Inflation in the United States - Keeping it Real!

Economics / Inflation Dec 18, 2013 - 05:25 AM GMTBy: James_Quinn

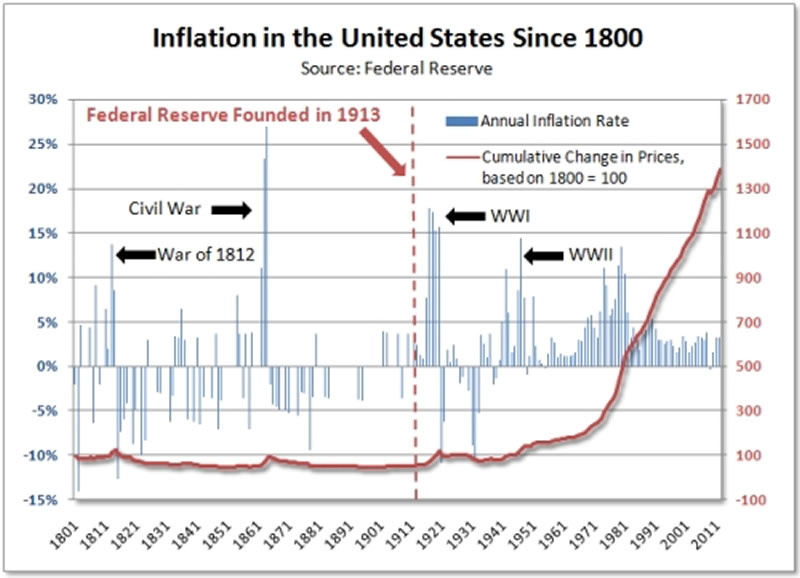

“One only needs to reflect on the dramatic decline in the value of the dollar that has taken place since the Fed was established in 1913. The goods and services you could buy for $1.00 in 1913 now cost nearly $21.00. Another way to look at this is from the perspective of the purchasing power of the dollar itself. It has fallen to less than $0.05 of its 1913 value. We might say that the government and its banking cartel have together stolen $0.95 of every dollar as they have pursued a relentlessly inflationary policy.” - Ron Paul – End the Fed

“One only needs to reflect on the dramatic decline in the value of the dollar that has taken place since the Fed was established in 1913. The goods and services you could buy for $1.00 in 1913 now cost nearly $21.00. Another way to look at this is from the perspective of the purchasing power of the dollar itself. It has fallen to less than $0.05 of its 1913 value. We might say that the government and its banking cartel have together stolen $0.95 of every dollar as they have pursued a relentlessly inflationary policy.” - Ron Paul – End the Fed

The BLS reported the CPI this morning. They tell me that inflation is well contained and has only risen by 1.2% in the past twelve months. Our beloved Federal Reserve chairman is worried inflation is too low. It is fascinating that the only people worried about inflation being too low are Ivy League educated economists and bankers whose wealth depends upon the middle class sinking further into poverty.

As a person who lives in the real world, I can honestly say I like it when the things I need to buy cost less today than they did last year. When did inflation become a good thing for the average American? Our country was somehow able to grow from a fledgling new country to a world power in just over a century while experiencing mild deflation, except during times of war. The fallacy that inflation is beneficial to the common man has been peddled by bankers since 1971 when Nixon and his cronies closed the gold window and unleashed the inflationary boogeyman in the form of feckless politicians, captured Keynesian academics, and greedy soulless bankers.

It is no coincidence inflation accelerated the moment politicians, academics and bankers were unleashed to spend your money at will in order to obtain votes, Nobel prizes in economics, and ill-gotten obscene levels of wealth. David Stockman described Nixon’s dreadful sellout of the American people in his brilliant new book:

“Nixon’s estimable free market advisors who gathered at the Camp David weekend were to an astonishing degree clueless as to the consequences of their recommendation to close the gold window and float the dollar. In their wildest imaginations they did not foresee that this would unhinge the monetary and financial nervous system of capitalism. They had no premonition at all that it would pave the way for a forty-year storm of financialization and a debt-besotted symbiosis between central bankers possessed by delusions of grandeur and private gamblers intoxicated with visions of delirious wealth.” -David Stockman – The Great Deformation: The Corruption of Capitalism in America

The USD has lost 83% of its purchasing power since 1971. The moment Nixon began playing politics with the USD and bullied the Federal Reserve Chairman into pumping up the money supply prior to the 1972 election, the inflation genie got out of the bottle and led to the miserable stagflation of the 1970′s. It took extreme measures by Paul Volcker to get it back under control in the early 1980′s. Since Volcker we’ve had nothing but academics and toadies who have chosen to change the definition of inflation in order to mislead the average American regarding how badly they are getting screwed. Every refinement, tweak, adjustment, or revision to the calculation of CPI has been designed to produce a lower figure. Why control inflation when you can just change the calculation to suit your purposes?

Over the proceeding decades, the BLS has sliced and diced the CPI in such a way that they can make it say whatever TPTB want it to say. They need to keep the mushrooms (you) in the dark regarding your standard of living deteriorating, while the beneficiaries of inflation (bankers, politicians) see their standard of living soaring. They have made hedonistic “adjustments”, quality “adjustments”, substitution “adjustments” and geometric weighting “adjustments”, all with the sole purpose to reduce the level reported to the American people on a monthly basis.

CPI was supposed to measure a common basket of goods and services that Americans needed to purchase in order to live their lives. If the price for this basket rose, you had inflation. If the price for this basket fell, you had deflation. The politicians, academics, bankers and government bureaucrats decided if the price of steak went up by 10%, you would switch to chicken, therefore the price of steak did not go up by 10%. They decided if the price of a new car went up 5%, but you now had heated seats, the price didn’t really go up 5%. They now want to change to a chained CPI, which will further depress the reported figure. CPI no longer represents the increase in price of goods and services you need to live your day to day life.

Even the composition of the index doesn’t match the true cost picture for the average American. Somehow they bury the energy component within multiple categories and have the gall to argue that energy costs only comprise 9.6% of the average American expense budget. Tell that to the suburban two worker family that drives 30,000 miles per year and has to heat and cool a 2,000 square foot home. I doubt that too many families only spend 7% of their money on medical care. Housing accounts for 41% of the CPI calculation, but it is again a made up calculation called owner’s equivalent rent. Only an Ivy League economist could explain the calculation. The fact that home prices have risen by 12%, rents have risen by 4% and mortgage rates have risen from 3.25% to 4.5% in the last year somehow results in a 2.4% annual rate of inflation for housing.

If you have the feeling your standard of living has been falling for the last few decades even though your owners tell you the economy is expanding, inflation is contained, unemployment is falling, the stock market is rising, and consumer spending is growing, then you might be smarter than a 5th grader. The financial elite ruling class are counting on the dreadful public education system, along with their mainstream corporate media propaganda arms, to keep the techno-distracted math challenged masses from understanding how the financialization of the country has resulted in their demise.

Being a skeptical sort, I decided to verify the accuracy of the CPI propaganda issued by the Bureau of Lies and Scams. The combination of the internet and memories from my youth provide a powerful and accurate assessment about the truthfulness of our government. I decided to create a chart of goods and services that average Americans have spent their hard earned wages on for decades. In a matter of minutes I was able to obtain prices from 1971 for various items common to most people. I was eight years old in 1971, being raised in a middle class one earner household on the salary of a truck driver. The chart below provides the proof the government CPI data is a bad joke and the American people are the butt of that joke.

| Category | 1971 | 2013 | % Change | |

| Average Price of New Car | $3,470 | $31,252 | 800.6% | |

| Average Price of New Home | $26,000 | $245,800 | 845.4% | |

| Gallon of Gasoline | $0.36 | $3.50 | 872.2% | |

| Natural Gas | $0.35 | $4.00 | 1042.9% | |

| Loaf of Bread | $0.20 | $2.20 | 1000.0% | |

| Sirloin Steak per pound | $1.19 | $7.00 | 488.2% | |

| Dozen Eggs | $0.25 | $1.90 | 660.0% | |

| Box of cereal 12 oz | $0.36 | $3.50 | 872.2% | |

| Pack of Cigarettes | $0.32 | $6.00 | 1775.0% | |

| College Tuition – Private | $1,832 | $30,094 | 1542.7% | |

| Monthly Rent | $150 | $1,073 | 615.3% | |

| Baseball ticket – Phila | $2 | $23 | 1050.0% | |

| Movie ticket | $1.50 | $9.00 | 500.0% | |

| Maximum Social Security Tax | $406 | $8,950 | 2104.4% | |

| Median Household Income | $9,028 | $51,017 | 465.1% | |

| Median wage per worker | $6,497 | $27,519 | 323.6% | |

| Average Hourly Earnings | $3.60 | $20.31 | 464.2% | |

| CPI | 40.5 | 232.0 | 472.8% | |

| Consumer Credit Outstanding (tril.) | $0.14 | $3.07 | 2092.9% | |

| Mortgage Debt Outstanding (tril.) | $0.51 | $13.18 | 2484.3% | |

The BLS tells me the CPI has risen by 473% since 1971. The very same agency also tells me average hourly earnings have risen by 464% since 1971. This means the average worker is earning less than they did in 1971 in real terms. The median wage per worker has lagged CPI dramatically, as the averages have been skewed by those making outrageous compensation in the financial world. Median household income has barely kept pace with inflation even though households were forced to send both parents into the workforce, with the expected consequences of higher divorce rates and children left to fend for themselves or be raised by strangers.

By the government’s own measures, the average American’s standard of living has fallen since 1971. But, we also know the government has been manipulating the CPI figure lower since the mid-1980′s. After examining the true cost increases for housing, transportation, energy, food, education and entertainment, you would have to be brain dead or an Ivy League economist to believe inflation since 1971 has only been 473%. If home prices and car prices are 800% higher, while the energy needed to power and heat them are 900% to 1,000% higher, and the cost of food is 500% to 1,000% higher, how could the CPI only be 473% higher?

There are far more people going to college today than in 1971. With college tuition 1,500% higher, how can this not be reflected in the CPI? It certainly isn’t because the education is better. Statistics show the uneducated poor are more likely to smoke. Lucky for them, cigarette prices have risen at a rate of 4 times CPI due to the government taxing the crap out of them to fund their various taxpayer boondoggles. Inflation always hurts the poor and enriches the peddlers of debt.

My dad would take me to the brand new Veterans Stadium (built for $50 million in 1971) to see the Phillies in the early 1970′s. He paid $2.00 for a general admission seat and kids got in for 50 cents. We would buy a bag of soft pretzels outside the stadium and bring them into the park. We’d get a hot dog and soda for another $1. The entire outing to see a baseball game was about $5. Today, if I wanted to bring my family of five to a Phillies game at Citizen Bank Park (built for $458 million and paid for by the taxpayer) the lowest cost for the outing would be about $200. In 1971, you could spend a vacation week at the Jersey shore for $200. Now it gets you 3 hours of watching spoiled millionaires playing a child’s game while sitting with a bunch of foul mouthed drunks.

I also found it fascinating that the most regressive tax on earth, the Social Security tax, which hammers the poor and middle class while leaving the rich virtually unscathed has gone up by 2,100% since 1971. The rate in 1971 was 5.2% and the maximum salary level was $7,800. Today, the rate is 7.65% and the maximum level is $113,700. This increased cost for every middle class American is not factored into the inflation figures. Why would the government need to increase the maximum taxable wages by 1,500% when wages have gone up by less than 500%? The hard working truck driver bears the full impact, while Jamie Dimon not so much.

So now that I’ve proved beyond a shadow of a doubt the prices of everything we need to live have far outpaced our wages and the patently false drivel published by the BLS and parroted by the MSM, what are the implications? Well that is an easy one and is summed up by the last two entries in the chart. The average American has been lured into $16 trillion of debt over the last forty years in a pathetic attempt to keep up with the Joneses. Consumer credit (credit cards, auto loans, student loans) has gone up by 2,100% and mortgage debt has gone up by 2,500%. The American people have been sold a false lifestyle dream built on easy credit by evil bankers and Madison Avenue PR maggots.

There are those who would blame the people who have chosen to live far beyond their means. They have a point. The American people certainly haven’t shown a penchant for delayed gratification, saving for the future, or consuming less than they produce. But it takes two to tango and the lead in this dance of debt has been and continues to be the Federal Reserve and their Wall Street bank owners. It’s always reasonable to ask – Who benefits? – when trying to figure out why something has happened over time. Did the American people benefit by increasing the debt owed to Wall Street banks from $650 billion in 1971 to $16.25 trillion today? I don’t think so, based upon the visible deterioration I am witnessing in my suburban paradise.

The financialization of America; where Wall Street con artists,shysters and swindlers rake in billions for shuffling paper and making risky casino bets; mega-corporations ship blue collar middle class jobs to Asia in an all out effort to increase quarterly profits; politicians spend future generations into the poor house in order to get re-elected; and the Federal Reserve purposefully creates monetary inflation to prop up the corrupt system; has systematically destroyed the working middle class and created generations of debt slaves. The American people have been foolish, infantile, and easily duped. But it is clear to me who the real culprits in our long downward spiral have been. Lord Acton stated the obvious, many years ago:

“The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks.” ― John Emerich Edward Dalberg-Acton

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2013 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.