Stock Market Emotions Vs Reasonable Bearish Argument

Stock-Markets / Stock Markets 2014 Jan 15, 2014 - 02:25 PM GMT I am certain that you have already read some blog (or two) calling for the market to go higher. So be it. Here is the bearish argument.

I am certain that you have already read some blog (or two) calling for the market to go higher. So be it. Here is the bearish argument.

Not very many analysts look for a Triangle Wave (b). There was some recognition last week as a possible Sub-Minute Wave (iv), but it was discarded on Monday with the oversized decline. Today it seems to be forgotten. On the other hand, it makes perfect sense, considering its position within an Orthodox Broadening Top.

The second item is that there are already five waves from Monday’s low, with sub-Minute Wave (v) only partially complete. Sub-Minute Wave (v) equals sub-Minute Wave (i) at 1846.00. I would be concerned about being wrong above that level.

The Pre-Market shows SPX up 3.50 at this time. There may not be long to wait to see whether this formation is correct. Frankly, I think it is a bull trap.

Of course, ZeroHedge is also caught up in the emotions of the moment, “Day two of the bounce from the biggest market drop in months is here, driven once again by weak carry currencies, with the USDJPY creeping up as high as 104.50 overnight before retracing some of the gains, and of course, the virtually non-existent volume. Whatever the reason don't look now but market all-time highs are just around the corner, and the Nasdaq is back to 14 year highs. “ Note: The COMP is higher by 1.1 points. The NDX is not.

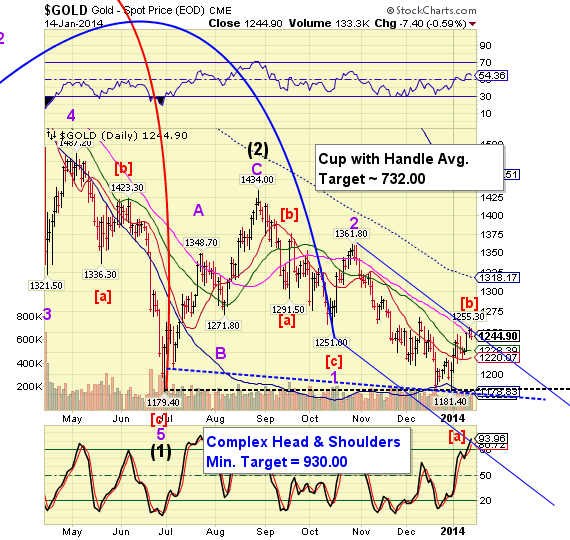

Gold has dropped another 8 points this morning. It is beneath Intermediate-term support at 1228.39 and may soon cross Short-term support at 1220.97. This time the trendlines and cycle Bottom Support at 1178.83 may not hold. The Cycles Model suggests that gold has an entire month of decline ahead, if not a bit more.

CRB and Crude have both made new lows this month, implying there is more downside to go. Evidence of this is also contained in the Baltic Dry Index, which has plummeted 41% since mid-December. This is pretty fair evidence that the economy is slowing dramatically.

ZeroHedge comments, “Despite 'blaming' the drop in the cost of dry bulk shipping on Colombian coal restrictions, it seems increasingly clear that the 40% collapse in the Baltic Dry Index since the start of the year is more than just that. While this is the worst start to a year in over 30 years, the scale of this meltdown is only matched by the total devastation that occurred in Q3 2008.”

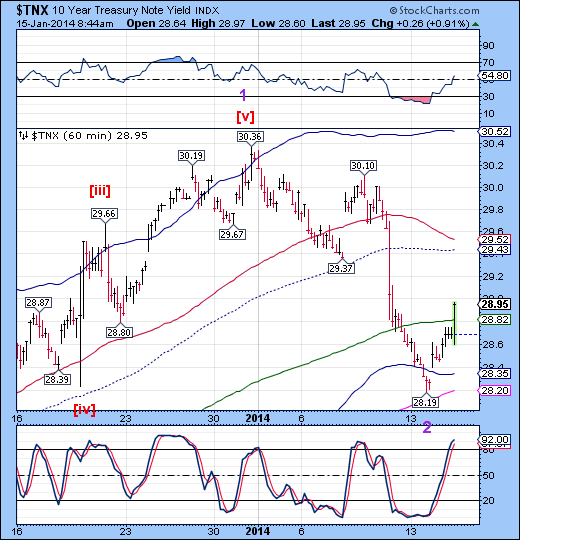

The 10-year Treasury yields have risen dramatically this morning, suggesting the start of what could be an extended Minor Wave 3. The effects may not be minor, since the 32.25 year trendline is just overhead.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.