Protect Your Wealth from Wall Street Liars

Stock-Markets / Market Manipulation Apr 16, 2008 - 03:33 AM GMTBy: Jim_Willie_CB

Few seem to remember that Wall Street is not a non-profit community driven by altruism or any sense of service. They would gladly cheat you out of your entire life savings if their actions were legal, or at least not prosecuted. In the last two to three years, the lies, deception, misdirection, false reporting, corruption, and grand fraud will be the topic of historical accounts for decades. When returning on my flights from another successful Cambridge House gold conference, this in Calgary Alberta , many thoughts came to mind, jotted down while gazing at the natural beauty made up from cloud blankets with a sun guarding its lot. The sun and clouds care not at all about economic landscapes underneath, even if in turmoil. Whenever travels take me across national borders, nationalism, idealism, culture, and dreams come to mind. It seems pursuit of truth, clarity, and integrity has become negotiable, one and all in the United States . Its people are being stripped of so much. Perhaps this layout will be helpful. Routinely such matters are covered in the Hat Trick Letter reports. Gold & silver continue to do well to protect individuals and their wealth. Banks are no longer safe, an astonishing conclusion. Bonds are not safe, and neither are money market funds!!!

Few seem to remember that Wall Street is not a non-profit community driven by altruism or any sense of service. They would gladly cheat you out of your entire life savings if their actions were legal, or at least not prosecuted. In the last two to three years, the lies, deception, misdirection, false reporting, corruption, and grand fraud will be the topic of historical accounts for decades. When returning on my flights from another successful Cambridge House gold conference, this in Calgary Alberta , many thoughts came to mind, jotted down while gazing at the natural beauty made up from cloud blankets with a sun guarding its lot. The sun and clouds care not at all about economic landscapes underneath, even if in turmoil. Whenever travels take me across national borders, nationalism, idealism, culture, and dreams come to mind. It seems pursuit of truth, clarity, and integrity has become negotiable, one and all in the United States . Its people are being stripped of so much. Perhaps this layout will be helpful. Routinely such matters are covered in the Hat Trick Letter reports. Gold & silver continue to do well to protect individuals and their wealth. Banks are no longer safe, an astonishing conclusion. Bonds are not safe, and neither are money market funds!!!

USGOVT ECONOMIC STATISTICS

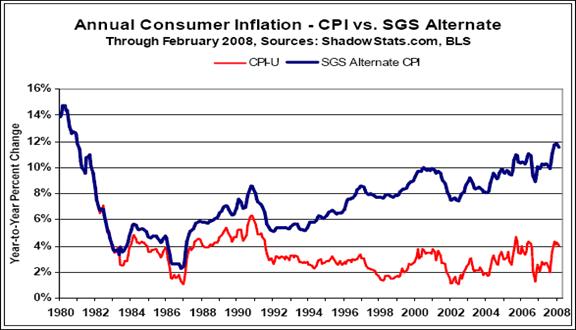

It all starts with outright doctoring on a chronic basis by the USGovt, to the point that the vast majority understands and accepts the practice. Therein lies the foundation for the system extending the institutionalized dishonesty of the nation, carried further by Wall Street as it endorses the doctored statistics routinely. The fish rots from the head down, Wall Street being the blood system, the economy the torso. Put your full faith in accurate economic statistical gathering with the Shadow Govt Statistics crew led by John Williams. No, not the man of Boston Pops musical fame, the other guy. The Gross Domestic Product has been running negative in growth except for a couple quarters five or six years ago, now about minus 2.3% or so.

The Consumer Price Index has been accelerating lately, now at 11.8% and still climbing. People do eat food, and people do require energy, so please no need to remove them from calculations. The unemployment rate has been also rising lately, now at 9.8% or so. If out of work, then unemployed, that simple, so no need to talk about participation or discouraged workers by the goofy methods in the Bureau of Labor Statistics. The Birth-Death Model is another colossal fraud. Good thing few know what it is. The lies can choke a horse. Motive is clear, to present a picture of strength to sell stocks and government bonds. If the real CPI was widely known to be over 10%, both USTreasurys would suffer declines and gold would be pushed to the heavens.

USDOLLAR REBOUNDING… NOT !!!

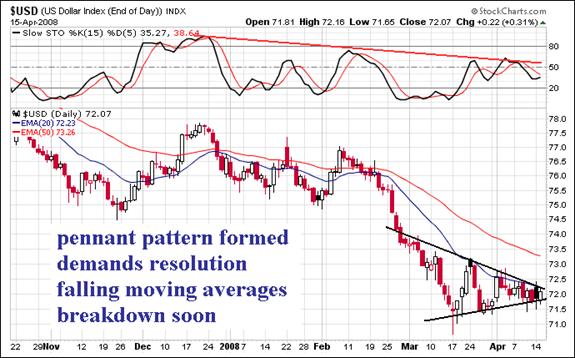

The USDollar has been trying to rebound for a month. Past USDollar charts offered in my analysis have entirely focused upon weekly charts. The daily chart over just the past six months is highly revealing. In the last two months, the 20-day moving average has served as stiff upside resistance. The stochastix show difficulty in staying above the 50 midline, a sign of weakness in the rebound attempt. With growing federal deficits, widening trade deficits, an underwater banking capital core, and rising homeowner negative equity, the US financial fundamentals resemble a banana republic on four primary pillars , unworthy of any currency rebound. The pair of 20-day and 50-day moving averages are still declining. Look for a breakdown to 70 and below in the next several weeks. The downtrend is stronger than any newly formed basis for a bottom bounce. The impact on gold will be to send it over the 1000 level again, this time as floor support for the summer advances. The next USFed rate cut could be the impetus. A game of chicken is being played by the Euro Central Bank, which refused to cut rates since last summer.

OIL PRICE WILL FALL AS USECONOMY SLOWS

Nice thought, but the US is not the engine of global growth anymore. Asia and the Middle East are the wealth centers, where trade surpluses accumulate. Whatever slack in US demand, Asian demand will grab it. Besides, incremental growth in Brazil , Russia , India , and China (the BRIC nations) is associated on a decreasing level with their exports to the US . The crude oil price is surely determined by equilibrium in supply & demand, however, the entire curves are altered by the falling USDollar. Wall Street cannot seem to admit in its mouthpieces that the USDollar will keep the crude oil price high, and demand from growing emerging economies will prevent much of any price drop from a weaker USEconomy. The entire claim smacks of US arrogance. With the crude oil price hitting $114 per barrel, will Wall Street firms drop their 2008 call for relaxation back to the 80-90 level? Doubtful. Sponsored (ordered?) attacks of hedge funds with cutbacks in credit and margin calls did nothing to bring down the crude oil price.

US BANKS HAVE SEEN THE WORST NEWS

This is not even close to being true, addressed in a previous recent article. Housing prices are accelerating down, driven by some degree of capitulation on price. The high level of inventory continues to be aggravated by more home foreclosures. Anecdotal evidence supports this, as February prices were a quantum level lower. Hired home processors working on the behalf of bankers and lenders simply gave up. They want to move inventory, period. Again, the point must be repeated until it happens. The Exploding ARMs, the prime adjustable rate mortgages with negative amortization option features, they will begin failing this summer as they reset. When the rising loan limit is hit, the monthly payment doubles or triples! The phenomenon of walking away from mortgages has worsened lately. US banks will suffer wave after wave of losses. The new US Federal Reserve lending facilities are a certain help, but not a cure. The banks are suffering from colossal strain in negative capital core, a situation growing worse by the month. Their capital has melted down completely. Their status will eventually become worse than Japan 's from 1990.

CONTAINMENT OF SUBPRIME

This was the wrong deceitful refrain last autumn. My analysis refuted it steadily, calling the problem one of absolute bond contagion. The totality of spread risk to the entire global banking system is now finally recognized. The subprime infection has spread to asset backed commercial paper, to prime mortgages, to commercial mortgages, to municipal bonds, to car loans, and to credit card loans. European, English, and Asian banks are all affected. Perhaps the so-called experts were simply wrong in their claim of containment, but doubtful. Most likely they were a combination of liars and incompetents.

NO SPILLOVER TO OVERALL ECONOMY

This is an ongoing refrain, another cartload of bull cookies. Since the claimed economic expansion began in 2002, the boast was that the financial sector lifted the entire USEconomy. But now, with strain, pain, and no gain on the financial side, we are told to believe no spillover. When is there EVER no spillover from financial to economic? Never! The connection is obvious, as companies, households, and individuals are increasingly frustrated with blocked loans. Approval of loans is a major challenge. Reduced economic activity is the immediate result. The fact that negative GDP statistics have not been registered yet, only means not yet. Besides, there is an integrated 4% to 5% lie in the GDP anyway. A negative official GDP means a 5% recession, which is horrific.

TURNAROUND IN SECOND HALF

Once more, we hear this desperate refrain. When it hits my ears, it hurts them. This is the most desperate of claims, used recently by USFed Chairman Bernanke. It is also used by Wall Street firms. The USEconomy is at the tipping point, almost negative on even the official GDP. The US corporate profitability is also at the tipping point, almost negative after losing its growth. The second half of the year is far enough away, that it is not within quick reach. The second half of the year is far enough away, that if the turnaround fails, most people will forget. This is a standard con, woven in desperation. The words ‘Second Half' should evoke laughter, nay, guffaws.

LIMITS ON MORTGAGE RELATED LOSSES

Last late summer, Bernanke spoke publicly about an estimated $200 billion in total mortgage portfolio and bond losses. My estimate was $2000 billion, as in $2 trillion. Any such similar estimate of this magnitude by a person in a prominent position would have evoked fear and trembling. So the ratcheted estimate technique has been deployed. The estimates now have finally reached $1000 billion, from more than two or three corners. With the next prime Option ARM wave of failures, the estimates will move toward $2 trillion. Again, the purpose of Wall Street and USFed pronouncements is not accuracy, but control of the people so as to avert panic. Boil the frogs slowly.

USFED ROLE: STABLE EMPLOYMENT, MINIMAL INFLATION

This is a tragedy. The USFed in my view operates as the Dept of Inflation, accountable to nobody, certainly not their employer, the US Congress, which uses them as contactor. The USFed attempts the unattainable, to control inflation when they unleash it, or permit it. Their task is akin to herding cats. They in no way regulate credit growth, since they encourage it actively. The inflation directive is an absolute heresy, since inflation is the USFed's raison d'être, their reason for being. Maybe minimized perceived price inflation, or officially stated price inflation, those are their purposes. They manage the inflation machinery, an unmanageable task. They unleash the monster, and apologize periodically for failure to control that monster. They mop up their own messes, but are regarded as saviors. They are looked upon to save the system, after they contributed principally to the destruction of the system. As for employment, the tragic outcome of inflation is lost jobs on a massive scale. Chronic inflation lifted US wages to an uncompetitive level. Failed banking systems and lending apparatus is killing jobs by the millions. The entire US Federal Reserve is a failed institution. It seeks greater powers after ruining the national financial structure!!!

GLOBALIZATION KEEPS THE US STRONG

After four decades of chronic inflation, the US was extraordinarily vulnerable to competition from Asia . In the 1980 decade, immediately after the near death experience of mighty Intel Corp, the dispatch and abandonment of US manufacturing began. Japan and the Pacific Rim began a long expansion that continues to today. In the 2000 decade, the refrain was to pursue low cost solutions. How is that working out? A disaster for the US , as China has morphed from a partner to an adversary, precisely as my analysis forecasted in 2004 and 2005 articles. Trade friction is still an issue. Globalization was critically important to maintain profitability of US multi-national corporations. In that respect, globalization keeps the US strong. As it applies to US workers, globalization is a wrecking ball, destroying jobs, destroying livelihood, undermining families, ruining dreams, gutting the US middle class, producing poverty in its wake. The entire Globalization movement has been described by some as a rather global socialist concept, in pursuit of a global level field.

BANKS RESUPPLYING WITH FRESH CAPITAL

Insolvent US banks are not bringing in new capital. They are selling bank capital in return for desperately needed cash. They sell stock and bonds. Their core assets have eroded so badly from failed mortgage related losses, that they must sell equity capital and securitized debt so as to resupply their core with cash. The challenge for US banks is to dilute themselves with additional equity, as they bring in new cash, which brings down their stock prices. Some recent actions by smaller lending institutions was to double their stock share count, a 50% immediate dilution. Without this radical dilution, their insolvent state will lead to difficulties, like running out of cash liquidity. At that time, they must declare bankruptcy.

BEAR STEARNS WAS BAILED OUT, HUH?

If so, they why are they dead? Why are half of their employees losing jobs? Why are their employees losing life savings? Why was its office building set for a fire sale? No, Bear Stearns was raided, its assets taken by its main creditor, JPMorgan. This was a clear case of JPMorgan being bailed out by the USFed, in order for its credit derivatives not to blow up. JPM cut off Bear Stearns on credit, and killed them with the blessing of the USFed and credit extended by the USFed. They averted a blowup of JPM that would have been an order of magnitude more disastrous than the LongTerm Capital Mgmt fiasco of 1998. In fact, the story is worse. By endorsing the raid, the USFed has given a green light for any bank or investment bank to raid any competitor or client that does NOT have access to USFed lending facilities. Some call it Fed Lending Arbitrage. We are therefore witnessing an ugly extension to the Mussolini Fascist Business Model toward a consolidation phase of mega bankers. If a competitor or client threatens a big banking institution, conspire with the USFed, deny it credit, raid its assets, and kill them. This is street fighting in three pieced suits.

CONSUMPTION IS BACKBONE OF US STRENGTH

This lie is being laid bare nowadays. The USEconomy does not save, but rather spends. Now with difficulty spending, since credit is tight, the system is grinding in a horrible slowdown. What happens to spenders when their inflated assets start to deflate? They declare bankruptcy. They suffer the indignity of home foreclosure. They lose their jobs. They move into homes of their parents. They might even move into tent cities. Try a Google Search of ‘Tent Cities in the US ' for a shock. Ontario California is the biggest one in the United States . They will spring up in most major US cities before long. No, consumption breeds poverty, not prosperity. The process went so far as to encourage conversions of home equity into spendable cash. People burned their furniture, to fund their lifestyles. Now almost 10% of US households have negative equity, with more owed on loans than their homes are worth. Consumption fails the system on the macro economic level, and on the micro household level.

WALL STREET AS ENGINE OF CAPITALISM

The last few years should teach any open-minded person that Wall Street exploits the system, rather than invigorates the system. Wall Street firms do not simply act as agents to bring capital to expanding young enterprising firms. Wall Street firms also act as agents to defraud large institutions where huge pools of savings used to accumulate. Wall Street firms actively targeted those firms, for the sale of subprime mortgage bonds. The more accurate description is that Wall Street has been an active agent in the inflation game, enabling debt to be sold in the financial markets, whether corporate or government in origin. Wall Street has controlled a monopoly in gathering magnificent fees as it enabled growing companies to pursue additional necessary capital. But also, Wall Street used its position to conduct the largest fraud ever perpetrated by US financial institutions in modern history. In doing so, Wall Street proved not only they are parasites to the system , but protected criminals. They essentially killed the US banking system, by infecting it with toxic assets that to this day continue to choke many processes. Time will tell if they also killed the USEconomy. My forecast is for the longest recession in US modern history, as the housing market endures another two years of decline.

TREASURY INVESTMENT PROTECTION SECURITIES

These so-called TIPS don't protect against much of anything, most of all price inflation. If they counter the corrupted CPI index that supposedly measures price inflation, then they too are corrupted. Could the TIPS actually sport a negative yield these days? Ooops, exposed!

THE TRAP OF EXCHANGE TRADED FUNDS

The Exchange Traded Fund concept is simple. The application is not, especially when criminal motive is executed, protected by USGovt regulators and Wall Street bankers. Any ETFund managed by a US firm or London firm should be regarded as fraudulent unless proven otherwise. To me, it is beyond disbelief, moving toward shock, that the gold community has not attacked the StreetTracks GLD fun for its fraudulent operations. They fail to comply with their own prospectus. They fail to comply with disclosure. They have successfully diverted plentiful physical demand into a fund managed by JPMorgan. Gold believers have been duped. Every day, one can read of some respected analysts who endorse this ETFund vehicle, despite its fraud. Where is the thought process? If the mafia opens up a neighborhood savings & loan after city-wide thefts, then one should harbor suspicion. The Barclays ETFund for silver, named SLV, is another fraud.

Jim Turk of GoldMoney has revealed its highly questionable behavior. Both GLD and SLV have probably been using their gold and silver bullion to short gold and silver for a few years. These vehicles keep down the price of gold & silver, or at least neutralize money invested in them in terms of the metal prices. The precious metals community has been hoodwinked, still happening sadly. The gold community does a great job in researching and scrutinizing the track record, competence, and integrity of management when examining a stock for a mining firm, but not for ETFunds like GLD and SLV. Very strange and inconsistent usage of gray matter in my opinion. The Hat Trick Letter provides a special report on this controversial topic in February, with past coverage in the April 2007 report last year.

GOLDMAN SACHS & THEIR 2008 GOLD CALL

In November 2007, when gold was between 710 and 730, Goldman Sachs released a research paper that gold would endure the 2008 year marked by the gold price being flat or down. The report brought laughter to my desk. My immediate thought was that GSax had put a big long position on gold, expecting a big price upward move. In fact, in the previous few months, GSax had covered their entire short gold position on the Tokyo Commodity Exchange (TOCOM). That is about as bullish a change as possible. Yet the US press announced the GSax negative gold opinion without much minimal research. Gold promptly shot over 800 in early January, and then jetted over 1000. It is consolidating in the lower 900 levels lately. How was that GSax call after all? Not only lousy, but motivated to deceive in my opinion. GSux has a long history of such intentionally deceptive but useful calls. They are not a non-profit firm. They are never held liable for lies. They are agents for the Dept of Treasury. They are accused of front running many USGovt sanctioned market rescues ordered by the Working Group for Financial Markets (aka the Plunge Protection Team). They are above the law.

IMF & SWISS GOLD SALES

In summer 2007, the Swiss National Bank announced they would sell 250 tonnes of gold bullion. The gold community shrieked. That much supply hitting the market would surely send the gold price into a plummet. Not so! The Swiss did not sell that much. In fact, it is unclear they have that much gold to sell at all. The mere announcement was actually bullish for gold, a sign of central bank desperation. Why talk about selling if they could actually sell? In the last couple months, a similar situation has arisen. The Intl Monetary Fund has announced another huge gold bullion sale. They are under budget strain, in need to raise cash to maintain operations. The gold community shrieked! That much supply hitting the market would surely send the gold price into a plummet. Not so! The IMF was doing the European Central Bank's bidding. Since member ECB banks have run low on available gold bullion to dump on the market, the IMF ran the story. Again, this is desperation. Since the Swiss made their announcement on gold sales, the gold price has risen over 30%. These groups see a $1500 gold price coming, and a global gold bull market gaining momentum, acceptance, and publicity. They are running scared.

WARREN BUFFET & HIS SILVER FUMBLE

This title could also be “GOLD EARNS NO YIELD” instead. But my choice is to highlight the deception of popular Warren Buffet, who with 90% likelihood lied through his teeth two years ago. A common deception theme circulated by the lapdog press is that gold metal investment earns no yield, no income, a virtual dead asset. How are debt securities doing these days, the ones that offer 5% to 8% in yields? The lesson with mortgage related assets is that yield matters little when principal suffers big losses in value. Exactly. That is why gold is a good investment, up in value considerably in the last few years. The Buffet story on his silver fumble involved an important story within the story. No deep inclusion of his relationship with Hank Greenberg of AIG will be provided. Greenberg found himself in trouble, but has influential connections. Hank and Warren are close friends. What follows is my conjecture, knowing the potential and knowing the extremely likely learning curve extended from Hank to Warren . AIG is part of the gold cartel, which keeps the gold price down by usage of the illicit gold futures contract game. Buffet owned in Berkshire Hathaway 129 million ounces of silver, bought under $4 per ounce a long time ago. He boasted of the smart buy. It did not just sit idly. He earned a yield off the metal position by selling forward contract options. This is no different from selling option calls on forward contracts for Cisco Systems or General Electric. The practice earns a yield, an income stream, sometimes hefty. The risk is that the price moves up too fast, and the holder of the options (other guy) exercises the right of taking your stock, or in Buffet's case the silver bullion, at the option contract price.

My guess is Buffet sold option calls at a $7 price when silver was selling at a $5 price. The silver price moved up rapidly, to his surprise. That left him with two choices. He could buy back the contracts, his sold options calls, at a big loss. Or he could permit the option contract holder to call away his position, selling to that party for the contracted $7 price. The first choice would mean announcement of a loss to Berkshire Hathaway holders, who would naively expect a profit from silver going from $4 to $9. An open admission like that would have exposed Buffet to criticism for mismanaging a silver position, but more importantly, for bringing attention to how silver metal DOES earns a yield. He made the cowardly second choice. He said to his shareholders, a bold lie in my view, that he sold his silver position too early. He did not sell it willingly. He sold it from exercise of a failed option call, written calls, used widely to earn income, like a dividend yield, a standard practice. Buffet did not understand the silver market. More could lurk behind the scenes to this story. Buffet might have been forced to sell his position, to satisfy Greenberg and his cartel buddies, who were desperate to find sufficient physical silver during broad shortages. Greenberg was under investigation for fraud. Buffet might have been involved. Buffett might have wiggled out of trouble by giving in to the regulatory authorities, letting his silver position be sold to help supply. We may never know the truth. My version is much more credible than Warren 's, that he just sold too early. Nonsense!

BERNANKE HELICOPTER DROPS OF MONEY

So far, the fleet of helicopters is more like a fleet of UPS vans making money drops to Wall Street bankers, not the public, in corporate banking socialism. The USGovt measly stimulus plan is a total joke, sending $600 to $700 to each taxpayer. Bernanke seems to have changed his playbook. He seems to have a deep motive to strangle the overall USEconomy, while filling banks with lent money or refunding AAA-rated bonds with USTreasurys. The helicopters are absent. A giant funnel has been opened to pour money into the elite banks. Loans to ordinary folks are hard to obtain. Refinanced loans are next to impossible, especially when either negative equity is involved, or a second mortgage is tied to the property. A grand disparity exists, as the M1 cash money supply struggles to avoid negative growth, while the broad M3 money supply threatens to grow at an annual 20% rate. The fat cat bankers are receiving the attention, not the homeowners whose equity is burning fast. The Fascist Firemen have the wrong priorities.

The collection of US homeowners is too big to fail, not corrupt Wall Street firms whose demonstrated fraud to this day goes without prosecution. Civil and other lawsuits might be the only justice that comes. Plow under the failed bankers. The practicality of allowing banks to dissolve when they hold credit derivatives will not be permitted. Too bad homeowners don't all hold massive credit derivatives.

GEOPOLITICS HOT BUTTONS

This is not the proper forum, but a brief comment is warranted. Weapons of Mass Destruction were obviously a ploy to justify the Iraq War. Talk of crude oil in Afghanistan , or oil pipelines, was also nonsense to justify another war front. The history of Afghanistan is replete with heroin, not oil. Nothing has changed. The terrorism charges seem to offer cover for both cushy private military contracts and security equipment contracts. The terrorism card also clouds the entire seizure raids of an entire nation's oil treasure, in Iraq . Nevermind that Iraq has a horrendous history. Now the United States has a marred history.

The USGovt in the last few years has openly defied NATO treaties. Placement of missiles in Eastern Europe receives almost no criticism in the US press, even though in violation with another Russian treaty in the aftermath of the Soviet Union demise. The recent summit meeting between chess player Russian former president Putin and the US president, who lacks broad expertise, was replete with deception. On the resort off the Black Sea , the two met a week ago. The press reported only on missile deployment discussion. The entire meeting was arranged to defuse the threatened attacks by the US Military upon Iranian nuclear facilities. For the whole month of March, Russian dignitaries had been dispatched to the White House on the matter. US presidential elections come within months. The time for action is nigh in the view of the current lame ducks. The Black Sea meeting was about Iran and US plans for action. They undoubtedly discussed Iran 's recent request for inclusion in the Shanghai Coop Org (SCO) designed for security and cultural sharing. SCO is led by China and Russia , who would clearly offer military backup to Iran . The press deceived on the entire meeting. No mention of SCO was given in the US press, which in my view is nothing but a national apparatus for public address, crowd control, and shaping of public opinion.

From subscribers and readers:

“You are able to consume and regurgitate complicated information into layman's terms. It shows that you understand your subject well. It is very easy to take complicated material and repackage it as complicated material. You, however, have the ability to take the complicated and make it understandable to the common man.” (RickS in Californiaa)

“Keep up the good work, and stay safe- the world needs your interpretative skills. “From your radio interviews, I know that your quick wit and conviction are genuine. Your confidence and eloquence comes across just as strongly. You make specific, seemingly outrageous predictions with specific timing, and you are very often right. Really, can one offer any higher praise to an analyst?” (TomH in California )

“The unfortunate demise of Dr. Kurt Richebacher leaves Jim Willie, Bob Chapman, and Jim Sinclair as the finest financial minds on the scene today.” (DougR in Nevada )

“There are four writers that I MUST READ. You are absolutely one of those favorites!! William Buckler, Ty Andros, Richard Russell, and YOU!!” (BettyS in Missouri )

“Your newsletter caught my attention when the Richebächer report ended. Yours has more depth and is broader in coverage for the difficult topics of relevance today. You pick up where he left off, and take it one level deeper, a tribute.” (JoeS in New York )

By Jim Willie CB

Editor of the “HAT TRICK LETTER”

www.GoldenJackass.com

www.GoldenJackass.com/subscribe.html

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise like a cantilever during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by heretical central bankers and charlatan economic advisors, whose interference has irreversibly altered and damaged the world financial system. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy. A tad of relevant geopolitics is covered as well. Articles in this series are promotional, an unabashed gesture to induce readers to subscribe.

Jim Willie CB is a statistical analyst in marketing research and retaicl forecasting. He holds a PhD in Statistics. His career has stretched over 24 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.