Stocks Bear Market Focus Point: The Demise of the Social Compact is leading us to the next GFC

Stock-Markets / Stocks Bear Market Dec 15, 2013 - 09:32 PM GMTBy: Garry_Abeshouse

For those readers of my commentaries who do not look at charts on a regular basis, the price charts in the commentary that follows this one, should be a timely reminder of where we are in the scheme of things and how unrelated to the real world equity prices have become as a result. Risk is now at levels not seen since 2006 – 2008. What makes this situation even more unstable and untenable over the short to medium term, is that the Obama government, as part of their plan to destroy the US Tea Party once and for all by grabbing a majority vote in the US house of Reps on November 4th 2014, will be doing “whatever it takes” to keep the US dollar depressed and US equities on the boil. But despite this, financial markets are just too big and too fragmented to be totally controlled – even by the USA.

For those readers of my commentaries who do not look at charts on a regular basis, the price charts in the commentary that follows this one, should be a timely reminder of where we are in the scheme of things and how unrelated to the real world equity prices have become as a result. Risk is now at levels not seen since 2006 – 2008. What makes this situation even more unstable and untenable over the short to medium term, is that the Obama government, as part of their plan to destroy the US Tea Party once and for all by grabbing a majority vote in the US house of Reps on November 4th 2014, will be doing “whatever it takes” to keep the US dollar depressed and US equities on the boil. But despite this, financial markets are just too big and too fragmented to be totally controlled – even by the USA.

This is an extremely high risk and introverted strategy and ignores the realities being faced by the rest of the world. We are no longer in the 20th century, when wars were all the go and corrupt banks indulged unfettered in doing what they do best – fleecing the rest of us. But the US government still sees itself at war, but this time the adversary is a small group of home grown extremists. These extremist, let’s call them “The Tea Party Taliban” (first labelled by writers from TV’s “The Newsroom”). They intensely hate Obama and appear to ignore logic to the extent that they do not seem to care if their own states are disadvantaged and their country is brought to its knees, all for the sake of idealistic fantasies coming out of the narrow minds of fanatics, walking precariously with both feet firmly planted in the air.

The announcement on December 10th that congressional negotiators had reached a deal on United States federal spending for the next 2 years, suggests there has been a short pause in the intensity of this civil war against Obama and his government. Paul Ryan has more or less convinced enough of his more moderate right wing colleagues, that unless they agreed to this deal, the gods from above would be wreaking down vengeance upon their party in eleven months’ time. This now makes it tougher for Obama to pull the political wings off the “Tea Party Taliban” in the short term, which suggests that next year will again be full of political fun and games. Murdoch and FOX will continue their fight for the rights of the Power Elite to take back what rightfully belongs to middle aged and older white America – a country past its prime, where poverty is endemic and where declining social cohesion and the rule of law is being controlled by guns, the highest incarceration rate in the world and a power elite determined to stay that way.

On top of that, the US government and the US Fed continue to play a cat and mouse with the large banks, attempting to reign in tax evasion by the large corporations, while at the same time bringing back real jobs to shore up the recovery. But all is not going smoothly, as you would expect. The problem with running a large country like the USA is that the way society and real people function often bears little relation to theoretical economic modelling of “economists” such as Paul Ryan, and tends to resist the machinations of political game playing. So despite the fact that 47% of voters may be underemployed and poor, most are not stupid – which is what Obama is banking on in 11 months’ time.

But the fact that economists rarely seem to be able to pick major economic downturns, does not seem to bother the Free Market Theologians, as they juggle their narrow terms of reference to suit their individual outlooks – not unlike theologians of the other variety. But this approach over the longer term is really self-defeating. After all, corporate profits can only grow if workers are working in jobs that are capable of lifting their income over the poverty line. No decent jobs – no sustainable profits, no rise in consumption - it is as simple as that.

Since the Thatcher Years in the 1980’s, corporate downsizing, corporate corruption and tax evasion have all been elevated to art forms on a scale unprecedented in history. And by doing so, totally ignores the fact that globalised capitalism is unsustainable unless it coexists in an environment with a strong social compact with workers and the state. Ignore that fact, then expect sh-t to happen. As it stands, it is unlikely logic will prevail, so expect corrective measures to be taken in the usual way - through highly destructive events such as civil wars, trade wars and bear markets.

David Simon: “There are now two Americas. My country is a horror show” - Extract

The creator of The Wire, David Simon, recently delivered a thought provoking speech about the divide between rich and poor in America, and how capitalism has lost sight of its social compact. He said in part: “And so in my country you're seeing a horror show. You're seeing a retrenchment in terms of family income, you're seeing the abandonment of basic services, such as public education, functional public education. You're seeing the underclass hunted through an alleged war on dangerous drugs that is in fact merely a war on the poor and has turned us into the most incarcerative state in the history of mankind, in terms of the sheer numbers of people we've put in American prisons and the percentage of Americans we put into prisons. No other country on the face of the Earth jails people at the number and rate that we are.”

Uncomfortable statistics

According to the Social Security Online Website, at the end of 2012 there were almost 72 million (47%) out of 153 million American workers earning $20,000 or less, which is considered to be the poverty line in the USA for 3 people.

According to the New York Times, long term joblessness is up 213% since 2007.

According to the St. Louis Fed., there are 5 million less full time jobs in the USA in 2013 compared to 2007.

According to U.S. Department of Education, U.S. public schools are now enrolling a record number of homeless children and youth — over 1.1 million — with the largest populations in California, New York, Texas and Florida. The reported figure — 1,168,354 homeless students — is known to actually underestimate the number of homeless children across the United States.

According to a just released report from the Southern Education Foundation, a majority of students in public schools throughout the American South and West are poor for the first time in at least four decades.

And lastly, according to an analysis by UC Berkeley’s Emmanuel Saez and the Paris School of Economics’ Thomas Piketty, The top 1 percent in the USA earned one-fifth of the USA’s household income last year – breaking the previous record set in 1928, the year before the historic stock market 1929 crash, The top 1 percent is defined as households with incomes above $394,000 in 2012.

And amidst all this poverty, what are Americans spending all their money on – iPads, iPhones, Movie tickets, fatty high carb, high sugar fast food and guns.

(eg. Smith & Wesson, the US gun manufacturer, just announced boosted earnings from a 27% jump in the sales of handguns, despite being in the midst of a fresh push for gun control.)

In my last commentary back in June, I warned how in a slowing global economy,

a strengthening USD may have an adverse effect on the national debt of many countries.

“Further financial dislocation will be exacerbated by USD denominated debt in a world where almost all currencies will fall against the USD over the coming months. In my work, I have begun to look at a possible future scenario of how a continuing slowdown in global GDP, combining with and exacerbated by a fall in oil and metal prices and a fall in global equities will impact harder on nations with net debt exposures denominated in USDs. A global trade war threatens, as nations set about devaluing their currencies when they can, in order to improve their export position, with Japan being the most aggressive to date. All these factors taken together are an explosive force that has the capacity to change a nation’s balance of payments from black to red almost overnight.”

Ambrose Evans-Pritchard, UK Telegraph, September 15th 2013 - Extracts

“The Swiss-based `bank of central banks’ said a hunt for yield was luring investors en masse into high-risk instruments, “a phenomenon reminiscent of exuberance prior to the global financial crisis”.

General Motors ends manufacturing in Australia

While writing this commentary, I stopped to watch Mike Devereux from General Motors in Australia announce that after 65 years it will cease manufacturing cars in Australia. Over the next four years nearly 3000 GM workers will lose their jobs, while the flow on effect is expected to result in an estimated further 30,000 to 50,000 jobs being lost over time. The impact of this will be felt very strongly in one affected Victorian region, where there is currently 21.5% unemployment already. For Australia, riding on the back of similar job losses overseas, this is still devastating news and the reasons behind this action are complex indeed. But when large numbers of jobs are permanently lost and a whole manufacturing industry dies, the socioeconomic impact cannot be ignored. Which goes back to David Simon’s commentary on two Americas above.

But the real story, no matter where you are, always comes back to the availability of “real” jobs.

All nations over the coming years will be forced to do whatever is necessary in order to raise the income of as many workers as possible above the poverty line. Civil unrest, political uncertainty and loan defaults in a growing number of countries are here to stay unless poverty is reduced to manageable levels.

Most of the other discussions are peripheral to this one. And I am not talking about part time and short term casual jobs over Xmas, I am talking about rebuilding the number of full time jobs involved in making or growing stuff that you can see and hold – not parasitic jobs such as those in the financial sector across the world and entrenched in the US Healthcare industry. This is being made more difficult by corporate downsizing and continuing concern about the fragility of the economic recovery.

First world countries will be forced to “encourage” the repatriation of “real” jobs to their respective countries, from third world nations with cheap labour. This may assist first world countries to some degree, but in a time of declining consumption and corporate downsizing, it will have a devastating effect on poorer third world nations where the bulk of consumer goods are manufactured.

Weather report (1956 to 2014): Mostly Cloudy With Occasional Drones In The Afternoon

“So without organic demand in the US from rising real income and new households with good-paying jobs and low levels of debt, the consumer-debt based economy will stagnate. This has left the economy dependent on serial asset bubbles that create phantom collateral that can support new debt, albeit only temporarily.” (Courtesy of ZeroHedge). . . . . and so it goes on:

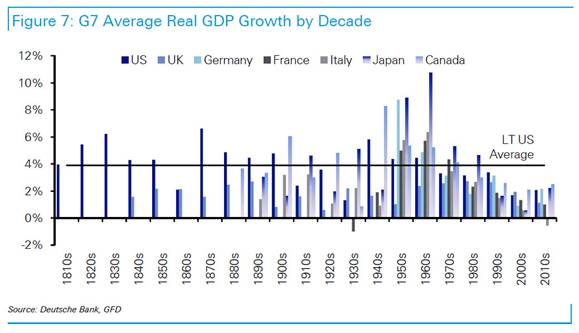

Deutsche Bank: "We Think Something Structurally Has Changed Since The Great Financial Crisis" - Extracts

“We think that something structurally has changed since the GFC, a change that seems destined to continue to hold back growth in the near-term and more worryingly has lowered the longer-term trend rate of growth. In the absence of structural reforms, a lack of appetite for debt restructuring and no ability to pursue more aggressive fiscal policy, the temptation will be strong globally to continue to throw liquidity at the problem which is likely to continue to have more impact on asset prices than the actual economy.”

“Our base case is that the world needs low yields and high liquidity given the huge amount of outstanding debt that we’re still left with post the leverage bubble and the GFC. There’s still too much leverage for us to believe that accidents won’t happen with the removal of too much stimulus. If we’re correct, we may see a reaction somewhere to tapering and this in turn may force the Fed into a much slower tapering path than it wants.”

“Our base case is that the world needs low yields and high liquidity given the huge amount of outstanding debt that we’re still left with post the leverage bubble and the GFC. There’s still too much leverage for us to believe that accidents won’t happen with the removal of too much stimulus. If we’re correct, we may see a reaction somewhere to tapering and this in turn may force the Fed into a much slower tapering path than it wants.”

John Mauldin:

“The Mortgage Bankers Association's Purchase Index has been locked in a sideways channel since mid-2010. And since June when the Fed first sent out the feelers that it might commence a tapering of policy in September, the level had slumped.”

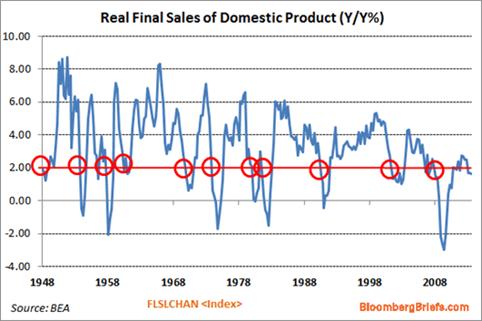

“And since consumers can't spend what they don't have, they've reduced the pace of spending to below that critical sub-2 percent pace of spending on real final sales of domestic product. There's a little known rule of thumb in the economics world: when the annual growth rate of several economic indicators falls below 2 percent, the macro economy eventually slides into recession. Currently several of these statistics are flashing warning signals: real GDP (1.6 percent), real disposable personal incomes (2 percent), real consumer spending (1.7 percent), and real final sales of domestic product (1.6 percent).” (December 12th 2013)

The above chart is a shocking illustration of what happens when “real Jobs” are replaced by “parasitic jobs” and large corporations become disconnected from their geographical roots and relocate to tax havens, such as the Cayman Islands.

“Dragon-Kings, Black Swans and the Prediction of Crises”

In a paper presented to a prestigious Engineering Journal in July 2009, Didier Sornette “proposed that the true origin of a bubble and of its collapse lies in the unsustainable pace of stock market price growth based on self-reinforcing over-optimistic anticipation.”

He proposed that the eventual collapse of a market top is preceded by the accumulation of several bubbles, whose interplay and mutual reinforcement leads to an illusion of a “perpetual money machine”, allowing financial institutions to extract an increasing amount of wealth from an unsustainable and artificial process. As the speculative bubble progresses to maturity, it becomes more and more unstable and extremely sensitive to any disturbance, which in turn leads eventually to a crash. These resultant crashes or outlier events, he terms “Dragon Kings”.

He sees the origin of these “Dragon King” type crashes as being constructed progressively by forces acting within the market as a whole, which become over time a self-organizing process with universal properties. In this sense, the true cause of a crash arising from this process would be caused by an inherent and progressive systemic instability. Accordingly, the crash of October 1987 is not unique but representative of an important class of market behaviour, underlying also the crash of October 1929 and many others.

In his 1992 paper, “The Financial Instability Hypothesis”, Hyman Minsky proposed a similar process where financial markets would become increasingly “fragile” prior to an eventual collapse. Didier Sornette more or less took up where Minsky left off. Minsky died in October 1996, before the Tech bust in 2000 and way before the major excesses of the big banks had become apparent.

All this is highly reminiscent of what is occurring now in the US with the Fed’s perpetual money machine. All it will take is the right trigger to bring down this highly “fragile” house of cards. This trigger could come from anywhere and at any time – within the USA or more likely outside in one or more of the “emerging market economies”. The GFC arising from the market collapse in 2008 began from the pulling of a singular trigger. This trigger, the bursting of the United States housing bubble which peaked in 2005–2006, progressively morphed into multiple triggers bursting associated bubbles exposed by predatory lending, deregulation, over-leveraging, the over complexity of “innovative” derivatives. The list goes on.

We are being continually warned that what happened just a few years ago could easily happen again. The triggers are already in the system, we just do not know exactly which, when and where one will be pulled first to set off the train of events. As I have mentioned many times before, this is what bull traps are made of.

On a final note, just assuming that the Obama administration is capable of doing the impossible by keeping the equity market near its highs and the USD low – what then?

Even then we are left with a low volume US equity market, dribbling its way up and down, at a time when corporate profits are through the roof, assisted by low dealer inventories and low staff levels. Both have remained low since the GFC, while at the same time long term unemployment remains high and child and family poverty is endemic. Yet despite all of this, key equity indices have dribbled to new all-time highs for most of 2013, while NYSE margin Debt is at an all-time high as well. So you would think that the hedge funds would have been laughing all the way to the bank – wrong.

As Bloomberg reported on December 2nd under the by-line of “Hedge Funds Continue to Be for Suckers”,quoting Goldman Sachs, they pointed out in 2013 to date, a year when the S&P 500 rose 25%, Hedge Fund profits only rose 6%. Not only that, but they are still “mostly long, and they are mostly long the kinds of well-known stocks that your grandmother might decide to buy after logging on to her Etrade (ETFC) account. Which means that they are as dependent as every other investor on market support from the Federal Reserve.” What this report also implies for the Hedge Funds as a group, is that they also cannot generate significant profits from High Frequency Trading either, othwise their profits would be much higher than 6%. In fact the major part of their profits it seems comes from Fees from their clients.

In September 2013, the WSJ reported, “Because hedge funds manage $2.41 trillion, according to industry-tracker HFR, a change of a few percentage points adds up to a lot of dollars. Last year, hedge funds pocketed $50.5 billion in management fees and performance fees, meaning the share of profit.”

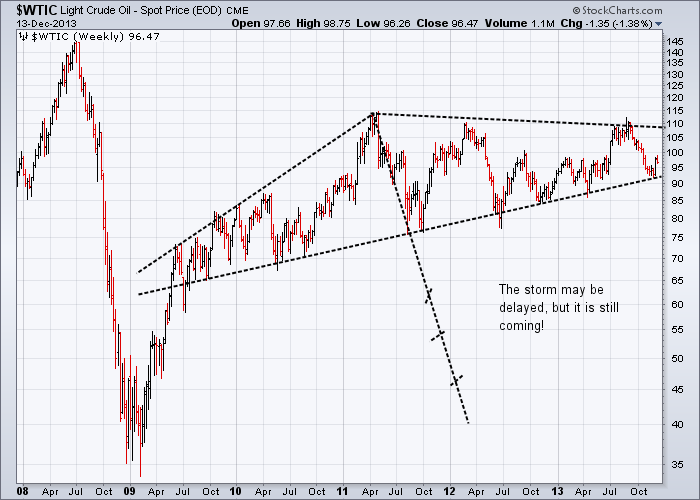

So, as I asked my reader last time, “Are you ready to weather the coming storm?”

Till next time.

Garry Abeshouse Technical Analyst. Sydney Australia

I have been practicing Technical Analysis since 1969, learning the hard way during the Australian Mining Boom. I was Head Chartist with Bain & Co, (now Deutsch Bank) in the mid 1970's and am now working freelance. I am currently writing a series of articles for the international "Your Trading Edge" magazine entitled "Market Cycles and Technical Analysis".

I specialise in medium to long term market strategies.

© Copyright Garry Abeshouse 2013

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.