Stock Market Thoughts For the End of the Year

Stock-Markets / Stock Markets 2013 Dec 26, 2013 - 02:43 PM GMTBy: PhilStockWorld

What a year this has been!

What a year this has been!

As you can see from Doug Short's S&P chart, we're now up 171% from our 2009 low of 666 but the mission is not yet accomplished at 1,833 – not with 1,850 so close and obtainable as a target for a 2013 finish that will put this year firmly in the history books – as well as in brochures that will be used to entice more people into the market next year.

On an inflation-adjusted basis, we are still 11% below 2000's ridiculous highs but keep in mind those highs only seem ridiculous in retrospect – at the time, people were predicting Dow 40,000 etc. Actually, at +115% from the lows, adjusted for inflation, Doug points out that we are still miles behind 1982-2000's epic bull rally, where the market gained a devilish 666% over 18 fabulous years.

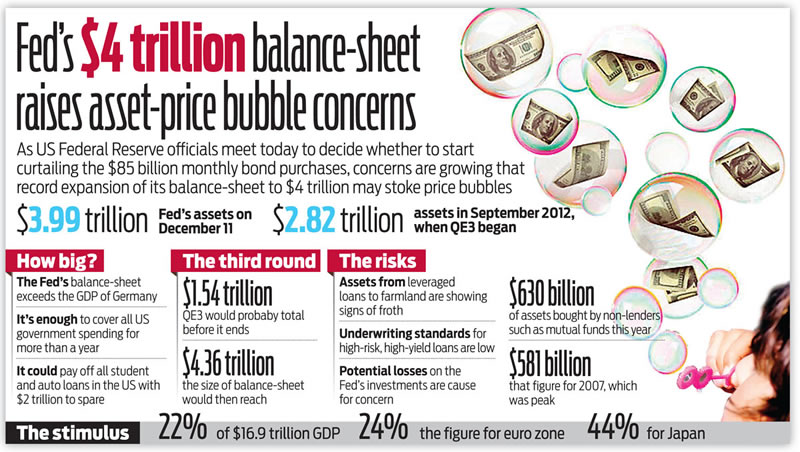

There was, however, no massive influx of free money and ultra-low interest rates driving the previous rallies, other than the New Deal Rally of 1932-1937 – but that one didn't end too well. We can't expect the past to guide us when we have a Fed that is pumping the GDP of Mexico into the US Economy each year while Japan adds the GDP of the Netherlands to their economy. Always keep in mind the charts don't show you HOW we got those results – it's only the results that matter in those index prints.

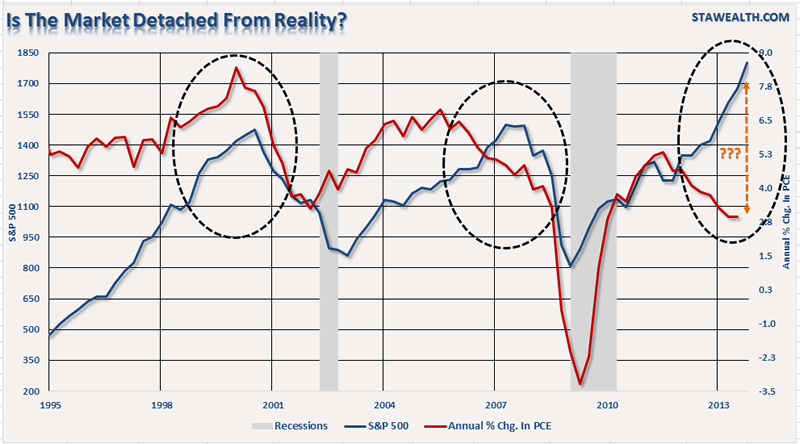

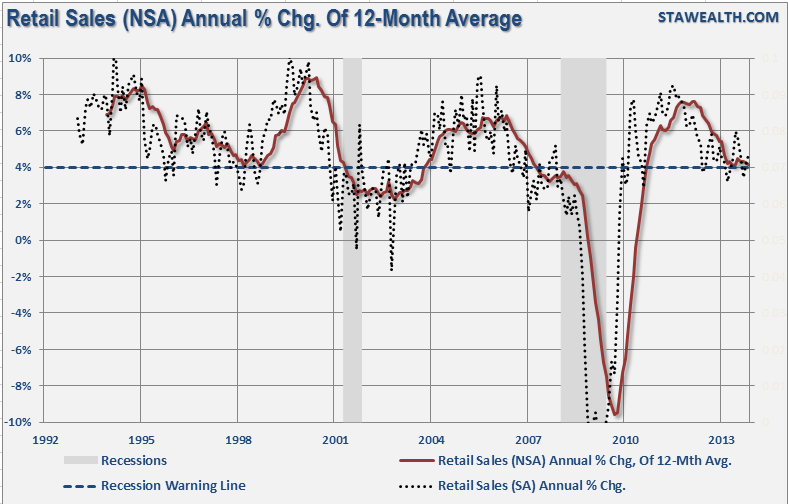

In the above charts (also Doug's), it's very clear that the actual economy is NOT improviing – in fact, it's obviously getting worse. In fact, it's almost getting catastrophic and will be if the actual data of the 2013 Holiday Shopping Season doesn't miraculously turn around in the last two weeks of the year. Consumer Spending is 70% of the economy and we KNOW Government Spending, which is 20%, (other than the Fed) isn't picking up the slack and Corporate Spending couldn't make up that difference – even if they wanted to.

The fact that this "economic recovery" is completely…

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.