US Subprime Crisis Bottom, Bullish Stock Market and Gold as New Money

Stock-Markets / Credit Crisis 2008 Apr 18, 2008 - 08:34 PM GMTBy: John_Lee

I just returned from sunny Calgary where I spoke at the Cambridge Conference (See more details at my Travel Diary here: http://www.goldmau.com/content/diary/08-04-18.php). It is surprising to me how many gold analysts predict the complete of fallout of US housing and how that will crash the stock market, world growth and commodities.

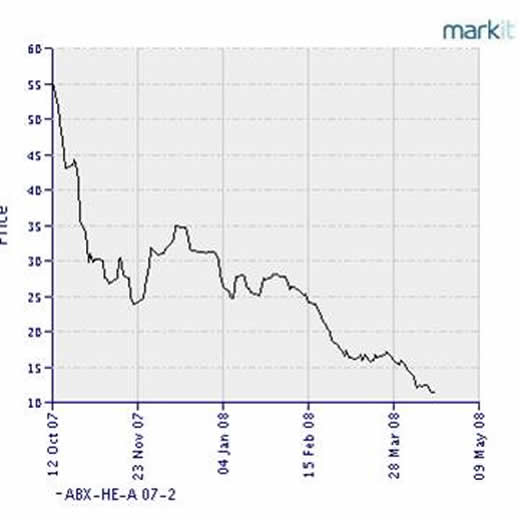

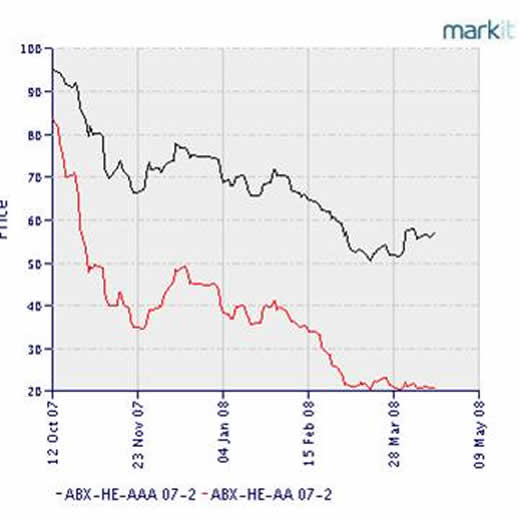

Subprime Securities Firesale finished:

As seen by the ABX index above, mid quality subprime debts are now selling at 10-20cents on the dollar. Those mortgage debts are being sold as if they are worth nothing.

Let's not forget those notes have houses as collaterals. The index is implying that 9 out of 10 subprime mortgages are expected to default, with investors getting zero back from foreclosures.

Dave in San Diego took out $1 million subprime mortgage at 8% to buy a home from Wells Fargo with zero down. Let's assume Dave misses 3 payments and his home is now worth only $500,000. I, as an investor, can theoretically buy his $1 million mortgage note from Wells Fargo for as little as $100,000, foreclose the property and put it on fire sale for $300,000 and make $200,000. Or better yet, I can restructure to have Dave stay in his home, have him pay 2% instead of 8%, which works out to be $20,000 a year, or 20% annual return on my $100,000 investment. Dave still owes me $1 million, which he might eventually pay me back when housing markets recover. Ok, may be not $1 million, but I'd be happy to take $700,000, or a 7 bagger with 20% annual coupon.

I am not saying US housing prices won't go lower, but rather, the financial markets have fully priced in 50%+ subprime default rate and 50%+ correction of US home prices.

The markets are completely irrational selling subprime at 10cents on the dollar, a direct result from $2 trillion subprime debt sellers simultaneous wanting to get out. Analysts in hindsight will comment on how cheaply those subprime assets were selling today.

Banking Crisis is over and banks on sale:

Above is the chart of combined market capitalization of America's top 5 banks. Citigroup, Bank of America, JPMorgan, Wachovia, and Wells Fargo.

The combined market capitalization has gone from nearly $1 trillion to less than $600 billion in the past 12 months. China can use half of her foreign reserve to buy all key US banks. Indeed you are seeing Canadians, Asians, and Arabs buying stakes in US banks at these fire sale prices. I expect the banking sector as a whole to bottom shortly if they haven't already.

Equity Market Bottomed too:

The $400 billion loss of market capitalization by top 5 banks translates to 3.5% loss of the entire US market capitalization of approx. $12 trillion. Factor in hundreds of other mortgage brokers and banks that have been erased from the market outright, you can reason the general equity market has held up remarkably very well with just a 10% drop in S&P500.

Why is it that US equities are seemingly un-affected by subprime? S&P 500 derive some 30-50% of its revenue from outside of USA, and those international revenues were mostly unaffected by subprime. World GDP grew from $30 trillion in 2002 to $55 trillions today, the fastest pace since WWII. And world population is 15 times that of the US.

Global growth is just one reason why US equity held up well. The biggest reason in my view however, is the lax monetary and heavy handed interventionist policy.

US Fed Funds rate is unnaturally low at 2.25%. Bank of Canada is talking of lowering rates further from an already measly 3% while oil is breaking out $115. We live in interesting times. One can now borrow at 4% to buy oil trusts paying 15% dividend, or an India ETF that pays 20% a year.

I certainly would not be bearish of the equity market as it is measured in dollars. The cost of dollars is next to free at 2%. Everything is relative, when something is measured in terms of ‘nothing', it takes a lot of that ‘nothing' to make up something. When S&P 500 is measured in gold, you can see S&P 500 is barely half of what it was a year ago.

Now that we are near the bottom of interest rates, I expect all the hoarded money to spill out looking for a new home as it simply does not pay to park money earning 2% with real inflation running at double digit.

US consumer spending non-factor to commodity prices and global growth:

Prior to the end of world's love affair with the dollar, the driver of the world engine was the US economy, through consumer spending. US consumers held the key to creating dollars out of thin air as they handed those dollars to world exporters. The money from your refinance and cash advance came out of thin air created by Countrywide and Citibank.

Today, we have too many dollars. No one wants dollars from India's Taj Mahal, to Brazilian Victoria Secret model. The dollar binge is over in favor of RMB, Brazilian Real, Philippine Peso, Thai Baht, and the Euro etc. There is no longer de facto money as money in the form of new darling currencies were created through borrowing in their respective countries. Mind you many of those currencies were once unwanted or even hated. This is the new growth engine. Attention is focused on global citizens, not US citizens. This is such a key understanding that most US-centric analysts don't get.

Don't believe my analysis, China revised their GDP upwards to 11% throughout 2006 and 2007, commodity prices are breaking record highs by the day, this is all while US economy have slowed to a halt. In short, US consumers have greatly diminished impact on world growth and commodity prices. The US has only 8% of the world population and the US dollar is ditched by savers and producers in favor of just about every other currency.

Gold is the new universal money

Money supply grows by the billions every second as paper money created out of thin air through borrowing by consumers, corporations, and governments around the world.

The Fed and ECB printed about $1 trillion in the last 9 months just to contain the subprime collapse. All those bailouts create moral hazards. This moral hazards combining with record commodity prices and fear of inflation are the recipe for a fierce gold market. This is why my focus right now is on precious metals.

How ironic the subtitle “Gold is the new universal money”. Gold has been proven to be the most reliable and long lasting money, and we can see why. Gold is the same everywhere, it lasts forever, and most importantly, it can not be created out of thin air. I travel lots and every time I revisit a country I notice their paper money changes shape, size, or even colors. How reliable is that?

Asia barely sneezed at subprime but they sure are catching cold feet on inflation and fever on gold. People are beginning to sense the threat of inflation, having previously thought that inflation dragon is dead for ever.

Fundamentally gold is under priced today to just about all asset classes. Studies suggest a gold price between $1,500 to $2,000/oz based on today's oil and copper price of $110/barrel and $4/pound respectively.

Technically, at $920/oz Gold is comfortably above previous all times of $850/oz set in 1980. I am very confident the downside is $850-$890/oz, while the upside is anyone's guess.

We run an equity fund and my focus is on mining equities, which mathematically and historically have shown to provide leverage to the gold price. Although the topic on analysis of gold is for another day, I invite you to read my past write ups on gold at www.goldmau.com and join me for the bull ride in gold.

John Lee, CFA

johnlee@maucapital.com

John Lee is a portfolio manager at Mau Capital Management. He is a CFA charter holder and has degrees in Economics and Engineering from Rice University. He previously studied under Mr. James Turk, a renowned authority on the gold market, and is specialized in investing in junior gold and resource companies. Mr. Lee's articles are frequently cited at major resource websites and a esteemed speaker at several major resource conferences.

John Lee Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.