Five U.S. Housing Market Headwinds

Housing-Market / US Housing Jan 14, 2014 - 06:33 PM GMTBy: Mike_Shedlock

Black Knight Financial Services, formerly LPS, released its latest Mortgage Monitor Forecast.

Black Knight Financial Services, formerly LPS, released its latest Mortgage Monitor Forecast.

Key Highlights

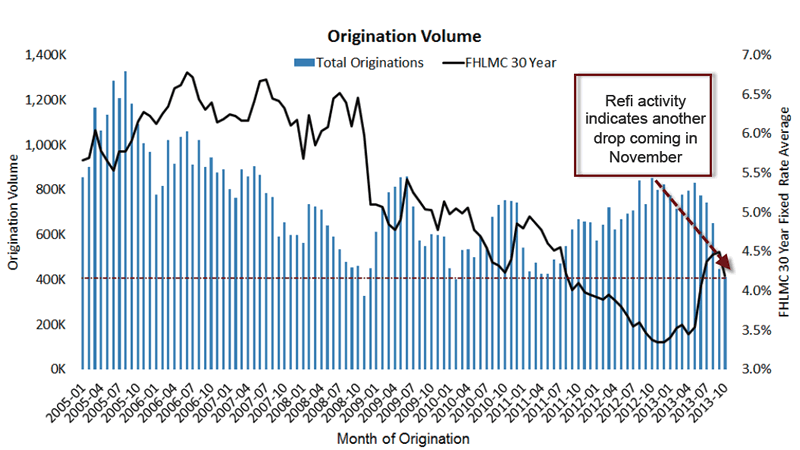

- Mortgage originations are at the lowest levels in almost four years

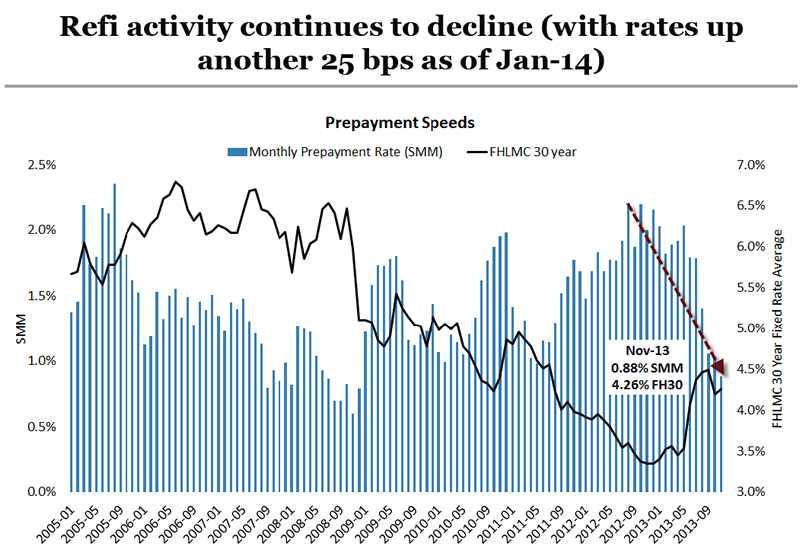

- Prepayment/refi activity indicates another drop coming

- Higher interest rates slow refinance activity

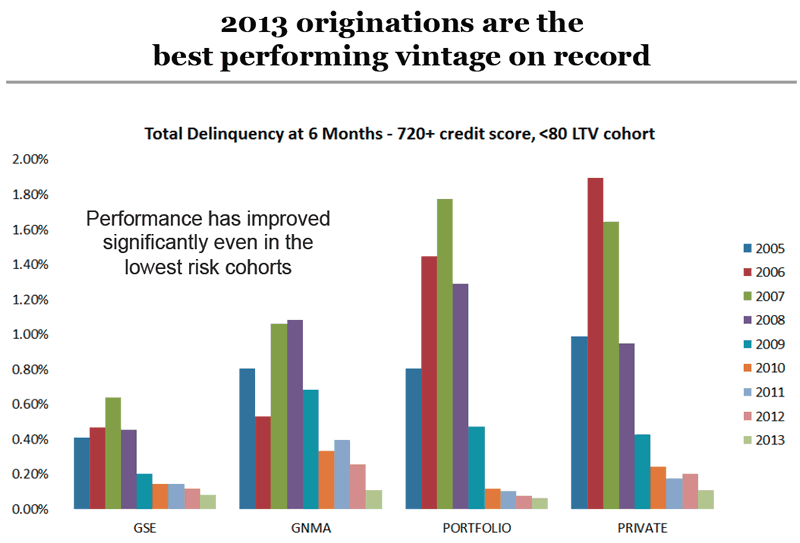

- Quality of loans originated in 2013 have made it the best performing vintage on on record.

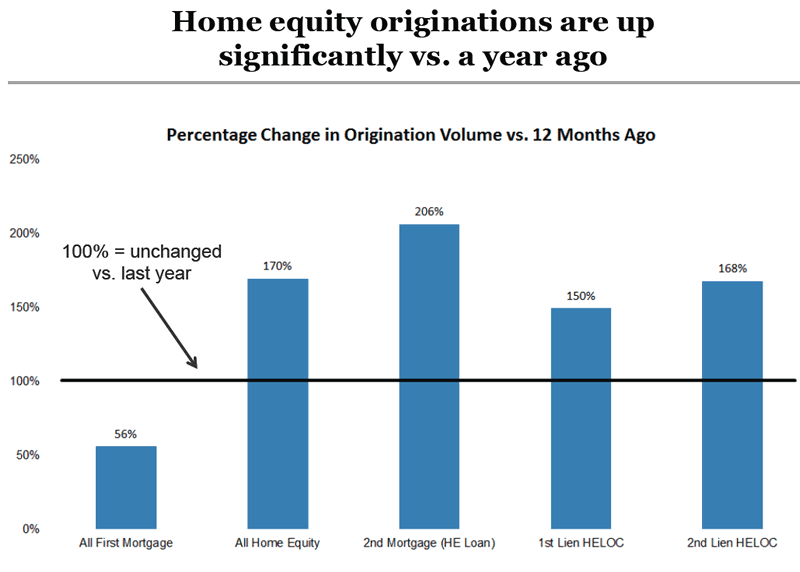

- Home equity originations are up significantly since a year ago: total HE lending is up 70%, while volume on 2nd mortgages has more than doubled

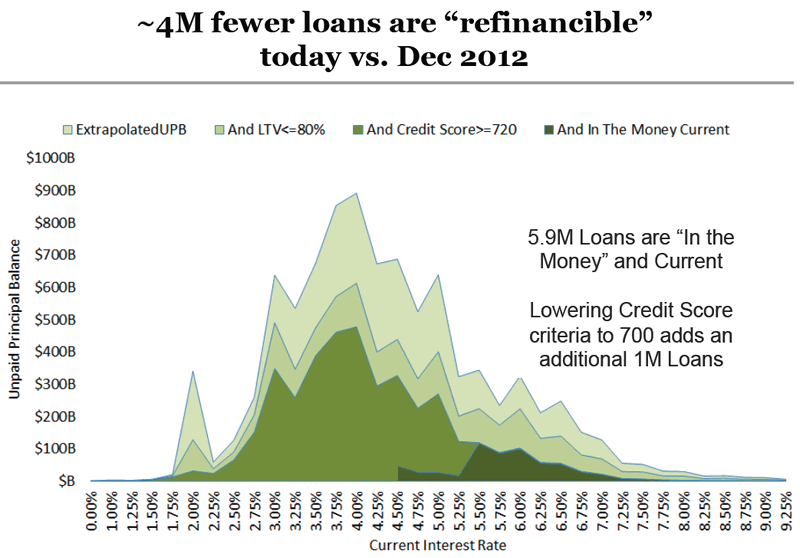

- Population of “refinancible” loans continues to shrink - Only 5.9M loans meet broadly defined criteria for refinancing, down 4M since December 2012.

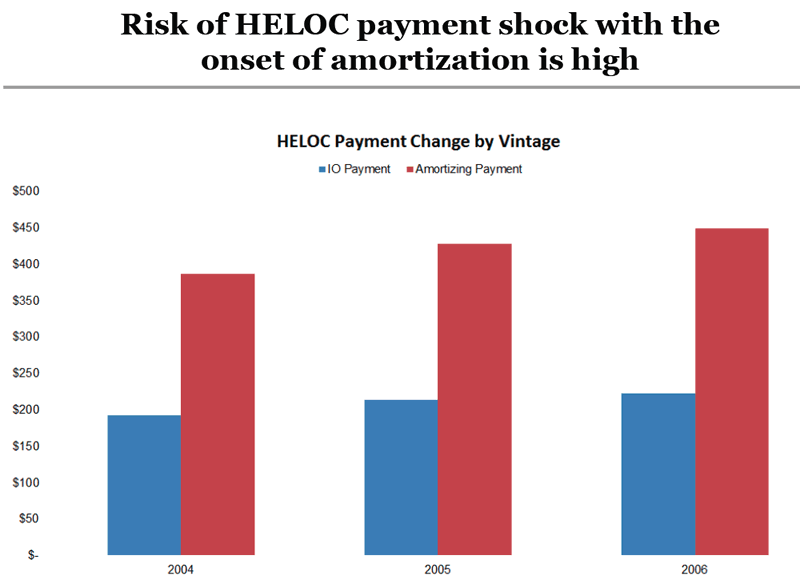

- Delinquencies continue to rise among HELOCs that began amortizing

- High risk of “payment shock” in the coming three years

Here are some charts.

Anecdotes in red are mine. Click on any chart for sharper image.

Origination Volume Lowest Since 2010

Refi Activity Collapses with Rising Rates

2013 Best Vintage on Record

Home Equity Loans Up

Refinancible Loan Percentage Collapses

Payment Shock on HELOCs

Key Takeaways

Performance on 2013 origination is at record highs because of record low interest rates coupled with rising home values.

If home prices stagnate or rates continue to rise, this could be as good as it gets. The Fed is fighting major headwind battles.

Five Headwinds

- Rising rates

- Slowing economy

- Reduced values because of rising rates

- Reduce values because of rising home prices

- Demographics of retiring and downsizing baby boomers

Regardless, I think this is as good as it gets. If the economy does not slow (extremely doubtful in my opinion), rates will rise, further collapsing values.

If the economy slows, demand for housing will slow with it. This may seem circular, and it is. But it all depends on where we are in the cycle. A "recovery" since 2009 is pretty long in the tooth, historically speaking.

Even with the alleged recovery, originations are back to 2010 levels. What happens if the recovery falters?

Values are already extremely distorted by Fed activity and all-cash purchases by the likes of Blackrock and equity funds.

Home equity extraction is likely to decline as is the stock market. Those are my opinions, but they are backed up by valuation metrics and extreme sentiment including a bubble belief the Fed can do no wrong.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2014 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.