The Great QE Taper Caper

Interest-Rates / Quantitative Easing Dec 21, 2013 - 11:11 AM GMTBy: Andy_Sutton

Let’s do a little flashback this week and then look at some things and try to make some sense of what happened yesterday as the Great Taper Caper unfolds. We go back to March 3rd, 2009. Ben Bernanke was in front of Congress. He was allegedly under oath. He was asked directly by Senator Bernie Sanders this important question: “Will you tell the American people to whom you lent $2.2 trillion of their dollars?” Bernanke gave a one-word answer – “No”.

Let’s do a little flashback this week and then look at some things and try to make some sense of what happened yesterday as the Great Taper Caper unfolds. We go back to March 3rd, 2009. Ben Bernanke was in front of Congress. He was allegedly under oath. He was asked directly by Senator Bernie Sanders this important question: “Will you tell the American people to whom you lent $2.2 trillion of their dollars?” Bernanke gave a one-word answer – “No”.

There are a couple of problems with all this obviously, but let’s get the more subtle ones first. This is yet another golden opportunity to point out who really runs the show from a monetary perspective. Those ‘dollars’ aren’t even dollars. That is the first problem. They are ‘not-so-USFed’ notes. They are debt. They don’t belong to the people, rather they hang like a millstone around the collective neck of We the People. Second problem, why was Bernanke allowed to leave that hearing without being charged, at a minimum with obstruction? Because the banksters run the show, that’s why. Those hearings everyone pays such rapt attention to are theater.

I have little doubt there are some in Congress who really would love to do the right thing, but they all know their boundaries – and the rules. You don’t mess with the ‘fed’ regardless of who the puppet is. The funny thing is people want to politicize Bernanke, yet he belongs to both parties and their thinking, which is another indication as to the true state of affairs. Sure, there was some hubbub about getting rid of him the last time around and he received the smallest percentage of the vote of any chairman in history. More theater. It wouldn’t matter if they nominated and confirmed Donald Duck to run the ‘fed’, it would still be a cesspool of iniquity.

There are undoubtedly some other issues in place from 2009, but those are the big ones. Before anyone endeavors to understand what went on yesterday, they must understand the order of things. The USGovt largely exists to enforce the laws that benefit the corporations that put said representatives in power. They are not representatives of the people anymore. Anyone who wants to challenge that should just take a look at the laws that have been passed over the last 30 years or so and see who benefitted the most from those laws. It certainly wasn't We the People.

The Big Taper – What do We Really Know?

Having said all that as a preamble, let’s move on to yesterday. What do we really know about QE and its status? Let’s use the 2009 exchange as a basis for expounding on what might be true. Can we trust these people? They’ve lied about everything from TARP and its purpose to the amount of funny money committed to bailing out the ‘fed’s’ member banks (owners by definition), to the status of Germany’s gold. Yet we’re suddenly supposed to take them at their word when they say they’re going to dial back their money creation by $10 billion a month? I don’t think so.

Remember, this is the outfit that won’t permit an audit because of ‘national security’, among other reasons. No kidding - if people found out what really went on there, we’d probably be at war overnight, if not sooner. So there is really no way to know what is going on. For all we know they might have decided to hike the numbers from $85 billion/month to $100 billion/month and that is what goosed the markets. Here’s what I think is going on:

I think that there are an uncomfortable number of people who are becoming aware of what is really going on. Sure, it doesn’t show right now because it isn’t a huge percentage, but it doesn’t take much as history repeatedly demonstrates. People are starting to wake up to the fact that these asset bubbles are, in fact, creations of the banksters, as we Austrian economists have been pointing out since long before this author was even born. It is starting to click in people’s minds and make some sense.

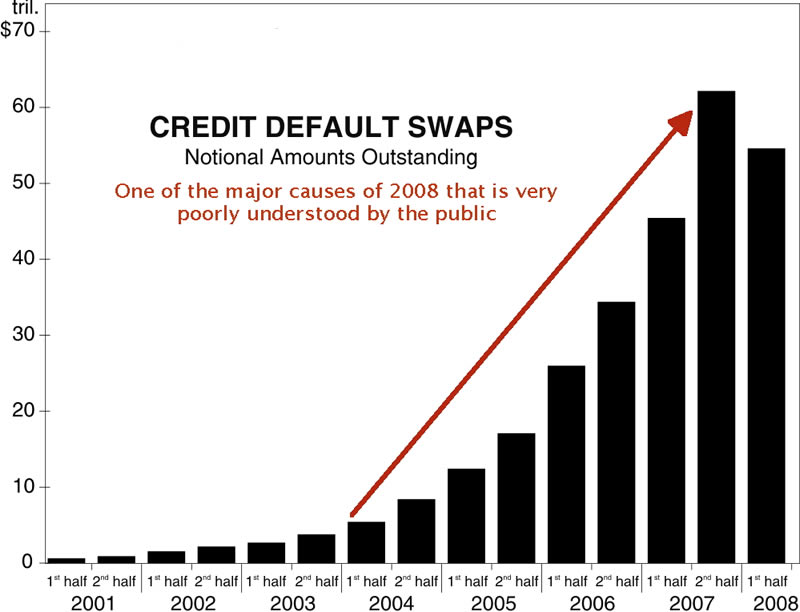

Remember whom the banksters blamed for the 2008 credit crunch? They blamed you and your mortgage. It was your fault the world almost ended. Timeout. There have been real estate bubbles before. There have been people willing to take on more debt than they could handle for a long time now and we never had this kind of problem. No, the fact that the world nearly ended wasn’t your fault. The fact that you had a mortgage wasn’t the cause of the 2008 disaster either. One of the main causes of the ‘crisis’ was the absolutely ludicrous use of credit default swaps (see chart below).

While you might have made a foolish financial decision, that didn’t bring the global financial system to the precipice of ruin as these cretins would have you believe. No, it was their fault. They took your mortgage, packaged it up with a hundred other mortgages, paid off some shill to slap a triple-A rating on it and sold it all over the world. Then, to make matters worse, outfits like AIG wrote trillions in ‘insurance’ against losses from these packaged mortgages. And when they all went bust in a short period of time, suddenly it was ‘Houston, we have a problem’. The problem was leverage. The problem is still leverage. Nothing has changed. Nothing was learned. Yet the biggest ‘consumer protection’ bill of all time did little more than force the banks to add a few more pages of fine print to various credit agreements, stripped you of your status as a depositor, and made you susceptible to Cyprus-like monetary confiscations. For the People, by the People, of the People, right? Wrong. Not anymore. That world is gone.

Getting back to yesterday, this establishment, if you will, needs to be protected. The dollar has value (sarcasm mine) only because people have the confidence that they can walk into a store and exchange it for something of real value. When you really think about it, every time you engage in such a transaction, someone truly is getting something for nothing. Sure, we work for the paper, but the paper is worth nothing. It would be much more honorable to work for a dozen eggs or a bushel of wheat. In similar fashion, the establishment is only able to succeed because people have confidence in it. If that confidence is lost, then the establishment becomes impotent.

So what is the establishment anyway? It is basically the entirety of what is going on right now. It is the political environment, the monetary/economic environment, and the consumer behavior environment all wrapped into one package. In short, it is the status quo. And right now, the status quo is working out masterfully for the banksters and the folks behind the curtain. The status quo/establishment must be protected. That’s what yesterday was all about, in my opinion. They need to show that the markets can live without full bore QE. Even if it only ends up being a one-day pop, the message has already been delivered. Psychologically, it is the first message that resonates the most and has the most impact. The truth about yesterday will come out in time, but it won’t matter so much to the average person. By then the party line will have been delivered and reinforced ad nauseum and it will take a tremendous amount of effort to convince the average person otherwise.

The intent of yesterday’s lame announcement by a perceived lame duck fed chair had, at a minimum, three purposes:

1) Demonstrate that the not-so-USFed is able to cut back on its props without destroying the markets and that the current mania is NOT a bubble. The burst in the major indexes yesterday backed that up as discussed above. Consider the fact that much of the trading volume on a daily basis is done by computers. Roll that together with what happened yesterday. There was a quick sell-off followed by a 350 point run in the Dow. The moves were of similar proportion in the other indexes. The initial read here is that the markets were about to react in the same manner as they did when WSJ reporter Hilsenrath leaked the possibility of a taper back in May, then Bernanke made his faux pas. According to Zerohedge, Hilsenrath cranked out a 700+ word article about the FOMC announcement in exactly three minutes. The markets, particularly on the bond side, tanked. The same move had started yesterday, and then suddenly it was lights out. This reeks of Plunge team action. No doubt the big shots made some serious money between 2 and 4 PM on Wednesday.

2) Reinforce the notion that the not-so-USFed is open to more laissez-faire policy. This is utter nonsense, because nobody even bothered to mention rates, which weren’t (and won’t be) changed. We don’t know a lot about Janet Yellen, but we know she’s a big time dove when it comes to monetary policy. She’s never seen a prop, an intervention, or an interference that she’s not loved. She will NOT be in charge just like the ‘Bernank’ was never in charge, but having a compliant CEO who is willing to go along with the Board of Directors (and in this case, the shareholders) is always a good thing. And when you’re pulling off a heist of epochal proportions, you need to have a mouthpiece that really believes the rubbish he or she spews forth.

3) Push forth the concept that the USEconomy is strong enough to stand on its own. There are not many things in life that are certain, but the fact that the USEconomy is hooked on debt, government assistance, and economic interference is probably one of them. I will say categorically that if we see a boost in the economy after this alleged pullback in QE that either the pullback was a fabrication and, in truth, the amount was likely increased, or that the economic statistics are being further cooked. Perhaps a little (or a lot) of both.

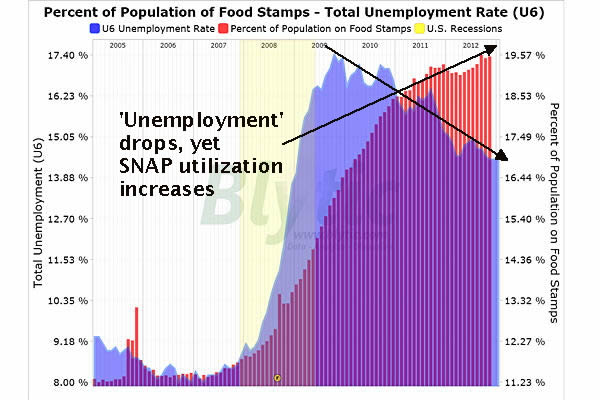

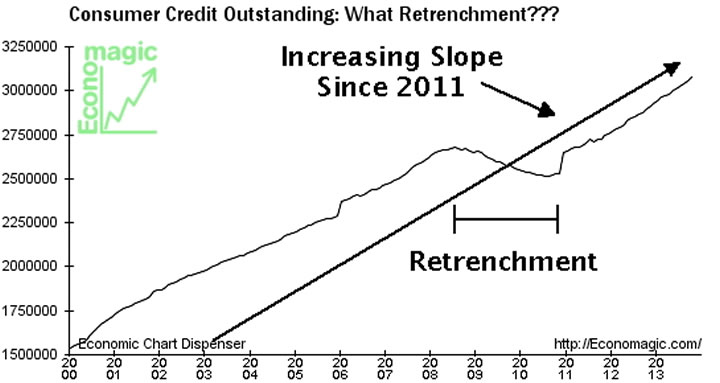

Supporting this assertion is the growing reliance on government assistance and the large chunk of flesh the new Stasi healthcare regulations are going to take from the average American over the next year or two. Add to that the fact that the ‘jobs’ we’re creating are generally of a below subsistence level nature. We’re going to have more people looking for help, not less. The economy, in the aggregate, is becoming more dependent on these props, not less. That is the dirty secret the establishment needs hidden. Even among those considered more prosperous, the accumulation of high interest rate debt is growing at an alarming rate.

Topping it all off is the fact that collateralized loan obligations are back – big time. The article skims over the risk and is largely of the type that says ‘move along, there is nothing to see here’, but the fact that these products are back, coupled with leverage ratios that are greater than 2007 all point in one direction – another blowout fracture of the banking system is in the cards. But never fear, they’ve got the ultimate backstop this time – you.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.