Clear Evidence That Fed QE Doesn’t Create U.S. Jobs

Economics / Quantitative Easing Jan 13, 2014 - 03:39 PM GMTBy: Graham_Summers

Over the last five years, the US Federal Reserve has substantially changed the investing landscape of the capital markets in the last 12 months. In particular we need to assess how ongoing QE programs affect notions of “risk” and rates.

Over the last five years, the US Federal Reserve has substantially changed the investing landscape of the capital markets in the last 12 months. In particular we need to assess how ongoing QE programs affect notions of “risk” and rates.

In the period from March 2008 to late 2013, the Federal took a series of strategic steps to attempt to rein in the financial crisis and to support certain financial institutions that it deemed most critical to the health of the financial system.

These steps consisted of cutting interest rates to zero and engaging in rounds of Quantitative Easing, commonly referred to as QE.

QE in its simplest form consists of printing new money that is then used to buy US debt, called Treasuries. The Fed has made a myriad of claims for why it did this (to help housing, the help the economy, etc.) but the blunt reality is that this policy was primarily a means of financing the US deficit, which swelled in the post-2008 period as the public sector expanded rapidly in an effort to pick up the economic slack in the private sector.

The US went into the 2007-2008 Crisis with a national debt of $5 trillion and unfunded liabilities (Medicare, social security) somewhere in the ballpark of $50 trillion. And as the debt ballooned in the post-2008 era due to Government spending, it became more and more important for the Fed to maintain low rates: any increase in interest rates would mean much larger interest payments on a rapidly growing debt load.

This is why the Fed has maintained near zero interest rates as the US nati0nal debt swelled to $16 trillion. It’s also why the Fed continues to engage in QE despite the clear evidence over the last four and a half years that it is not an effective tool for stimulating economic growth or a rise in employment.

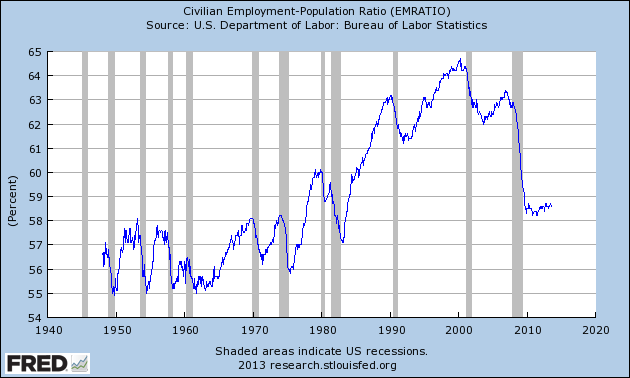

Regarding this latter point, I want to draw your attention to the labor participation rate below. The official unemployment rate is highly charged politically as it is used by the media to gauge how well a particular administration is doing at generating job growth.

As such the unemployment numbers are routinely massaged to the point of no longer reflecting the true number of unemployed Americans. For this reason, I prefer to use the labor participation rate when gauging the health of the US jobs markets: this metric represents the number of Americans who are currently employed as a percentage of the total number of Americans of working age.

As you can see, the number of employed Americans of working age peaked in the late ‘90s. It has since fallen to levels not seen since the early ‘80s. Moreover, looking at this chart it is clear that job creation has failed to keep up with population growth.

This negates any claims of “recovery” in the jobs market.

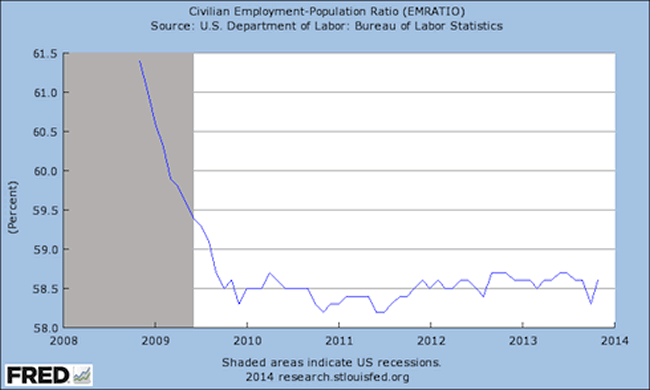

In particular, I want to draw your attention to the last five years of this chart below. The US Federal Reserve began its first QE program, called QE 1, in November 2008. Since that time it has launched three other such programs, spending over $2 trillion in the process.

During this period, the labor participation rate has not once experience a sustained uptrend. Put another way, job creation has never outpaced population growth to the point of creating a significant turnaround in the jobs market. This has happened despite the recession officially “ending” in mid-2009.

The evidence here is clear. QE does not generate jobs in the broad economy.

Best Regards

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2014 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.