Incompetent Bank of England Celebrates Inflation Success for 1 Month out of 50

Economics / Inflation Jan 15, 2014 - 01:46 AM GMTBy: Nadeem_Walayat

The Bank of England and Coalition Government politicians were accompanied by hip hip hurray cheers right across the mainstream media as all were found celebrating the good news that the the Bank of England has achieved its primary remit for the targeting of 2% CPI Inflation for December 2013 data (RPI 2.7%, Real 3.6%), the first time the central bank has achieved its official target for the duration of the Coalition government as the CPI inflation rate has spent the whole of this parliament well above the target, ranging as high as 5.2% as illustrated by the graph below.

The Bank of England and Coalition Government politicians were accompanied by hip hip hurray cheers right across the mainstream media as all were found celebrating the good news that the the Bank of England has achieved its primary remit for the targeting of 2% CPI Inflation for December 2013 data (RPI 2.7%, Real 3.6%), the first time the central bank has achieved its official target for the duration of the Coalition government as the CPI inflation rate has spent the whole of this parliament well above the target, ranging as high as 5.2% as illustrated by the graph below.

Though understand this that just as the Bank of England has FAILED to reach the target rate for 49 out of 50 months, so it is highly probable that next month UK CPI will be far worse than anyone expects it to be today, forget dipping below 2%, staying at 2%, 2.1%, 2.2% or even 2.3%. Instead next month UK CPI inflation could jump to 2.5% as that would be an accurate reflection of the consequences of having an incompetent Bank of England in charge of targeting inflation. Which I am sure will have the same self-professed experts who were found to be congratulating the Bank of England on Tuesday the 14th of Jan 2013 such as the BBC's former journalist Stephanie Flounders (now working for JP Morgan) on Channel 4 News making the statement:

"I think its going to be really helpful for the Bank of England if it continues and people are expecting inflation to maybe be under 2% more than above it over the next year or so, that will be a huge benefit to them because the Bank of England does want to keep interest rates low and get more people back to work and crucially get productivity and growth back" - Stephanie Flanders

Well next month the same people will be criticising the BoE in the event of Inflation soaring by probably 0.5% in just 1 month, that will be coupled with all of the calls today that interest rates will be on hold for the whole of 2014 reversed to calls that the Bank could be forced to act soon to combat rising inflation.

However, the real inflation truth is far removed from that which the media focuses upon with the annual percentage rates of inflation that masks the truth of what is an exponential inflation mega-trend which is the primary consequences of perpetual money and debt printing monetization programmes that the government is engaged in, in an attempt to buy votes through high deficit spending, an inflation trend that asset prices are leveraged to and oscillate around which currently has UK inflation compounding at the rate of 2% per year that resolves in the following exponential trend.

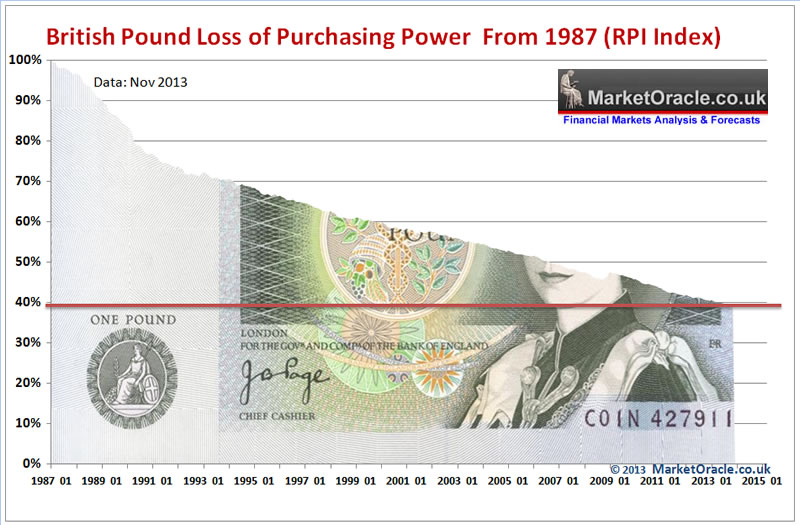

The below graph again illustrates how much Inflation we have experienced that most people are likely unaware of is that of the loss of purchasing power of the British Pound which is now worth less than 40% of its value of 25 years ago as governments continue to relentlessly erode its value all the way towards zero.

This IS the reason why your real experience of day to day living expenses does not match government / media propaganda. However, it is even worse because as I keep reiterating that the rate of Inflation is EXPONENTIAL. What this means is that if you stuffed money under your mattress 20 years ago, today it's value would have been inflated away by 50%.

The debt / money printing induced inflation mega-trend is forcing people to either spend or put their hard earned cash into the bankrupt banks for a pittance in interest that is TAXED, so that it is near impossible to consistently get a return that is greater than even the official rate of inflation let alone the real rate of inflation that is currently about 3.6%, as governments continuously tinker with the CPI methodology to reduce the official inflation rate as you will likely experience when you go to do you weekly shops and experience inflation rates nearer to 10% then 2%.

Government Money Printing Causes Inflation

Inflation is as a consequence of rampant government money printing by two primary mechanisms -

a. The off balance sheet bailout of the bankrupt banking system estimated at £700 billion since 2008.

b. Funding of the public sector black hole that manifests itself in an an average budget deficit of £110 billion per year, so totaling £660 billion since 2008.

Therefore the Bank of England's primary remit is not to target inflation but to instead to produce lots of graphs and fancy reports so as to give credibility to what amounts to nothing more than economic propaganda for the politicians to utilise towards the stealth inflation theft of purchasing power of savings and earnings in perpetuity as the price paid for rampant money printing be it called QE or debt that is never repaid but constantly rolled over and as has been the case for 5 years monetized i.e. effectively cancelled as the Bank of England returns most of the interest paid on the government bonds it has monetized back to the UK Treasury as the below graph illustrates.

The REAL UK Debt to GDP Ratio appears to be have been systematically engineered to stay at a constant 41% of GDP (actual 77%), which I expect to remain constant at 41% into March 2015 as opposed to my forecast of actual of 79% on the official measure as a consequence of the effective cancellation (not actual) of approx £600 billion or 40% of outstanding government debt by 2015.

What is missing from the self congratulating Bank of England and politicians is the crash in earnings that has not only failed to keep pace with inflation for several years but has also fallen in nominal terms in large part as a consequence of immigration of several million extra workers prepared to work for longer hours for less pay that acts to drive down wages and boost corporate profits, without adding much extra inflationary pressures as immigrants tend to be less inclined to spend earnings, rather save for investment or transfer funds back to countries of origin.

My next in depth analysis will cover in-depth the relationship between the drivers of inflation, wages, and housing market affordability, ensure you are subscribed to my always free newsletter to get this in your email in box.

Source and Comments: http://www.marketoracle.co.uk/Article43963.html

Nadeem Walayat

Copyright © 2005-2014 Marketoracle.co.uk (Market Oracle Ltd). All rights reserved.

Nadeem Walayat has over 25 years experience of trading derivatives, portfolio management and analysing the financial markets, including one of few who both anticipated and Beat the 1987 Crash. Nadeem's forward looking analysis focuses on UK inflation, economy, interest rates and housing market. He is the author of five ebook's in the The Inflation Mega-Trend and Stocks Stealth Bull Market series.that can be downloaded for Free.

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Nadeem is the Editor of The Market Oracle, a FREE Daily Financial Markets Analysis & Forecasting online publication that presents in-depth analysis from over 600 experienced analysts on a range of views of the probable direction of the financial markets, thus enabling our readers to arrive at an informed opinion on future market direction. http://www.marketoracle.co.uk

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors before engaging in any trading activities.

Nadeem Walayat Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.