Stock Market Indices Uptrends Are Intact

Stock-Markets / Stock Markets 2013 Dec 04, 2013 - 10:12 AM GMTBy: PhilStockWorld

Courtesy of Doug Short. This is an update of the bullish trend in stocks that I have been monitoring for some time. First let me say I fully understand the macro-headwind of enormous debt. I’m also aware some argue there remains excessive leverage and risk-taking in the economy, poor demographics (e.g. large generation retiring), and less than stellar growth, which is often referenced by those in disbelief of the current rally. I also understand that weekly economic reports are often contradictory to this stock market rally. But one thing remains quite clear — the trend is up until it isn’t (Thanks Yogi).

Courtesy of Doug Short. This is an update of the bullish trend in stocks that I have been monitoring for some time. First let me say I fully understand the macro-headwind of enormous debt. I’m also aware some argue there remains excessive leverage and risk-taking in the economy, poor demographics (e.g. large generation retiring), and less than stellar growth, which is often referenced by those in disbelief of the current rally. I also understand that weekly economic reports are often contradictory to this stock market rally. But one thing remains quite clear — the trend is up until it isn’t (Thanks Yogi).

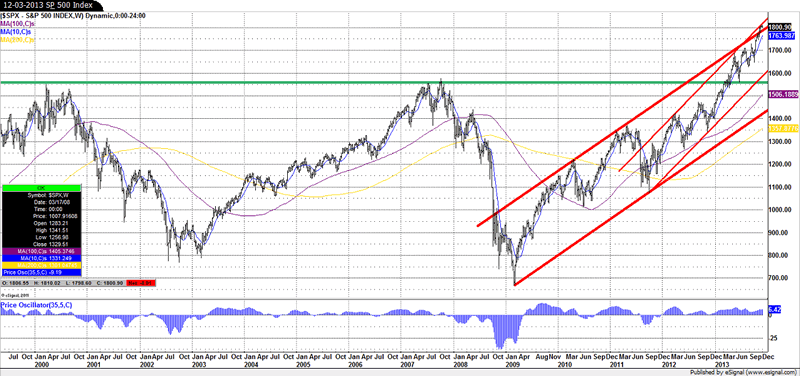

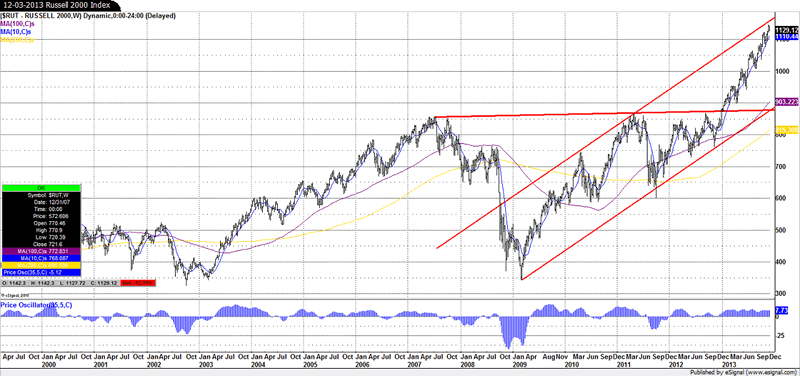

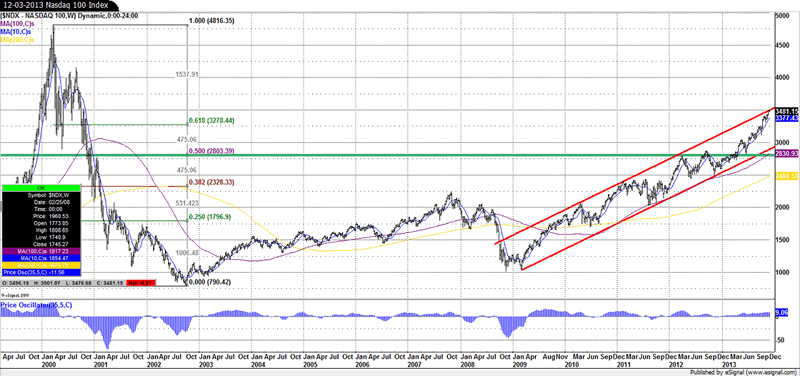

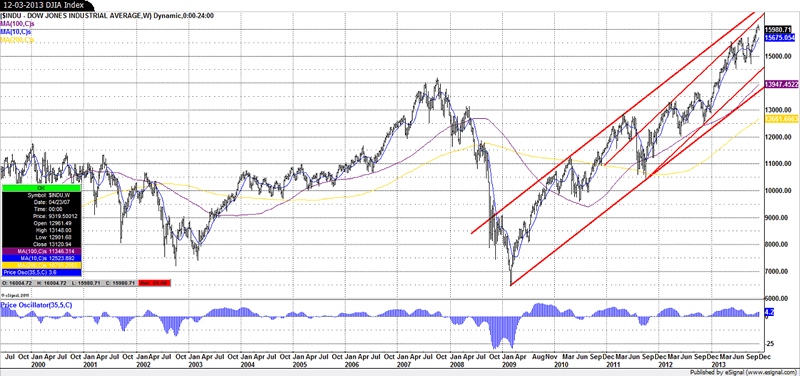

The following four charts clearly show the continuation of bullish patterns as the various stock indices relentlessly charge to new all-time highs. As you view these charts (S&P 500 Index, Nasdaq 100 Index, DJIA Index, Russell 2000 Index), also note the preponderance of the stock market to finish the calendar year on a high note. It seems to me that in the last decade only 2007 saw the market not trending higher into year’s end. This is what’s commonly referred to by traders as the Christmas rally. However, please be aware I am not making a buy recommendation. I am instead merely suggesting the uptrend is intact. Clearly, the market is up handsomely and those calling for a pull-back will eventually be correct; and that pull-back can come at any time.

S&P 500 Index

Nasdaq 100 Index

DJIA Index

Russell 2000 Index

Finally, even though I believe Central Bank policy is mostly responsible for the current rally, and we may still see a day of reckoning for the stock market, I have recognized that the timing of any such day is a near impossibility. I also believe that while waiting in preparation for it, it behooves us to separate the market from the economy. Frankly — an uptrend is firmly in place until further notice and this is a technician’s market.

Dominic Cimino

Chief Investment Strategist

Financial Advisor

Preferred Planning Concepts, LLC

2800 South River Road #240

Des Plaines, IL 60018

Registered Representative, Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC. Investment Advisor Representative, Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Preferred planning concepts, LLC & Cambridge are not affiliated.

? 2013, Dominic Cimino of Preferred Planning Concepts, LLC (You can explore the services offered by Preferred Planning Concepts by viewing us on our website at www.ppcplanning.com) Any redistribution, reprinting, or reference to this chart or content is allowed so long as reference to the author and source is acknowledged.

Important Disclosures

Please be aware that this is not a recommendation to purchase or sell any security. This is not a recommendation for any individual or institution to alter their portfolio holdings. Every individual or institution has its own risk tolerance and investment objectives and perspectives.

Any above opinions of the author should be viewed as such. These opinions in no way represent any type of guarantee. Realize that if you choose to invest in securities, investing in securities carries with it uncertainty and the risk of loss of principal. Lost investment opportunity is also a possibility. Investing in securities carries no guarantees.

Past performance is no guarantee of future results. The price movements within capital markets cannot be guaranteed and always remain uncertain. The above opinions are meant to stimulate thought and should be viewed as such. You are encouraged to discuss these views with your representatives if you have any questions or concerns.

Any indices mentioned are unmanaged and cannot be invested in directly.

It must here be mentioned that technical analysis offers no guarantees of future price movements. Technical analysis represents an observation of past performance and trend, and past performance and trend are no guarantee of future performance, price or trend. The price movements within capital markets cannot be guaranteed and always remain uncertain.

Neither Cambridge Investment Research nor Preferred Planning Concepts is responsible for the accuracy of content provided by third parties. All material presented herein is believed to be reliable but we cannot attest to its accuracy.

All charts presented were made available by eSignal, a charting service available to individuals or professionals. Anyone interested in exploring the potentials of eSignal should give us a call.

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.