Why the U.S. Fed's 100th Birthday Could Be Its Last

Politics / US Federal Reserve Bank Dec 03, 2013 - 03:16 PM GMTBy: Money_Morning

Peter Krauth writes: On December 23rd, the Federal Reserve will turn 100 years old.

Peter Krauth writes: On December 23rd, the Federal Reserve will turn 100 years old.

We can look back on its few successes... but its many failures far outweigh any positives it may have achieved.

What's at stake now is the Fed's future. And it looks bleak.

In fact, the Fed won't even exist in 100 years...

America's First Three Central Banks

Central banks and fiat money have been a major point of contention ever since the founding of America.

Between 1775 and 1779, as the colonies delved deeper into rebellion, the fiat money supply grew by over 5,000%.

Within just four years, the colonial currency, the continental, lost more than 99% of its worth. It soon stopped circulating altogether, hence the phrase "not worth a continental."

America's first central bank of the time, the Bank of North America, was organized by a member of Congress. Chartered in 1781, it lasted barely a year as confidence in its inflated paper notes plummeted.

As the Constitutional Convention approached in 1787, most delegates were staunchly against fiat money. Recent experiences fresh in their minds, these guys knew exactly why.

Jefferson said: "A private central bank issuing the public currency is a greater menace to the liberties of the people than a standing army." "We must not let our rulers load us with perpetual debt."

But the attraction of central bank benefits (for its insiders) was simply too irresistible. Alexander Hamilton, the era's ultimate insider, campaigned hard against Jefferson, and by 1791 a 20-year charter was granted to the Bank of the United States.

To the surprise of almost no one, fervent money printing resumed, and the purchasing power of paper money issued by the Bank of the United States fell by 42% in just five years. The bank's charter was never renewed.

Congress being what it is, by 1816 it had approved a 20-year charter for the Second Bank of the United States. It too eventually failed as the money supply exploded, then contracted, as the bank's directors played nasty politics with the nation's economy.

Through all these shenanigans, despite stock market crashes and wars, a gold standard (in one form or another) allowed the dollar to remain relatively stable.

That would change in the next century.

A Beast Is Born

Then came the Bank Panic of 1907, a manufactured crisis aimed at eliminating banks' competition from trust companies. The ultimate goal was the establishment of a central bank.

It worked.

A commission was set up to investigate the crisis and recommend solutions, which led to the establishment of the Federal Reserve System.

The system was supposed to be "beneficial" for the country, and yet the plans were hatched in secret, and passed at Christmastime 1913, in the absence of lawmakers.

The promise of the Federal Reserve was that it would serve as a "bank of last resort," providing stability through its dual mandate of maximum employment and stable prices.

What America got instead was massive credit expansion, the 1929 stock market crash, and the ensuing Great Depression.

At the time, the Fed was required to hold a gold reserve of at least 35% of the deposits owed to its member banks, and another 40% of the Federal Reserve notes (dollars) outstanding, which were redeemable in gold.

This dark period was capped off with Roosevelt's 1933 gold confiscation, which added substantially to the Fed's coffers, enabling (of course) more money printing.

Gold reserve requirements were lowered gradually until 1971, when they were totally eliminated by Richard Nixon. He closed the gold window, removing foreigners' ability to redeem U.S. dollars for gold.

At that point, pretty much any and all obstacles to profligate money printing had been removed.

A Terrible Track Record

So let's look at the Fed's performance measured against its dual mandate.

The first is to achieve maximum employment.

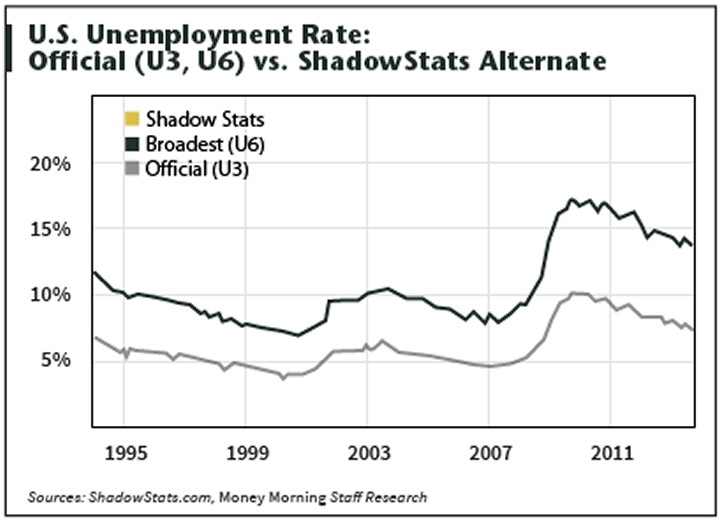

Unemployment, as calculated by ShadowStats (based on previous government calculation methods), has current unemployment near 23%, and it never reached below 10% going back to 1994.

Grade: Fail

The second Fed mandate is stable prices.

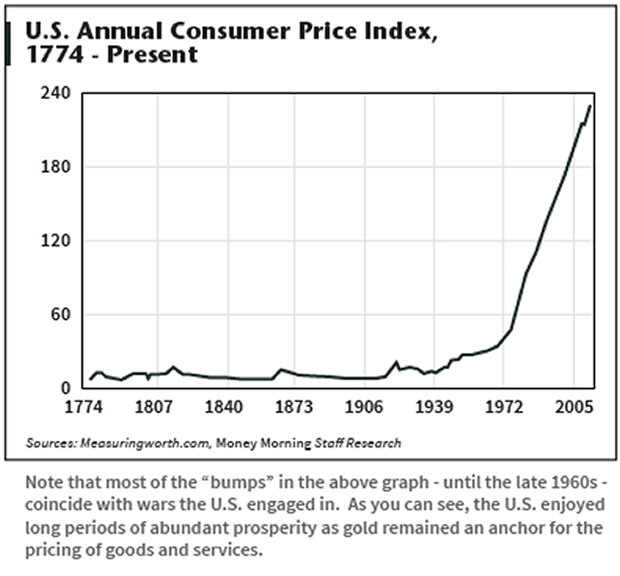

As you can see from the very first chart above, prices began to rise soon after the Fed's creation in 1913, but then exploded higher as the last link to gold was severed by Nixon in 1971.

Grade: Fail

Over the years, Fed duties have expanded considerably. Their track record on those has been dismal too.

- Maintaining moderate long-term interest rates: Until the Fed, long-term rates averaged about 6%. Between 1974 and 1992, they were above 8%, peaking at 14% in 1981: Fail

- Supervising and regulating banking: 1933 Great Depression, the worst banking crisis of the 20th century. 1980s-1990s Savings and Loan Crisis: Fail

- Maintaining stability of the financial system: 2007-2008 Financial Crisis, considered the worst since the Great Depression: Fail

There is a lesson for us in all these failures - even if the Fed refuses to learn.

Do as They Do, Not as They Say

The history lesson is quite clear: When the dollar is tethered to gold, in some form, it actually holds its value remarkably well.

And the period before the Fed still experienced tremendous growth in the economy, production, and living standards.

Meanwhile, the gold supply grew minimally, so that was certainly no impediment.

While the Fed hates gold, and Bernanke is unwilling to admit that it's real money, the Fed and Treasury (apparently) own thousands of tons. What's more, central banks globally became net buyers of gold in 2011, the first time in over 20 years. Central banks in Asia and a host of developing nations keep growing their stash.

Jonathan Spall, director of precious metals sales at Barclays Capital, told FinancialTimes.com, "We're going back to a time when gold is seen very much as money. It has been a complete reversal of the attitudes we saw during the 1990s."

For as much as our central bankers badmouth gold, they just can't seem to get enough of it.

The Byzantine Empire is a striking historical example of how a society and its economy can flourish thanks to the discipline of a gold standard.

The Byzantine Empire is a striking historical example of how a society and its economy can flourish thanks to the discipline of a gold standard.

In its heyday, the Byzantine Empire was the center of global commerce. It never went into debt, let alone bankruptcy. The imperial currency was never debased during the Empire's eight centuries.

But, that sound-money, gold-based system would not allow bankers to get as insanely rich as they can today, with a system of debt-based fiat money.

Looking Back, and Forward

In more recent history and closer to home, holders of U.S. dollars enjoyed about the same purchasing power between 1783 and 1913, thanks to its linkage to gold.

But sadly, once the Fed arrived, the U.S. dollar's ties to gold were gradually removed. Its purchasing power has since plummeted, losing 96% since 1913.

History has clearly demonstrated that central banks will come and go, but gold is a constant.

So, as the Fed marks its first (and likely last) hundred years, let's keep the bigger perspective in mind.

Jefferson knew exactly what he was talking about.

As governments grow desperately more reliant on ever more fiat money, its purchasing power is sure to wither; the dollar is headed the way of the continental.

Gold, on the other hand, has stood the test of time for 5,000 years.

But central banks?

Not so much.

Source :http://moneymorning.com/2013/12/03/why-the-feds-100th-birthday-could-be-its-last/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.