China Becomes World's Largest Trading Nation Surpassing U.S.

Economics / Global Economy Jan 15, 2014 - 10:16 AM GMTBy: BATR

The globalists put their plan into motion decades ago. The proper meaning of the headline is not that China is an economic miracle, but that the United States, systematically stripped of its industrial might, is destined to fall even further. The Chinese economy is a haven of direct transnational integration. The outsourcing of manufacturing from domestic capacity is not solely a response of cheaper economic cost of goods production. No, the underlying reason for the migration of product assemblage is to weaken an independent American economy.

The globalists put their plan into motion decades ago. The proper meaning of the headline is not that China is an economic miracle, but that the United States, systematically stripped of its industrial might, is destined to fall even further. The Chinese economy is a haven of direct transnational integration. The outsourcing of manufacturing from domestic capacity is not solely a response of cheaper economic cost of goods production. No, the underlying reason for the migration of product assemblage is to weaken an independent American economy.

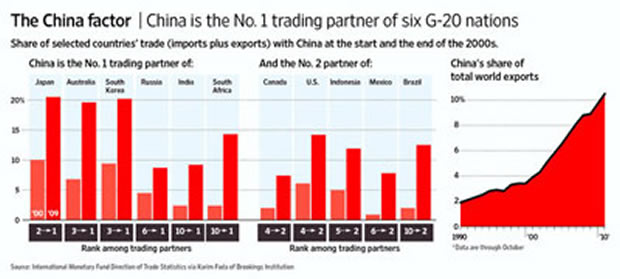

"China’s annual trade in goods passed the $4tn (£2.4tn) mark for the first time last year according to official data, after exports from the world's second largest economy rose 7.9% to $2.21tn and imports rose 7.3% to $1.95tn.

As a result total trade rose 7.6% over the year to $4.16tn. The US is yet to publish its 2013 trade figures, but with trade totaling $3.5tn in the first 11 months of the year, it is unlikely to beat China."

"It’s always been a matter of time until China surpasses the US ... and there are good reasons to believe that China is likely to retain this pole position for the foreseeable future.

"The trade figures look very healthy and the factors underpinning them are structurally sustainable. It is hard to see them being reversed significantly, at least in the short to medium term."

"And let’s not forget: The economic data out of Chinese agencies has long been seen as a bit questionable. Even the country’s own statistics office has said it is trying to clean up the inaccuracies. As our own Michael Kitchen points out, trade data has come under particular suspicion, as businesses disguise some money flows as trade to try to bypass controls."Of course, the U.S. press continues to make excuses that conceal the betrayal of American trade policy goals and practices. These are the same business journalists that repeat the statistical figures coming out of recent administrations that need revisions, when caught in dramatic errors of omission or deception.

Some important benefits of International Trade

- Enhances the domestic competitiveness

- Takes advantage of international trade technology

- Increases sales and profits

- Extend sales potential of the existing products

- Maintain cost competitiveness in your domestic market

- Enhance potential for expansion of your business

- Gains a global market share

- Reduce dependence on existing markets

- Stabilize seasonal market fluctuations

Now examine the real significance of this "Free Trade" globalist plan for America.

1. How can domestic competitiveness improve, when entire industries move offshore?

2. Where is the advantage in developing new technology domestically and transferring it to foreign plants, even if owned by "so called" U.S. national companies?

3. Increase sales and profits, booked by foreign subsidiaries, means that the capital is not repatriated back.

4. If products produced domestically, shipped, and sold to overseas markets, there would be a valid benefit. However, the direction is in reverse.

5. Maintaining cost competitiveness translates into closing domestic facilities.

6. Expansion of business means look overseas because domestic consumers have less money to spend.

7. Oh yes, the holy grail of market share, means last company standing, since domestic markets have reduced sales.

8. Yep, now that existing domestic markets are sinking, move your boat to a different ocean.

9. Seasonal fluctuations means that booms are past profit spikes, the new normal is a perpetual dip.

The Chinese perspective as reported in China Daily from Wang Haifeng, a researcher with the Institute for International Economic Research at the National Development and Reform Commission, needs especial emphasis.

"The size of the value of the trade in goods tells just one side of the story. The other side is that China's export competitiveness, as well as the competitiveness of its trade structure, is far behind the US. The competitive advantage of US exports centers on its technology, quality and brands, with added-value being very significant. China's export prices are much cheaper on average and a large part of its exports are from OEMs (original equipment manufacturers)," Wang said.

When an economic system intentionally transfers their technological advantages, inventions and intellectual edge to a foreign country so that companies can avoid domestic taxation or onerous regulation, the future adverse and inevitable consequences with such relocations, are preordained.

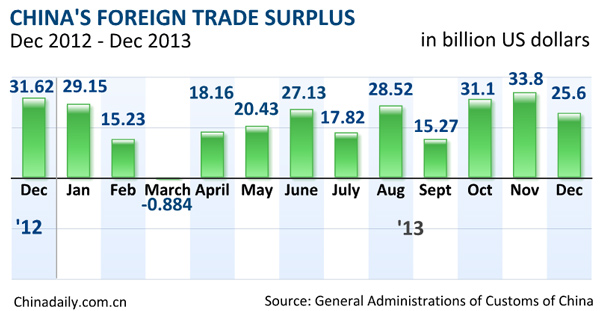

This example demonstrates the extravagant cash flow and disposable income that is circulating in China. Much of this opulence comes from the pocketbooks of struggling Americans, who buy essential or sustainable goods that have a made in China label.

Tech firms transfer the secrets of their products and software to their Chinese partners as the U.S. government subsidized consumer or the remnant middle class, just deepen this destructive cycle. This absurd economic bargain drives the wealth disparity to irrational levels. That is exactly the objective of the globalists, and the rest of us are mere spectators as the Chinese laugh at our stupidity.

James Hall – January 15, 2014

Source : http://www.batr.org/negotium/011514.html

Discuss or comment about this essay on the BATR Forum

"Many seek to become a Syndicated Columnist, while the few strive to be a Vindicated Publisher"

© 2013 Copyright BATR - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors

BATR Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.