Stock Market Pop-n-Drop Day

Stock-Markets / Stock Markets 2013 Dec 06, 2013 - 03:09 PM GMT Good Morning!

Good Morning!

The action this morning may be clarifying the Elliott Wave structure. It also sets up the SPX for a Minute Wave [c] pop to 1797.64 – 1800.00.

The Monthly Employment Situation Report is bringing Tape talk back…big time.

ZeroHedge reports, “Last month, the expected NFP print was 120K, instead we got 204K. Today, the expectations was 185K, while the print, was almost an identical 203K, even as last month's was revised modestly lower to 200K. The unemployment rate dropped from 7.3%, which was also below the 7.2% expected, to only 7.0%. The unemployment rate was derived from a drop in the number of unemployed from 11.3K to 10.9K, while the labor force rose from 153.8K to 155.3K, which also led to a modest bounce in the labor force participation rate which rose from a 35 year low of 62.8% to 63.0%.”

You can see how hollow these statistics are by looking at the CES Birth/Death Model, which add 421,000 “hypothetical “ jobs to the overall number. Real employment numbers may have declined in November, which suggests a disastrous Holiday season for retailers.

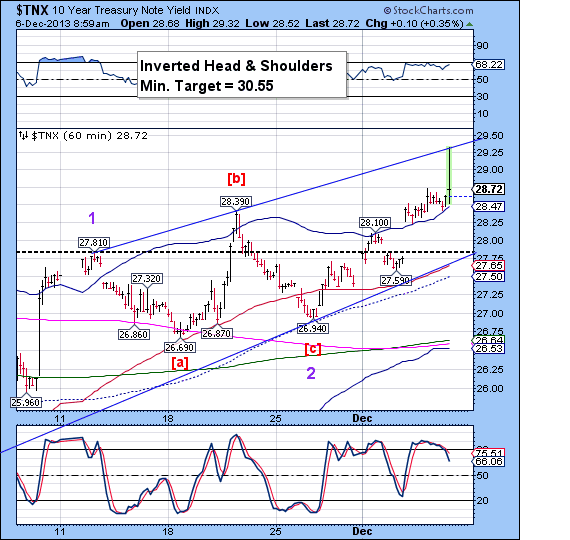

Meanwhile, TNX is challenging its August high at 29.84. It appears to have hit its upper trendline and completed a new impulsive wave, so it may come back to find support at its Head & Shoulders neckline at 27.80.

VIX was clobbered this morning, but it appears that it is now finished with its correction and may recover most or all of its losses by day’s end.

The US Dollar futures are basing at 80.23 in a double zig zag correction and may also go higher today.

Gold had some wild swings this morning and the futures are currently at 1243.00. That is still well below the 50-day moving average at 1252.29, which it may challenge one more time before a very large decline.

All in all, the decline in stocks and commodities (with the possible exception of crude) may resume today. The odds of an outright breakdown down today are slim, but this weekend is a double pivot weekend, so the surprise on Monday may be very big.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.