Stock Market Jobs Shock, the Walking Dead

Stock-Markets / Stock Markets 2014 Jan 11, 2014 - 07:56 AM GMTBy: Jesse

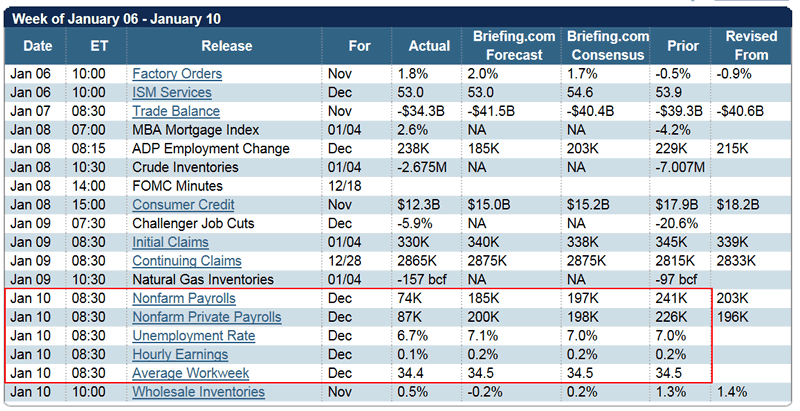

The Jobs number sucked out loud this morning, as the economy added a meager 74,000 jobs, compared to an expected number of 197,000. That's a swing and a miss. Both hourly earnings and average workweek missed as well. Today's box scores are included below.

The Jobs number sucked out loud this morning, as the economy added a meager 74,000 jobs, compared to an expected number of 197,000. That's a swing and a miss. Both hourly earnings and average workweek missed as well. Today's box scores are included below.

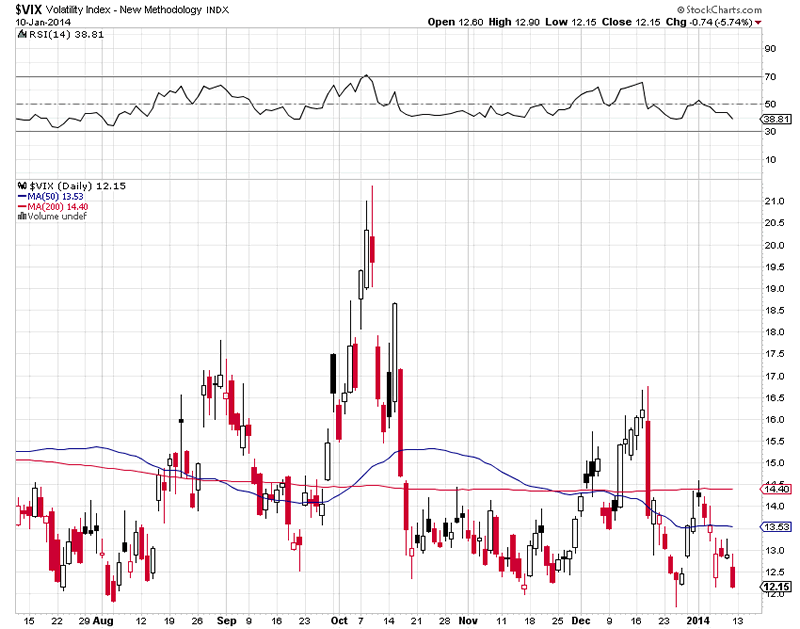

The good news was that the unemployment percentage dropped hard from 7.0% to 6.7%. Huzzah! Stocks rally back, and the VIX plummets.

The fly in that holiday toddy is that they did it by whacking the denominator in the unemployment ratio, declaring about a half million or so able bodied workers to be the new walking dead. (Hey, I was just kidding about liquidating people as the next move the other day.)

Capping that bit of cheer off, US retailers reported their worst holiday season since 2009.

Let's talk.

Stimulating the economy is not a bad idea when it is in shock from a financial crisis brought on as the result of massive systemic fraud and financial asset bubbles perpetrated by the financial system. And yes, austerity has been proven wrong, again and again, and is the stuff of puritans and pigmen.

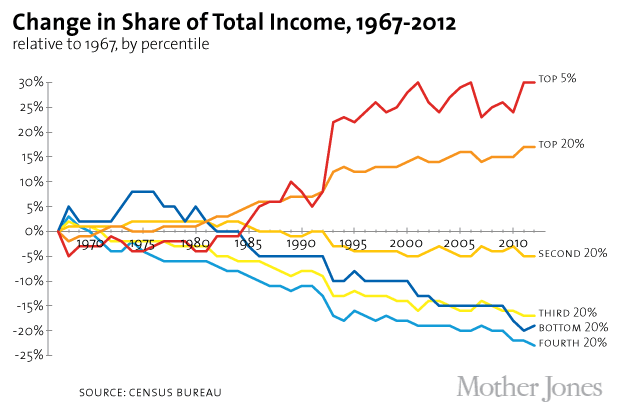

But stimulating the economy by giving more money directly to the same self-serving jokers that caused the problem in the first place, AND failing to correct the massive distortions in the economy that have been growing through horrible policy decisions over a period of years, is not exactly what Lord Keynes might have had in mind, ya think?

The Banks must be restrained, and the financial system reformed, with balance restored to the economy, before there can be any sustainable recovery.

Have a pleasant weekend.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In plewis

roviding information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2013 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Jesse Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.