New American Retirement Nightmare, No More Money to Retire

Politics / Pensions & Retirement Nov 20, 2013 - 12:42 PM GMTBy: Mike_Shedlock

Except for public union workers with pensions that ultimately will not be met, retirement age for most keeps inching up.

Except for public union workers with pensions that ultimately will not be met, retirement age for most keeps inching up.

People need to work longer or go back to work after a few years of retirement because they have insufficient savings. This creates competition between those over 60 and those under 20 for low-paying jobs.

I have been discussing this for years. This week it hit the cover of the NY Post: 80 is the new 60 when it comes to retirement

Call it the new American nightmare: Running out of money in retirement is scaring the hell out of record numbers of older workers, forcing them to stay in the workforce.

Now 80 is the new 60 when it comes to retirement. Many older workers who finally clock out have sharply underestimated their financial needs in retirement, raising the specter of personal financial disaster.

By putting off retirement the Baby Boomers are a large reason for the high levels of unemployment for those looking to enter the workforce. According to the latest Bureau of Labor Statistics the rate of joblessness in people 20- to 25-years old is 12.5 percent, twice the rate of people 25 and older.

These Boomers have plenty of company. The American Dream of retirement at 65 is looking more like a pipe dream to many.

Nearly half of older workers are on the job longer than they had planned to be — on average, by three more years than they estimated at age 40, according to a recent survey of Americans 50 and over by the Associated Press-NORC Center for Public Affairs Research.

And the latest studies shed additional disturbing light:

UBS Wealth Management Americas discovered that most wealthy investors today do not feel “old” until they turn 80. That’s a gigantic change from their parents’ generation, when “old” was regarded to be about 60. Also, pre-retirees underestimate how much it will take to finance a long and phased-in retirement. Their average expectation is that 58 percent of prior annual income will sustain them. The industry recommends 75 percent to 80 percent.

The percentage of older middle-class Americans who said their day-to-day financial concern is “paying the monthly bills” has climbed from 52 percent last year to 59 percent today, according to Wells Fargo. Saving for retirement comes in second. Four in 10 say saving and paying the bills is “not possible.”

Older adults are now the fastest-growing share of the US labor force. By 2020, workers 55 and older will comprise a stunning 25 percent of the civilian labor force.

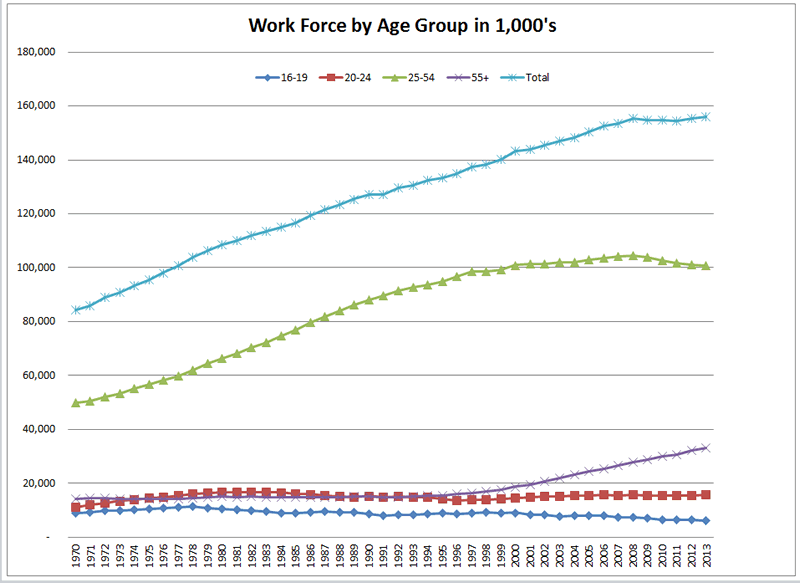

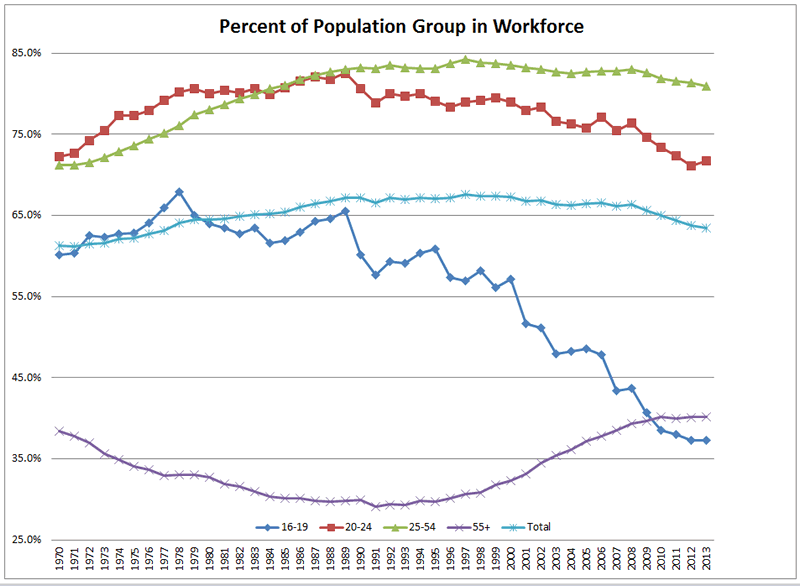

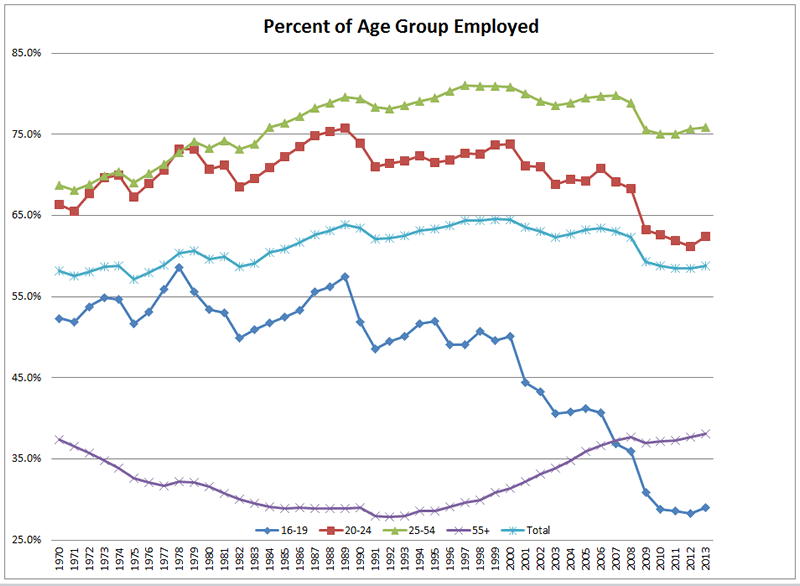

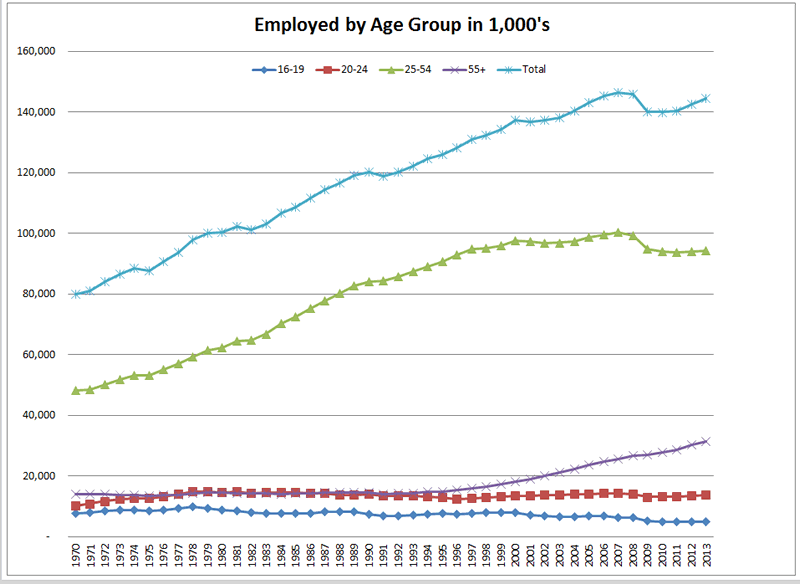

I posted the following charts by Tim Wallace in October (see Workforce, Population, Jobs by Age-Group), but since they tie in, here they are again.

Workforce Since 1970

Percent of Population in Workforce Since 1970

Number in Age Group Employed

Percent of Age Group Employed Since 1970

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2013 Mike Shedlock, All Rights Reserved.

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Mike Shedlock Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.