Where to Invest in India 2014? Housing? Stocks? Gold & Silver?

Stock-Markets / Investing 2014 Dec 27, 2013 - 03:29 PM GMTBy: Dhaval_Shah

Where to invest in 2014?

Where to invest in 2014?

Real Estate? Share Market? GOLD & Silver? FD/Bonds? Or Cash?……??

2013 has remained highly volatile. Let us review few important instances of 2013…

Ø On 1st Jan, 2013, Sensex was at 19,580 and as we are near to year end, it is trading around 21000. Less than 10% gain in a year, a flat year for the market.

Ø India GDP dipped to decadal low of 4.4%.

Ø Indian Rupee dipped to low of 68.80 raising concerns of instability in trade and commerce.

Ø Govt bond yield dipped to 7.25% and rose back to over 9%.

Ø Inflation (WPI) fell to 4.58% from high of above 8% for most part of last 2 years. But, that bottom proved temporary. Inflation pulled back to range of 7-8% range of past few years.

Ø Gold prices made low of close to Rs. 25000, then went up over Rs. 32000 and now trades near Rs. 28300. Internationally, Gold price is 40% down around $1200 from high of $1920.

Ø India also witnessed many reforms in last year. FDI in retail was such a momentous decision. It took many sessions of parliament and vigorous efforts of Govt to pass it but even after long time, it did not receive any proposal.

Ø New Governor Raghuram Rajan soothes both the markets-debt & equity, contains rupee fall, takes dynamic steps to bolster financial market.

Ø Rating agencies downgrade India one notch above junk status and warns India, if Current Account and Fiscal deficits are not arrested, it will downgrade India to junk status.

Therefore, as we enter in 2014, we have hard pressed memories of high inflation, high real estate prices, high gold prices and high interest rates of 2013 in mind. Probability of trend reversal in these asset classes are very high in 2014.

Hence, the question resurfaces is

Where to invest in 2014?

Which investment carries higher safety and security in year 2014?

Which investment will outperform inflation in year 2014?

Let us assess each of asset class….

Real Estate

Real Estate is driven by Capital. At height of bull period, real estate capital gets into below vicious circle.

Vicious Circle of Capital

![]()

![]() Capital Pushes the Prices Price pushes the land cost Requirement of Capital elevates the construction cost

Capital Pushes the Prices Price pushes the land cost Requirement of Capital elevates the construction cost

![]()

![]() Price Pushes Consumers away Investors with surplus money roped in Results in construction delay

Price Pushes Consumers away Investors with surplus money roped in Results in construction delay

Capital fails to generate the returns.

From common man to High Net worth Individuals, analysts to professional and builders, all agree that prices in Real Estate sector has zoomed to the moon, far from affordability.

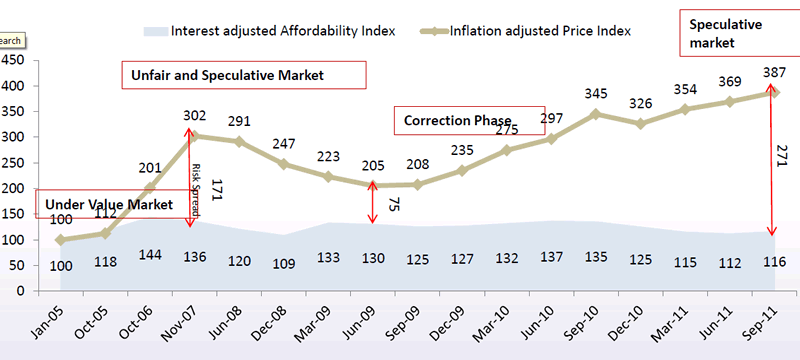

Below Chart shows difference between Price and Affordability in MMR(Mumbai Metropolitan Region). Same picture mirrors in rest of the markets.

The widening gap between the prices and affordability is pointing towards the speculative market practices. Even if the interest rates comes down to 9% level, still the prices need to undergo correction to the extent of 33% to attain the efficiencies of June 2009 . – From report of Liases Foras

Today, Two views are prevailing in Real Estate market. First Bull period is over in Real Estate and Second Real Estate will see recovery post General Election. Ironically, in both the situations, possibility of earning from real estate is insignificant in 2014.

In 2014, few factors will resist price rise in Real Estate sector. They are…

v In 2006, the median Home price was 5 years median salary of an individual, that has reached to 12-15 years median salary now. Main culprit is inflation. In last few years, inflation has outrun the wage hikes and median salary rise(increments) and that has created large gap between price and affordability. Inflation was benign in 2004-2007 years.

v In 2014, huge money will flow out of Real Estate market towards election funding.

v Interest subvention scheme(80:20) has been banned by RBI. That helped to create artificial demand for some time in past year.

v Now, there are more sellers than buyers in market,. There is inventory overhang of 2-3 years in top 7 cities in India. (NCR, Mumbai, Chennai, Banglore, Hyderabad, Pune, Kolkata)

v New Governor is destined to disinflate markets contributing inflationary expectations.

v As per the report of Liases Foras, by end of 2012, 52% sales of properties were sold to Investors. Historical data shows us that in any real estate market when more than 50% of sales are absorbed by investors, it is a signal of coming downtrend in sales and prices. In immediate preceding year of Dubai & US real estate crash, investors owning assets out of total sales, had reached to above 50%.

v 31% of projects launched in past 12 months have already witnessed deferred possession dates compared to their earlier made commitments

Let me also present some quotes from recent Real Estate report published by Liases Foras & other inputs

"This has been one of the worst years in the realty sector… sales are down, inventory is high and prices have peaked," says Pankaj Kapoor, managing director, Liases Foras, a real estate research firm. "There is a wide gap between affordability and pricing, which is why sales are not happening. There is no oversupply. It is just that supply has out-priced consumers."

The absorption for the January-September 2013 period declined by over 11 per cent, according to the data provided by research firm PropEquity. Out of the committed supply for this year, only 46 per cent was delivered till September.

Inventory had never earlier been as high as this year. At the end of the second quarter this year, says a Liases Foras report, the Mumbai Metropolitan Region had an inventory of 58 months(Close to 6 years), NCR 41 months(Close to 5 years), Hyderabad 32 months(Close to 3 years), Pune 31 months and Bangalore 30 months. (Inventory denotes months required to clear the stock at the existing absorption pace. A healthy market maintains eight months of inventory.)

In an attempt to build their image, developers, whose credibility has been hit by delay in deliveries, have been focusing on advertisements this year. "Property and real estate witnessed 30 per cent growth in TV advertising during January-June 2013 in comparison to January-June 2012," data by Television viewership measurement agency (TAM) show.

Read articles and reports, if interested in details..

http://www.business-standard.com...

http://www.liasesforas.com/R...

Therefore, I believe Real Estate is the sector you should avoid for investments in year 2014. Not only it will underperform but there are potential chances of negative returns to the tune of -20% to -30%.

Gold-Silver

After eleven years bull period, 2013 will be the first year for precious metals to close in red. It will be interesting to watch bullion market in 2014.

I recommended Gold in 2007 when it was trading around $700 and asked investors to exit when it reached above $1800( In Indian Rupee it was around Rs, 28000). Since then, I am bearish on Gold, expecting at least $1100 before next leg up.

You can read my past articles on Gold on my below blog links..

http://investmentacademy.wordpress.com/...– when I started recommending Gold

http://investmentacademy.wordpress.com.../ – over 60 economists expected Gold to surpass $2000 level

http://investmentacademy.wordpress.com/ – refer my latest recommendations on Gold

Broad participation in Gold market started from 2007-08 and still continue to be, though at lower pace. But, it looks that fundamentals are weakening to support Gold-Silver’s uptrend.

Upon inspecting Gold’s historical bull runs, we find that under following circumstances Gold-Silver performs…

![]() When Inflation is high

When Inflation is high

![]() When Govt looses people’s trust and confidence in Govt.

When Govt looses people’s trust and confidence in Govt.

![]() When currency depreciates more than expected and destabilises nations’ economy

When currency depreciates more than expected and destabilises nations’ economy

![]() When nation is at war

When nation is at war

![]() When Central Bank prints too much money relative to the historical and economic growth standards.

When Central Bank prints too much money relative to the historical and economic growth standards.

There could be more reasons, too, but above are chief of them.

Above parameters somewhere in play since 2008 and were supporting Gold’s bull run. But, their strength has been weakening for some time now.

In developed world, inflation is less than 2% even after unprecedented printing, economies of western world have stabilised, showing slow & gradual recovery, confidence in Govt has been restored to some extend in developed economies and war situation between North Korea and South Korea and Iran-Israel have been averted at least for some time now. These developments have caused Gold to fall 40% in last 1 year and still continue to be in downtrend.

Gold may breach $1100 level but somewhere in 2014, I believe Gold will bottom out.

Hence, in 2014, Gold will either fall further or will remain in range.

Canadian Imperial Bank of Commerce expects Gold to fall to $1000 level from here, Goldman Sachs targets $ 1050 and Standard Chartered, UBS and Citi estimates it to be $1200-$1250.

Broadly, Gold and Silver does not have much to offer to investors in terms of returns in year 2014.

Read More:

http://www.business-standard.com/...

http://economictimes.indiatimes.com...

http://www.business-standard.com/a...

http://www.business-standard.com/a...

Equity Market

Yes, after several attempts Sensex is back above 21000 level but portfolio of investors are still 40-50% down from last 21000 level seen in Jan, 2008.

Question is, Should we invest at this level?

Actually, discounting last 5 years inflation in Sensex, it should be anywhere around 30,000-33,000. It means, if Sensex reaches to around 30,000 level, it can be said that now Sensex has reached to 2008’s 21000 level.

Will Sensex reach to 24000? 28000? 30000?

It is very difficult to say, whether market will continue upside and will conquer 24000-28000 levels or not in 2014. But, I can say with confidence that we do not have yet proper conditions for sustainable bull market. For sustainable bull market, you should have low inflation and low interest rate. At present, both parameters are on opposite side.

Low inflation leaves higher disposable income in the hands of consumers and lower interest rates induce buyers to purchase capital assets. At present, higher inflation is leaving no or minimal surplus income to consume additional and higher interest rates are discouraging buyers from purchasing capital assets.

Therefore, it seems unless inflation cools and interest rate comes down to the level, where it generates risk appetite to start new businesses, employ more capital, expand capacity and enables higher consumption, market will keep gyrating in broad range. It may go up to form new and all time highs but sustainability will remain a question.

The best option is to keep investing small amount through SIP in large cap funds. But, do not invest lump sum in Equity at this level.

Selectively, I expect, after long downturn, commodities like Sugar and Coffee have prospects to outperform other assets in 2014..

Now, we are left with a question, where to invest in 2014?

I believe, 2014 is a year where safety and security will precede other parameters. Safe- money invested in sound company/asset/fund and Secure- the instrument of investment is liquid, redeemable.

Therefore, I recommend debt products this year. It includes Fixed Deposits, Bonds(many Tax Free bond issues are on offer), Secured NCDs.

But, the best option is short term bond funds of Mutual Fund, they are dynamic in nature.(i.e. they intend to offer accrual income but when interest rate falls, they have flexibility to capitalise gains).

Current YTM(annual return) is around 10.50% from short term debt mutual funds, it is quite higher than offered by Fixed Deposits coupled with tax benefit.

I prefer Debt Mutual Funds over Fixed Deposit from 2 perspective. One Debt Mutual Fund attracts lower tax(Flat 10% long term capital gains tax(after 1 year) or 20% with indexation benefit, in both the cases tax liability comes far lower than Fixed Deposit) and Second it does not deduct TDS.

Capital Protection Funds also look attractive from here. I will write on that shortly.

Please feel free to ask question…

Products on offer

| Product | Interest Rate

Upto |

Monthly | Min. Inv | Opens on | Closes on | Tenure | Tax Status | TDS | Rating | Listing

On |

Registrar |

| HUDCO Tax Free Secured NCB -II | 9.01% | 10-01-2014 | 10 yrs | Tax Free | NO | AAA | |||||

| IIFCL Tax Free Bond | 8.66% | 5000 | 09-12-2013 | 10-01-2014 | 10 yrs | Tax Free | No | AAA | BSE | Karvy Computer | |

| HDFC Recurring Deposit | 8.75% | 2000 | 12-23 months | Taxable | Yes | AAA | |||||

| 9% | 2000 | 24-36 months | Taxable | Yes | AAA | ||||||

| HDFC Double Money Plan(Doubles Money) | 9.15% | 20000 | 95 months | Taxable | Yes | AAA | |||||

| NHB Tax Free Bonds | 8.51% | 5000 | 30-12-2013 | 31-01-2014 | 10 Yrs | Tax Free | NO | AAA | NSE | Karvy | |

| SREI Infra Secured NCD | 11.50% |11.75% | 10000 | 30-12-2013 | 31-01-2014 | 3years | 5 years | Taxable | No | AA-(Stable) | BSE,NSE | ||

| Indian Railway Tax Free Bonds | 8.48% | 5000 | 06-01-2014 | 20-01-2014 | 10 Yrs | Tax Free | NO | AAA | BSE,NSE | ||

| Network 18 Fixed Deposit | 11.96% | 10000 | 1 year | Taxable | Yes |

Thanks

Regards

Dhaval Shah

Blog: http://investmentacademy.wordpress.com

E-mail: investmentacademy@yahoo.com, academyofinvestment@gmail.com

© 2010 Copyright Dhaval Shah - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.