U.S. Outstanding Credit Vs GDP

Stock-Markets / Derivatives Dec 17, 2013 - 07:33 PM GMTBy: John_Mauldin

By Grant Williams

By Grant Williams

On January 29, 1845, the New York Evening Mirror published a poem that would go on to be one of the most celebrated narrative poems ever penned.

It depicted a tragic romantic's desperate descent into madness over the loss of his love; and it made its author, Edgar Allan Poe, one of the most feted poets of his time.

The poem was entitled "The Raven," and its star was an ominous black bird that visits an unnamed narrator who is lamenting the loss of his true love, Lenore. (We'll get back to Bart Simpson dressed as the Raven later on.)

Today, the sad tale would be splashed on the cover of a million tabloid magazines with a title such as "Lenore Dumps Narrator," "I'll Never Find True Love Again — Narrator Spills on Tragic Split With Lenore," or even "Kanye & Lenore — It's Love! But Don't Tell The Narrator." But 1845 was the very epitome of "old school," and so the poor, bereft narrator's tale was shared with the world through a complex rhyme and metering scheme that was popularized by Elizabeth Barrett Browning in her poem "Lady Geraldine's Courtship."

"POETRY NERD!"

Quiet at the back or I'll have you removed.

Now, as the narrator slips slowly, desperately into the pit of insanity, he discovers that the raven, with the license afforded the poet, can talk; and so he sets about asking the mysterious bird for guidance in navigating his torment:

Then this ebony bird beguiling my sad fancy into smiling, By the grave and stern decorum of the countenance it wore, "Though thy head be shorn and shaven, thou," I said, "art sure no craven, Ghastly grim and ancient Raven wandering from the Nightly shore — Tell me what thy lordly name is on the Night's Plutonian shore!" Quoth the Raven "Nevermore."

Unfortunately for the narrator, the raven's vocabulary is limited to the single word nevermore, which, in a rare moment of clarity, the narrator reasons can only have been learned from an unhappy former owner:

Startled at the stillness broken by reply so aptly spoken, "Doubtless," said I, "what it utters is its only stock and store Caught from some unhappy master whom unmerciful Disaster Followed fast and followed faster till his songs one burden bore — Till the dirges of his Hope that melancholy burden bore Of 'Never — nevermore'."

It's at this point that the narrator demonstrates beyond any last vestige of remaining doubt that he is, in fact, completely insane when, knowing full well that there is only one possible answer to any question he might pose his strange visitor, he pulls up a "cushioned seat" in front of the bird and proceeds to question him:

But the Raven still beguiling my sad fancy into smiling, Straight I wheeled a cushioned seat in front of bird, and bust and door; Then, upon the velvet sinking, I betook myself to linking Fancy unto fancy, thinking what this ominous bird of yore — What this grim, ungainly, ghastly, gaunt, and ominous bird of yore Meant in croaking "Nevermore."

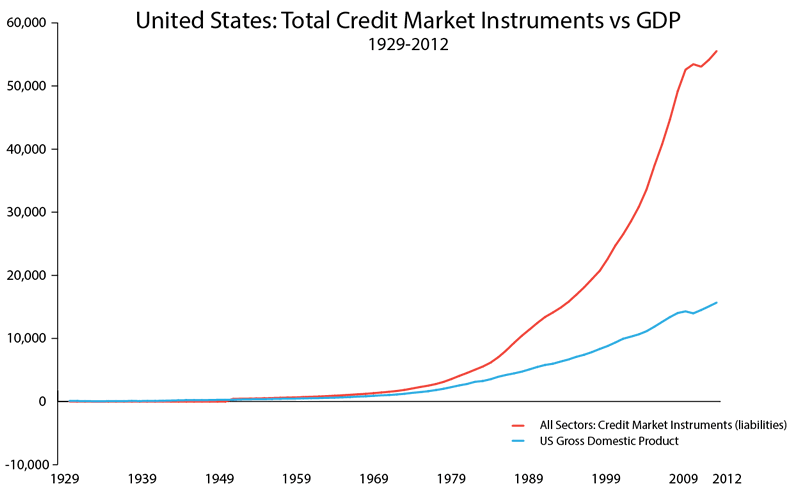

So, with the vision firmly planted in your mind's eye of a man completely out of touch with reality, seeking wisdom from a mysterious talking bird — knowing that there is only one response, no matter the question — Dear Reader, allow me to present to you a chart.

It is one I have used before, but its importance is enormous, and it will form the foundation of this week's discussion (alongside a few others that break it down into its constituent parts).

Ladies and gentlemen, I give you (drumroll please) total outstanding credit versus GDP in the United States from 1929 to 2012:

Source: St. Louis Fed

This one chart shows exactly WHY we are where we are, folks.

From the moment Richard Nixon toppled the US dollar from its golden foundation and ushered in the era of pure fiat money (oxymoron though that may be) on August 15, 1971, there has been a ubiquitous and dangerous synonym for "growth": credit.

The world embarked upon a multi-decade credit-fueled binge and claimed the results as growth.

Fanciful.

Floated ever higher on a cushion of credit that has expanded exponentially, as you can see. (The expansion of true growth would have been largely linear — though one can only speculate as to the trajectory of that GDP line had so much credit NOT been extended.) The world has congratulated itself on its "outperformance," when the truth is that bills have been run up relentlessly, with only the occasional hiccup along the way (each of which has manifested itself as a violent reaction to the over-extension of cheap money.

Along the way, the cost of that cheap money has drifted consistently lower from its peak in 1980 — and the falloff was needed in order that we be able to keep squeezing juice from an increasingly manky-looking lemon….To continue reading this article from Things That Make You Go Hmmm… – a free weekly newsletter by Grant Williams, a highly respected financial expert and current portfolio and strategy advisor at Vulpes Investment Management in Singapore – please click here.

Like Outside the Box?

Sign up today and get each new issue delivered free to your inbox.

It's your opportunity to get the news John Mauldin thinks matters most to your finances.

© 2013 Mauldin Economics. All Rights Reserved.

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.MauldinEconomics.com.

Please write to subscribers@mauldineconomics.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.MauldinEconomics.com.

To subscribe to John Mauldin's e-letter, please click here: http://www.mauldineconomics.com/subscribe

To change your email address, please click here: http://www.mauldineconomics.com/change-address

Outside the Box and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA, SIPC, through which securities may be offered . MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at http://www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, and none is expected to develop.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.