Stock Market Diamond is Back

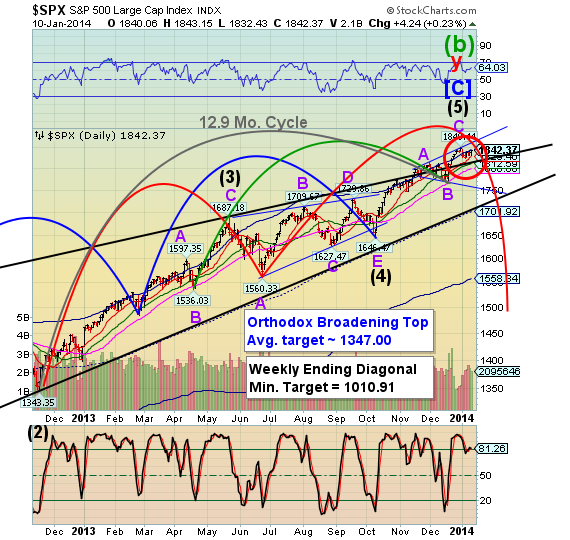

Stock-Markets / Stock Markets 2014 Jan 11, 2014 - 06:36 PM GMT The Diamond Formation is back, which is really quite exciting. You can see that the SPX closed right at its hourly Cycle Top as well as the down-slope trendline of the Diamond with all momentum oscillators overbought.

The Diamond Formation is back, which is really quite exciting. You can see that the SPX closed right at its hourly Cycle Top as well as the down-slope trendline of the Diamond with all momentum oscillators overbought.

It has been a long time since I have reported on a Diamond Formation. A downside break gives a very high probability 20-21% decline with 95% of those declines meeting or exceeding their targets. That could put the SPX under 1500.00 for this formation.

You can see that the Diamond formation has the capability of targeting the decline beneath the Daily Cycle Bottom support at 1558.84, which would be the first time this has happened since October 4, 2011.

That’s not all, though. I would like to point out that SPX did not even touch its daily Cycle Top line at 1845.51 all week long. The reversal pattern is holding up well, despite the challenges by the bulls.

Second, the target for this decline is well beneath the lower trendline of its massive Ending Diagonal pattern. This is also a key element, since after a retest of the trendline, the decline resumes to beneath the start of the Ending Diagonal at 1010.91.

This may signal the resumption of the bear market, since the current 2.58-year cycle started at that point. The Cycle rules state that, should any Cycle end beneath its starting point, the next Cycle of that magnitude or smaller will be bearish.

Today’s high may be construed as a truncated Wave 5. Add 1.72 years (exactly) to today’s date and we arrive at 2015.75, which is the next Super Cycle turn date, according to Martin Armstrong. Until recently, he has been expecting it to be a Cycle high. He has been waffling on that idea recently and suggests that we may know the answer by February 24, 2014, whether it will be a high or a low. My model is also lined up for that date. It suggests that the February 24 low may be beneath the October 4, 2011 low of 1074.00.

We are hosting two Christmas parties at our home this weekend and between them I am helping my eldest daughter move. Due to those conditions, the Weekend Update may not come out until Sunday.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.