Slow Start for Stocks 2014 - An Asset Manager`s Dilemma

Stock-Markets / Stock Markets 2014 Jan 12, 2014 - 06:10 PM GMTBy: EconMatters

The New Year has started and if you hadn`t noticed nobody is rushing in to buy everything that isn`t nailed down like last year where asset managers couldn`t wait from day 1 of 2013 to buy as much as possible.

The New Year has started and if you hadn`t noticed nobody is rushing in to buy everything that isn`t nailed down like last year where asset managers couldn`t wait from day 1 of 2013 to buy as much as possible.

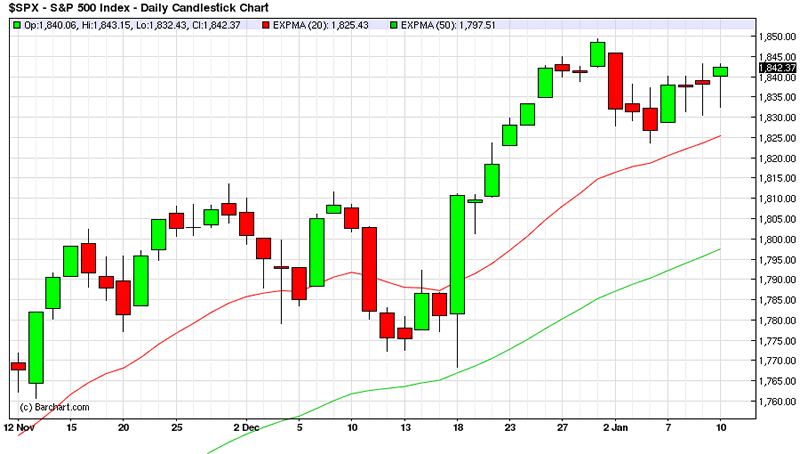

Market Churn

Yes, the fed tapered a measly $10 Billion, but they still are pumping $75 Billion into markets each month, throw in the monthly 401kcontributions, and this market isn’t doing anything right now, even though the fed will still be around until this summer with artificial support.

Give me a Good Dip to Buy!

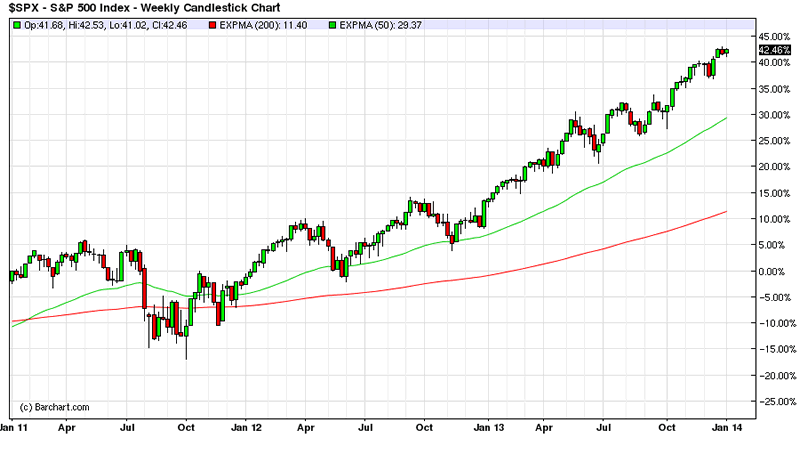

The conundrum for asset managers is that they need a good dip to buy! Otherwise considering the annual charade that is the holiday season in markets where traders, hedge funds and money managers yet to hit their goals push everything up while most of Wall Street is on vacation - these assets aren’t cheap!

Asset Managers risk buying at such elevated levels (priced for perfection) that any bad news can send them easily down 7% with a drop of the hat, and this is not how an asset manager wants to start off the year from a 7% hole.

No Cheap Bargains in Stocks

Everybody knows that there is nothing real cheap right now to buy; this is the reverse of an after Christmas retail sale where all kinds of items are marked down for clearing out inventory.

There are no after Christmas bargains here in Stock Land, and with signs the fed is contemplating leaving the party at some point in 2014, the usual fast start hasn`t happened this year.

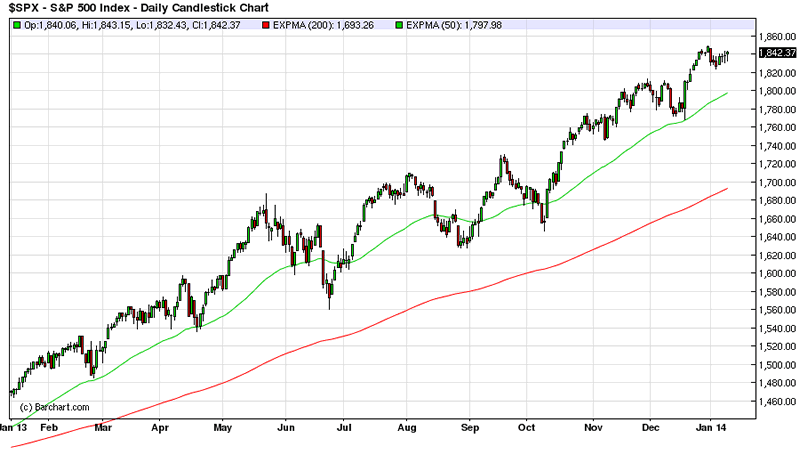

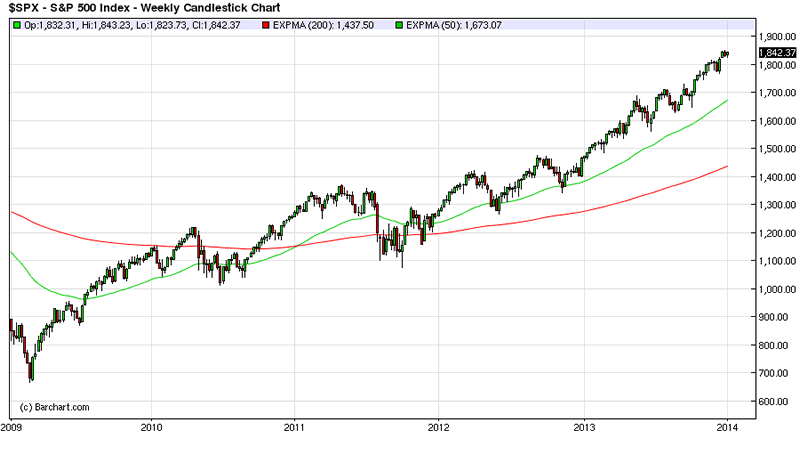

Comparing this to the start of the last five years - the first four months of the year have been as close to a sure thing for asset managers to get off to a nice healthy start as one could possibly hope for from a market environment perspective.

Remember those Huge Buying Days from January 2013?

This year is notably different in tenor, and yes it is still relatively early with only two weeks gone in the New Year, but the juxtaposition to last year is something to take notes on.

I imagine when assets have fallen enough to provide some level of reassurance that asset managers can flip any new money on a rebound for 5% here and there, that this is what we are going to see in markets until the fed`s exit is a certainty.

Consequently expect a lot of market churning, selling off near tops, and then maybe a large buying of an early substantial dip in 2014, and finally taking markets to new highs one more time early this year before everyone heads for the exits and starts paying back the immense margin commitments they borrowed to take advantage of this fed ride to stock nirvana fantasyland.

Sell in May, and Go Away

My prediction is that IF the Fed continues to wind down asset purchases and is completely out of the market by august that whatever high mark is established by late April will be the high for the year in equities.

The run for the exits is going to be one of the most 'Colossal Clusterf**ks' of all time to put it bluntly, or as Lacker hinted at the other day in his speech, we aren’t too keen on popping this obvious bubble in equities with our eyes open.

This is some scary stuff folks and experienced asset managers know this feeling all too well. Do I hold my nose and just buy, or do I get out now and protect myself from the Fed inspired asset bubble that inevitablygets pricked?

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2013 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

EconMatters Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.