Stock Market Dementia

Stock-Markets / Stock Markets 2013 Nov 26, 2013 - 05:32 AM GMTBy: Brian_Bloom

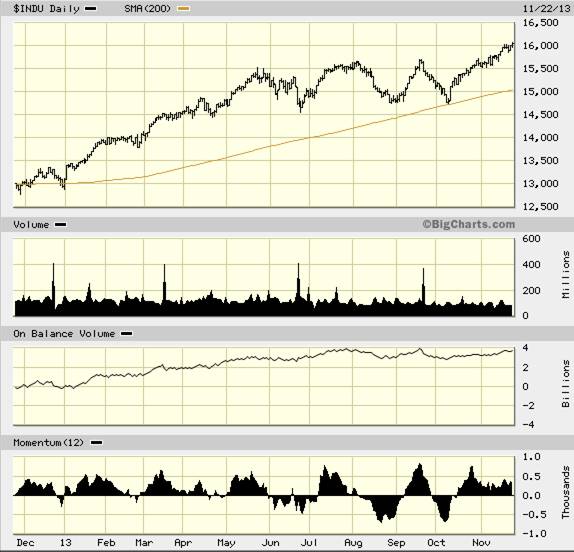

The patterns below are counter intuitive. Falling volume, falling momentum and rising prices.

The patterns below are counter intuitive. Falling volume, falling momentum and rising prices.

Note how On Balance Volume has failed to reach a new high

Applying common sense: The only logical justification for the above is that even though volumes of transactions are contracting, sellers are stubbornly holding on. i.e. “If we sell out, what do we do with the cash?”

The chart below shows that the 30 year yield has risen far more slowly than the 10 year yield – indicating that the market is not anticipating rising CPI

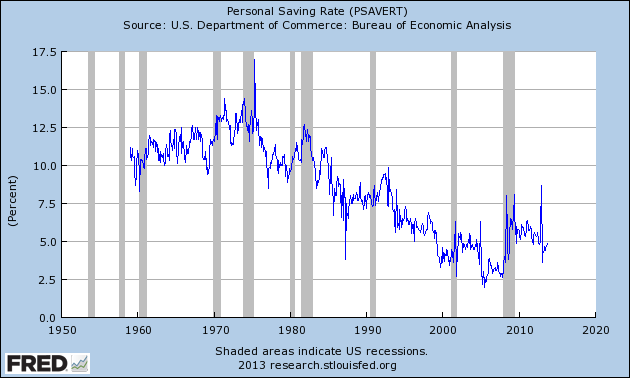

The chart below shows that personal savings as a percentage of personal disposable income was 4.9% on November 8th 2013 – up from a low of around 2.5% in 2007.

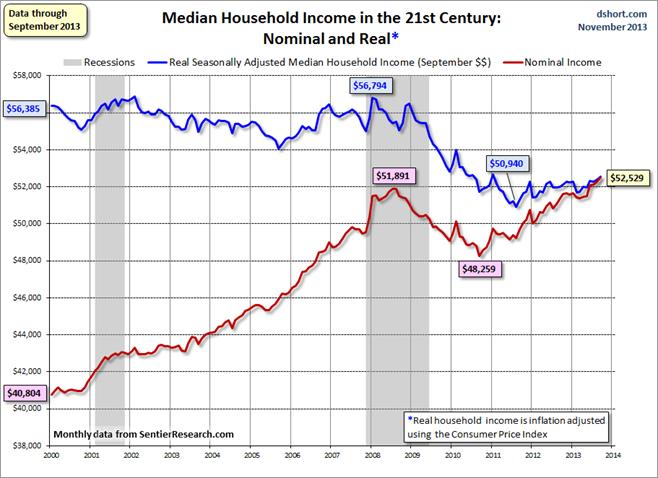

To September 2013, the median household income was lower (in real terms) than it was in 2008, and it was effectively the same ($52,529 vs $51, 981 = 1.2% growth) relative to the peak in 2008

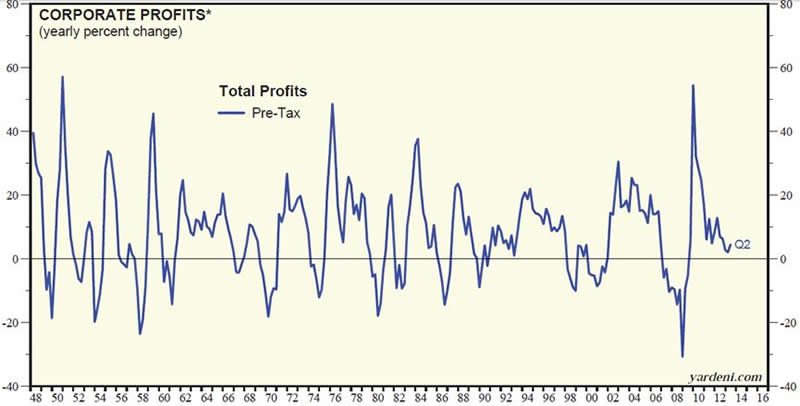

Below is a chart showing year-on-year changes in US corporate profits

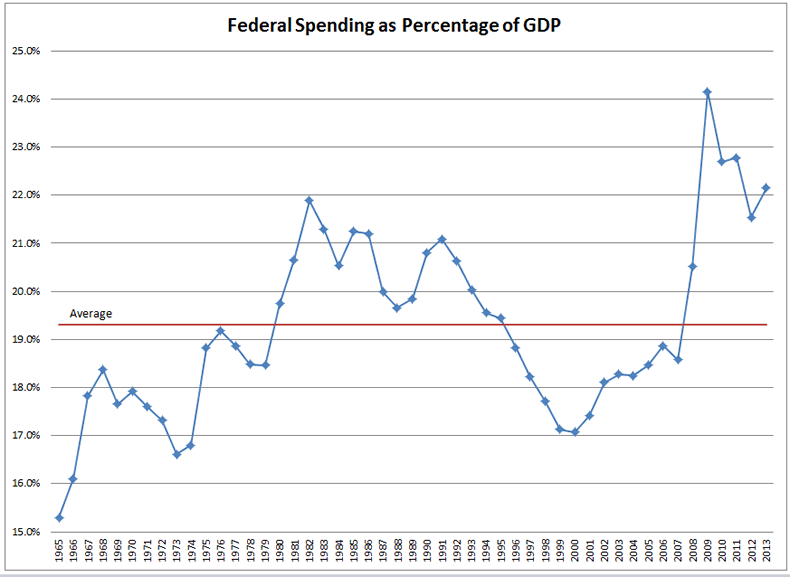

Finally, government spending as a percentage of GDP has risen by around 3.75% since the emergence of the GFC – from 18.5% to around 22.25%

So how do we make sense of this?

Household incomes are flat in nominal terms (down in real terms)relative to 5 years ago, household savings rates are up (lower proportion of income being spent), government spending has risen moderately as a percentage of GDP, corporate profits are flat, and the stock market is floating up on falling volume.

Conclusion

Optimism abounds but the situation cannot be explained in rational terms.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2013 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.