The Biggest Stock Market Bubble in History?

Stock-Markets / Stock Markets 2013 Nov 26, 2013 - 11:35 AM GMTMichael Lombardi writes:

The only thing keeping the stock market alive is the easy money that is indirectly being pumped into it by the Federal Reserve, nothing else. The fundamentals for the market are dead in the water.

Here, I present five indicators that point to high risk for key stock indices.

Optimism continues to increase. There’s a general consensus among stock advisors and investors that the key stock indices will continue to go higher. Take the Sentiment Survey by the American Association of Individual Investors, for example. As of November 14, 39.20% of all respondents said they were bullish. In late June, this number stood at 30.28%. Investors who are bearish on key stock indices dropped to 27.47% from 35.17% in June. (Source: American Association of Individual Investors web site, last accessed November 20, 2013.)

History has repeatedly shown us that when the optimism increases and reaches the level of euphoria, key stock indices have turned the opposite way. The examples of this are many.

Corporate earnings are in trouble. Companies are posting lower revenues but reporting higher per-share corporate earnings, beating estimates as they cut costs, reduce their labor forces, and continue on their record stock buyback programs. This “financial maneuvering” cannot go on indefinitely.

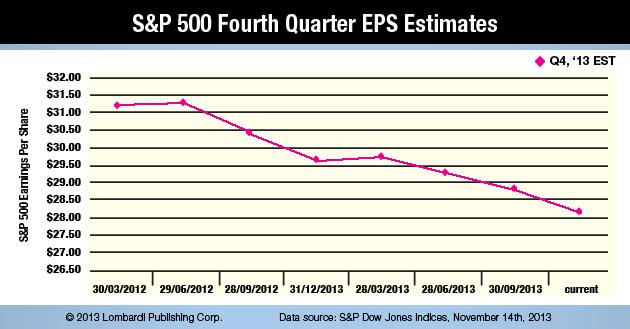

And the outlook for corporate earnings continues to deteriorate. Just look at the chart below of estimates of corporate earnings per share of S&P 500 companies in the fourth quarter. You will notice there’s a very clear trend: the estimates continue to decline. Meanwhile, despite corporate earnings estimates falling, the S&P 500 has soared even higher.

Companies are warning about their corporate earnings going forward, as well. As of November 15, 82 of the S&P 500 companies had issued negative corporate earnings guidance for the current fourth quarter. In contrast, only 12 of the S&P 500 companies have issued positive guidance on their corporate earnings for the fourth quarter. (Source: FactSet, November 15, 2013.) These are very troubling statistics.

Corporate insiders are selling stock at an alarming rate. According to a recent article in MoneyNews (November 22, 2013), stock buying by corporate insiders is at a 23-year low! When corporate insiders are selling more stock than they are buying, it shows a lack of confidence by the people closest to the public companies in key stock indices—not a good sign.

The amount of money investors have borrowed to buy stocks has reached an all-time high. Margin debt on the NYSE has surpassed $400 billion for the first time. Historically, when investors have borrowed so much to buy stocks, key stock indices have turned on them. (See “Warning: Stock Market Margin (Borrowing) Reaches All-Time High.”)

Consumer confidence is getting worse. In the first 10 months of 2013, the average month-over-month change in retail sales and food services was 0.24%. In 2012, this number was 0.47% and in 2011, this was 0.59%. (Source: Federal Reserve Bank of St. Louis, last accessed November 20, 2013.) Consumer purchases are slowing. The National Retail Federation (NRF) said this year there will be almost five-percent fewer shoppers out on Thanksgiving weekend compared to last year. In 2012, 147 million shoppers planned to purchase goods. This year, this number is 140 million. (Source: National Retail Federation, November 15, 2013.)

With all this happening, I don’t see many reasons to be bullish on key stock indices. I might be the only one saying it, but this could be the biggest stock market bubble ever created. When it pops, it won’t be pretty.

This article The Biggest Stock Market Bubble in History? is originally publish at Profitconfidential

Michael Lombardi, MBA for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.