Gold Stocks Bear Market Cycle Bottom Forming Right Now!

Commodities / Gold and Silver Stocks 2013 Dec 26, 2013 - 05:03 PM GMTBy: David_Banister

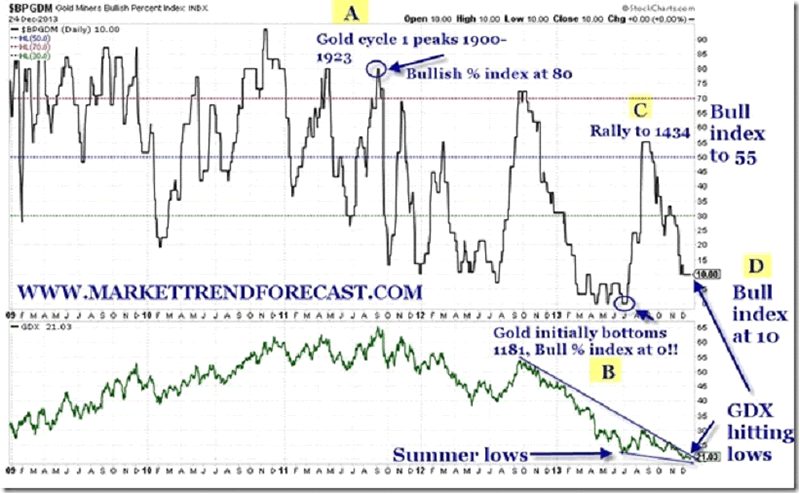

Today we take a look at the Bullish Percent Index chart relative to Gold’s cycle and Gold Stocks.

Today we take a look at the Bullish Percent Index chart relative to Gold’s cycle and Gold Stocks.

Essentially it tells you what percentage of Gold sector stocks are at or above a moving average, which normally would be 50 days. When 70% or more are above a 50 day moving average, sectors can be peaking out. If you look at our chart at the bottom, we have labeled various incidents with A, B, C, and D.

A. The precious metal as we all know peaked in the fall of 2011 at $1923 per ounce, and the Bullish percent index was at 80%! Usually at 30% or so, they are bottoming out in most cases.

B. We saw a rare case in the summer of 2013 where the Bullish percent index for Gold stocks was at 0%, yes that is not a miss-print.

C. Gold bottomed at 1181 in late June 2013, and then rallied up to 1434 and we saw Gold stocks rally 40-80% in individual cases and the Bullish percent index rallied up to 55%.

D. If we fast forward to December 2013, we have Gold pulling back in the final 5th wave down from the Bull cycle highs in August 2011 at $1923. The Bullish percent index is back to 10% and heading towards 0 or close once again. At the same time, the Gold miners index ETF (GDX) is at 5 year lows and even lower than June-July 2013 lows.

These types of indicators are coming to a pivot point where Gold is testing the summer 1181 lows and may go a bit lower to the 1090 ranges. At the same time, we see bottoming 5th wave patterns combining with public sentiment, bullish percent indexes, and 5 year lows in Gold stocks. This is how bottom in Bear cycles form and you are witnessing the makings of a huge bottom between now and early February 2014 if we are right.

The time to buy Gold and Gold stocks is now during the next 4-5 weeks just as we were recommending stocks in late February 2009 with public articles that nobody paid attention to. This is the time to start accumulating quality gold miner and also the precious metals themselves as the bear cycle winds down and the spring comes back to Gold and Silver in 2014.

Consider joining us for free weekly reports at www.markettrendforecast.com or sign up for a 33% discount on a one year subscription today

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (SafeHaven.Com, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2013 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisor.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.