India One of the Worlds Best Profit Plays for Investors

Stock-Markets / India Apr 17, 2008 - 09:01 AM GMT

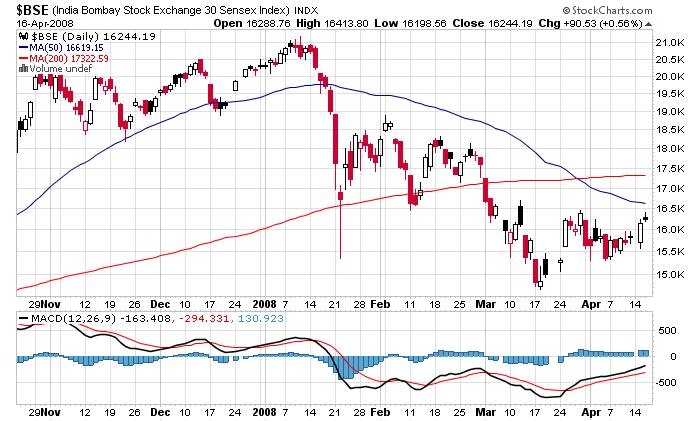

The Indian market as measured by the Mumbai Sensex Index is down 22% this year, about 25% below its all-time high reached in January. That's not very surprising: China is down further (about 35%) and most other emerging stock markets have also fallen. Growth in 2008 seems likely to be slower than in 2007 and there are some signs of a credit crunch. Yet India remains one of the world's great growth opportunities and investors at this level may well be getting in on the ground floor of a very major long-term profit play .

The Indian market as measured by the Mumbai Sensex Index is down 22% this year, about 25% below its all-time high reached in January. That's not very surprising: China is down further (about 35%) and most other emerging stock markets have also fallen. Growth in 2008 seems likely to be slower than in 2007 and there are some signs of a credit crunch. Yet India remains one of the world's great growth opportunities and investors at this level may well be getting in on the ground floor of a very major long-term profit play .

Let me explain …

India's economy expanded at a breezy 9% clip last year. The rate of growth is expected to throttle back to about 8% this year, but that's still excellent, justifying fairly lofty price-earnings ratios in the local stock market. Even so, market valuations there do not now appear excessive; the overall market is trading at about 18 times earnings, which is not particularly high given the economy's growth potential.

As with China, if India can get its house in order - both politically and economically - we're looking at the very real prospect of very rapid growth before that country's standard of living starts to approach that of the West, causing India's rate of growth to slow dramatically.

The bottom line: With 1.1 billion potential Indian consumers, we're looking at a huge potential purchasing power for all kinds of consumer products.

Now, there are some potential pitfalls to be concerned about in the near term.

For instance, the current Indian government, in office since 2004, is a coalition between the Congress Party, which had ruled India for most of the period since independence, though without any great success, and the Communists (who are a pretty mild lot, but are nevertheless pro-government and fairly anti-market).

Although India Prime Minister Manmohan Singh is a moderate, the government as a whole has seen India's economic emergence as an opportunity to fund favorite projects and social programs. For instance, this year's budget proposes an 18% increase in public spending for the 12 months that end next March, over and above the 24% increase in public spending for the year-to-March 2008. Even after several years of rapid growth, the state budget deficit (the federal shortfall plus the local deficit) is around 7% of Gross Domestic Product (GDP). With any kind of downturn at all, that 7% could quickly swell to 10% - a point at which deficits become difficult to finance.

Now there is some hope on the horizon - an election is due in May 2009, at the latest, and the center-right opposition is currently leading in opinion polls. Even so, shrewd investing veterans know better than to rely on that alone for their investment profits.

The other current problem is inflation, right now running at 8% per annum, which means that it's higher than the level of short-term domestic interest rates. Higher commodity and energy prices have affected India as they have other countries: India's position is made more difficult by the poverty that afflicts much of the population. The Indian government, like the good socialists that they are, has seen fit to restrict exports of rice and to subsidize other foods and gasoline (the latter makes no sense socially, since automobiles are largely owned by the middle classes, not the poor). Needless to say, these subsidies and restrictions make the budget deficit worse; and they will pose an additional problem in the future, when they are lifted and consumer prices soar in response.

Having described some of the challenges that India faces, let's be clear on a very key point: No market is perfect. Ironically, if it were, it would be a much less alluring investment opportunity. I mean, let's face it: If India didn't face the problems that we've detailed here, the market would be trading at a hefty 40 times earnings, well above its current multiple of 18.

The underlying truth remains that economic growth has achieved real momentum in India, that any government we can picture will do no more than slow the country's economy incrementally, and that the economics of providing manufacturing and services from a base in India - especially in the era of the Internet - is so compelling from a cost and logistical standpoint that it must inevitably continue to produce huge profits for long-term investors for decades to come.

When it comes to India, it's almost as if the central question no longer is "how much should I invest in India?" but rather "how can I afford not to invest in India?"

Let's take a look at how best to invest in this fast-growing economy.

India Profit Plays

The simplest way to invest in India is via an Exchange Traded Note (ETN), in this case the Barclays IPath India Index ETN ( INP ), whose returns are linked to the Morgan Stanley Capital International India Index (unlike a conventional ETF, an ETN is technically a 30-year note, so it distributes assets to holders at the end of 30 years). In January, INP was trading at about a 15% premium to its net asset value (NAV). But now it's trading very close to its NAV, having slipped backward.

As an alternative you might consider the Morgan Stanley India Investment Fund ( IIF ) or the India Fund ( IFN ), both actively managed funds investing in India, which currently trade at discounts to NAV of 2.0% and 0.3% respectively.

Individual shares to look at would include Infosys Technologies Ltd., ( INFY ) the India-based software giant, which following the fall in the Indian market has declined to a fairly reasonable 19 times earnings, or 16 times next year's earnings.

Another possibility is the pharmaceutical company, Dr. Reddy's Laboratories Ltd. ( RDY ), which, as a major generic drugs manufacturer, can expect to benefit from the expiration of many U.S. pharmaceutical patents in the next five years, and right now carries a P/E ratio of only 15.

Finally, you might consider an India-based automaker that's been in the news a lot recently: Tata Motors Ltd. ( TTM ), which is trading at only 11 times earnings, reflecting the risk involved in a medium-sized company taking on the world automotive industry. In the luxury end of the market, Tata recently bought Jaguar and Land Rover from Ford Motor Co. ( F ), for $2.3 billion. At the economy end of the market, Tata has announced the Nano, a car for the Indian market that will sell for $2,500 - 40% cheaper than any other car on the world market. And that's after Tata had a smash hit with a light truck designed for the India market, as well.

As I've previously articulated in several Money Morning articles , it is highly likely that - years from now - the worldwide center of auto-making will migrate from Detroit to someplace in either China or India, or both, thanks to the combined allure of low costs and potentially huge consumer markets. That means that Tata, as India's largest manufacturer, is likely to be a key player in the global auto market of the future.

So if you know what the ultimate outcome of that global game is going to be, why not deal yourself a winning hand right now, and then sit back and wait for this scenario (and your profits) to play out?

News and Related Story Links :

- Wikipedia : Manmohan Singh .

- Money Morning Economic Analysis : Analysts Cut India's 2008 GDP Forecast; Businesses Still Attracted to the Market .

- Money Morning Economic Forecast Series : Outlook 2008: Five Ways to Profit Even If India's Growth Slows in the New Year .

- Money Morning Investment Travelogue : Snapshot From India: Advice on Stocks, the Rupee, High Tech and Real Estate .

- Money Morning Currency Analysis : Goldman Sachs, India Expert Rahemtulla Both Predict a Stronger Indian Rupee, See Investment Opportunities .

- The New York Times : Tata Nano: The World's Cheapest Car .

- Money Morning Global Investing Analysis : Auto Industry moves to India and China .

- Money Morning News Analysis : Tata Targets Jaguar and Land Rover for Long-Term Returns

- Money Morning News Analysis : Pimp My Ride: Tata Motors Looks to Burnish its Brand .

- Bombay Stock Exchange Ltd : SENSEX: The Barometer of Indian Capital Markets .

By Martin Hutchinson

Contributing Editor

Money Morning/The Money Map Report

©2008 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investment advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Martin Hutchinson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.