Obama's Capital Gains Tax is a Tax on Economic Growth

Politics / US Politics Apr 15, 2008 - 12:13 AM GMTBy: Gerard_Jackson

Obama proposes to raise capital gains taxes. Only a thoroughgoing economic illiterate could sincerely declare that such taxes would not damage the US economy. (Economic policies that damage the economy do not bother Dems so long as their media pals can lay blame at the at the feet of capitalism or Republicans).

Obama proposes to raise capital gains taxes. Only a thoroughgoing economic illiterate could sincerely declare that such taxes would not damage the US economy. (Economic policies that damage the economy do not bother Dems so long as their media pals can lay blame at the at the feet of capitalism or Republicans).

The first thing to note is that capital gains taxes are barriers to the mobility of savings. This is because the tax can be avoided by simply holding on to one's shares. Therefore the greater the tax barrier the fewer transactions involving capital gains. Not only does the tax reduce the amount of savings available for investment it also misallocates resources.

The first thing to note is that capital gains taxes are barriers to the mobility of savings. This is because the tax can be avoided by simply holding on to one's shares. Therefore the greater the tax barrier the fewer transactions involving capital gains. Not only does the tax reduce the amount of savings available for investment it also misallocates resources.

Let me make this so simple that even Obama and his little mates can understand it: If you want less of a product then raise the cost of producing it. If you want more, lower the cost of production. For those economic geniuses in the media and the Democrat party, capital gains to business become savings, without which the rate of capital accumulation would be greatly retarded. This is because real capital gains are pure profits and it is these profits that fuel economic growth.

For those who doubt this, let me draw your attention to 1969. It was in that year that President Nixon was persuaded to raise the capital gains tax from 28 per cent to 49 per cent. Result: revenue from the tax dropped sharply with realised gains from the sale of capital assets falling by 34 per cent, and the stock issues of struggling companies dropping from about 500 in 1969 to precisely four in 1975.

High-tech companies in Silicon Valley were hit particularly hard. Yet the Treasury had assured President Nixon that the tax increase would raise $1.1 billion in the first year and then $3.2 billion a year until 1975. This is obvious proof that high taxes have a detrimental effect on business behaviour and investment. If you think about it, capital gains taxes are a great way to soak the poor without them knowing it.

Clearly, capital gains taxes erect a significant barrier to the movement of savings from old established companies to newer and more innovative enterprises. In fact, they become a tax on social mobility, as does a highly progressive income tax structure. It protects those (like Teddy Kennedy) who can live off their family's accumulating capital that is kept in tax-free trusts in other countries while railing against those who are trying to accumulate capital: it is not a tax on the rich but on getting rich; it encourages those who have accumulated wealth to simply conserve it while reducing the flow of venture capital, the lifeblood of new entrepreneurs.

No wonder the wealthy likes of Teddy Kennedy, Warren Buffet, George Soros, Theresa Heinz, etc., violently inveigh against cuts in capital gains taxes. Americans should bear this in mind next time a Buffett or a Soros tells them that their tax burden is too light. Capital gains taxes also penalise the decision-making ability of entrepreneurs. It is this decision-making ability that largely accounts for the existence of high-cost and low-cost firms in any industry. Therefore the capital gains tax also becomes a tax on entrepreneurial talent. The more successful the entrepreneur becomes in satisfying consumers' wants, the greater the financial penalty he will finally pay. This is guaranteed to restrict entrepreneurial mobility .

Those who deny that cuts in capital gains taxes promote capital accumulation are denying historical fact: always an easy task for Democrats. In 1978 Congress slashed capital gains taxes, resulting in an explosion in the supply of venture capital. By the start of 1979 a massive commitment to venture capital funds took place, from $39 million in 1977 to a staggering $570 million at the end of 1978. Tax collections on long-term capital gains, despite the dire predictions of big-spending critics of tax cuts, leapt from $8.5 billion in 1978 to $10.6 billion in 1979, $16.5 billion in 1983 rising to $23.7 billion in 1985.

By 1981 venture capital outlays had soared to $1.4 billion and the total amount of venture capital had risen to $5.8 billion. In 1981 the maximum tax rate on long-term capital gains was cut to 20 per cent. This resulted in the venture capital pool surging to $11.5 billion. Astonishingly enough, to conventional economists that is, venture capital outlays rose to $1.8 billion in the midst of the 1982 depression.

This was about 400 per cent more than had been out-laid during the 1970s slump. In 1983 these outlays rose to nearly $3 billion. Compare this situation to the period from 1969 to the 1970s which saw venture capital outlays collapse by about 90 per cent. All because of Nixon's ill-considered capital gains tax. But then Nixon never professed to know anything about economics, unlike most of his leftwing media critics.

In 1982 the US General Accounting Office sampled 72 companies that had been launched with venture capital since the 1978 capital gains tax cut. The results were startling. Starting with $209 million dollars in funds, these companies had paid $350 million in federal taxes, generated $900 million in export income and directly created 135,000 jobs! Professor Laffer and his supporters stood vindicated, not that you would know this from the corrupt mainstream media. Those Democrats who sneer at Laffer need to be reminded — not that it would do any good — that Walter Heller, chairman of Kennedy's Council of Economic Advisers and a Democrat, stated:

The upsurge of tax revenues flowing from economic expansion would finance higher levels of local, state and Federal spending than we would have had without the tax cut's stimulus — a stimulus that the country was unwilling to provide by deliberately enlarging the Federal budget. (Cited in A. James Meigs' Money Matters: Economics, Markets and Politic , Harper & Row, 1972, p. 38).

Once again let us return to Professor Laffer. All that he had really said, irrespective of what the media and the Democrats assert, is that beyond a certain point the burden of taxation would cut investment and thus reduce, if not halt, economic growth. No sound economist would deny this proposition. And yet Laffer was lampooned, pilloried, grossly misrepresented ad nauseam — and now that I think of it, still is. Clearly, economic reasoning and history have refuted the ridiculous contention that the abolishing the capital gains tax would cut national savings and impose costs on the poor. (It's pretty hard to imagine that in 1962 President F. J. Kennedy cut taxes, with the observation that "[a] rising tide lifts all boats").

|

|

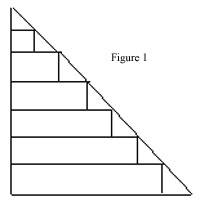

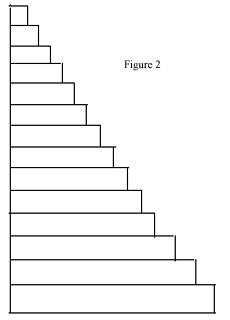

Every economy has what we call a production structure. This structure takes the form of integrated stages of production. As an economy progresses it adds more and more complex and stages to the structure. (There is a lot more to it than my explanation suggests. However, I'm trying to keep it simple for those who have no knowledge of production structure analysis). Now figure 1 represents an economy with few stages of production and hence lower living standards than the economy represented by figure 2.

If all pure profits (capital gains) are taxed away so that aggregate losses exceed net returns firm then the economy, represented by figure 2, would gradually abandon the higher stages of production and thus come to resemble figure 1and living standards would fall. This process is called capital consumption. I think it is important at this point to emphasise that where capital gains taxes are not indexed for inflation capital consumption can still develop. If a firm has a profit of $1 million which is then taxed at 40 per cent (the tax figures are for illustrative purposes only) it will be left with $600,000 which in turn pays a capital gains tax of 20 per cent, leaving $450,000 for dividends giving us an effective capital gains tax of 55 per cent.

If it so happens that because of inflation there was no real profit then the tax leads to capital consumption. What makes indexation really tricky is that it is based on consumer products and not factors of production. During an inflationary period factor costs tend to rise faster then consumer prices. The best solution is to abolition the capital gains tax and allow its fruits to ripen in the form of greater productivity and higher real wages.

It should be stressed that the only thing that has so far saved America from the financial depredations of big-spending politicians has been its inventiveness and entrepreneurial drive. But even this gift has been a curse. It has led the very same politicians to think they can mercilessly milk the economy indefinitely. They can't.

Note: Soros and Buffet's support for a capital gains taxes and the death tax. Because of their immense wealth these men are in a position to exploit every tax loophole. This makes taxes optional for them. Moreover, Buffet has profited considerably from the death tax, while making sure he won't have to pay it. These loopholes are only open to the uber-rich, those with the money to hire the best tax lawyers, and not those rich Americans, as Obama called them, on $75,000 plus. If Buffet and Soros were serious not only would they refuse to exploit loopholes they would demand that the Democrats impose a significant wealth tax that would go along way toward levelling the country's wealth. Fat chance.

So why are Buffet and Soros behaving in this despicable way? It was Keynes view that

. . . dangerous human proclivities can be canalised into comparatively harmless channels by the existence of opportunities for money-making and private wealth, which, if they cannot be satisfied in this way, may find their outlet in cruelty, the reckless pursuit of personal power and authority, and other forms of self-aggrandisement. It is better that a man should tyrannise over his bank balance than over his fellow-citizens; and whilst the former is sometimes denounced as being but a means to the latter, sometimes at least it is an alternative. (John Maynard Keynes, The General Theory of Employment, Interest and Money , Macmillan, St Martin's Press for the Royal Economic Society, 1973, p. 374).

When I first read this — many years ago — my first thought was: What if the bank accounts grow so big they can basically take care of themselves? We now have the answer. These men can then turn their thoughts and their vast fortunes into a means of acquiring political influence with the sole purpose — despite two-faced lofty sentiments to the contrary — of finding an "outlet in cruelty, the reckless pursuit of personal power and authority, and other forms of self-aggrandisement".

The sanctimonious Warren Buffett's economic illiteracy

Hillary, Soros, Alinsky, and Rush Limaugh

George Soros: economic buffoon and enemy of democracy

George Soros' slimy attack on President Bush

By Gerard Jackson

BrookesNews.Com

Gerard Jackson is Brookes' economics editor.

Copyright © 2008 Gerard Jackson

Gerard Jackson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.