Surprising Hedge Fund Plays of 2014 - Bitcoins and China

Stock-Markets / Financial Markets 2014 Jan 10, 2014 - 05:37 AM GMTBy: Clif_Droke

A number of hedge fund managers have already begun to make waves at the start of the New Year. In this commentary we’ll look at a couple of areas where hedge funds have taken big stakes and which could have major repercussions in the year ahead.

A number of hedge fund managers have already begun to make waves at the start of the New Year. In this commentary we’ll look at a couple of areas where hedge funds have taken big stakes and which could have major repercussions in the year ahead.

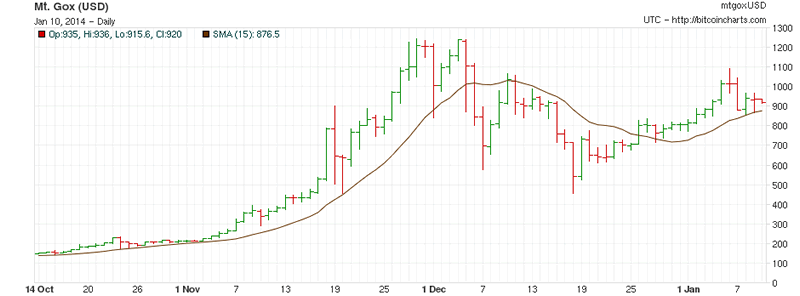

The first surprising hedge fund play of 2014 has emerged not in an established stock or commodity, but in the emerging digital payment platform known as Bitcoin. While purists insist it is neither a currency nor a commodity, there’s no denying the growing popularity of Bitcoin. The digital unit of stored value is attracting more and more interest from a wide array of individuals seeking an alternative to fiat currencies. Now it seems that even major financial institutions are set to enter the fray.

As with any speculative medium, it was only a matter of time before hedge funds jumped on board the Bitcoin phenomenon. According to a Bloomberg report, a San Francisco-based hedge fund is looking for a junior Bitcoin trader. As one reporter put it, “Where big money is, hedge funds go as well.”

The Bitcoin protocol will undoubtedly attract more interest from hedge funds, which in turn will push its value higher. As an analyst interviewed by Bloomberg pointed out, “Huge price fluctuations is exactly what [hedge funds] are looking for. [They] love nothing more than mad volatility, and that’s exactly what you’ve seen in Bitcoin.” And as we’ve seen in all too many cases, when hedge funds commit their capital to anything that’s already in an established uptrend, it can only succeed in generating additional upside momentum.

Analysts have noted the lack of liquidity in the Bitcoin market and have suggested this as a reason why a bubble may not grow to gargantuan proportions. Conventional trades in Bitcoin aren’t possible at this time due to the extremely slow transactions times, but that will likely soon change with Wall Street’s increasing presence in the market. Hedge fund managers are momentum specialists who not only thrive on upward trending markets, but who can collectively create a manifold increase in momentum in the markets they focus on.

Consider for instance the presence of hedge funds in certain individual China stocks. You’ll recall the bubble in U.S.-listed China stocks from a few years ago. While many of these stocks have since deflated, there are still to be found a few conspicuous examples of the active influence of hedge fund managers. At the time the hedge funds took speculative positions in certain low-priced China shares, these stocks were highly illiquid. Sometimes two or three days would go by without a single transaction being made in them. Yet this didn’t deter the “hedgies” from taking a large stake in them.

Two examples that come to mind are Ping An Insurance Group Co. (PNGAY) and the U.S. listed version of Agricultural Bank of China (ACGBY), both of which are known to be heavily owned by hedge funds. To this day, despite China stocks being in a bear market, PNGAY has not only seen increased liquidity due to hedge fund presence, but the stock recently experienced a run-up that can only be attributed to hedge fund-created momentum. Note the follow chart which shows PNGAY’s price trend in relation to the sagging Shanghai Composite Index, the main benchmark for Chinese stocks. After experiencing a “blow off” top in November-December, PNGAY has since sagged. Yet the heavy trading volume and upside momentum of recent months is testament to the power of hedge fund speculative activity in a historically illiquid market.

From the above example we can learn an unmistakable lesson, namely that hedge fund presence in Bitcoin is a double-edge sword. While it will only serve to attract more attention toward the emerging virtual currency and eventually increase its liquidity, it will also create ever-increasing price gyrations. This will defeat the goal of Bitcoin’s stability vis-à-vis the dollar that many of its exponents had hoped for. In short, the early appearance of hedge funds in the Bitcoin market virtually assures the expansion of a massive bubble – and its eventual implosion.

In the gold market many hedge funds have raised their bullish bets on gold to a six-week high. The net-long position in gold jumped 19 percent to 34,104 futures and options in the week ended Dec. 31, U.S. Commodity Futures Trading Commission data show. Short holdings slid 4.6 percent to 72,571, the lowest since Nov. 19.

Billionaire hedge fund manager John Paulson, however, is the largest holder in the SPDR Gold Trust (the biggest ETF). He told clients recently that he personally wouldn’t invest more money into his gold fund because it’s not clear when inflation will increase.

While not specifically a hedge fund, the gold outlook of investment bank Goldman Sachs is also worth noting. The group foresees a decline of at least 15% for the yellow metal this year.

“We expect gold to continue to fall as better data from the U.S. continues to see interest rates rise, causing reduced demand for non-yielding gold,” wrote Goldman Sachs’ Eugene King in December. “We expect outflows from ETFs to continue and a reduced rate of central bank buying. Better jewelry demand on a lower price and physical buying of bar and coin in India and China, in our view, will be insufficient to support the price. We forecast gold at US$1,144/oz in 2014.”

Goldman’s Jeffrey Currie, head of commodities research, believes that prices are “likely to grind lower” through 2014. Further, he believes the metal will reach $1,050 by the end of 2014, according to a Nov. 20 report.

You can mostly discount what the bankers are saying, but Goldman seems to be an exception since its prediction tend to be reasonably accurate. I suspect this has more to do with Goldman’s ability to set an agenda that Wall Street follows (i.e. self-fulfilling prophecy) than with any prognosticative ability on their part. At any rate, it normally pays to find out what the boys at Goldman are saying.

High Probability Relative Strength Trading

Traders often ask what is the single best strategy to use for selecting stocks in bull and bear markets? Hands down, the best all-around strategy is a relative strength approach. With relative strength you can be assured that you’re buying (or selling, depending on the market climate) the stocks that insiders are trading in. The powerful tool of relative strength allows you to see which stocks and ETFs the “smart money” pros are buying and selling before they make their next major move.

Find out how to incorporate a relative strength strategy in your trading system in my latest book, High Probability Relative Strength Analysis. In it you’ll discover the best way to identify relative strength and profit from it while avoiding the volatility that comes with other systems of stock picking. Relative strength is probably the single most important, yet widely overlooked, strategies on Wall Street. This book explains to you in easy-to-understand terms all you need to know about it. The book is now available for sale at:

http://www.clifdroke.com/books/hprstrading.html

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

Order today to receive your autographed copy along with a free booklet on the best strategies for momentum trading. Also receive a FREE 1-month trial subscription to the Momentum Strategies Report newsletter.

By Clif Droke

www.clifdroke.com

Clif Droke is the editor of the daily Gold & Silver Stock Report. Published daily since 2002, the report provides forecasts and analysis of the leading gold, silver, uranium and energy stocks from a short-term technical standpoint. He is also the author of numerous books, including 'How to Read Chart Patterns for Greater Profits.' For more information visit www.clifdroke.com

Clif Droke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.