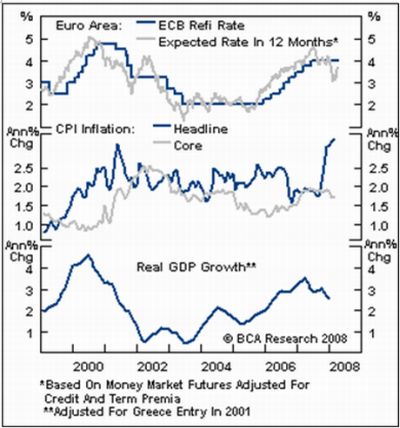

The US dollar hit an all-time low of $1.5983 against the euro before clawing back some of the losses to close 0.4% down over the week. The European Central Bank again stressed its concern about rising prices in the Eurozone, dashing hopes of an interest rate cut over the short term.

The Japanese yen was on the receiving end of investors' renewed appetite for risk and gave up 3% against the US dollar and 3.2% against the euro.

Commodities

The Dow Jones-AIG Commodity Index notched up another gain (+2.4%) during the past week, with a number of commodities scaling fresh peaks.

West Texas Intermediate oil registered a record of $117 a barrel on Friday before dropping back a bit, but still closed 5.9% higher on the week. The surge was attributed to unexpectedly large declines in US crude and petrol stocks, supply concerns in Mexico and Nigeria and fears that Russian oil production had peaked.

Rice prices were subject to panic buying, hitting $1,000 a ton as concerns about supply shortages mounted on the back of major exporters imposing restrictions.

Elsewhere on the commodities front, copper reached an all-time high of $8,800 a ton as a result of a market deficit and a historically low stock-to-consumption ratio.

Now for a few news items and some words and graphs from the investment wise that will hopefully assist in guiding us in making appropriate investment decisions to keep our portfolios making headway.

Source: Tom Toles , April 18, 2008.

Credit Suisse: Ten big investment themes for 2008

Ten big investment themes for 2008, ranging from high-risk, but potentially high-return options, through to some of the more secure “stay safe” investments, are described by Giles Keating, Credit Suisse head of the Global Economics and Strategy Group, in the following video:

Ten big investment themes for 2008, ranging from high-risk, but potentially high-return options, through to some of the more secure “stay safe” investments, are described by Giles Keating, Credit Suisse head of the Global Economics and Strategy Group, in the following video:

Please click here for full report.

Source: Credit Suisse , April 15, 2008.

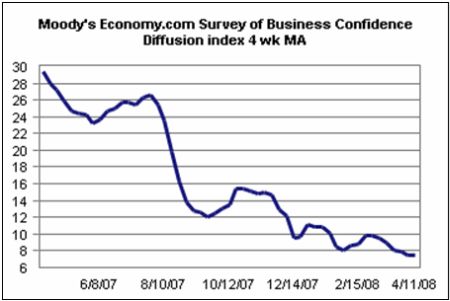

Moody's Economy.com: Global business confidence keeps sliding

“Global business confidence continues to deflate. US business confidence slid to a new record low in mid-April, consistent with recession. Assessments of current business conditions and the strength of sales have never been lower. Financial services firms have also have never been as pessimistic. Equipment investment slipped sharply last week, and hiring intentions are soft. … confidence remains stronger in Asian and South America.”

Source: Moody's Economy.com , April 14, 2008.

Nouriel Roubini and Jim O'Neill (Financial Times): US economy – how slow will it go?

“There is now doubt that the US economy has slowed down but by how far and how fast? In a discussion held earlier this month in Italy, John Thornhill asks two economists how they expect the market and economic turbulence to develop.

“There is now doubt that the US economy has slowed down but by how far and how fast? In a discussion held earlier this month in Italy, John Thornhill asks two economists how they expect the market and economic turbulence to develop.

“Nouriel Roubini is a professor of economics at New York University's Stern School of Business and is famously pessimistic about the slump. Jim O'Neill is head of global macro research at Goldman Sachs and takes a more sanguine view. They discuss whether the European economy is robust enough to weather the storm brewing across the Atlantic and compare approaches taken by the US Federal Reserve and the European Central Bank to counter the problem.”

Source: John Thornhill, Financial Times , April 14, 2008.

Bloomberg: Surge in amount of distressed corporate bonds

“The amount of distressed corporate bonds jumped to $206 billion April 11 from $4.4 billion in March 2007, according to a Merrill Lynch index of bonds yielding at least 10 percentage points more than Treasuries. The share of leveraged loans considered distressed was 16% at the end of March, the highest since 1997, says Standard & Poor's, based on loans trading below 80% of their face value.” - Source: Tiffany Kary and Caroline Salas, Bloomberg , April 15, 2008.

Financial Times: Fed is responsible for crisis, says Henry Kaufman

Source: Financial Times , April 16, 2008.

Bloomberg: Templeton's Mobius says credit crisis is near end

“Templeton Asset Management's Mark Mobius said the credit-market crisis that's caused $245 billion of losses at banks and brokerages is ‘near the end'.

The MSCI World Index has gained 8.4% since closing at a 17-month low on March 17 after JPMorgan Chase rescued Bear Stearns and the Federal Reserve cut rates to shore up confidence in the financial system. Mobius joins the chief executives of JPMorgan, Lehman Brothers, Morgan Stanley and Goldman Sachs in predicting that the worst of the credit crisis has passed.

“‘Most of the bad news is already in the market,' Mobius, 71, said. ‘The writedowns are coming in fast and furious.'”

Source: Hanny Wan and Catherine Yang, Bloomberg , April 15, 2008.

Richard Russell (Dow Theory Letters): Current situation very different from Great Depression

“Some analysts who haven't been around very long are equating the current situation with the Great Depression of the 1930s, the economy I grew up in. Ridiculous.

“In the current situation the Dow was down 12% from its high at the worst; during the Depression the Dow lost 89% of its peak value. Today unemployment is maybe 5%, during the Depression it was 25%. Today maybe 2% of homes are in foreclosure. During the Depression it was like 20% or more. Today one big bank has gone under. During the Depression (1931) 1400 banks went under. During the Depression in NYC men were living in tin and cardboard home-made hovels. Today it costs you $2 200 a month for a small studio in Manhattan. During the Depression you could buy a loaf of bread for a dime, assuming you had a dime. Today a loaf of bread will cost you $2.50 to $5.00 depending on the quality.”

Source: Richard Russell, Dow Theory Letters , April 18, 2008.

Carrick Mollenkamp (The Wall Street Journal): Bankers cast doubt on key interest rate amid crisis

“One of the most important barometers of the world's financial health could be sending false signals. In a development that has implications for borrowers everywhere, from Russian oil producers to homeowners in Detroit, bankers and traders are expressing concerns that the London inter-bank offered rate, known as Libor, is becoming unreliable.

“Libor plays a crucial role in the global financial system. Calculated every morning in London from information supplied by banks all over the world, it's a measure of the average interest rate at which banks make short-term loans to one another. Libor provides a key indicator of their health, rising when banks are in trouble. Its influence extends far beyond banking: The interest rates on trillions of dollars in corporate debt, home mortgages and financial contracts reset according to Libor.

“In recent months, the financial crisis sparked by subprime-mortgage problems has jolted banks and sent Libor sharply upward. The growing suspicions about Libor's veracity suggest that banks' troubles could be worse than they're willing to admit.

“The concern: Some banks don't want to report the high rates they're paying for short-term loans because they don't want to tip off the market that they're desperate for cash. The Libor system depends on banks to tell the truth about their borrowing rates. Fibbing by banks could mean that millions of borrowers around the world are paying artificially low rates on their loans. That's good for borrowers, but could be very bad for the banks and other financial institutions that lend to them.”

Source: Carrick Mollenkamp, The Wall Street Journal (via GATA ), April 16, 2008.

Martin Feldstein (The Wall Street Journal): Stop reducing interest rates

“It's time for the Federal Reserve to stop reducing the Fed funds rate, because the likely benefit is small compared to the potential damage.

“Lower interest rates could raise the already high prices of energy and food, which are already triggering riots in developing countries. In order to offset the inflationary impact of higher imported commodity prices, central banks in those countries may raise interest rates. Such contractionary policies would reduce real incomes and exacerbate political instability.

“The impact of low interest rates on commodity-price inflation is different from the traditional inflationary effect of easy money. The usual concern is that lowering interest rates stimulates economic activity to a point at which labor and product markets cause wages and prices to rise. That is unlikely to happen in the US in the coming year. The general weakness of the economy will keep most wages and prices from rising more rapidly.

“Economic recovery will require resolving the difficult problems of the credit markets, dealing with the millions of homeowners who may now be tempted to default on mortgages that exceed the value of their homes, and reducing the risk that the ongoing decline in house prices will push millions of additional homeowners into a vulnerable, negative equity condition. A lower Fed funds rate will not solve any of those problems.”

Source: Martin Feldstein, The Wall Street Journal , April 15, 2008.

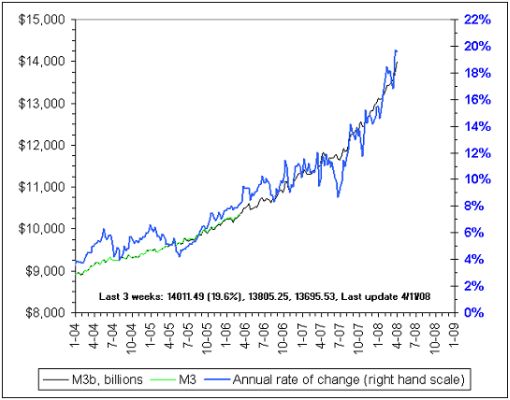

Richard Russell (Dow Theory Letters): M-3 is booming

“What's happening to M-3, the broad US money supply? The chart below is put out by A World of Possible Financial Futures , and I suspect it is quite accurate. It shows their calculation of M-3. The Greenspan Fed elected to hide the M-3 figures, and I guess to avoid embarrassing Greenspan, Bernanke has not brought the M-3 statistics back. C'mon, Bernanke, how about that transparency you were promising? At any rate, M-3 is booming.”

Source: Richard Russell, Dow Theory Letters , April 16, 2008.

Asha Bangalore (Northern Trust): FOMC would prefer additional moderation in inflation

“The Consumer Price Index (CPI) increased 0.3% in March after holding steady in February. During the three months ended March, the CPI has risen at an annual rate of 3.1% compared with a 4.1% gain in all of 2007.”

“The Fed is most likely to lower the Fed funds rate 25 bps on April 30 to 2.00% given the weakness in the housing sector, retail sales, and employment conditions. The upward pressure from rising import prices due to a weak dollar, the steady erosion of the dollar, dissents within the FOMC, combined with the remarks in the minutes of the March 18 FOMC meeting which noted the Fed needs time to assess the impact of its aggressive policy changes, and the view that monetary policy alone cannot correct the current impairment in financial markets are factors that support our forecast that the Fed may watch and wait after the April 30 cut in the Fed funds rate.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , April 16, 2008.

Asha Bangalore (Northern Trust): Wholesale prices stoke concerns of hawks

“The Producer Price Index (PPI) for Finished Goods advanced 1.1% in March following gains of 1.0% and 0.3% in January and February, respectively. The PPI for finished goods has risen at an annual rate of 10.2% in the first three months of 2008 vs. an 11.5% increase in the fourth quarter of 2007 and a 6.3% gain in all of 2007.

“This noticeable increase in wholesale prices in the first three months of the year reflects sharply higher prices for food (+10.1%), energy (+22.5%), and that of core items excluding food and energy (+5.0%). In March, the energy price index rose 2.9% and the food price index moved up 1.2%.

“The acceleration of the core PPI to 5.0% in the three months ended March is supportive ammunition for the hawks in the FOMC. But, inflation is a lagging indicator which peaks long after an expansion in economic activity has ended. The expectation is that a moderation in inflation will emerge as the economy slows in the next few months.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , April 15, 2008.

Bloomberg: US foreclosures skyrocket as homeowners walk away

“US foreclosure filings jumped 57% and bank repossessions more than doubled in March from a year earlier as adjustable mortgages increased and more owners lost their homes to lenders.

“More than 234,000 properties were in some stage of foreclosure, or one in every 538 US households, RealtyTrac, a seller of default data, said in a statement. Nevada, California and Florida had the highest foreclosure rates. Filings rose 5% from February.

“About $460 billion of adjustable-rate loans are scheduled to reset this year, according to analysts at Citigroup Inc. Auction notices rose 32% from a year ago, a sign that more defaulting homeowners are ‘simply walking away and deeding their properties back to the foreclosing lender' rather than letting the home be auctioned, RealtyTrac Chief Executive Officer James Saccacio said in the statement.

“‘We're not near the bottom of this at all,' said Kenneth Rosen, chairman of Rosen Real Estate Securities and the Fisher Center for Real Estate at the University of California at Berkeley. ‘The foreclosure process will accelerate throughout the year.'

“Rising foreclosures will add more inventory to an already glutted market, keep home prices down through at least next year and thwart efforts by Congress and President George W. Bush to help homeowners avoid default, Rosen said in an interview.”

Source: Dan Levy, Bloomberg , April 15, 2008.

Asha Bangalore (Northern Trust): Index of leading indicators supports forecast of weak economic conditions

“The Conference Board's Index of Leading Economic Indicators (LEI) inched up 0.1% in March, following five consecutive monthly declines. On a year-to-year basis, the LEI declined 1.8% in the first quarter of 2008. This is the largest quarterly drop in the current economic expansion. Historically, negative year-to-year readings of LEI are associated with recessions.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , April 17, 2008.

Asha Bangalore (Northern Trust): Largest peak-to-trough drop in single-family starts and permits on record

“The housing starts and permits data in March suggest that the bottom for construction of new homes is not here yet. Total housing starts plunged 11.9% to an annual rate of 947,000 units in March, reflecting a 5.7% drop in single-family starts to 680,000 and a 24.6% drop in multi-family starts.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , April 16, 2008.

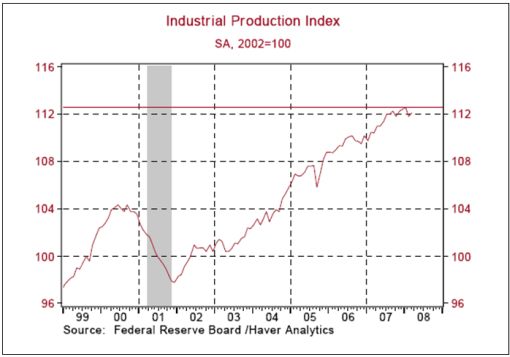

Asha Bangalore (Northern Trust): Factory sector has peaked

“Industrial production is one of the four economic variables the National Bureau of Economic Research uses to date business cycles.”

Source: Asha Bangalore, Northern Trust – Daily Global Commentary , April 16, 2008.

John Mauldin (Thoughts from the Frontline): A muddle-through economic recovery

“… home values are falling and will likely do so for another year at the least. As Woody Brock pointed out we are at the beginning of a reversion to the mean on national wealth. We are getting a reverse wealth effect. People either can't or won't borrow as much and thus we get negative stimulus from housing prices. It is likely that people are going to start saving more, which while a good thing from an individual stand point, it is a drag on overall consumer spending.

“Second, even though core inflation is tame, real inflation that includes the things you and I actually buy is high and rising. Money that is spent on gas and rising energy bills is money that cannot be spent on discretionary items. Rising food bills means that there is less money left over to buy entertainment and other modest luxury items.

“Third, rising unemployment clearly means that a small but growing segment of the population has less money to spend. Unemployment is at 5.1% and is likely to rise to over 6%. That is clearly bearish of consumer spending.

“All of these factors suggest a recession of at least two quarters if not three. While lower Fed funds rates and the efforts by Congress to stimulate lower mortgage rates will eventually help, it will not be an immediate panacea.

“The cause for the current recession is the bursting of the twin bubbles of the housing markets and the credit crisis. These are problems that are going to take several years to solve, not matter what the Fed does to interest rates … we still have to work our way through 3.5 million excess homes, 2 million of which are vacant. That will take a few years.”

Source: John Mauldin, Thoughts from the Frontline , April 18, 2008.

David Fuller (Fullermoney): Bearish sentiment – “déjà vu all over again”

“Judging from sentiment readings … the conventional view is that this is a time of great risk for stock market investors.

“After all, ‘The situation is much more serious than any other financial crisis since the end of World War II', according to George Soros recently; the USA's consumer-related portion of the economy is in deep recession; global GDP growth is slowing; resources inflation is rampant, and there are food price or scarcity riots in a number of countries. In other words, there really is ‘blood in the streets'.

“Does this sound like the end of the world? That would presumably be worse than an often repeated forecast over the decades: ‘The end of capitalism as we know it.' It would even be worse than taxes in Europe.

“Or perhaps there is more emotion than analysis in these views, and this is a better time to buy than sell.

“Being of the generation of investors duly frightened by but who also survived oil shocks, the secondary banking crisis, a secular bear market on Wall Street from the late 1960s until 1982, food hoarding and rampant inflation during the 1970s, another banking crisis in the early 1980s linked to Latin American loans, including ‘too big to fail' Continental Illinois, plus record high interest rates, the Crash of ‘87, not to mention the Aids epidemic, the S&L crisis, followed in the 1990s by SARS, bird flu, the Asian Financial Crisis, Russia's debt default, Long-Term Capital (mis)Management's blow up, Y2K hysteria, the dot-com bubble's bursting in 2000, 9/11, not to mention several wars over the decades, recent bearish sentiment has a ‘déjà vu all over again' feel to it.

“Yes, I know that many say, ‘It is worse this time', but they always do. I am more impressed by the bullish, contrary opinion sentiment indicators, which have a better track record. Problems of liquidity, solvency and profits will linger, but they have almost certainly passed their nadir and stock markets are a discounting mechanism.

“As dust from the Wall Street inspired banking crisis slowly settles, the technical building blocks of base formation development become more evident. It will take time for markets to reorganize and assemble them as platforms of support, as we have seen before, but the process is underway. In fact, investors waiting to re-enter the markets are spoiled for choice by some of the best valuations in recent years …”

Source: David Fuller, Fullermoney , April 17, 2008.

Richard Russell (Dow Theory Letters): Improved stock market outlook

“I like the market's action. PTI rising, new highs increasing while new lows are contracting, short interest is high and rising, and there's a lot of disbelief in the market's being able to move higher. As you know, the more skepticism, the better. The whole market situation looks good to me.

“I'm most interested to see whether Lowry's Selling Pressure breaks down and whether their Buying Power moves up. A lot of the market's upside progress has been a result of declining supply, but that's not enough – demand must pick up if this rise is to continue.

“LATE FLASH AFTER THE CLOSE OF THE MARKET – LOWRY'S ISSUES AN INTERMEDIATE-TERM BUY SIGNAL!”

Source: Richard Russell, Dow Theory Letters , April 18, 2008.

Bloomberg: Goldman says “awful” profits will drag down S&P 500 Index

“Goldman Sachs strategists said the US corporate earnings season got off to an ‘awful' start and shares will drop as companies slash forecasts for the rest of 2008.

“‘We expect generally disappointing results and a swath of lowered profit guidance that will drive the S&P 500 Index lower,' a team led by David Kostin, Goldman's US investment strategist, wrote …

“Kostin said last month that the S&P 500 may finish the year at 1,380, down 6% from the end of 2007. The forecast is the most bearish since at least 2000 by Goldman, which profited last year as other investment banks lost money on subprime mortgages.

“The forecasts conflict with estimates by Wall Street analysts that S&P 500 companies will report a 14% rise in the third quarter and 55% growth in the fourth. Predictions of a ‘speedy recovery' are too optimistic and stocks will drop when investors view estimates with ‘appropriate skepticism,' Kostin wrote.

“‘After-tax corporate profits relative to US gross domestic product are ‘well above sustainable levels,' Morgan Stanley strategist Gerard Minack wrote in a report today. He said a US recession and increased competition will cause earnings to decline. ‘If profits fall as much as I think they could, then markets are not cheap,' Minack wrote.”

Source: Alexis Xydias and Michael Patterson, Bloomberg , April 14, 2008.

Eoin Treacy (Fulermoney): Chinese stock market could become political issue

“The Shanghai A-Shares continue to make new lows in a move that has seen the Index fall almost 50% from its peak. While the downtrend is losing momentum somewhat, a sustained break of the progression of lower rally highs would be needed to indicate that the Index has reached a low of significance.

“The market has fallen enough to become a political issue, making it advisable to keep a close watch on government statements over the coming weeks, for clues as to any policy changes.”

Source: David Fuller, Fullermoney , April 18, 2008.

Bill King (The King Report): US playing the fool for ECB

“The US financial crisis plus the European assertion (from G7 soiree) that they should have more say in world economic events because they have a strong currency gives us an opportunity to proffer a theory.

“After England lost its position as the leading industrial power in the world to the US, it survived and prospered because London remained the financial center of the world.

“As the US's position of industrial leader of the world has diminished sharply over the past few decades, it has prospered because it became the financial center of the world.

“As China ascends, it's obvious (unless someone is totally CNBC), that it and Japan will increasingly become the dominant industrial powers.

“It is our view that European leaders understand that they cannot compete with Asia as an industrial power; so they must displace US financial hegemony with a strong currency, the euro. US leaders, lead by Easy Al and Bernanke, are aiding and abetting the rise of the euro as a world reserve currency and the ECB as a financial power as they aggressively debase the dollar.

“Because the US is playing the fool for the ECB, the main threat to the euro will appear when global recession intensifies and ‘lesser' European countries beg for funny money. If not satisfied, a schism could develop with some ‘lesser' countries leaving the EMU. However, a Franco-German-Swiss dominated ECB and euro, which would be even stronger, could result.”

Source: Bill King, The King Report , April 14, 2008.

GaveKal: Strong euro negative for European economy

“The rise of the Euro to the US$1.60 band will have serious consequences for the European economy. And we don't just mean the export-oriented manufacturers. Take, as one example, Spain's stalled real estate market, which is desperate for fresh liquidity. In the past, English buyers/tourists have been a major support for that market – but with the Euro where it is, the Brits will unlikely be ‘bargain hunting' for Spanish villas. And this is true for most European vacation destinations, which are likely to see the UK demand for real estate dry up over the next few months.”

Source: GaveKal – Checking the Boxes , April 17, 2008.

David Bloom (HSBC): Is the yen still a Japanese currency?

“Is the yen still a Japanese currency? That is the question troubling David Bloom, global head of FX research at HSBC.

“He says events in Japan seem to carry a lot less weight than before in determining the value of the currency. ‘Four key factors that would normally be dominant in the determination of the yen have come and gone with very little impact,' he says.

“‘For nearly a month until April 8, the Bank of Japan did not have a governor, but the yen hardly seemed bothered … The idea that Japan was going to normalize rates has suffered a major setback, but the FX market seems unfazed.'

“Meanwhile, the March Tankan business sentiment index came in lower than expected and produced a limited reaction from the yen. ‘This marks a major change from the past when the Tankan would rule dollar/yen in the run up to the survey and sometimes for weeks afterwards.'

“He says its is hard to be anything but bearish about Japanese equities: ‘Previously this would have been a major yen negative, but once again the yen seems to be trading off non-Japanese issues.'

“‘The market believes nothing radical is happening or about to happen in Japan. In other words in a fast changing world, we have a slow changing Japan,' he says. ‘The yen now seems to be bought and sold as a proxy for global risk premium and has very little to do with the machinations of the domestic economy.'”

Source: David Bloom, HSBC (via Financial Times ), April 16, 2008.

George Soros (Bloomberg): Commodity “bubble” still in “growth phase”

Source: Bloomberg , April 17, 2008.

John Authers (Financial Times): Commodity bull run co-existed with low bond yields

Source: John Authers, Financial Times , April 17, 2008.

Financial Times: Rice traders hit by panic as prices surge

“Rice prices hit the $1,000-a-tonne level for the first time on Thursday as panicking importers scrambled to secure supplies, exacerbating the tightness already provoked by export restrictions in Vietnam, India, Egypt, China and Cambodia.

“The jump came as the Philippines, the largest rice importer, failed for the fourth time to secure as much rice as it wanted. The unsuccessful tender followed Bangladesh's inability to buy any rice at all this week.

“Traders and analysts warned that rice demand was escalating in spite of prices rising to three times the level of a year ago as countries try to build up stocks.

“Vichai Sriprasert, president of Riceland International, a leading rice exporter in Bangkok, said several of its customers, including governments, were buying far more than they usually did amid fears about scarcity.

“‘It is panic,' he said. ‘My customers are demanding double the usual volume. We would not have enough supplies for all the demand we are facing.'

“Michael Whitehead, a rice specialist at Rabobank in New York, added: ‘The potentially destabilizing social effect of rice shortages in most high-consumption countries has strengthened the resolve of governments to build supply.'”

Source: Javier Blas and Raphael Minder, Financial Times , April 17, 2008.

David Fuller (Fullermoney): Rice price rises not sustainable

“Rice is the latest and one of the most spectacular examples of the commodity supercycle … The reasons behind this unprecedented development can be summarised in five words, often repeated on this site: Supply Inelasticity Meets Rising Demand.

“However, hoary observers of market trends will recall that when a financial story reaches page 1 of the international press – whether it is the collapse of Bear Stearns or in this instance the now parabolic upward acceleration of rice prices – a late stage of that particular cycle has been reached.

“Rice is experiencing a buying climax, meaning that this rate of advance is not sustainable beyond the short term, and will be followed by at least a medium-term correction. This will be signalled by a downward dynamic and reaction considerably in excess of the two small setbacks seen in March.

“On a medium to longer term basis, food scarcity leading to price inflation will remain a problem. However it will often be rotational, encouraging farmers to switch crops, where possible, in search of higher prices. Food exporting countries will be major beneficiaries of this secular bull market. Thailand is the world's largest exporter of rice.”

Source: David Fuller, Fullermoney April 18, 2008.

Ambrose Evans-Pritchard (Telegraph): Oil surges on back of global shortage

“Oil prices have surged to almost $115 a barrel as China builds up stocks before the Olympics and hedge funds pour money into commodity futures as a way to exploit the collapse of the dollar.

“The Opec producers cartel yesterday defied calls from Gordon Brown for a boost in output to help ease the global shortage, sticking to its target of 32 million barrels per day (bpd) for the next three months.

“There is some evidence that Opec has actually cut output by 350,000 bpd since the start of the year – a hostile move in the current climate. It blames the latest spike on ‘speculators', claiming that world demand will fall 1.4 million bpd to 85.7 million this quarter as the US grapples with recession.

“Nobody else can step into the breach. Output is falling in the non-Opec trio of Britain, Norway and Mexico. Russia's production slipped 1% in the first quarter. The cost of developing oil fields worldwide has doubled in three years. The cost of operating an oil rig per day has risen from $200,000 to $600,000 since 2003.

“‘The system is operating flat out,' said Chris Skrebowski, editor of Petroleum Review. ‘We have been very lucky for the past few years that there has not been any major war or revolution to disrupt supplies. The market is incredibly tight as it is.'”

Source: Ambrose Evans-Pritchard, Telegraph , April 17, 2008.

Financial Times: Fears emerge over Russia's oil output

“Russian oil production has peaked and may never return to current levels, one of the country's top energy executives has warned, fuelling concerns that the world's biggest oil producers cannot keep up with rampant Asian demand.

“The warning helped on Tuesday to push crude oil prices to a fresh all-time high above $1112 a barrel, threatening to stoke inflation in many countries.

“Leonid Fedun, the vice-president of Lukoil, Russia's largest independent oil company, told the Financial Times he believed last year's Russian oil production of about 10 million barrels a day was the highest he would see ‘in his lifetime'. Russia is the world's second biggest oil producer.

“Mr Fedun compared Russia with the North Sea and Mexico, where oil production is declining dramatically, saying that in the oil-rich region of western Siberia, the mainstay of Russian output, ‘the period of intense oil production [growth] is over'.”

Source: Carola Hoyos and Javier Blas, Financial Times , April 14, 2008.

Richard Russell (Dow Theory Letters): Silver/gold relationship points to inflation

“Silver is an interesting metal. Originally, the US dollar was defined in terms of a specific weight of silver. Yet silver is called the ‘poor man's gold'. In deflationary times or in recessionary times, investors' tend to view silver as an industrial metal … At such times, silver declines in relation to gold. In 1932 during the Depression, gold was selling at $20 an ounce while silver was selling at 23 cents an ounce.

“But in ‘good' times, and particularly in inflationary times, silver is viewed by investors as a monetary metal. At such times silver is apt to outperform gold. So what's going on now in the gold/silver relationship. Below we see a chart of the gold/silver situation. To smooth the erratic action, I include the 50-day moving average of the ratio. And the moving average has been rising since February in favor of silver.

“My conclusion is that currently silver is being viewed today as a monetary metal, and that the current atmosphere is one of inflation. The silver/gold relationship is telling us that.”

Source: Richard Russell, Dow Theory Letters , April 15, 2008.

BCA Research: ECB keeps talking tough

“The market is pushing out the timeline for ECB rate cuts.

“The market is pushing out the timeline for ECB rate cuts.

“There was no change in the ECB's strong anti-inflation stance at the Governing Council meeting. A meaningful decrease in inflationary expectations will be required to quell fears of second round wage effects. We continue to anticipate that the impact of food and energy prices on inflation will decline by the third quarter. Economic growth is below trend and will continue slowing. Domestic consumption is weak and exports will slow as global growth wanes and the strong euro bites into market share. Declining growth and a peak in inflation should open the door to rate cuts at the ECB by the third quarter. Bottom line: Expect ECB rate reductions of 50 basis points by yearend starting in the third quarter.”

Source: BCA Research , April 11, 2008.

Financial Times: Eurozone inflation at 16-year high

“France reported the sharpest rise in annual inflation for 11 years on Tuesday while German businesses blamed inflationary pressures for a sharp fall in confidence.

“After two months of increases, the German ZEW institute blamed the fall of its economic sentiment index to a level not seen since early 1993 on ‘extraordinarily high price pressure' and a fall in consumer spending power.

“Higher fuel and food costs saw price increases in the eurozone's largest economy hit an annual 3.2% in March. This helped drive inflation across the 15-country single-currency region to 3.5% last month, a 16-year high.

“In France, the government said prices rose 3.5% year on year in March, the fastest annual rate of increase for 11 years. The surge triggered a 2.3% increase in the national minimum wage. That means 2 million workers who receive a minimum wage – and several million others whose salaries are set in reference to it – could see two pay increases this year. The minimum wage rises when price gains since the last review top 2% – the first time since 1997 that the automatic mechanism has taken effect before the usual annual review of the minimum wage level in May.

“The data, reported on Tuesday, seem to support the European Central Bank's policy of abstaining from interest rate cuts.”

Source: Gerrit Wiesmann and Ben Hall, Financial Times , April 15, 2008.

John Authers (Financial Times): Japanese inflation is back

“Japanese inflation is back, with consumer inflation now more than 1% for the first time this decade. That should be a cause for rejoicing. Since 1990, the Japanese economy has, after all, been bedeviled by deflation, a symptom of the lack of economic activity.

“Sadly, it appears to be the wrong type of inflation. Rather than what economists call ‘demand-pull' inflation – where prices rise because of buoyant economic demand – Paul Jackson of Société Générale suggests this is ‘cost-push' inflation. Corporate goods price inflation – the costs paid by companies – has leapt to 3.9%, its highest in nearly 30 years. Some of this must be passed on in consumer prices.

“Thus the return of inflation is not a symptom of returning vigor for consumers but rather another reason to fear that they will retrench, and that Japan will lapse back into recession.

“This is not visible from the price of the yen, which relies more on global perceptions of risk than on anything endemic to Japan. Since the credit crisis took hold last summer, it has appreciated by 23 per cent against the dollar.

“The knock-on effects are nasty. Japan's stock market is no longer the world's largest, as it was at the turn of the 1990s, but it accounts for almost 9% of global market value, according to MSCI. The Nikkei 225 is acutely sensitive to the yen, thanks to the importance of exports. It has fallen more than 30% as the yen has risen.

“There is no obvious way out. Higher inflation usually aids the case for raising interest rates, which would further strengthen the currency. Weak growth and cost-push inflation argue for a cut in rates. Either way, the return of Japanese inflation adds uncertainty to a world that already has more than enough.”

Source: John Authers, Financial Times April 14, 2008.

Jing Ulrich (JPMorgan): Rising inflation big challenge for Chinese economy

“Inflation remains the biggest challenge facing the Chinese economy, even though consumer price rise

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.