Gold At a Crossroads

Commodities / Gold and Silver 2013 Nov 28, 2013 - 04:14 PM GMTBy: Aden_Forecast

Despite its recent weakness, the world is still viewing gold as a store of value.

Despite its recent weakness, the world is still viewing gold as a store of value.

Overall demand remains strong. As Eric Sprott points out, " It's staggering to think demand for gold is twice global mine production."

China is now the largest gold buyer and producer in the world. And with their economy looking better, gold continues getting a big boost from this area.

Gold's steps are your friend

For now, all is still good on the basing front. And our best bet is to keep track of the stepping stones because gold is at a crossroads.

They served us well on the way up, and they'll serve us well now.

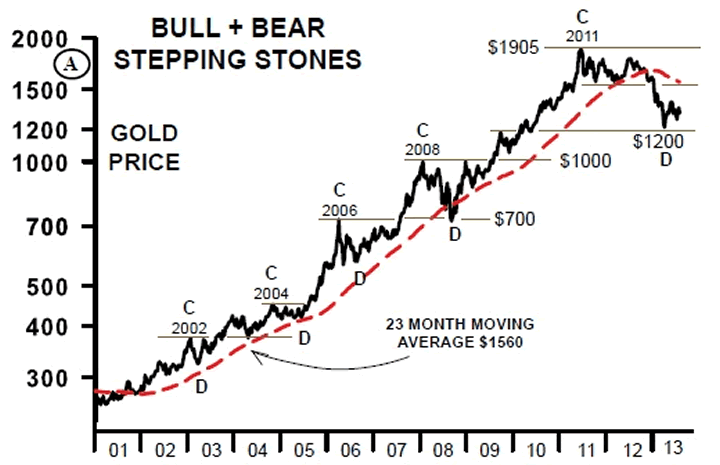

Chart 1 shows gold's steps, along with its mega 23 month moving average.

Briefly, during the up moves, the C peaks generally marked the support for the future D declines.

This was a bull market check point.

The interesting point today is that the low in June near $1200 is still higher than the prior C peak in 2008.

This is technically a good sign and if $1200 holds, it'll be a bullish signal.

The C rise up to the 2011 peak was an unusually long C rise, but the D decline has also been unusually long. This means, on the downside, if the June low is clearly broken for a few days, we could then see the $1000 level tested, the 2008 prior C peak.

If so, the entire post financial crisis rise would've been erased. This would probably be the worst case scenario.

What's best to buy & keep

Many have asked if CEF and GTU are safer and better to hold than the gold and silver ETFs, like GLD and SLV.

Both CEF and GTU are Canadian gold and silver funds that are backed up by gold and silver in their funds.

This is not necessarily the case with the ETFs. Many rumors are flying that the Comex gold warehouse supplies are way down, and during the mad ETF selling last April-May-June, China was picking up a lot of that same gold and silver.

For reasons of safety, you know gold and silver are stored with CEF and GTU, but you'll never really know about the ETFs.

In today's world, safety is important, and keeping the physical metals in your possession is always best, followed by CEF and GTU.

Follow the bankers

When price manipulators take the gold price down, central banks see value and buy.

Mario Draghi, the head of the European Central Bank (ECB) said it well when he explained, " I never thought it wise to sell gold because for central banks this is a reserve of safety."

He also said it gives non-U.S. dollar countries a good protection against fluctuations of the dollar.

This is clearly a different view than Ben Bernanke's view that nobody really understands gold prices. He doesn't seem to enjoy talking about the barbarous relic, but stay tuned.

By Mary Anne & Pamela Aden

Mary Anne & Pamela Aden are well known analysts and editors of The Aden Forecast, a market newsletter providing specific forecasts and recommendations on gold, stocks, interest rates and the other major markets. For more information, go to www.adenforecast.com

Aden_Forecast Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.