Sick German Banks the Monster European Banking Crisis of 2014

Stock-Markets / Credit Crisis 2014 Dec 17, 2013 - 10:03 AM GMTBy: John_Mauldin

(Special note from John: The letter is later this week, and I apologize. The rule is that you don't want to know about the storms I encountered, just whether I got the ship to harbor. So, back in the harbor, here is the letter, which will give you a head's-up on a brewing banking crisis in Europe.)

(Special note from John: The letter is later this week, and I apologize. The rule is that you don't want to know about the storms I encountered, just whether I got the ship to harbor. So, back in the harbor, here is the letter, which will give you a head's-up on a brewing banking crisis in Europe.)

This week, Geert Wilders and his Party for Freedom in the Netherlands and Marine Le Pen of the Front National (FN) of France held a press conference in The Hague to announce that they will be cooperating in the elections for the European Parliament next spring and hope to form a new eurosceptic bloc. Their aim, as Mr. Wilders put it, is to "fight this monster called Europe," while Ms. Le Pen spoke of a system that "has enslaved our various peoples." They want to end the common currency, remove the authority of Brussels over national budgets, and undo the project of integration driven with so much idealism by two generations of European politicians. (My thought about Marine Le Pen after looking at her policies is that if Marine Le Pen is the answer for France, they are asking the wrong question.)

For now, Le Pen and Wilders are in a decided, if growing, minority (think Beppe Grillo, who got 25% in Italy in the last election). But as the graphic below suggests, the stitching that is holding the Frankenstein of Europe together seems to be getting a little frayed. And my new worry is that the real monster, one likely to pop many more of the tenuous stitches that hold things together, could be lurking in German banks. This week's letter explores a problem as "hidden" as subprime was back in 2006. Not as big, to be sure, but it might not need to be big to tug too hard the frayed threads that hold Europe together. (Note: this week's letter will print out longer than usual due to the large number of graphs and pictures.)

But first and quickly, we have finalized the dates for next year's Strategic Investment Conference. Mark your calendar for May 13-16. We are adding half a day so we can bring you a few more must-hear speakers. In addition to our always killer lineup of investment and economics thought leaders, I want to add some technology and politics. The significant difference about this conference is that there are no "B list" speakers. Everyone is a headliner. No one pays to get to speak or promote their deal. When we started the conference 11 years ago, my one rule was that we would invite speakers that I wanted to hear and create a conference that I would want to go to.

With my co-hosts Altegris Investments, we have done that and more. Attendees typically rate this conference as the best they attend. This year we have moved to San Diego, where we can have more space. We will still keep it small enough so that you can meet the speakers, as well as a room full of extremely interesting fellow attendees. You can sign up now and book your rooms by going to http://www.altegris.com/sic. Don't procrastinate. Mark down the dates and plan your time accordingly.

"But where are you out of consensus?" came the question. I had just spent a few minutes outlining my view of the world to a group of serious money managers here in Geneva, highlighting some of the risks and opportunities I see. The gentleman's question made me realize that for the short-term, at least, I am all too sanguine for my personal taste. I have never thought of myself as one of those consensus guys. But when you consider that Japan is continuing down its path to starting a global currency war, with a currency that will drop at least in half from where it is now (plunging Japan into Abe-geddon); that China is launching its most serious economic overhaul in 20-30 years; that the US is still careening toward its day of reckoning with entitlement spending while dealing with the fall-out from taper tantrums in emerging markets; and that Europe is steering a course straight into deflation – the lot leaving us with Disaster A, Disaster B, or Disa ster C as the consensus choice; then yes, I suppose I am a consensus guy, of sorts. But those are all worries that will come to a head later next year or the year after, not in the next few months or weeks, which is where most traders live. The trader who quizzed me wanted to know what was going to affect his book this week!

We seem to occupy a world where we are all somewhat uncomfortable. The problems are all so apparent; but somehow we are compelled to take risks anyway, hoping that the risks we take are properly managed or that we can exit at the propitious moment. The game seems to be moving along, absent another major shock to the system. It's not quite party like it's 2006, because the level of complacency is nowhere near the same; but we do seem headed down the same risk path, even though it scares us. Which means that it might take somewhat less than a subprime debacle and banking shock to trigger a crisis, since no one wants to be exposed when the next crisis happens. The majority of market players appear to believe that another crisis might materialize, but in the meantime you have to dance while the music is playing. Fifty Shades of Chuck Prince.

So, as investors and money managers, we must be on shock alert. Where will the next one come from? By definition, a shock is a surprise to the markets, something that few people recognize until it becomes too big to ignore. Ben Bernanke achieved a degree of infamy for saying that the subprime crisis would be contained, even as some of us were shouting that losses would be in the hundreds of billions (what optimists we were!). And then came the shock that created the biggest global economic crisis since the Great Depression.

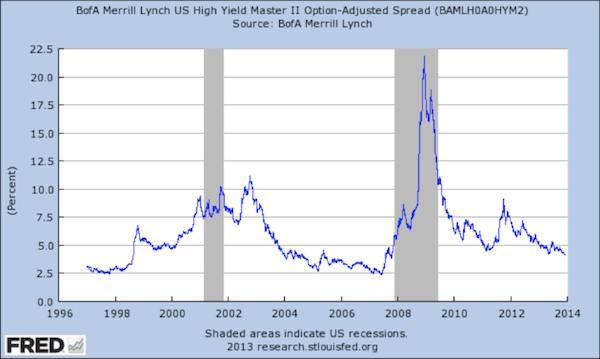

But an almost desperate reach for yield and shouldering of risk are clearly in evidence. Junk bond issuance is over 2.5 times what it was in 2006 and twice as high as a percentage of total corporate bond issuance. Leveraged loans are back to all-time highs, even as credit spreads continue to fall (see graph).

Collateralized loan obligations (CLOs) are close to all-time highs after almost disappearing in 2009. And subprime auto-asset-backed paper is projected to set a new record in 2014. Party on, Garth!

But if you ask the participants in those very markets, and I do, if there is any sign that the reach for yield is easing, the answer is generally "Not yet." After 2008, everyone remains nervous; but when the analysis is done, enough buyers conclude that the future will be somewhat like the recent past. Although no one I talk to believes that in 2014 we will see another year in the stock market like the current one, still, the consensus outlook is rather sanguine. But I talk to more bulls than you might think. Last night in Geneva David Zervos was arguing (till rather late in the night, for me at least) his familiar spoos and blues with me (long S&P 500, long eurodollar). He is ready to double down on QE. Our hosts bought an excellent if outrageously expensive dinner (for the record, there is no other kind of meal in Geneva – can you believe $12 Diet Cokes?), and it was only polite to listen. And the trade has been right.

But for how long? Central banks are still going to be easy. But markets can be characterized as fully valued, at best, especially since there have been more earnings warnings this last quarter than at any time in the recent past. While the conditions are not quite the same as in 2006-07, we are getting a little frothy. So is it 2005, so that we can enjoy the ride into late 2006 and then look for an exit strategy? I would argue that the markets actually need a "shock" of some kind. And in addition to the "consensus-view" shocks mentioned above, I see one especially big, nasty lion lurking in the grass. In the form of German banks.

The Sick (German) Banks of Europe

Quick: I say "German banks," and what's the first thing that comes to your mind? The Bundesbank? Staid, no-nonsense central banking? The Bundesbank is all about maintaining the price of money – forget QE. Deutschebank? Big, German – must be stable and low-risk. The fact that southern Europeans are opening accounts left and right in DB must mean that DB is lower-risk than the local wild guys. Except that they have the largest derivatives portfolio, at $70 trillion (but don't worry because it all nets out, sort of, and of course there is no counter-party risk!), and they are the most highly leveraged bank in Europe (at 60:1 in the last tests – not a misprint), which might give you pause. Although their CEO argues that their leverage doesn't matter. And keeps a straight face. Just saying…

If something happens to DB, they are, in all likelihood, Too Big To Save, even for Germany. But Deutschebank is not my focus here today. It is their much smaller brethren, Too small to be called siblings, actually. More like first cousins twice removed. But there are a lot of them, and they all piled into some very interesting and, as it turns out, very questionable trades. And the story begins with the American consumer.

This Christmas, we will all engage, as will much of the world, in an orgy of gift giving. (I helpfully offer a few ideas of my own at the end of the letter.) The iPads and Xbox Ones and GI Joes with the Kung-Fu Grip (gratuitous esoteric movie reference) will be flying off the shelves. But the one thing that ties all those gifts together is The Box, the humble container unit, the TEU, which allows the world to transport all those items ever more cheaply. That story is resoundingly told in a book that Bill Gates featured in his Best Reads for 2013, simply entitled The Box. You can read a great review here. It turns out that the shipping container was created in the '50s by a force-of-nature entrepreneur who fought governments and regulators (who typically tried to protect unions rather than help con sumers) to bring the idea to market. It finally took off when the military decided it was the best way to ship material to the troops in Vietnam. It is one of those things that make sense and would have happened anyway, but as often happens, military spending drove the ramp-up.

The container was not without controversy. Longshoreman unions fought it aggressively, as containers meant fewer high-paying jobs. But The Box also meant far cheaper transportation of goods, and so it helped boost international trade. Now it is hard to imagine a world without containers. And even though the container business started in the US, there is not one US firm in the top 18 container shipping companies. The business is dominated by European and Asian firms.

And container ships were profitable. Oh my, fortunes were built. And they were so successful that a few German bankers looked at the easy money made by US bankers securitizing and packaging mortgages and decided they could do the same with ship financing. I know it is hard to believe, but the German government decided to create pass-through tax vehicles that gave serious tax preference to high-tax-rate investors for all sorts of things, including movies (such cinematic monuments as Terminator 3, I Robot, and the forgettable Stallone flick Get Carter were financed with German "tax shelters"); but my research has so far unearthed nothing to equal the German passion for financing ships. Seriously, would any US government entity give tax breaks to a favored industry? Would a Canadian or Australian or [insert your favorite country here] government? Such things are done by many governements, of course. Here we may apply Mauldin's Rule (stolen from someone else, I am sure): Any seriously out-of-whack financial transaction requires government involvement (generally in the form of some market-distorting law).

Cargo ships, especially container ships, were serious cash machines for long-term money. Buy the ship with some leverage, put it to work, and watch the cash roll in. The Greeks were especially good at this, but the Germans and Scandinavians caught on quick. The Germans went everyone one better and allowed small high-net-worth investors to put their money into funds that financed these ships. At one point, I am told, German banks might have been financing 50% of the world's cargo ships. (They control at least 40% of the world's container ship market today.) Anyone familiar with limited partnerships in the US in the late '70s and early '80s knows how this story ends for the investors.

I came across this story from the inside, as a business partner of mine is in the shipping business; but he owns and operates a special type of ship: massive tugboats that move ocean drilling-rig platforms, and those are still in healthy demand. But his original financing many years ago was from Germany.

It turns out that if a little leverage makes a deal look good, then a lot makes it look even better. In 2007, ships were financed at 75% leverage (on average). It looks like 2008 vintages were financed in the 90% range! (Data is from a presentation I was sent, done by Dr. Klaus Stoltenberg of NordLB.)

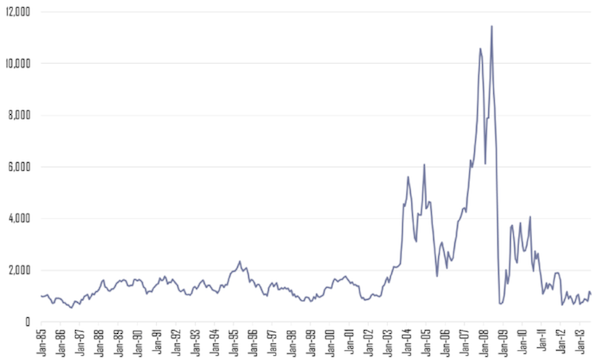

And why not? Baltic Dry shipping rates were going sky-high! Shipping rates were up over five times from their lows only a few years earlier. Think of buying a commercial building, and suddenly the rents you're getting are five times higher. In the low-yield world of 2007, would you want some more of that?

Baltic Dry Index Shipping Rates Since 1985:

Then the bottom fell out in the credit crisis as international trade financial banking collapsed, shipping came almost to a standstill, and ships were barely able to cover their operating costs, there was so little cargo. Remember the pictures of hundreds if not thousands of ships moored in the South Pacific islands, unable to find cargo? Story here. I wrote a few paragraphs about them at the time.

New shipbuilding quickly fell as well, with stories in the press of no new ship orders in 2009. But governments wanted to make sure workers had jobs, so subsidies and new ship designs soon came into play. Making a long and fascinating dinner story short, it turns out that you can now buy a container ship that sold for $40 million in 2008 for $23 million today. That, of course, is a significant operating-cost advantage for new ships. But new designs also make new ships 25-30% more fuel-efficient! A ship is leased for a certain amount per day to cover operating expenses. Fuel costs are extra. Depending on the size of the ship, the savings can be up to $7,000 a day, money that goes directly to the shipper. A ship that is 60% of the price and costs significantly less to operate can make money at far lower shipping prices, and not surprisingly gets more of the shipping market share.

The result is that many container ships that were built pre-2009 are now simply uneconomical to operate. Depending on the ship, some cannot even generate enough income to cover their operating costs. (Please note that not all pre-2009 ships have issues; but a lot, if not most, of them do.) So those ships are clearly upside down on their loans. I was telling this story last week, and one trader said, "So the investors had to put in more money?" Good question.

As it turns out, the German banks, for the most part, actually make the capital guarantee part of their loan commitment. The investors lose 100% of their money but are able to walk away, kind of like defaulting US homeowners can in most states. The banks take the loss. Sure, they own the ships, but most are basically so much scrap metal, destined for dismantling in India, Pakistan, or Bangladesh.

(Sidebar: so many ships are being scrapped because they are uneconomical that the scrapping business has exploded. One source suggests there are less than three years worth of ships that are likely to be scrapped. But the number of new, larger ships being built is impressive, which suggests that the supply destined for scrapping will keep growing, at least for the time being.)

At the top of the market, Europe financed 75% of the ships being built, and German banks financed 75% of those, or maybe as much as 50% of the world’s total. Moody's gave us an estimate this week that German banks will face credit losses of $22 billion in 2014. "Germany's eight major ship financiers have lent a total of 105 billion euros to the sector, a fifth of which are categorized as non-performing," Moody's said in the report. "We expect the extended downward shipping cycle to cause rising problem loans in the shipping sector during 2013-14, requiring German banks to increase their loan-loss provisions. This will challenge their earnings power."

Whether the losses can be "contained" (to borrow a word from Chairman Bernanke) depends on what new rules are implemented by the new European banking authority next year. Only 30% of the losses have been accounted for with loan-loss provisions. That is bad enough; but if what I am being told is true, the losses could soar much higher. German banks are still financing ships that are not making debt payments, rolling over principal and more in an effort to avoid having to write down losses. Further credit is being extended to shipping companies in the hope that they can work out the problems, as the banks do not want to go into the ship-operating business. Over 100 German ship funds have already shut down as the long-simmering crisis in global container shipping finally comes to a rolling boil. A further 800 funds are threatened with insolvency, according to consultants TPW in Hamburg.

How bad is it? Banks are taking control of ships, marking them down to a fraction of their cost, and then financing 100% of the cost of selling them to Greek shipping companies. Can we say irony? Greek shipping families basically operate tax-free (a point I wrote about some four years ago) and take a very long-term and conservative view. They sold ships to the Germans at the top of the market for very nice premiums and are now buying them back at significant discounts.

The critical point is that a "European bank health check may trigger additional provisioning as loans benefiting from remediation measures – such as covenant waivers or an extension of repayment schedules – may be re-classified as problem loans under the new standard of the European Banking Authority...." (Reuters)

As Evans Ambrose-Pritchards wrote in The Telegraph last year:

"Most of the 20 top banks for the shipping industry have stopped all funding…. Shipping is the biggest casualty of the new regulations. All the banks are reducing their portfolios, using any breach of covenant to get out of contracts. The second-hand ship market has broken down," said Mr Smith…. Both bulk ships and tankers are trading at lower levels today than during the worst moments of the 2008-09 crisis. The odd twist is that Greek shippers are the ones quietly snapping up bargains from distressed German companies. "The Greeks are sitting on a pile of cash. They are in their own special cocoon completely removed from Greece's political troubles," said Dimitris Morochartzis from Lloyd's List Intelligence.

"They played their cards really well during the boom, selling ships for a profit at the top of cycle. They are now buying them back for a fraction of the price," he said.... Giorgos Xiradakis from consultants XRTC said Greek firms are teaming up with Chinese banks. Chinese premier Wen Jiabao pledged $5bn in loans to the Greek shipping industry two years ago, part of a twin-headed plan to gain a stronger foothold in the EU market and to provide vendor financing for the Yangtze shipbuilding industry – currently in dire straits…. German shipping experts say that two-thirds of the country's marine fleet is in financial distress. If the crisis drags on much longer, the Greeks may leapfrog ahead to become world leaders in container shipping. The irony of prudent Greeks cleaning up after a reckless debt spree by the Germans is lost on nobody.

One of the rules of investing is that there is never just one cockroach. S&P noted this fall that Europe's banks still had a funding gap of €1.3 trillion at the end of 2012; and most of this has yet to be funded or loan-loss provisions made, so the financial system is not out of the woods by any means – no matter what the complacency of consensus indicates. Shipping is just one business segment of German banks, but given the present economics of shipping, losses are likely to be much higher than forecast. And if the banks have hidden the actual extent of their losses in those other segments, as they appear to have done in the shipping arena? Inquiring minds wonder about problems in the other business groups of these banks. The shortfalls could be much larger than we know. Bad debts in Spain keep hitting a fresh record each month, and I have written about the problems in French and Italian banks. There seems to be a Europe-wide problem with bank debt . That might explain the worry that Mario Draghi expressed last month, which we'll turn to in a bit.

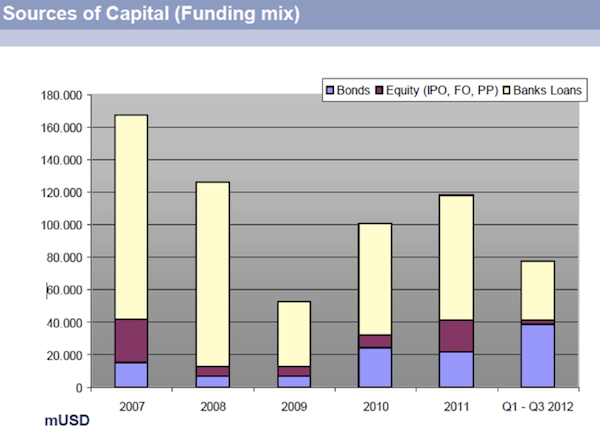

The problem is not simply that European banks are inadequately capitalized. A committed ECB, given the freedom to act by Germany et al., could overcome that problem, though not without repercussions. The additional problem causing the current growth malaise and an unprecedented wave of high unemployment in the "developed" global economy is the rather perverse disincentives in effect for the banking industry in Europe. These disincentives have resulted in capital for businesses drying up.

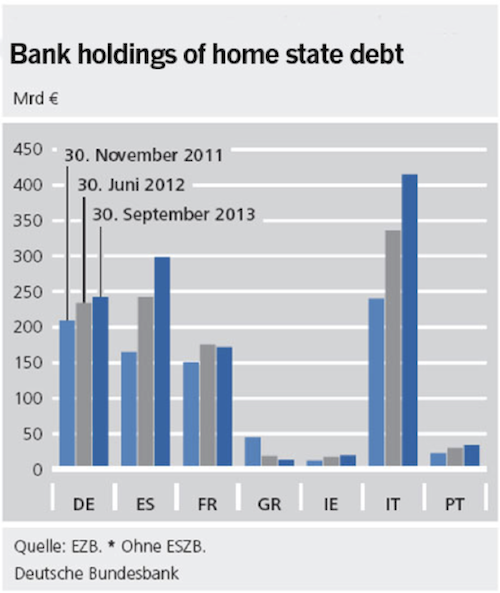

The ECB has actually provided huge amounts of capital for banks in an effort to get them to lend to businesses. But faced with regulatory risks and the significant requirement for increased reserve capital imposed by Basel III, the banks have taken the cheap money and bought their national government bonds, because the spreads are so high and the reserve capital required for making a sovereign loan is still bupkis (a technical banking term pertaining to European sovereign loan-loss provisions to insolvent governments). Italy has now seen its debt-to-GDP ratio rise from 119% to 133% even as Italian banks buy huge amounts of debt, mainly from non-Italian banks. Ditto for Spain, Portugal et al. The chart below illustrates the issue.

Thus there is a massive shortage of financing available for solid medium and small businesses. Further, regulators are now seriously thinking about not only applying additional controls on the capital that is loaned to banks, but also forcibly converting junior and senior loans to capital, aggressively hurting those who are lending to banks. So much so that ECB president Mario Draghi recently wrote a private letter (which of course did not remain private) to the various authorities imploring them to stop their efforts. The problem is, the authorities see the problems correctly and are trying to force recapitalizations at the expense of the private sector, which is the right thing to do. Taxpayer funding of private banks should not occur except under extreme circumstances and then only "with extreme prejudice," which means wiping out the private shareholders.

But if potential new investors think their loans are at risk for large haircuts, then the market for bank debt will dry up again. Didn't we watch that movie in 2008-09? The wording in Mario's letter asserts that punitive haircuts (the easy thing for a regulator to impose) and a full-blown assault on junior bank debt could lead to a "flight of investors out of the European banking market." There are no easy solutions for an overleveraged, out-of-control banking system. Except the one proposed by Irving Fisher late in his life, after he had witnessed the debacle of the Great Depression. His basic recommendation was to not allow the leveraging to begin with. It is too late to do anything after the fact except clean up the mess.

Draghi says the ECB's bank stress tests early next year will degenerate into a fiasco or worse unless EU leaders put in place "credible public backstops" to cover cases where there is not enough money from private investors to recapitalize the banks. The whole botched structure "may very well destroy the very confidence in euro area banks which we all intend to restore." (The Telegraph)

Draghi is clearly committed to providing as much central bank financing as he possibly can to keep the system liquid. (You do not write such an impassioned letter if you have no concerns.) As some have noted, the German Bundesbank has hinted that investors might see their capital impaired before the government has to admit to taxpayers the true cost of holding the eurozone together – no matter what the cost turns out to be to the system in general if investors take the hit. Then again, maybe the Bundesbank will feel that they can exert their will only in the midst of a crisis. If so, they may very well help precipitate one.

I think a major risk to the current status quo is another European sovereign debt and banking crisis in a world where risky leverage is once again mounting in the quest for elusive yield. The uncertainty we face, no matter what the consensus view, is troubling to your humble analyst. How should we then invest?

The brilliant and always must-read Howard Marks of Oaktree summed the situation up nicely in his latest letter. (According to Business Insider, "[Howard's] letters read like Michael Lewis ghostwriting for Warren Buffett: insightful, direct, homespun, expert and sharply pointed. Their quality and insight have gained them a devoted readership among value investors.")

I quote a little liberally, because summing up his already succinct prose loses a lot in translation. (Note: emphasis in the original)

As I've said before, most people are aware of these uncertainties. Unlike the smugness, complacency and obliviousness of the pre-crisis years, today few people are as confident as they used to be about their ability to predict the future, or as certain that it will be rosy. Nevertheless, many investors are accepting (or maybe pursuing) increased risk.

The reason, of course, is that they feel they have to. The actions of the central banks to lower interest rates to stimulate economies have made this a low-return world. This has caused investors to move out on the risk curve in pursuit of the returns they want or need. Investors who used to get 6% from Treasurys have turned to high yield bonds for such a return, and so forth.

Movement up the risk curve brings cash inflows to riskier markets. Those cash inflows increase demand, cause prices to rise, enhance short-term returns, and contribute to the pro-risk behavior described above.

Through this process, the race to the bottom is renewed. In short, it's my belief that when investors take on added risks – whether because of increased optimism or because they're coerced to do so (as now) – they often forget to apply the caution they should. That's bad for them. But if we're not cognizant of the implications, it can also be bad for the rest of us.

Where does investment risk come from? Not, in my view, primarily from companies, securities – pieces of paper – or institutions such as exchanges. No, in my view the greatest risk comes from prices that are too high relative to fundamentals. And how do prices get too high? Mainly because the actions of market participants take them there. Among the many pendulums that swing in the investments world – such as between fear and greed, and between depression and euphoria – one of the most important is the swing between risk aversion and risk tolerance.

Risk aversion is the essential element in sane markets. People are supposed to prefer safety over uncertainty, all other things being equal. When investors are sufficiently risk averse, they'll (a) approach risky investments with caution and skepticism, (b) perform thorough due diligence, incorporating conservative assumptions, and (c) demand healthy incremental return as compensation for accepting incremental risk. This sort of behavior makes the market a relatively safe place.

But when investors drop their risk aversion and become risk-tolerant instead, they turn bold and trusting, fail to do as much due diligence, base their analysis on aggressive assumptions, and forget to demand adequate risk premiums as a reward for bearing increased risk. The result is a more dangerous world where asset prices are higher, prospective returns are lower, risk is elevated, the quality and safety of new issues deteriorates, and the premium for bearing risk is insufficient.

It's one of my first principles that we never know where we're going – given the unreliability of macro forecasting – but we ought to know where we are. "Where we are" means what the temperature of the market is: Are investors risk-averse or risk-tolerant? Are they behaving cautiously or aggressively? And thus is the market a safe place or a risky one?

Certainly risk tolerance has been increasing of late; high returns on risky assets have encouraged more of the same; and the markets are becoming more heated. The bottom line varies from sector to sector, but I have no doubt that markets are riskier than at any other time since the depths of the crisis in late 2008 (for credit) or early 2009 (for equities), and they are becoming more so.

As I close on a beautiful Sunday afternoon, the following darkish note hit my inbox, and I think it's the perfect thing to wrap up with. It seems the world's largest investor, BlackRock (at $4.1 trillion), suggests in their yearend letter that investors should be prepared to pull out of global markets at signs of serious trouble, but should try to squeeze out more returns in the process. Their advice should make you think about your own investment decision process. "Beware of traffic jams: easy to get into, hard to get out of," they write. They highlight the risks that are posed by central banks (shades of Code Red!):

"The banking system in the eurozone periphery is under water, with a non-performing loan pile of €1.5 trillion to €2 trillion. Germany and other core countries are unlikely to pick up the tab. Eastern Europe could become the epicentre of funding risk in 2014 due to big refinancings," it said. BlackRock said the eurozone is "stuck in a monetary corset", failing to generate the nominal GDP growth of 3pc to 5pc needed for economies to outgrow their debt burdens.

The European Central Bank has allowed passive tightening to occur as banks repay funds under the ECB's long-term lending operations. The group says the ECB may have to start printing money, but the politics are toxic. "German opposition is a roadblock, unless the risk of deflation expands beyond Europe's southern tier," it said. The risk in the US is that Fed tapering could cause the housing recovery to stall. The Fed has purchased three times all net issuance of US mortgages so far in 2013. (The Telegraph)

It's Quiet Out There. Maybe Too Quiet…

My porous old memory can't quiet place the source, but I think it might have been an old John Wayne movie, where the sergeant says, "It's quiet out there," and Wayne answers, "Maybe it's too quiet" – just before all the Indians in the world swoop onto the camp out of the darkness.

The consensus seems to be saying it is quiet out there. And I can't hear anything, either. And that makes me even more nervous. Be careful out there.

It's that time of year when busy people start to look for gifts. I find ideas from others help me, and so here at random are a few I like. The new Panasonic Wet-Dry Arc 5 five-blade electric shaver is simply the best I have ever used and is now about half the price that it was a few years ago. For him and her, the Clarisonic ARIA Sonic Skin Cleansing System is really good for cleansing your face.

Then I continue to endorse a skin stem-cell skin cream called Lifeline. I talk to readers everywhere who have seen amazing results. It's not cheap, but it truly does encourage new and younger-looking skin. The company has created a special holiday package for my readers at a much-reduced cost. You can read more at http://bit.ly/JMHoliday.

And for those who are looking for something more economics-oriented from an investment analyst, I suggest giving a DVD of Money For Nothing: Inside The Federal Reserve, which is a highly acclaimed, independent, nonpartisan documentary film that examines America's central bank in a critical yet balanced way. It features interviews with Paul Volcker, Janet Yellen, Jeremy Grantham, and many of the world's best financial minds. Money For Nothing is the first film ever to take viewers inside the world's most powerful financial institution. You can order your copy at http://moneyfornothingthemovie.org/.

Southern Cal, Dubai, Riyadh, and Western Canada

I will fly to San Diego this Friday to meet with my partners at Altegris and then drive up to attend my friend Rob Arnott's annual Christmas party and watch the Newport Beach Parade of Lights, which is a nighttime parade of fabulously lit-up boats and yachts through the harbor. I was there a few years ago and was amazed at how spectacular it was. Other than that outing, I will be home for the holidays until January 8, when I leave for Dubai and then Riyadh for a week. Then I am home for a week before flying to Vancouver, Edmonton, and Regina for a three-day speaking tour at the respective cities' annual CFA forecast dinners. A note from a reader in Edmonton pointed out that it is already -30 there. I think I may try to find my thermal underwear.

I started this letter in Geneva, wrote on the plane, and am finishing it at my dining room table in Dallas. I came home hoping the office would finally be done, but the finish line now looks like maybe Tuesday. Maybe. And then there are other issues, but I am going to be very pleased when it is all done. And the important thing is that the kids are loving it.

Have a great week. I see a lot of writing and working through a pile of emails this week, as well as trying to get into the gym 4-5 times a week for the next three weeks and doing yoga at least twice a week. My gift to myself. I can really tell when I miss my gym workouts, and yoga is making a difference when I'm consistent.

You wondering how the Cowboys can be that bad analyst,

(I mean seriously. They are just an embarrassment. For a team that once had the ultimate Doomsday Defense.)

Like Outside the Box?

Sign up today and get each new issue delivered free to your inbox.

It's your opportunity to get the news John Mauldin thinks matters most to your finances.

© 2013 Mauldin Economics. All Rights Reserved.

Outside the Box is a free weekly economic e-letter by best-selling author and renowned financial expert, John Mauldin. You can learn more and get your free subscription by visiting www.MauldinEconomics.com.

Please write to subscribers@mauldineconomics.com to inform us of any reproductions, including when and where copy will be reproduced. You must keep the letter intact, from introduction to disclaimers. If you would like to quote brief portions only, please reference www.MauldinEconomics.com.

To subscribe to John Mauldin's e-letter, please click here: http://www.mauldineconomics.com/subscribe

To change your email address, please click here: http://www.mauldineconomics.com/change-address

Outside the Box and MauldinEconomics.com is not an offering for any investment. It represents only the opinions of John Mauldin and those that he interviews. Any views expressed are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest and is not in any way a testimony of, or associated with, Mauldin's other firms. John Mauldin is the Chairman of Mauldin Economics, LLC. He also is the President of Millennium Wave Advisors, LLC (MWA) which is an investment advisory firm registered with multiple states, President and registered representative of Millennium Wave Securities, LLC, (MWS) member FINRA, SIPC, through which securities may be offered . MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB) and NFA Member. Millennium Wave Investments is a dba of MWA LLC and MWS LLC. This message may contain information that is confidential or privileged and is intended only for the individual or entity named above and does not constitute an offer for or advice about any alternative investment product. Such advice can only be made when accompanied by a prospectus or similar offering document. Past performance is not indicative of future performance. Please make sure to review important disclosures at the end of each article. Mauldin companies may have a marketing relationship with products and services mentioned in this letter for a fee.

Note: Joining The Mauldin Circle is not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for investors who have registered with Millennium Wave Investments and its partners at http://www.MauldinCircle.com (formerly AccreditedInvestor.ws) or directly related websites. The Mauldin Circle may send out material that is provided on a confidential basis, and subscribers to the Mauldin Circle are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. You are advised to discuss with your financial advisers your investment options and whether any investment is suitable for your specific needs prior to making any investments. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private and non-private investment offerings with other independent firms such as Altegris Investments; Capital Management Group; Absolute Return Partners, LLP; Fynn Capital; Nicola Wealth Management; and Plexus Asset Management. Investment offerings recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor's services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

PAST RESULTS ARE NOT INDICATIVE OF FUTURE RESULTS. THERE IS RISK OF LOSS AS WELL AS THE OPPORTUNITY FOR GAIN WHEN INVESTING IN MANAGED FUNDS. WHEN CONSIDERING ALTERNATIVE INVESTMENTS, INCLUDING HEDGE FUNDS, YOU SHOULD CONSIDER VARIOUS RISKS INCLUDING THE FACT THAT SOME PRODUCTS: OFTEN ENGAGE IN LEVERAGING AND OTHER SPECULATIVE INVESTMENT PRACTICES THAT MAY INCREASE THE RISK OF INVESTMENT LOSS, CAN BE ILLIQUID, ARE NOT REQUIRED TO PROVIDE PERIODIC PRICING OR VALUATION INFORMATION TO INVESTORS, MAY INVOLVE COMPLEX TAX STRUCTURES AND DELAYS IN DISTRIBUTING IMPORTANT TAX INFORMATION, ARE NOT SUBJECT TO THE SAME REGULATORY REQUIREMENTS AS MUTUAL FUNDS, OFTEN CHARGE HIGH FEES, AND IN MANY CASES THE UNDERLYING INVESTMENTS ARE NOT TRANSPARENT AND ARE KNOWN ONLY TO THE INVESTMENT MANAGER. Alternative investment performance can be volatile. An investor could lose all or a substantial amount of his or her investment. Often, alternative investment fund and account managers have total trading authority over their funds or accounts; the use of a single advisor applying generally similar trading programs could mean lack of diversification and, consequently, higher risk. There is often no secondary market for an investor’s interest in alternative investments, and none is expected to develop.

John Mauldin Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.