Eurozone Economy Expands but Hollande Concedes France Crippled by High Taxes

Economics / France Jan 03, 2014 - 11:19 AM GMTBy: Mike_Shedlock

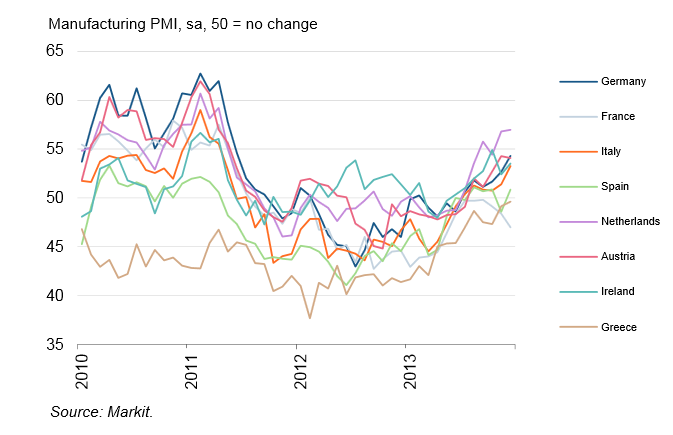

Eurozone manufacturing is at a 31-month high according to Markit. Every country but France and Greece are expanding. French manufacturing is at a seven-month low in an intensified downturn.

Eurozone manufacturing is at a 31-month high according to Markit. Every country but France and Greece are expanding. French manufacturing is at a seven-month low in an intensified downturn.

The seasonally adjusted Markit Eurozone Manufacturing PMI® rose for the third month running to post 52.7 in December, up from 51.6 in November (and unchanged from the earlier flash estimate).

The latest improvement in overall operating conditions was underpinned by solid and accelerated growth in the Netherlands, Germany, Ireland and Italy, while Austria continued to expand at a robust clip despite the rate of increase easing slightly since November. Meanwhile the Spanish PMI moved back into expansion territory. There was even relatively positive news from Greece, where higher levels of output and new orders elevated its PMI to a 52-month high and close to the 50.0 stabilisation point. France moved in the opposite direction, however, with its PMI falling to a seven - month low and signalling contraction for the twenty-second successive month.

Chief Economist Comment

Markit Chief Economist Chris Williamson "While Germany, Italy and Spain are seeing the strongest output growth since early - 2011, buoyed to varying degrees by improved export sales, France is seeing a steepening downturn, in part the result of widening export losses. This suggest s that competitiveness is a key issue which the French manufacturing sector needs to address to catch up with its peers."

Hollande Concedes Taxes 'Too Heavy' Offending Everyone

French president François Hollande rang the bell on the new year the same way he rang the bell throughout 2013, with an economic as well as public relations gaffe. His vague promise of lower taxes coupled with an admission on national TV that taxes are too high, infuriated French households facing tax rises now, at the start of the year. The Telegraph explains François Hollande concedes taxes 'too heavy' in admission that annoys all sides in France.

A New Year's message from François Hollande backfired as his vague promise that taxes would be lowered some time in the future jarred with French voters facing tax increases that took effect as he was speaking.

Instead of winning plaudits for his unexpected admission that taxes had become "too heavy, much too heavy", the unpopular socialist president - weakened by tax increases, rising unemployment and a shrinking economy - provoked incredulity and scepticism among critics on both Left and Right.

Hard-pressed French households faced VAT increases on most goods and services from Jan 1 and only days earlier France's supreme court had upheld a new 75 per cent supertax on high-paying companies.

Mr Hollande made his televised address in front of a virtual background, an image of the Elysée Palace, which provoked a flood of comments on Twitter comparing his appearance with that of a Soviet leader of the 1970s.

He offered companies a "responsibility pact", which he defined as the possibility of "lower labour charges and fewer restrictions on their activity in return for hiring more workers and more dialogue with trade unions".

Vague Promises, Nonsensical Proposal

Hollande offers a "possibility" of lower taxes and labor charges IF businesses expand hiring and negotiate more with unions.

What business would accept that nonsensical proposal? Given the proposal was accompanied by an admission "taxes are too heavy, much too heavy", it's no wonder everyone was offended. It's also no wonder France is going the opposite of the rest of the eurozone. But the rest of the eurozone is not out of the woods yet. No structural problems have been fixed anywhere.

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.