Government Interventions Tinkering with the Deleveraging Derivatives Monster

Stock-Markets / Credit Crisis 2008 Apr 18, 2008 - 05:01 PM GMTBy: Doug_Wakefield

Staying Alive - The size and frequency of the government's interventions into the markets, especially over the last month, has generated little coverage. Those articles that have addressed this seem to ignore its implications, concluding that the markets will chug along indefinitely. The only real surprise is that these comments have more frequently come from individuals who have written extensively of the morass in our financial system. How is it that so many take such historically profound information in stride? Why does most of the public not recognize the numerous warning signals the real world is giving to prepare for significant changes?

Staying Alive - The size and frequency of the government's interventions into the markets, especially over the last month, has generated little coverage. Those articles that have addressed this seem to ignore its implications, concluding that the markets will chug along indefinitely. The only real surprise is that these comments have more frequently come from individuals who have written extensively of the morass in our financial system. How is it that so many take such historically profound information in stride? Why does most of the public not recognize the numerous warning signals the real world is giving to prepare for significant changes?

I invite you to think with me and ask yourself the question I asked a few professional traders recently: “What questions are we not asking that we should be?”

Historically speaking, inflation is a cunning enemy, creating the greatest societal illusion of power and success, only to dash dreams as debts come crashing down. And, history and science show that there are no easy solutions, for debt – created out of thin air to bail out yesterday's failing debts – is a sand pile that suddenly gives way in an avalanche. Though science shows that earthquakes are often preceded by increasingly frequent tremors, we are more prone to extrapolate our current circumstances into the future than we are to look for cluster patterns. So when the dramatic shift lower occurs, the vast majority are not prepared. Whether it was pride or fear or the pace of the race we call life that prevented us, we failed to tear through the flimsy façade of the just-so story presented to us and to look more deeply into difficult information. So, famous people lose money; rich people lose money; politicians lose money; and we can be sure that millions of couch potato investors and advisors will lose money.

If our financial success has been built on inflation, or worse, runaway inflation, and if we are told that our current credit expansion –the largest in history – can continue, would it not make sense that we would want to dismiss the rising fear and distrust around us as individuals becoming too negative or too emotional? If given the choice between fear and overconfidence, from which would we rather operate?

I recently talked with Dr. Larry Parks, Director of the Foundation for the Advancement of Monetary Education . While some may be tempted to dismiss this institution as heady or academic, Dr. Park's passion to communicate his message is nothing short of patriotic. I asked him to tell me what he thought I might have missed in my research. In response, Dr. Parks directed me to the Bank of International Settlement 's most recent OTC Derivatives Report, which states:

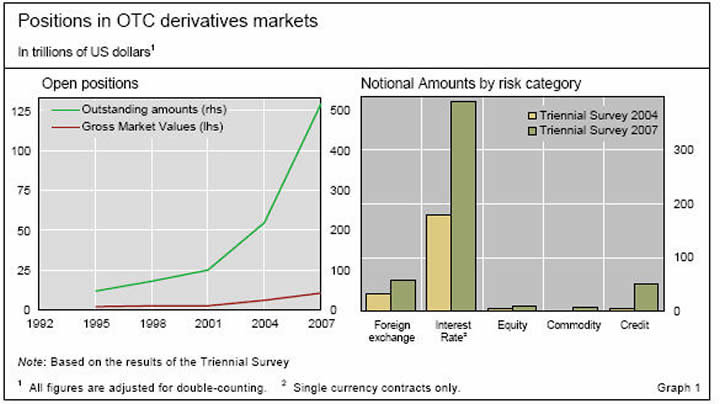

“Notional amounts outstanding of such instruments totaled $516 trillion at the end of June 2007, 135% higher than the level recorded in the 2004 survey (Table A). This corresponds to an annualised compounded rate of growth of 33%, which is higher than the roughly 20% average annual rate of increase since positions in OTC derivatives were first surveyed by the BIS in 1995. Notional amounts outstanding provide useful information on the structure of the OTC derivatives market but should not be interpreted as a measure of riskiness of these positions. While a single comprehensive measure of risk does not exist, a useful concept is the cost of replacing all open contracts at the prevailing market prices.” [Triennial and semiannual surveys on positions in global over-the-counter (OTC) derivatives markets at the end of June-2007 , BIS, released Nov. ‘07]

The first thing to note about this BIS chart is that it is measured in trillions of US dollars, which makes one thing clear: we have reached a point in financial history that we have never seen before. That's right, no one you are reading and no one commenting on our current financial markets is an expert on where we are going. So, successful navigation of these straits will require a great deal of listening, frankness, and humility – things that have always been in short supply within the financial system.

I am not the expert, and I have no problem with that. There is simply too much to know to claim mastery of the subjects about which we write. I do love to read brilliant thinkers, and I enjoy talking with those whose experience is so vastly different from my own that I am bound to gain a broader perspective. Mike Arnold's experience makes him keenly aware of the world of money and charts like the one above. Mike is a professional trader. He was a floor trader and an off-floor trader on the Chicago and New York Exchanges. He managed a group of off-floor traders in Chicago and New York and has taught hundreds of people to trade stocks, futures, and options. Those at the highest levels in the world of money will tell you that the best way to gain an understanding of how the world of money works is to become a floor-trader.

When I asked Mike to spend time thinking with me, he gave me some great insights. In answering the same question I posed to Dr. Parks, Mike commented:

“We've built this monstrosity of a machine, and there are tons of architects always working on it. The problem is no one knows what is going on in the entirety. Nothing this complex has ever existed in history. I believe what we are watching is an exercise in the folly of human ego.”

What is most frightening about the BIS's chart and Mike's comments is that, whether we are bulls or bears, we do not want the system to fail, and we do not want to see good people bear the increasing weight of trying to bail out the system on their backs. And yet, we all know that ultimately this is the decision we must make. The more we ignore the human element in this giant quagmire, the worse it will be when the major markets start reflecting the real world problems that bailouts have only exacerbated.

Whether we're hedge fund managers, with billions under management, individual investors, with small IRAs, or somewhere in between, I hope the following ideas will help each of us.

Point # 1 – Do not look to be acceptedSurround yourself with individuals whose business models have provided them with a great deal of latitude in the world of money. If you respect great contrarian stories like Templeton, buying heavily into Japan in the 70s, and Buffet, loading up as the markets declined in 73 and 74, ask yourself, “As we headed into various equity markets' tops last October and November, did my investments look like everyone else's? If I were to go to a conference with thousands of people, would I feel comfortable because my story is the same as theirs?”

If the answer is yes, the daily headlines are warning us to stop looking for short-term emotional rewards and start looking at the hard facts of science and human behavior throughout history. Because it is most often a classic sign that everyone is wrong in the group and no one wants to be rejected for a contrary view, we would all probably agree that when everyone is agreeing with us, we should not trust ourselves too much. If no one ever criticizes our opinion, then this may be an indicator to rethink our position.

To drive this point home even more, consider the chart below. Remember, at the end of a credit bubble, we should not look for the advice that makes us feel comfortable. Rather, we should ask a ton of questions about the real financial and social issues before we are caught off guard. If you owned a large block of Bear Stearns, did you take its decline in stride as just the “natural” forces of the “free markets?”

Realize that at the highest levels, the true story of money is dirty. Think about it. When Bear Stearns, one of the top five-brokerage houses in the US, collapsed recently, did people start scrambling to get out of their buy-and-hold strategies? Did they start to ask a lot of tough questions? No. Why? JP Morgan, a firm with a long history of “rescuing” other banks, was going to bail Bear out.

Never mind the meetings with Treasury officials over the previous weekend to talk about things too sophisticated for the masses to understand anyway. All we know is that JP Morgan initially announced that they would only have to spend $236 million to buy out the entire brokerage house. Of course, the Federal Reserve loaned JP Morgan $30 billion to “stabilize” the situation. Did most investors understand that in so doing, we were ultimately paying for the deal through a decrease in the value of the US dollars currently in our pockets? When average Americans fall behind on their debts, banks begin charging us 31 percent, and we are hounded by bill collectors. When major banks fall behind and lose billions, the banking cartel creates money out of thin air and gives new loans at 2.25 percent to its favored members. Does this sound sustainable to you? Does it build confidence in the system?

Point # 3 – Now is the time to do something different

Listen to people who have different opinions than your own. Have respect for individuals whose experience in the world of trading and managing money is vastly different from your own. Bob Lang, of Lang Asset Management , is one such individual in the world of money. He has managed money for nearly 5 decades. After 4 decades on the long side of the markets and two years of practicing a short-selling platform (without real money), in January of 2000 , he went live with one of the few short-only platforms in existence. I ask him yesterday, “What percentage of people have you talked with over the last 8 years that you really think understand the benefits of short selling in declining markets?” Bob responded,

“By the time a prospect comes to us, they are usually very concerned about the economy and the markets, but very few of those individuals really understand the benefits of short selling. Due to the large losses of the late 90s or the first few years out of the 2002 bottom, most consultants still do not believe in the concept of shorting. So, the consultants would rather a manager make the asset allocation decision between long and short ratios, so if the results are disappointing, the consultants can blame the manager. Most money managers don't even like to short. For example, in the first quarter of 2008, the typical long/short fund was down 6 percent. Obviously, shorting was not a part of their long/short strategy.”

And in a way, when I think of the numerous conversations I've had with individuals since the beginning of the credit crisis last July, I completely understand. Sometimes it seems like every time I think maybe the government intervention schemes have reached an unsustainable level, and I am encouraging individuals to consider managers or funds that use short selling tools or I am ready to move some money out of the markets, the “exercise in the folly of human ego” takes over in Washington and Wall Street, and the markets don't decline. Think about it; on Wednesday JP Morgan announced that their profits declined 50 percent in the first quarter on a $5.1 billion dollar loss ; its stock, and the markets, exploded up.

I mean, we are reading the headlines and our world leaders even comment on historic problems, and then we watch this happen. How would we feel ? Would we think, “Maybe I just don't get it? Maybe things really aren't as troubling as I was lead to believe.” General George S. Patton once said, “Fatigue makes cowards of us all.” As government makes more frequent forays into the markets, we should be careful to guard against it.

Point # 4 – Don't hammer nails with a screwdriver

In the charts below, I present the performance of two funds, with diametrically opposed investment objectives, through a bull and a bear market.

One of the funds is designed to mirror the daily movement of the NASDAQ 100, and the other aims to move exactly the opposite of the NASDAQ 100. Wouldn't it make sense to try and use different tools in different market environments, versus the same tool for all market conditions?

Point # 5 – Wall Street's warnings are often “a day late and a dollar short”

Those who have studied the destruction of our nation's money at the hands of our Federal Reserve may have profited handsomely over the last several years in commodities, oil, and metals. As we look back over the last several weeks, I'd like to pose a few questions. Has manmade inflation, through the destruction of a currency, ever been sustainable? If not, will you know ahead of time when the day arrives that the Federal Reserve's inflation and the government's massive intervention fail – as they did in 1929? My question is not what constitutes money. Rather, as credit continues to contract throughout the system, what happens when the collective groups of investors, who have made money investing in inflationary strategies, are increasingly impacted by the desire to lock in profits or the need for actual money that they can spend in their daily lives? What would happen if these marginal transactions flipped the switch on a number of quant models, causing an inordinate number of them to exit the markets or short into the decline?

And lest we think that our current, historic juncture is substantially different from the generations that preceded us, let's look at the London Herald's front page from October 25 th of 1929. That morning its headline read, “WALL STREET CRASH!” The following excerpts are from two articles on the front page:

“A crisis meeting of New York's leading bankers was held in the offices of JP Morgan & Co and prices recovered slightly in the afternoon on the assurance from the firm's senior partner, Thomas W. Lamont, that the problems were ‘technical rather than a fundamental'. Mr. Lamont admitted that: ‘there has been a little distress selling on the Stock Exchange' but the most influential financiers in New York concluded that the market was essentially safe and was simply readjusting after four strong years of growth.”

Next, we read:

“Massive sales in the early morning created an extraordinary atmosphere of chaos and panic. Brokers flooded the market with orders from their investors to sell at any price. As the situation reached crisis level, the market broke down entirely as the sea of brokers clamored madly for non-existent buyers. Stocks were traded for any price and the value of some companies halved during the course of the morning.”

Has human tendency changed so much over the last 80 years that we would take a 50 percent loss in stride? History records the plight of those investors who trusted the financial leaders' comforting rhetoric that Friday in 1929. How did those who stayed put “for the long term” do by 1932? What could these charts, of the two largest municipal bond insurers in the United States – MBIA and Ambac – be telling us regarding future risks?

Closing Remarks

I can almost hear someone saying, “But certainly, with all the people at the highest levels of government and finance working on this, something will be done to change the course of yet one more credit bust, which has already been stalled by the creation of new ways to repackage and sell yesterday's leveraged debt to someone else.” After all, who am I to question the advice given every day by thousands of advisors and newsletter writers? Who am I to question the system's sustainability? At the end of the day, I'm just a person who keeps asking, “What is the question that we all need to be asking that we aren't?”

A couple years ago Gordon Graham, former Director of the Socionomics Institute , suggested I read Dr. Jared Diamond's book, Collapse: How Societies Choose to Fail or Succeed . We included the story below in our June 2006 newsletter. As you read it, ask yourself if this information would be appropriate for investors, advisors, traders, or for that matter, anyone.

“Consider a narrow river valley below a high dam, such that if the dam burst, the resulting flood of water would drown people for a considerable distance downstream. When attitude pollsters ask people downstream of the dam how concerned they are about the dam's bursting, it's not surprising that fear of a dam burst is lowest far downstream, and increases among residents increasingly close to the dam. Surprisingly, though, after you get to just a few miles below the dam, where fear of the dam's breaking is found to be the highest, the concern then falls off to zero as you approach closer to the dam! That is, the people living immediately under the dam, the ones most certain to be drowned in a dam burst, profess unconcern. That's because of psychological denial: the only way of preserving one's sanity while looking up every day at the dam is to deny the possibility that it could burst.

If something that you perceive arouses in you a painful emotion, you may subconsciously suppress or deny your perception in order to avoid the unbearable pain, even though the practical results of ignoring your perception may prove ultimately disastrous. The emotions most often responsible are terror, anxiety, and grief.” [Page 435 & 436]

If you are growing more concerned by real world events, while finding emotional rest in the long sideways movement in the US equity markets since January, I encourage you to check out our research. As one 40-year veteran from the institutional side of the money world told me recently, “When I read your information, I know that you are just telling me what you have learned from your research, with no agenda other than presenting material for each of us to consider. In my 40 years of managing money, this is almost unheard of.”

To learn more about our research and advisory services, click here . To subscribe to our research, click here .

By Doug Wakefield with Ben Hill

President

Best Minds Inc. , A Registered Investment Advisor

Copyright © 2005-2008 Best Minds Inc.

Best Minds, Inc is a registered investment advisor that looks to the best minds in the world of finance and economics to seek a direction for our clients. To be a true advocate to our clients, we have found it necessary to go well beyond the norms in financial planning today. We are avid readers. In our study of the markets, we research general history, financial and economic history, fundamental and technical analysis, and mass and individual psychology.

Disclaimer: Nothing in this communiqué should be construed as advice to buy, sell, hold, or sell short. The safest action is to constantly increase one's knowledge of the money game. To accept the conventional wisdom about the world of money, without a thorough examination of how that "wisdom" has stood over time, is to take unnecessary risk. Best Minds, Inc. seeks advice from a wide variety of individuals, and at any time may or may not agree with those individual's advice. Challenging one's thinking is the only way to come to firm conclusions.

Doug Wakefield Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.