Second Greatest Opportunity to Buy Gold: Empire Club Investment Outlook 2014

Commodities / Gold and Silver 2014 Jan 11, 2014 - 07:03 PM GMTBy: Nick_Barisheff

Last year, a year that saw gold's greatest decline in 32 years, my book $10,000 Gold was published. How's that for timing.

Last year, a year that saw gold's greatest decline in 32 years, my book $10,000 Gold was published. How's that for timing.

However, I'm confident that gold's bullish fundamentals are still intact.

Last year the COMEX futures exchange distorted gold prices, and provided investors with the second-greatest opportunity to buy gold since 2002.

On April 12 the gold price declined by $150 per ounce, and on June 20 by $80 per ounce, because of the naked short selling of futures contracts.

These precipitous drops triggered sell stops and margin calls, and the Western media jumped in to declare that the bull market in gold was over.

In sharp contrast to the falling price of paper gold, the demand for physical gold soared. Many retail coin stores ran out of stock, and premiums rose as much as 20% for gold and 40% for silver.

The lower gold price presents a problem for miners. Because average mine production costs exceed $1,200 per ounce, many high-cost producers will be forced to shut down, causing supply and demand pressure. Clearly, the physical price of gold cannot decline further for any length of time, and the correction is close to a bottom.

In addition, the days of COMEX dominance in gold price setting are numbered, since monthly deliveries on the Shanghai Exchange already surpass mine supply.

The main driver of the gold price is, and always has been, increasing money supply.

"An increase in the money supply" is the very definition of inflation, as it devalues currency and destroys purchasing power. If increasing money supply led to prosperity, Zimbabwe would be the richest country in the world.

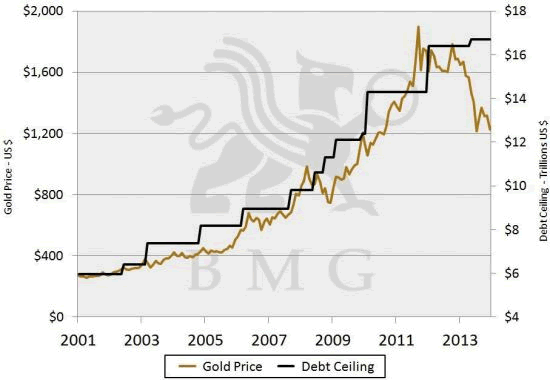

Gold Price & U.S. Debt Ceiling

This chart shows that gold and U.S. government debt have shared a lock-step relationship since 2001. Despite the divergence in 2013, over the longer term, gold and U.S. debt should return to the mean.

Official U.S. public debt currently stands at $17.3 trillion. In order to bring the debt-to-gold relationship back into equilibrium, gold should be at $1,800 today.

Since there is no political will to curtail debt increases or introduce austerity measures, I believe gold will surpass $1,800 and likely set new highs in 2014.

And it's not just the U.S. Ever since President Nixon closed the gold window in 1971, the world has been in a global fiat currency experiment where every dollar in existence has been created through the issuance of new debt.

Without the stability of gold backing, this has encouraged unbridled currency creation and reckless credit expansion at an exponentially increasing rate, taking fewer and fewer years to double.

Since President Obama took office in 2008, U.S. cash debt has increased from about $10 trillion to over $17 trillion today. This figure does not take into consideration the very real $127 trillion in unfunded liabilities such as Medicare, the Prescription Drug Plan and Social Security, for which taxpayers will ultimately be responsible.

Today, this works out to $1.1 million for each U.S. taxpayer.

The debt build up is not limited to the US but includes most western economies. The systemic risks that caused the financial meltdown in 2008 have gotten worse. The world's financial system was almost destroyed because of $1.2 trillion in mortgage derivatives. Today interest rate derivatives alone are 450 times higher at $561trillion or 7 times global GDP.

What could possibly go wrong?

Long-term Treasuries ended 2013 pushing 3 percent, and will likely rise if the Fed's tapering measures increase. In the U.S., a one percent rise in interest rates translates to an additional $170 billion in additional annual interest costs, and increases both the debt and the deficit.

All other Western central banks face similar situations. Interest rates at 3% in Japan will consume all the country's tax revenues just to service interest payments. The bigger problem will be the decline in bond portfolios. In Europe, most banks hold significant amounts of sovereign debt as part of their capital. As interest rates increase, the value of their holdings will decrease incrementally. Due to high leverage ratios, some banks may need either bail-outs or bail-ins to shore up those capital ratios, and those same banks may find their interest rate derivatives have unexpected counterparty risks.

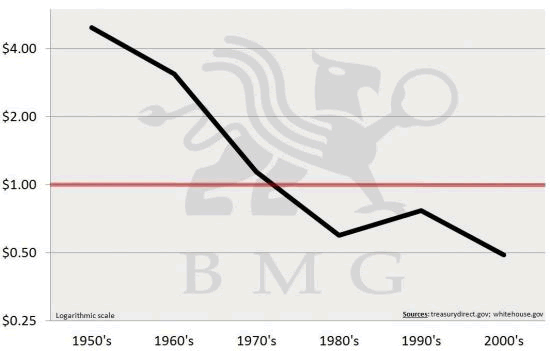

The debilitating effect of the growing debt is clearly illustrated by the next chart. It shows that in the 1950s, for every dollar of debt increase, the economy grew by about $4. In 2013, for every dollar of debt increase, the economy has only grown by fifty cents. In real GDP over the last decade it has only grown by $0.08.

You don't need to be a mathematician to understand that this trend is not a recovery, and is unsustainable over the long term.

GDP increase for every $1.00 Increase in Debt

While demand for gold in the West dropped to an all-time low in 2013, the unprecedented demand for physical gold from Eastern buyers confirms that Eastern nations will no longer tolerate the debasement of their U.S. Treasury holdings.

China bought a record 2,200 tonnes of gold last year. This is close to total global mine production for 2013. Many informed gold watchers feel this is a conservative figure, and the true figure will remain a mystery until China chooses to disclose it--likely in 2015. China is the world's largest gold producer, and not only buys all of its own domestic production, but also buys through opaque sovereign wealth funds. In 2009 China announced its gold reserves at 1,054 tonnes. I would not be surprised to see that China owns over 5,000 tonnes by 2015.

If we add the purchases of the other Far Eastern, Middle Eastern and Central Asian countries like Russia, far more physical gold was purchased than was mined.

The movement away from the U.S. dollar is intensifying. China has signed as many as 25 trade agreements that circumvent the U.S. dollar, and settle trade imbalances with the participants' own currencies. This will continue to place downward pressure on demand for U.S. dollars. If the dollar loses its reserve currency status, America's ability to print unlimited amounts of dollars without consequences will be over.

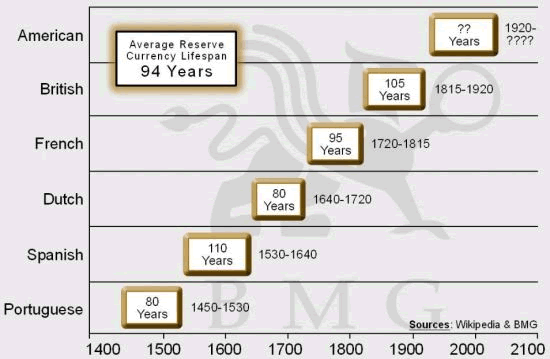

Lifespan of Reserve Currencies

This chart shows the lifespan of the six reserve currencies that preceded the U.S. dollar; the average is 94 years. Gold's lifespan as stable money is 3,000 years and counting. If we take the demise of the British pound as the world's reserve currency in 1920 as our starting point, 2014 will mark the 94th year of the U.S. dollar's lifespan. During this time it has lost 97% of its purchasing power. I firmly believe we are in the late stages of the U.S. dollar's reign as world reserve currency.

Considering the strengthening fundamentals we witnessed for gold in 2013, despite its poor price performance, it appears that an opportunity similar to that of 1976 is a strong possibility.

Gold rose 450% from 1971 to 1974. It then retreated 43% over the next 18 months. Many investors lost confidence and sold their holdings vowing never to invest in gold again. At the bottom of the correction, the New York Times declared unequivocally, "the end of the gold bull."

However, during the next four years gold climbed 750%. A similar percentage increase from today's price would see gold trading above $10,000 an ounce.

While there may still be price declines, I feel today's situation is similar to that of the 1970s, and that we have the second-greatest opportunity to buy gold since 2002.

Today many investors are tempted to sell their underperforming precious metal holdings and use the proceeds to purchase U.S. equities. But remember--the old Wall Street saying is "Buy low, sell high" NOT "Sell low, buy high."

While no one knows with absolute certainty the exact timeframe for developing events, the most conservative route for portfolio protection is diversification with a 10% allocation to gold. Gold is the most negatively correlated asset to financial assets, and acts as portfolio insurance in a decline or a crisis.

This means physical gold bullion to which you hold clear title, bullion stored in allocated storage or in your own vault. It is critical that your bullion holdings have no counterparty risks, and are not proxies or derivatives like gold certificates, futures contracts, or ETFs.

Thank you, and all the best in 2014.

By Nick Barisheff

Nick Barisheff is the founder, president and CEO of Bullion Management Group Inc., a company dedicated to providing investors with a secure, cost-effective, transparent way to purchase and hold physical bullion. BMG is an Associate Member of the London Bullion Market Association (LBMA).

Widely recognized as international bullion expert, Nick has written numerous articles on bullion and current market trends, which have been published on various news and business websites. Nick has appeared on BNN, CBC, CNBC and Sun Media, and has been interviewed for countless articles by leading business publications across North America, Europe and Asia. His first book $10,000 Gold: Why Gold’s Inevitable Rise is the Investors Safe Haven, was published in the spring of 2013. Every investor who seeks the safety of sound money will benefit from Nick’s insights into the portfolio-preserving power of gold. www.bmgbullion.com

© 2014 Copyright Nick Barisheff - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.