U.S. Treasury Bond Yields Creeping Higher

Interest-Rates / US Interest Rates Dec 28, 2013 - 03:06 PM GMTBy: PhilStockWorld

Courtesy of Doug Short: What’s New: The 10-year note closed the week at 3.02%, up 17 bps since the close before the latest FOMC minutes were released and the highest since July 25, 2011. The interim closing low was 1.43%, exactly one year later on July 25, 2012.

Courtesy of Doug Short: What’s New: The 10-year note closed the week at 3.02%, up 17 bps since the close before the latest FOMC minutes were released and the highest since July 25, 2011. The interim closing low was 1.43%, exactly one year later on July 25, 2012.

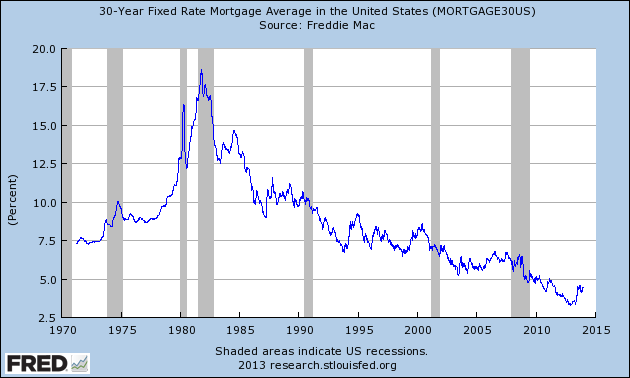

The latest Freddie Mac Weekly Primary Mortgage Market Survey, released yesterday, puts the 30-year fixed at 4.48%, 117 bps above its all-time low of 3.31% in late November of last year and 10 bps below its interim high reported on August 22nd.

The 30-year Treasury closed today at 3.94%, its highest level since August 1, 2011.

Here is a snapshot of the 10- and 30-year yields.

A log-scale snapshot of the 10-year yield offers a more accurate view of the relative change over time. Here is a long look since 1965, starting well before the 1973 Oil Embargo that triggered the era of “stagflation” (economic stagnation with inflation). I’ve drawn a trendline connecting the interim highs following those stagflationary years. The red line starts with the 1987 closing high on the Friday before the notorious Black Monday market crash. The S&P 500 fell 5.16% that Friday and 20.47% on Black Monday.

Here is a long look back, courtesy of a FRED graph, of the Freddie Mac weekly survey on the 30-year fixed mortgage, which began in May of 1976.

A Perspective on Yields Since 2007

The first chart shows the daily performance of several Treasuries and the Fed Funds Rate (FFR) since 2007. The source for the yields is the Daily Treasury Yield Curve Rates from the US Department of the Treasury and the New York Fed’s website for the FFR.

Now let’s see the 10-year against the S&P 500 with some notes on Federal Reserve intervention. Fed policy has been a major influence on market behavior.

For a long-term view of weekly Treasury yields, also focusing on the 10-year, see my Treasury Yields in Perspective, which I update on weekends.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.