Bitcoins Goes Mainstream - How Washington is Ruining the Economic Recovery

Stock-Markets / Financial Markets 2014 Jan 16, 2014 - 07:54 PM GMTBy: Clif_Droke

Columnists and newsletter writers are tripping over themselves to describe what they collectively believe will be a bullish year for stocks and the economy in 2014. They point to the Fed’s artificially low interest rates and continued commitment toward a lower unemployment rate as key reasons why the party will continue in the coming year. They also believe that government intervention both at home and abroad will produce a sixth year of recovery.

Columnists and newsletter writers are tripping over themselves to describe what they collectively believe will be a bullish year for stocks and the economy in 2014. They point to the Fed’s artificially low interest rates and continued commitment toward a lower unemployment rate as key reasons why the party will continue in the coming year. They also believe that government intervention both at home and abroad will produce a sixth year of recovery.

Even the most famous of bearish economists, Dr. Nouriel Roubini, has joined the bullish bandwagon for 2014. The infamous “Dr. Doom,” who correctly predicted the 2008 economic collapse, has been incorrectly bearish for much of the past five years. In his 2014 outlook, published on the Project Syndicate website, he states that the risk of economic shocks is becoming “less salient” due to central bank-led monetary stimulus and government intervention.

Yet ironically, it is the continued intervention of governments that may well undo the recovery of the last five years. Each time the economy makes a forward stride and consumers begin to improve their balance sheets, they are penalized by Washington in the form of higher taxes. Obamacare represents one such tax penalty to consumers. Corporations, meanwhile, are being penalized by the recent minimum wage hike, which will pinch already-tight profit margins.

What we’re faced with entering 2014 is dual policy structure between central bank monetary strategy and government fiscal strategy. In effect, Washington continues to embrace a backward-looking austerity policy even as the Federal Reserve is desperately trying to increase monetary liquidity. Neither side is coordinated, which explains the disjointed nature of the economy as well as the mixed results.

The Fed has also made clear its intention of tapering its asset purchases in 2014, going so far as to announce the first stage of paring bond purchases in December 2013. What the Fed fails to realize, however, is that this effort is premature. With the 60-year deflationary cycle not due to bottom until September/October of this year, an early diminution of bond purchases could prove to be disastrous – especially if deflationary pressure in Europe and/or economic trouble in China flares up in the coming months.

Cycles analysts realize that 2014 has the potential to be a turbulent year, certainly much more volatile than previous years. How 2014 turns out will largely hinge on Washington’s continued poor policy choices. A stubborn insistence at embracing austerity policies will put a drag on the year ahead and will only add to the deflationary undercurrent courtesy of the long-term Kress cycle.

Now what about the gold outlook for 2014? Goldman Sachs analyst Jeffrey Currie sounded yet another bearish note for gold on recently. Goldman’s head of commodities research told CNBC that his end-of-year price target for 2014 is $1,050, which represents a 16 percent decline from current prices. His forecast is predicated on continued economic recovery in the U.S.

If Currie is wrong and the U.S. economic recovery stumbles in 2014, gold will have a reason to rally as investors turn to the yellow metal as a safe haven from economic uncertainty (as they did in the years leading up to 2011).

Bitcoin

It had to happen sooner or later and this week it finally did.

The Bitcoin phenomenon made the front cover of a major news magazine when Bloomberg Businessweek ran a story on the intricacies of Bitcoin mining. The impressionist art on the front cover was evocative of the dream of fabulous wealth entertained by many Bitcoin enthusiasts.

The question that naturally comes to mind is whether or not this qualifies as a legitimate "magazine cover indicator" and does it therefore have predictive value? Historically, whenever an investment craze makes the front cover of a major magazine it reflects the saturation of that investment and implies that the value of said investment has (temporarily at least) overextended. A "correction" or decline in the investment's value often follows soon thereafter.

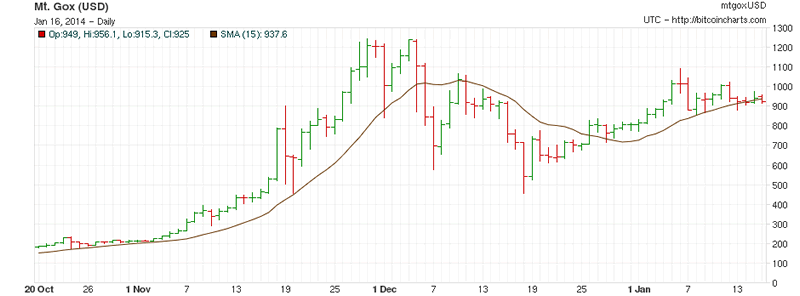

Bitcoin is a bit different than more classical investment crazes, however, and requires an entirely different set of tools to evaluate it. The appearance of Bitcoin on theBusinessweek cover likely doesn't signal the end of the craze -- especially since the vital ingredients of full-fledged mania status are missing, viz. strong institutional and hedge fund involvement and widespread public participation. What the cover could signify, however, is the commencement of an extended "internal correction" in Bitcoin's value.

An internal correction can be defined as a lateral trading range-type market in which consolidation takes place over an undetermined length of time. This would give Bitcoin a much-needed rest and would also take some of the heat off the market by removing it from the mainstream media spotlight. This is necessary from the vantage point of the hedge funds who need a dull, uneventful market in order to quietly build a substantial position.

Don't be surprised, then, if Bitcoin posts an underwhelming performance for a while.

Kress Cycles

Cycle analysis is essential to successful long-term financial planning. While stock selection begins with fundamental analysis and technical analysis is crucial for short-term market timing, cycles provide the context for the market’s intermediate- and longer-term trends.

While cycles are important, having the right set of cycles is absolutely critical to an investor’s success. They can make all the difference between a winning year and a losing one. One of the best cycle methods for capturing stock market turning points is the set of weekly and yearly rhythms known as the Kress cycles. This series of weekly cycles has been used with excellent long-term results for over 20 years after having been perfected by the late Samuel J. Kress.

In my latest book “Kress Cycles,” the third and final installment in the series, I explain the weekly cycles which are paramount to understanding Kress cycle methodology. Never before have the weekly cycles been revealed which Mr. Kress himself used to great effect in trading the SPX and OEX. If you have ever wanted to learn the Kress cycles in their entirety, now is your chance. The book is now available for sale at:

http://www.clifdroke.com/books/kresscycles.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.