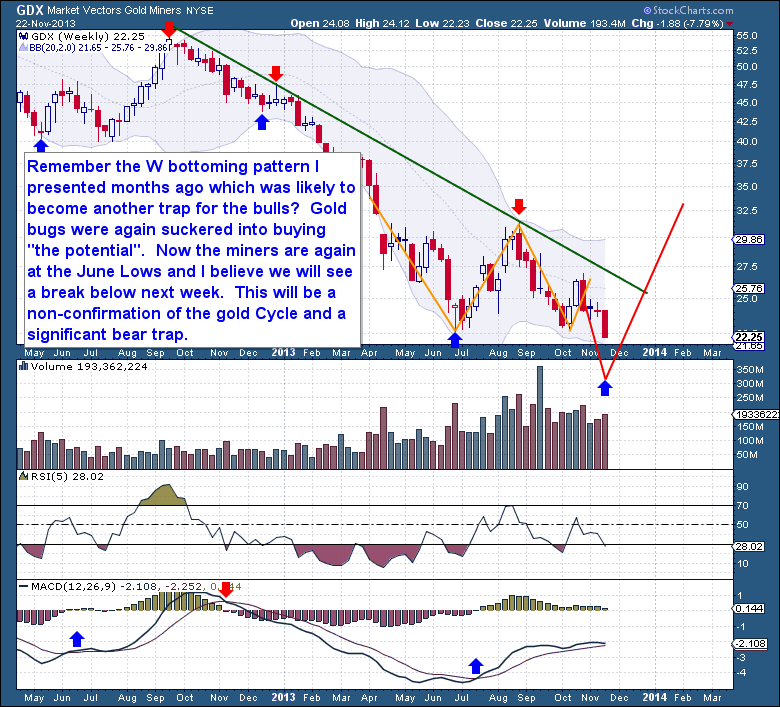

Gold Miners Look To Break Below June Low

Commodities / Gold & Silver Stocks Nov 27, 2013 - 01:18 PM GMTBy: GoldSilverWorlds

I’m looking for the miners to break below the June Low, but for Gold to hold above it. A decline by miners below the low should trigger exhaustion selling, but if Gold doesn’t confirm, it should mark a significant bear trap for investors in miners. If Gold holds above the June low, additional weakness in miners should be short-lived…and a final bottom in miners will become more likely.

Investor Cycle Trading Strategy – Gold/Silver

Last week, I wrote that I did not want to trade Gold Long until it dropped toward the $1,220 area. I wanted to see the current Daily Cycle step-down into a sharper decline before I had the confidence to buy an oversold Cycle. Waiting, I believed, would provide a good trade setup with a much tighter stop, with the June low of $1,179 just below the expected DCL/ICL.

Last week’s strategy is still on play, with Gold having done as we expected. It is now much closer to our target and a week deeper in the timing band. Patience has allowed the setup to come to us. One last drop early next week will create an ideal entry point.

Expected Trade: Within 1-3 Sessions. I’m preparing to buy a 35% position Long Gold/Silver/miners.

Source - http://goldsilverworlds.com/investing/gold-miners-look-to-break-below-june-low/

© 2013 Copyright goldsilverworlds - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.