Taper Quantitative Easing Interest Rates Derivatives Reality Check

Interest-Rates / Quantitative Easing Dec 12, 2013 - 05:25 PM GMTBy: Dan_Amerman

The potential "tapering" of quantitative easing can be likened to a lessening of chemotherapy treatments when a cancer patient's symptoms change. It means one thing if the patient is being cured. It means something quite radically different when there has not been a cure, and the underlying cancer remains as bad as ever.

The potential "tapering" of quantitative easing can be likened to a lessening of chemotherapy treatments when a cancer patient's symptoms change. It means one thing if the patient is being cured. It means something quite radically different when there has not been a cure, and the underlying cancer remains as bad as ever.

We are told that quantitative easing (QE), a.k.a. "cheap money", exists for the purpose of stimulating economic growth and corporate profits, and is thereby helping the United States and other nations that are struggling with persistent and deep-rooted economic and unemployment problems. If this were the whole truth, then QE is a temporary and technical fix, a mere "accommodative policy" that can be stepped down and then eliminated altogether once markets improve and economies no longer need assistance.

This common narrative is dangerously mistaken, however, because the primary purpose behind the strategy is something else altogether: quantitative easing started as and remains a defensive attempt to prevent what could otherwise very quickly become an annihilation scenario for global financial markets.

Quantitative easing started revolutionizing the US financial markets in 2008 (QE1), with the emergency creation of more than $800 billion in new money out of the nothingness to stop an institutional bank run already in progress, that was within days or weeks of annihilating both Wall Street and the European banking system.

Today, the core underlying problems of "Too-Big-To-Fail" banks – which face a toxic three way combination of counterparty risk, contagion risk and liquidity risk – are larger than ever. Because heavily indebted sovereign nations lack the financial resources to handle another crisis by way of conventional bail-outs, this creation of unlimited amounts of artificial money – in a manner that is independent of both taxes and budgets – remains the bulwark, and the primary line of defense against existential threats to global financial markets.

Quantitative easing is currently a primary determinant of stock and bond market valuations and investor returns on a global basis. Therefore, an informed understanding of its central role in driving prices and returns is of crucial importance to investors. And those who lack this understanding of reality will likely be making investment decisions across all markets that are likely based on "bad information".

To better understand, we will explore the underlying reasons for why quantitative easing came into existence, starting with QE1, which was followed by the rules-changing QE2, which was then followed by the most aggressive variant to date, QE3, with what is currently $85 billion per month in new money being created.

Stopping The Bank Run That Would Have Annihilated Wall Street

QE1 was introduced by the Federal Reserve in October of 2008 in order to prevent a collapse of the global financial system that was already in process. Indeed, if it weren't for quantitative easing, the world would've seen the quick collapse of Wall Street, major European banks, and most likely the global financial order as a whole.

There were three intertwined dangers that threatened to bring collapse within a matter of days or weeks, which have been described by the International Monetary Fund as being counterparty risk, contagion risk, and most important of all – liquidity risk.

The basic problem was that Wall Street had been having a party, creating huge derivatives contracts that couldn't be honored, while large bonuses were passed out to investment bankers.

But the party ended with the looming potential insolvency of Fannie Mae and Freddie Mac, which because of credit derivatives exposures by Wall Street firms, could have taken down the financial system in a matter of days. So when the federal government stepped in to bail out Fannie Mae and Freddie Mac in September 2008, arguably the primary beneficiaries were in fact the Wall Street firms.

And when Lehman was allowed to go under rather than being rescued, this created the possibility of huge counterparty risk exposures when it came to all the investment banks and related institutional firms. The inability of Lehman to honor its promises meant that each counterparty that had entered into a derivatives contract with Lehman was at risk of nonpayment, which created an acute danger of cascading failures in the vast network of interwoven derivatives promises, in what could rapidly become an annihilation scenario.

This in turn created an environment of what the IMF refers to as contagion, or panic, where everyone was afraid to sell assets, because if they were to establish new market values on these large holdings of subprime mortgage derivatives and many other types of risky investments, all of Wall Street – along with many European banks – would have become insolvent.

Making the problem far worse, and the immediate source of the global meltdown risk, was liquidity risk.

Now Wall Street is based on the principle of OPM, otherwise known as Other People's Money. That is, for the most part those enormous profits and personal bonuses are earned by borrowing money from people and other firms, taking risks with their money, and then keeping most of the profits when the risks pay off.

And with contagion and counterparty risk spreading around much of the world, the financial institutions who had been loaning this money to the highly leveraged Wall Street decided they wanted their money back – and they wanted it back immediately.

October of 2008 was, then, in relatively pure form, the institutional version of an old fashioned bank run.

In a classic bank run, a bank makes a big investment that goes bad. Rumors of the loss spread to depositors. A long line forms, as worried depositors insist on withdrawing every cent of their deposits, immediately. But the bank doesn't have the money, as most of it is tied up in loans. So depositors are paid until the cash runs out, the doors close, and what seemed for all the world to be the safest, most prestigious and wealthiest business in town in the morning, is bankrupt and closed for good before the business day ends.

This familiar scenario happened over and over again during the decades and centuries before deposit insurance was introduced – and it was happening again in 2008 on the largest scale the world had ever seen.

Wall Street creditors wanted their money back. Wall Street didn't have the money to pay them, and if they were to sell risky and illiquid underwater assets as a group to get the money to pay back their creditors, this would have created "fire sale" prices on all of the investments, driving prices down that much further, and essentially creating a financial annihilation scenario.

And under the rules as they existed at that time – there was simply no way out. An institutional bank run was in process, the financial world was melting down, and there was no money to fix the problem.

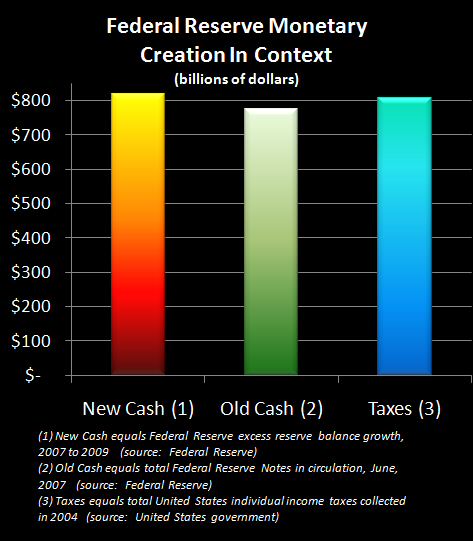

So the Fed radically changed the rules, so to speak, with the introduction of Quantitative Easing One. As explained in my article, "Creating Trillions Out Of Thin Air" (linked below), through the use of excess asset reserves, the Federal Reserve created more money out of thin air in the space of a few weeks than all the cash that was in circulation in the United States after 200 years of national existence.

http://danielamerman.com/articles/Trillions.htm

This $819 billion was not funded by taxes; it was a not a matter of spending by the US government. Instead, it was plain and simply the creation of money on a fantastic scale to get Wall Street and the global banking system out of the existential risk they were facing. A flood of newly created money was loaned by the Fed to various US and foreign financial institutions; the banks then used this new money to pay the creditors who were pulling out $800+ billion in loans. And thus a global bank run was stopped in its tracks, in such a way that kept effectively insolvent institutions viable – with no explicit bail-out being necessary.

The general public never fully understood this, nor just how close the financial world had come to annihilation – and likely global depression.

And this lack of understanding is what made it possible to sell the myth of so-called "weak banks" and "strong banks".

There were no "strong banks". Indeed, the so-called "strong banks" survived only because the Federal Reserve created over $800 billion out of the nothingness and loaned this money to them to prevent their near immediate insolvency. Absent quantitative easing, it was game over for the financial system.

This convenient myth persisted, however, and helped enable the payment of near record bonuses to Wall Street investment bankers in the following year – because there was no overt rescue that the public understood.

QE3 Today: Averting Three-Way Disaster

Quantitative easing effectively redistributes wealth from households to corporations, thereby increasing corporate profits, which is part of the reason for the rally in the stock markets. Through effective currency warfare, QE also has at least the desired intent of lowering the cost of domestic production, thereby increasing exports while reducing imports, with the goal of boosting employment.

But the main reason for quantitative easing is the existential threat to the US and global financial system from interest-rate risk, credit derivatives risk, and interest-rate derivatives risk.

Those risks constitute three deeply-intertwined disaster scenarios which are still out there – indeed they're worse than they ever were before. And if the Federal Reserve were to ever completely lose control of interest rates – these risks could still take down the global financial system in a matter of days through a combination of counterparty risk, financial contagion and liquidity risk.

The first level of interest-rate risk is that of deeply indebted sovereign governments who already can't pay their bills. As an example, the United States is currently about $17 trillion in debt – an amount approximately equal to its total economy in size. With each year that goes by, as the debt continues to mount, the interest payments on that larger debt get higher. This is the case even with the extremely low interest rates that have been the quite deliberate product of quantitative easing. And this situation could quite quickly turn into a disaster scenario if higher interest rates were to occur.

According to the US Treasury Department, the average interest rate on all US government debt outstanding was 2.408% as of November, 2013 (not including Treasury Inflation-Protected Securities).

Once interest rates have had the time to reset among the various maturities of debt outstanding, a 5% increase in borrowing costs for the federal government with current levels of debt outstanding would triple interest costs. Absent a tax increase, this would raise the federal deficit by $850 billion per year, approximately doubling the deficit compared to currently forecast deficit levels.

Which means that, absent a huge tax increase, the money to pay for that additional $850 billion in interest costs would need to be borrowed. There would then be a quick and potentially fatal acceleration in the amount of debt that would have to be issued, with interest climbing on that new debt even as it had to be paid on the existing $17 trillion, bringing the whole disaster forward in time at an even faster rate.

And if we take into account the risk involved with an effectively bankrupt nation that can't pay for imports, and we add not 5% but 10% to the cost of the federal debt – which is still well below the peak seen in the early 1980s when there were lesser economic issues – then we would see a five times increase in annual interest payments, and we would see the annual total deficit more than tripling to approximately $2.5 trillion dollars per year. With the fantastic increase in interest expenses being financed by soaring deficits, which in turn accelerates the increases in debt outstanding, which then further ratchets up interest expenses, which must be paid for by still more borrowing – clearly this rapidly creates an impossible situation.

Interest-Rate Derivatives Danger

Unmanageable sovereign debt – and compounding interest costs on that debt – is a huge problem for the world, but it's not the largest problem.

The greatest danger is the approximately $561 trillion of interest-rate derivatives that were outstanding as of November of 2013, according to the Bank For International Settlements.

Wall Street and the major financial firms around the world have created fantastic paper profits – and paid out enormous personal bonuses – on the promise that they can do something which they in fact can't do, nor have they ever had the ability to do.

The thinly-capitalized financial firms have promised the major borrowers of the world – which include state, provincial and municipal governments, as well as corporate borrowers, as well as commercial real estate owners – that through the purchase of interest-rate derivatives products, these borrowers will be protected from loss in the event that interest rates shoot up.

Now of course when push came down to shove in practice, Wall Street was completely incapable of covering even the relatively minute damages from the collapse of the $1.2 trillion subprime mortgage derivatives market.

In the graph below, we take a look at the size of the subprime mortgage derivatives market at the time of its collapse, and we compare it to the current interest rate derivatives market. It is a tall chart, because the interest rate derivatives market is more than 450 times the size of the subprime mortgage derivatives market in 2008, and for the subprime derivatives market to even be visible for the eye to see and compare – requires a very tall chart indeed.

The second half of the article is linked below. Subjects covered include:

Two obscure risks which have historically created market meltdowns, and how they sharply increase the chances of an interest-rate derivatives disaster.

Understanding the toxic feedback loops between sovereign governments, large financial institutions, interest rate risk, credit derivatives and interest-rate derivatives.

How the recent trend towards bail-ins is like quantitative easing, another part of a larger defensive strategy.

Why government interventions are likely to return even if there is a major tapering, or even discontinuation of QE.

Daniel R. Amerman, CFA

Website: http://danielamerman.com/

E-mail: mail@the-great-retirement-experiment.com

Daniel R. Amerman, Chartered Financial Analyst with MBA and BSBA degrees in finance, is a former investment banker who developed sophisticated new financial products for institutional investors (in the 1980s), and was the author of McGraw-Hill's lead reference book on mortgage derivatives in the mid-1990s. An outspoken critic of the conventional wisdom about long-term investing and retirement planning, Mr. Amerman has spent more than a decade creating a radically different set of individual investor solutions designed to prosper in an environment of economic turmoil, broken government promises, repressive government taxation and collapsing conventional retirement portfolios

© 2013 Copyright Dan Amerman - All Rights Reserved

Disclaimer: This article contains the ideas and opinions of the author. It is a conceptual exploration of financial and general economic principles. As with any financial discussion of the future, there cannot be any absolute certainty. What this article does not contain is specific investment, legal, tax or any other form of professional advice. If specific advice is needed, it should be sought from an appropriate professional. Any liability, responsibility or warranty for the results of the application of principles contained in the article, website, readings, videos, DVDs, books and related materials, either directly or indirectly, are expressly disclaimed by the author.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.