Gold And Silver 2014 Sharply Higher Prices? Be Careful What You Wish For

Commodities / Gold and Silver 2014 Dec 28, 2013 - 02:44 PM GMTBy: Michael_Noonan

2013 comes to an end, and with it all those calls for gold and silver to be at much higher price levels. What will 2014 bring? More and more renewed calls for much higher price levels. Will 2014 be the year?

2013 comes to an end, and with it all those calls for gold and silver to be at much higher price levels. What will 2014 bring? More and more renewed calls for much higher price levels. Will 2014 be the year?

It is a possibility, but as the expression goes, "Be careful of what you wish for." So many who expect gold to exceed $3,000, even $10, 000, while for silver $100 and higher, but what are the expectations for how circumstances will be with PM at the higher end?

Do you believe your 100 ounces or 1,000 ounces of gold, and/or your 1,000 ounces or 10,000 ounces of silver will have increased your wealth, as you have been anticipating during the accumulation process, and everything else will be relatively the same, except your increased good fortune?

Be careful what you wish for. Things that change, apart from increased PM prices, may be far different from what you may think or have not thought through. One of the strong possibilities will be more war; if not a major one, then smaller civil wars disrupting life in the Western world as we know it.

The strongest predictor of future behavior is past behavior, and we know for certain is that starting another major war can be expected as a means of deflecting governmental instability. It always seems to start from some unrelated event, but the event is always calculated to being about the desired results: war. They are profitable for the controlling moneychangers, and they redirect the attention of the masses from the hardships of a [carefully orchestrated] resultant war.

Another certainty will be the relentless loss of personal freedoms, a throw-back to the Stasi days in East Germany, except it will be in your own neighborhood. The USA is much more like the USSA, and personal freedom will likely not exist, at least not as we know it today. The federal government will be in total control, monitoring the daily life of everyone 24/7.

If you have gold and or silver, and you want to use it, the question might be how? What happens if the powers that be have outlawed transactions in anything other than the State- sanctioned digital "currency" in which every transaction must contain your photo ID, address, and some form of "official approval" before completion?

Your 1 ounce gold coin is worth $10,000, but you just want to buy some food. Okay, your 1 ounce silver coin is worth $200, a more manageable situation. If what you want costs less than $200, what would you accept in return as "change?" Can you trust the person on the other side of the transaction not to turn you in to the authorities? Do you run the risk of alerting authorities to the fact that you have gold and/or silver, which now has you under a more intense surveillance from then on?

Beyond what is already known about ongoing world events, there are two primary wars of which few are aware. One began around 1770, and the other is currently being waged by the East v the West, as the West struggles for survival. We will endeavor to address the latter one, next week.

To understand the first, we are providing a link that was sent to us from one of our readers. We have made several mentions of the Rothschilds, the New World Order, the elites, the moneychangers, et al. They are real, and their impact on your life may have gone unnoticed, at least directly, as has always been their intent. We strongly urge you to read the entire article. It is the most comprehensive abbreviated version that gives a full account of how one man has changed the direction of the world, and irretrievably for the worse.

Not many Americans could explain what a dollar is if their life depended on it. We keep saying a dollar is not a Federal Reserve Note, or a Federal Reserve Note is not a dollar. Yet, the elites, through their installed Federal Reserve, would have everyone believe otherwise. See Gold - A Suppressed Market Remains Suppressed, But For How Long?, paragraphs 10 through 16, for a brief discussion on the subject as an example of how the illuminati work behind the scenes, carefully directing everything.

This information is not presented as the definitive explanation for events as they are today, but it is closer to the truth of which most are unaware. Read it. Understand it. Share it with your friends. Knowledge of what the illuminati are doing is essential for personal and economical survival.

We cannot speak for Europe, but the existence of the Euro Zone is a huge red flag. For sure, we are familiar with the de facto federal government that has been in total control of the United States since the 1933 bankruptcy, and even as extensively leading up to that culminating event. The Rothschild formula, as carried out by the illuminati is very real.

Here is the link for an ultra macro look at the world, followed by some charts for a micro look at gold and silver. http://www.secretsofthefed.com/qwefqwr/

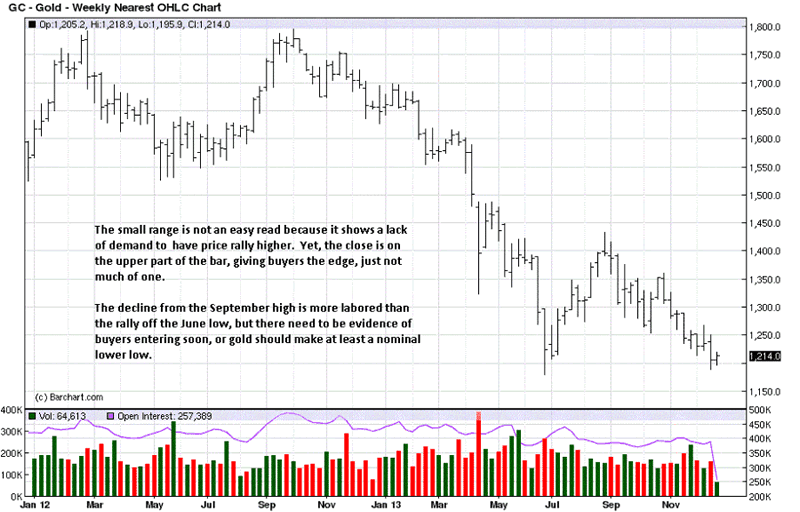

There is little from last week that has altered the picture for the down trend in gold. The small range for the week is difficult to read. The close on the upper end of the range tells us buyers won the battle, last week, but the lack of further upside direction also says the rally effort was weak. With the holiday, it may not be worth trying to read much into it.

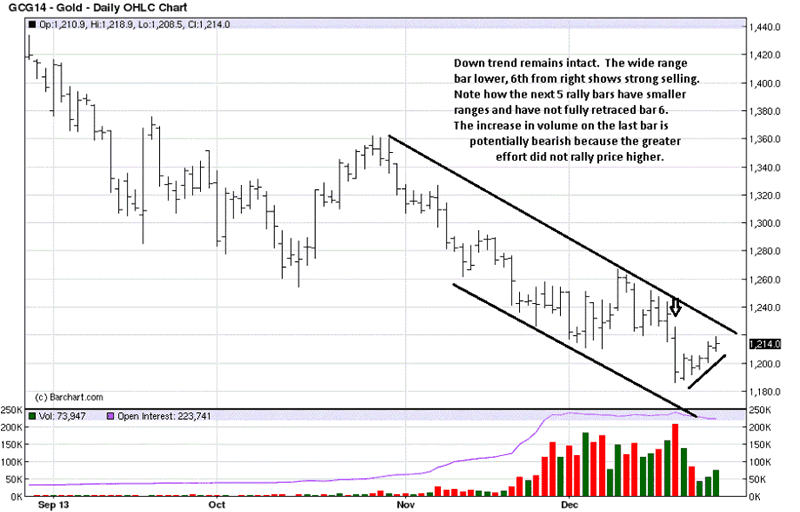

The last six bars suggests the probability for at least a nominal lower low if greater than not. The rally effort of the last 5 trading days is labored when compared to the ease of downward movement for the 6th bar.

Of the three green rally bars, designated by a higher close from the previous day, the most volume was on the last one, and the close was mid-range. This tells us that sellers were meeting the effort of buyers and even stopping the buyers. Odds favor further decline into next week. Whatever the market does, the trend has not yet reversed.

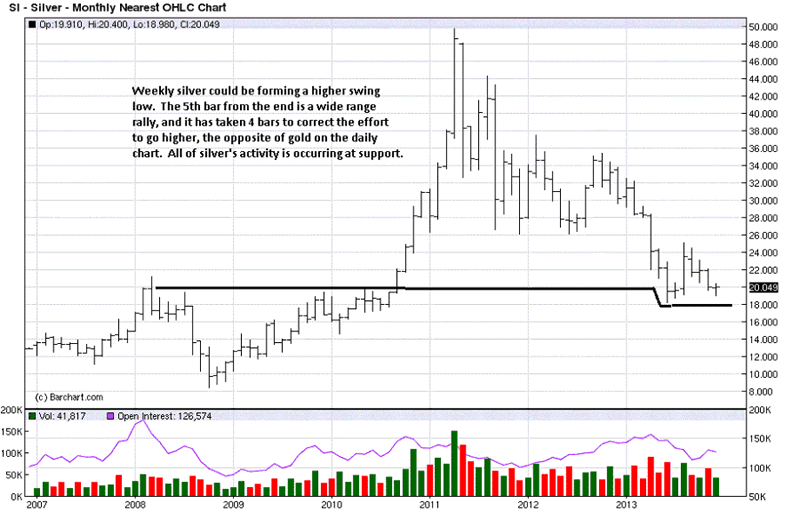

The support area for silver is holding relatively better than that for gold, but the trend is still down.

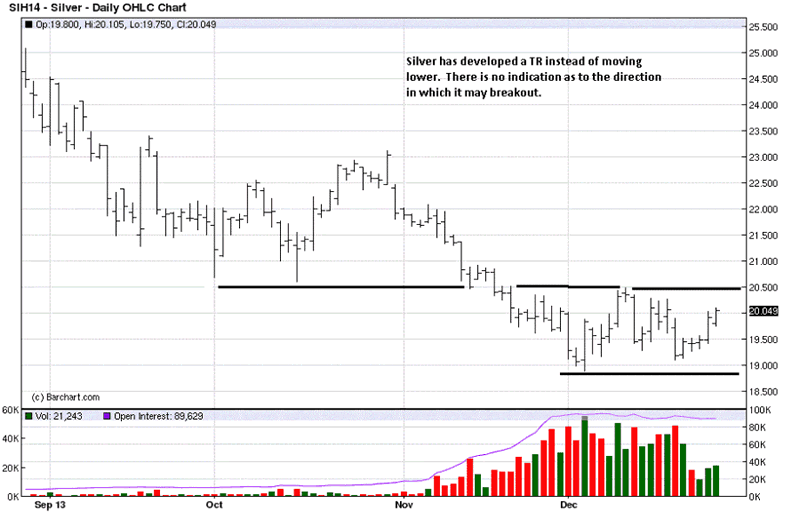

While it can be viewed more as a positive that daily silver has formed a trading range, [TR] instead of going lower, TRs do not provide much useful information as they form.

By Michael Noonan

Michael Noonan, mn@edgetraderplus.com, is a Chicago-based trader with over 30 years in the business. His sole approach to analysis is derived from developing market pattern behavior, found in the form of Price, Volume, and Time, and it is generated from the best source possible, the market itself.

© 2013 Copyright Michael Noonan - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Michael Noonan Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.